The one thing that always comes up when we talk about perpetuation planning is taxes.

How do I deal with this tax mess?

You have capital gains and goodwill versus ordinary income and commissions... then there's the self-employment tax and QBID... it can get confusing very quickly.

Instead of telling everyone to go talk to their tax professional, we thought we'd be more proactive and bring in an expert. We want agents to know and understand how to perpetuate your insurance book of business with minimal tax implications.

We'd hate for any broker to sell their agency and realize later they paid more than they needed to in taxes.

Meet Our Tax Professional

Andy Thomas is a Partner at MCK-CPA and Advisors and is a tax planning and compliance expert. Andy offers consulting for the purchase and sale of businesses and has been a huge help to us as we navigate our acquisitions.

Andy Thomas is a Partner at MCK-CPA and Advisors and is a tax planning and compliance expert. Andy offers consulting for the purchase and sale of businesses and has been a huge help to us as we navigate our acquisitions.

Andy will explain the legal and tax considerations of selling your insurance business in simple terms that everyone can understand. Watch this webinar recording or read on for a written version:

Acquisitions at New Horizons

Before we get into the taxes, here's a quick overview of how New Horizons is helping agents retire.

We are very interested in acquiring more books of business and servicing those customers from our main office. In the last several years or so, we've bought over 10 books of business from agents ready to retire.

We love that business, and we are confident that the agents we've worked with have been pleased. They feel they've been treated fairly and their customers are being taken care of. Everyone is winning!

Read More: [Case Study] Everything You Need to Know About Selling Your Insurance Business

To summarize what we've been doing, I want to quickly go over the three ways we can pay you for your book of business.

Paid out over time

So far, we've bought the majority of these blocks of business over time. We came up with a valuation and agreed to pay it over a four or five-year period. We pay a guaranteed amount every month over that time no matter how the book performs.

In sum, this popular option is cash over time on a guaranteed basis.

Lump sum upfront

Another method we've done is a lump sum payment upfront.

We come to a valuation, and we pay one check. This could be someone retiring, though it's not as likely. It's often someone with a health issue or a younger person who wants out of the business.

Hybrid/partnership

The third way is newer to us, and we're very excited about it. The toughest part of the succession planning process is deciding you're ready to retire. We've found this over and over again – agents say they're not quite ready yet, but they want to have it all together when the time comes.

We've come up with a hybrid, or partnership model, that's for the agent who isn't quite ready to retire but knows it's coming in the next few years. We pay a big chunk upfront and over the next several years, we partner together. We both have responsibilities, and we're working together during that time.

You still earn some income off of that book, even though we purchased it, and once the timeframe is done, we settle up and figure out what to do with any new business you sold along the way.

One topic that always comes up during the perpetuation planning process is the matter of taxes.

How do I deal with the taxes?

Asset Sale vs. Stock Sale

Whenever you go to sell, you have to determine if it's an asset sale or a stock sale. Very few agents have a C-corporation, so in our world, it's almost always an asset sale.

Read More: Do I Need an LLC as an Independent Insurance Agent?

The next question is what are you selling?

Hard Assets (Equipment) vs. Intangible Assets (Your Book of Business)

In the insurance business, you have your hard assets, like computers and desks. But that's not really what you're selling.

You're selling your book of business, which is called an intangible asset. By definition, it's called either "blue sky" or goodwill.

You also have a non-compete agreement to protect the buyer. You may want to put a meaningful dollar amount on that – say $5,000 – to protect you if something ever escalates and goes to court.

Note: When we're talking about intangible assets, they're referenced in tax code 197.

How to Avoid High Taxes In the Perpetuation of Your Insurance Agency

When it comes to tax strategy, it's really a discussion of treating the sale as commissions (ordinary income) or goodwill (capital gains).

- The buyer wants commissions – lower taxes for the buyer!

- The seller wants goodwill – lower taxes for the seller!

It's in the buyer's best interest to treat a sale as commissions, and it's in the seller's best interest to treat the sale as goodwill, which are taxed at the capital gains rate.

Here at New Horizons, we have treated all of our acquisitions as goodwill, which is not in our best interest, but we feel it adds a ton of value to the seller.

- When we treat the sale as goodwill, we have to take 15 years to deduct whatever we paid for that book of business.

- If we treated the sale as commissions (ordinary income), it would favor us because we could write it off sooner, but the seller would pay a lot more in taxes.

Tax Implications of a Business Sale

Let's look at this from the seller's point of view.

