A lot of agents out there are strictly Medicare Supplement agents, and there are a lot of reasons for that.

Medicare Supplements have been around since the 1960s, while Medicare Advantage wasn't introduced until 1997. The average age of a senior market insurance agent is 59, so it makes a lot of sense to me that agents would get comfortable with Medicare Supplements at the beginning of their insurance careers.

Once you're comfortable with a certain way of doing things, it's a lot harder to change. I'll be the first to admit that change is hard, especially when it comes to today's technology!

I've also heard from brokers across the country who can't get behind Medicare Advantage because their clients would forfeit their Original Medicare benefits.

Well, yes, on one hand, you do forfeit the Original Medicare benefits. But the government is handing that money to the insurance company who can actually do the job better. Private industry, in my opinion, has always been able to outperform the bureaucracy of the government.

A quick look at the CMS organizational chart gives you an idea of what I mean:

A copy of the CMS organizational chart - click to enlarge

We even have a Medicare Advantage product that will give you money for crying out loud!

Finally, many brokers I talk to are simply uncomfortable with the compliance barrier. The Scope of Appointment combined with strict marketing guidelines is intimidating, and it's just not a challenge they want to face. But we have more tools and support than ever before to make compliance less of a challenge.

I believe there's no better time than today to start offering Medicare Advantage to your clients. Without further ado, here are 10 reasons you should seriously start selling Medicare Advantage plans today.

Want to download this article in e-book format? Get it here:

1. Staying compliant is easier than ever.

Many agents refuse to touch MA because of compliance concerns. However, with the introduction of MedicareCENTER, you can send Scope of Appointments via text and enroll your clients all in one place.

It's never been easier to stay compliant and earn commission on MA and PDP sales.

In addition, our organization bends over backwards for our MA brokers. We help them through the scopes, the certs, and the AHIP. We don't do it for you, but we give you all the help we can.

2. The market is booming, and there are more options than ever before.

The Medicare Advantage market is booming. In fact, about 60% of all Medicare products sold across the country today are Medicare Advantage.

There are simply better plans with lower premiums, and there are more plans to choose from than ever before. The average number of Medicare Advantage plan choices per county will increase from about 39 plans in 2020 to 47 plans in 2021. That's a 78.5% increase since 2017 (CMS).