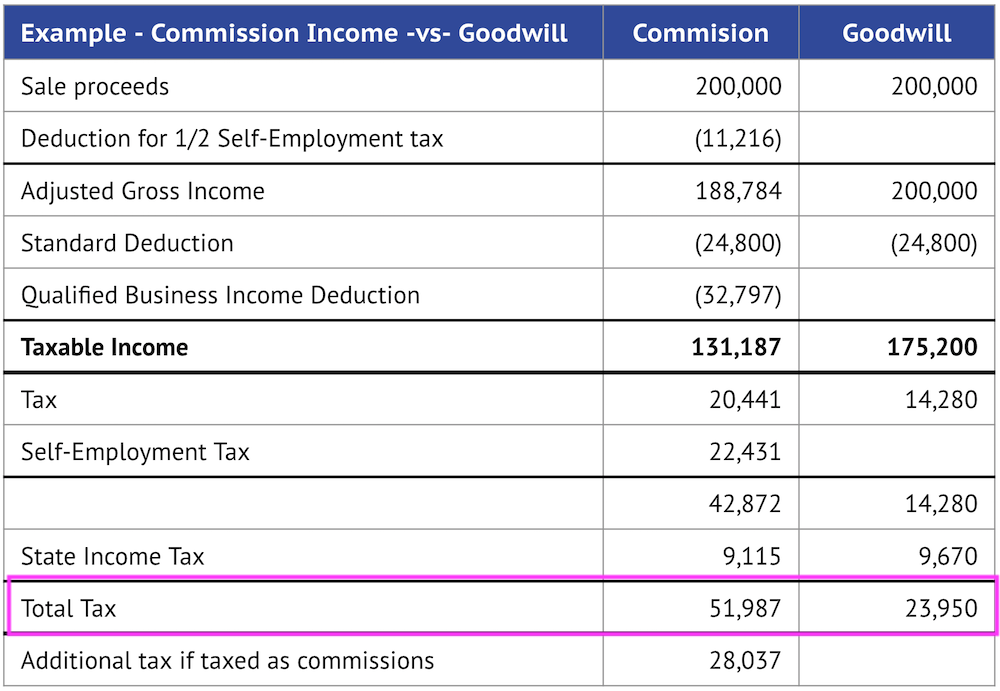

If your book of business is valued at $200,000 and you sell it as goodwill in one lump sum, you will pay $23,950 in taxes. If you sell it as commission, you will pay $51,987 in taxes.*

*Based on Illinois state income tax rate and 2020 tax laws – may differ slightly based on state and tax laws.

That is a massive difference! You want to fight to treat the sale of your insurance agency as goodwill. This chart goes through all the math to show how the total tax is figured in commission income vs. goodwill.

In another, more complex example, if you sell your $200,000 book of business as goodwill over four years – given several assumptions – you'll pay a total of $15,632.*

*Based on Illinois state income tax rate and 2020 tax laws. Includes $40,000 IRA distribution in Year 1, $50,000 in Year 2, $60,000 in Year 3, and $70,000 in Year 4 to simulate a retiree who is supplementing her income.

It can pay to spread out your payments.

Watch a full walkthrough of these examples in our recorded webinar:

Spend Time on Tax Planning

Whenever you sell your book, you want to fight to make sure it's positioned as capital gains/goodwill. Get into the details with your accountant, legal professional, and tax expert.

You've spend the majority of your life building up your business – you don't want to pay twice as much in taxes because you didn't spend extra time considering the tax implications.

Tax planning can really pay dividends here!

Frequently Asked Questions

Q: If I sell my business, will you send me a 1099?

A: If New Horizons bought your business, we are only required to send 1099s for a few categories, but the answer is essentially no.

Q: Do you have to report a sale treated as goodwill to the IRS?

A: No – there's no reporting of this to the IRS. You will need to tell your tax expert about the transition by giving them a copy of the contract, for example, but there's no reporting of it to the IRS.

Q: How do you value a business?

A: The businesses we are looking for are all renewable income products, like a Med Supp or Med Advantage. We look at the recurring income stream and place a multiple on that. It could be from 1.5-2.5x, depending on what the book is made up of.

Read More: It's Time to Sell Your Insurance Business: What's It Worth?

Q: Can you sell a Medicare Advantage and Part D book of business?

A: You can! Putting a value on it is tough, but we will look at it together.

Conclusion

You've likely spent your entire life hustling and building up a solid book of business. The last thing you want to do is put together a perpetuation plan without understanding the tax consequences.

When you're looking for a buyer, make sure you understand how they'll treat the tax portion of it. You ideally want the buyer to treat the sale as goodwill, which is taxed at the capital gains rate and will likely save you thousands in taxes.

If you have any questions about taxes and succession planning as an independent insurance agent, feel free to reach out to us directly. You can book a call directly on my calendar by clicking the image below!