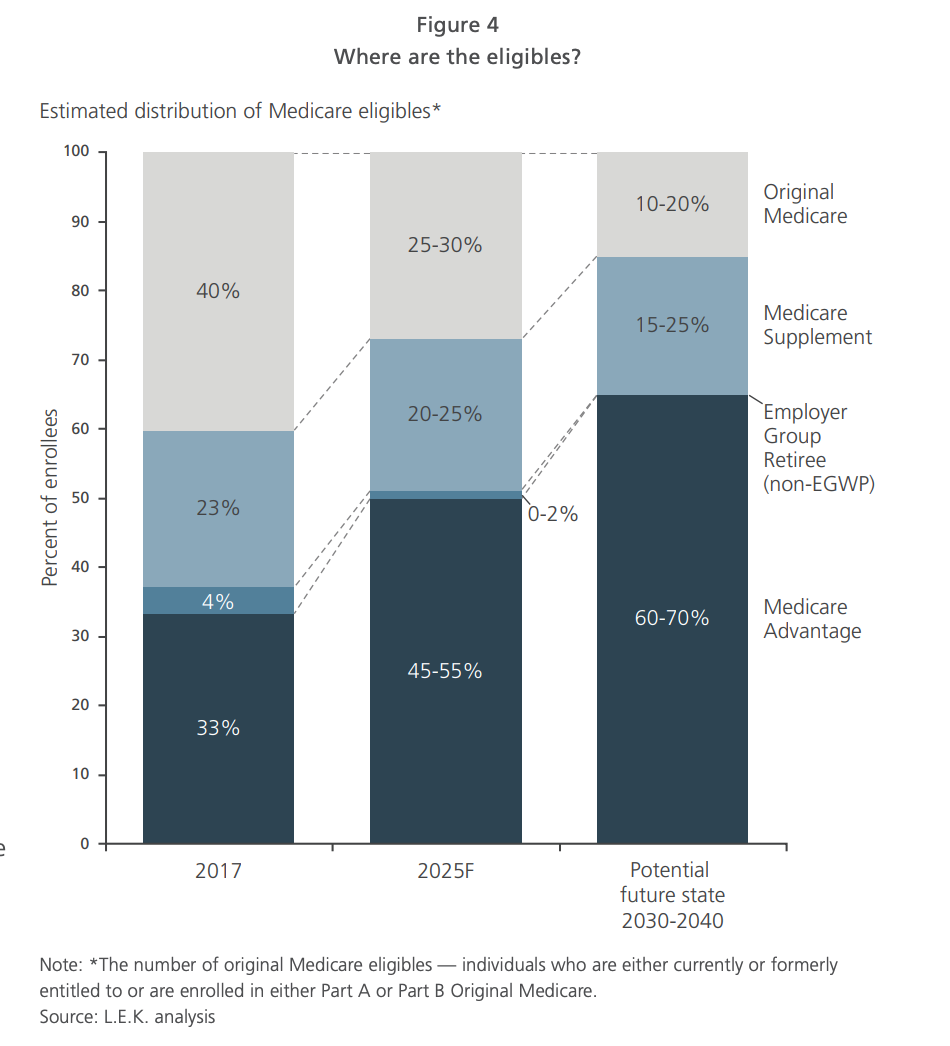

In the following chart, we can see that Medicare Advantage is sold more often than Medicare Supplements. In 2017, we see that Medicare Advantage accounted for 55% of all Medicare products sold. This chart also illustrates the projections through 2040.

Chart source: LEK

So many folks are leaving Original Medicare and are going to Medicare Advantage.

I don't believe they're leaving because of services, because you get great services from Original Medicare and a Medicare Supplement. I can only believe it has to be driven by premium. The premium savings is strong enough that they're willing to take a chance on the MA space.

The Medicare Advantage market is only growing at this point. About 46% of people eligible for Medicare are enrolled in Medicare Advantage (MA) plan and in the next few years, the balance is likely to tip so that more than half of beneficiaries will be in MA plans.

3. Provider acceptance is on the rise.

MA products are network-based, and individuals want freedom of choice. They want to be able to go their favorite doctor, they want to make sure they have affordable coverage when they travel, and snowbirds need reassurance that their insurance will cover them in two locations.

With the emerging growth of the MA product, a provider can't afford to shut out half of what he does. A provider wants to serve 100 out of 100 people walking into his practice – he doesn't want to send away a hefty portion of those.

By attrition, more and more providers have to say "yes" to any MA product. In the early 2000s, when MA only represented 5% of the Medicare population, providers didn't want to mess with it.

But today, the size of it requires them to deal with it. It's no longer a stranger.

National players like Aetna can provide a national network – they have that capability. So really, when you offer an Aetna Medicare Advantage plan, there are in-network providers all over the place! And that's a good thing!

Now on the other hand, small regional players could have a very powerful regional product, but once you step outside their service territory, it's like going on the three-hour tour with Gilligan's Island. You're on your own.

But with national players like Humana, Aetna, Anthem – network isn't as much of a concern. It's not the hurdle so many agents think it is. The network maps are becoming all-encompassing. It's simply becoming less and less of a problem.

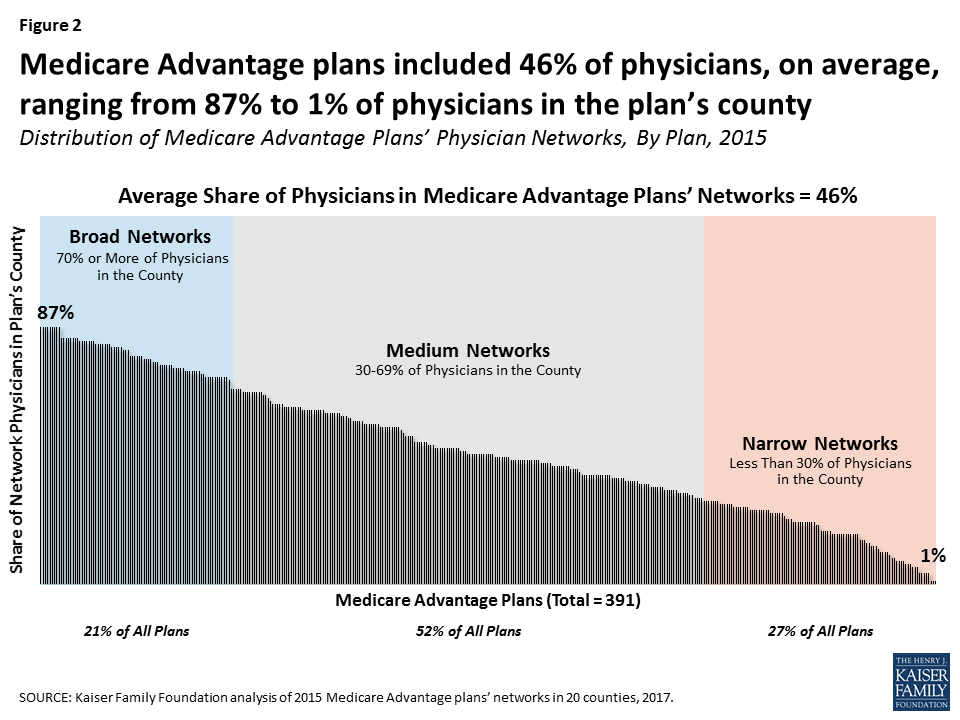

"About one in four (27%) plans had narrow networks (with less than 30% of physicians in the county), about half (52%) of all plans had medium-sized networks (with 30 to 69% of physicians in the county), and about one in five (21%) plans had broad networks (with 70% or more of the physicians in the county)." Source: KFF.org

4. There's no underwriting.

An obvious benefit of Medicare Advantage is there are no underwriting hurdles to get through.

MA is a great place for Med Supp clients to go when their premiums get too high, but on the other hand, it's also a great fit for healthy clients who can enjoy a low premium in their good years.

MA fits so many client profiles, and with the ESRD question going away in 2021, MA is truly a non-underwritten product. Now, to be reasonable, ending the ESRD hurdle will add more losses and might have an adverse effect. We will keep an eye on how MA insurers deal with the heavier claims.

5. Clients are asking for it.

Clients want MA. Shouldn't you offer what your clients are asking for?

Even if you prefer Medicare Supplements, you risk losing that client to another broker. Why would you turn a client away?

6. $0 premium options are very compelling.

Medicare Supplement premiums go up over time, while Medicare Advantage premiums are going down over time.

The average 2021 MA premiums declined over 34% from 2017 while plan choice and benefits actually went up. The average 2021 MA premium will be the lowest it's been in 14 years (CMS).

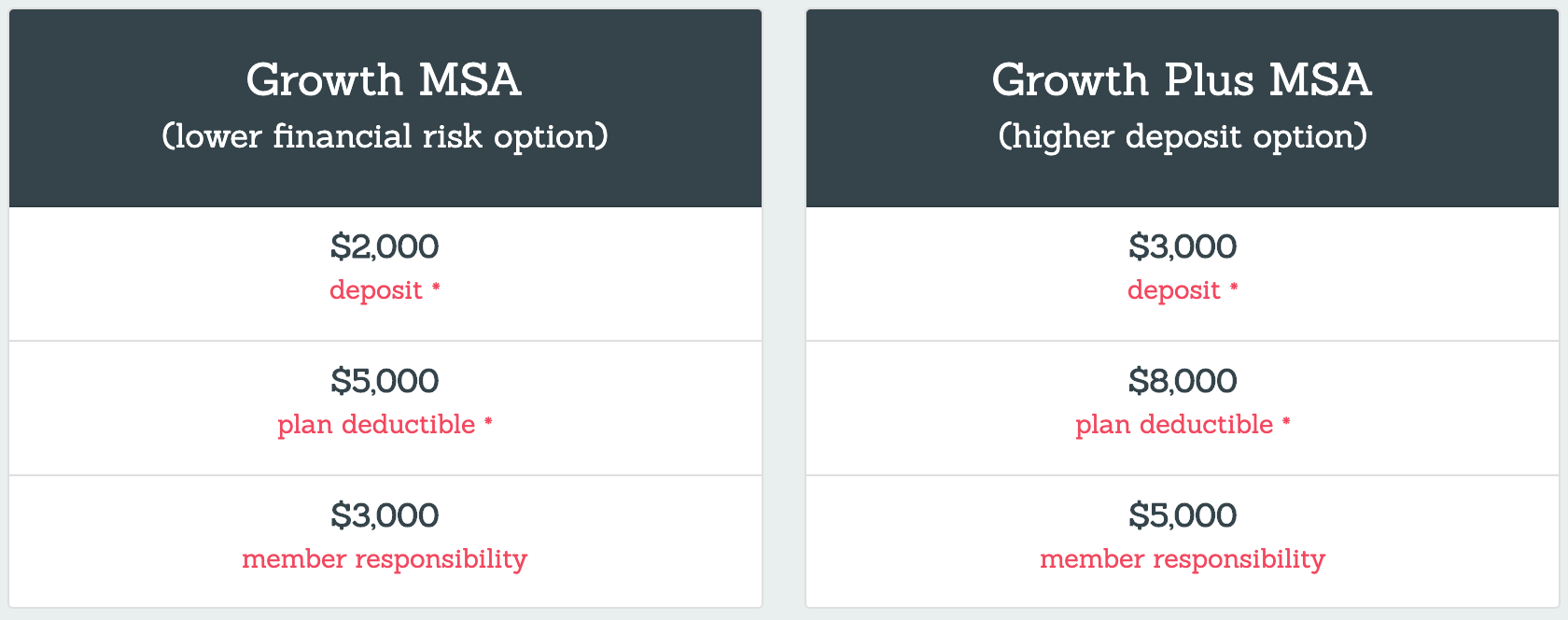

If these statistics don't strike you, consider the 2021 Lasso Healthcare MSA. The Growth MSA plan offers $0 premium, a $2,000 deposit, and a $5,000 deductible.

Your client has a worst-case scenario of $3,000 out of pocket for the year. How many people are paying more than $3,000 in Medicare Supplement premium alone? If you have any clients who pay more than $250 per month in premium, moving them to the Lasso Healthcare Medicare Advantage product is a no-brainer.

The same goes for healthy clients. When you tell someone who only goes to the doctor for an annual check-up that they could have a $0 premium product in exchange for some copays and a deductible, why wouldn't they jump at it?

It's incredible what we can offer to the Medicare population today.

Healthy people don't want to sink money into a premium when they know there's a good chance they won't utilize the plan. Clients see their Medicare Supplement having a 5-10% rate increase each year, and they see more and more of their money coming out of their pocket.

When we compare that to the Lasso Healthcare Medicare Advantage MSA, for example, they're actually starting the year in a positive financial position versus money coming out of their pocket every month. That's incredibly compelling.

7. Extra benefits add additional value to MA plans.

Medicare Advantage plans have the flexibility to add more benefits than ever before – benefits that traditional Medicare doesn't offer.

Extra benefits now available can include (Medicare.gov, CMS, Humana, Aetna, Centene):

- Transportation to doctor visits

- Over-the-counter drugs

- Adult day-care services

- Additional telehealth benefits

- Caregiver support services

- Counseling programs

- In-home support services

- Therapeutic massage or home-based palliative care

- Healthy foods and meals

- Dental benefits

- Vision benefits

- Hearing care benefits

- Gym memberships

- Gift card rewards for completing certain activities, like having an annual wellness exam or getting a mammogram

- Medical alert systems/Fall prevention kits

- 24-hour nurse hotlines

- Worldwide ER coverage

- Chore services (like home cleaning)

- Lower copays and additional benefits like meals and transportation for those with particular conditions like diabetes or congestive heart failure

- Pest control, home cleaning services, meal home delivery, and transportation for non-medical reasons for those with chronic conditions

As you can see, there are a wide variety of added benefits your clients can get from Medicare Advantage plans.

Regional plans tend to have the most extras, because in certain pockets of the country, an organization will try to dominate the marketplace. I've seen carriers give away a monthly allotment towards bug infestations and even upgrades in your bathroom.

The competition is getting more and more fierce, and that's a great thing for the consumers! And that's why people are asking for it!

My own philosophy on extra benefits

While I think these extra benefits are great, there are some carriers that I worry may be abusing the funds they're given. For example, some carriers in the St. Louis area allow you to buy meat on a monthly basis. Right now, CMS is encouraging this, but I think there may be some legislation in the future that might put this fire out a bit.

My philosophy has always been that government money should be dedicated to claims adjudication. I'm never a fan of diverting federal money to "extras" when it should be going towards claims.

But many of these added benefits are keeping beneficiaries healthy.

For example, we know that dental health is tied to your overall health. Endocarditis, or the infection of the inner lining of your heart chambers or valves, happens when bacteria or germs from another part of your body – like your mouth – spread through your bloodstream.

Heart disease has been linked to oral bacteria. Pneumonia can occur when certain bacteria in your mouth is pulled into your lungs. Diabetes puts your gums at risk.

The same goes for vision care. Eye health is tied to your systemic health. Tumors, autoimmune disorders, thyroid disease, and high blood pressure can all show symptoms in the eyes.

The healthier you are, the fewer claims you have.

So, I do think there's a place for additional benefits with Medicare Advantage plans. And right now, I only see these extras continuing to expand.

8. Coverage is simplified with all benefits in one plan.

When your clients choose MAPD, they have all their benefits under one plan. If they go the alternative route, they have a Medicare Supplement, a Part D plan, and potentially ancillary coverage like DVH.

That's several premiums and multiple plan cards. The simplicity of one monthly premium and one health plan card is very attractive to many seniors.

All benefits under one plan isn't always ideal, as we know. For example, the most competitive MAPD plan in the county might not work well with your client's specific drug list.

That's part of the reason we really like the Lasso Healthcare MSA. It's a Medicare Advantage plan without drug coverage, but the client can actually add a Part D drug plan that's compatible with their prescriptions. They get the best of both worlds, so to speak.

But when the stars do align and your client has a great Medicare Advantage plan that works well with their preferred physicians and their medication list, it's a beautiful thing.

9. CMS is enhancing MA coverage.

CMS is definitely on a mission to make MA coverage as attractive as possible. We see CMS opening up the added benefit window even more every year.

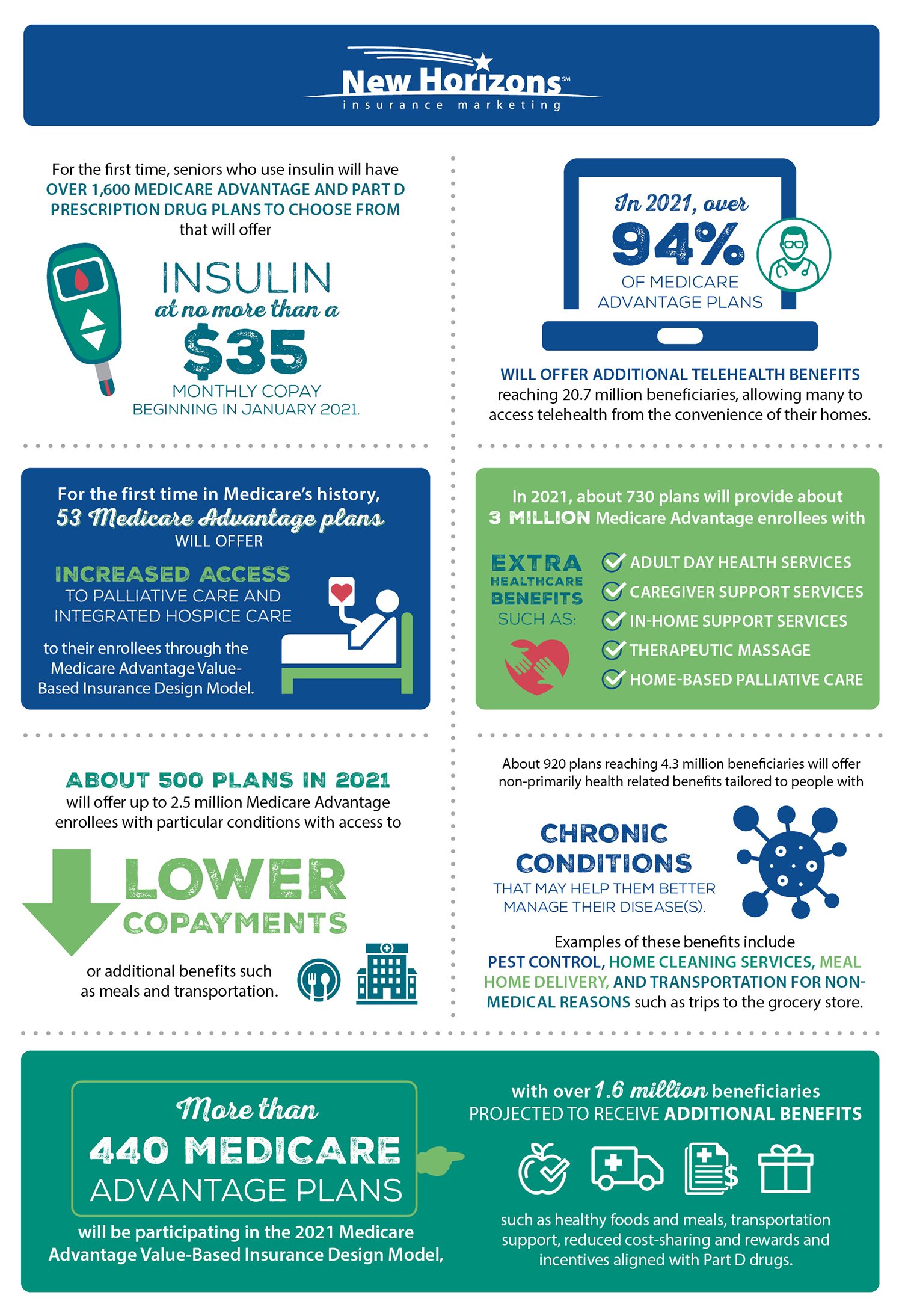

For the first time, seniors who use medication to control their diabetes will have over 1,600 Medicare Advantage and Part D prescription drug plans to choose from that will offer it at no more than a $35 monthly copay beginning in January 2021.

In 2021, over 94 percent of Medicare Advantage plans will offer additional telehealth benefits reaching 20.7 million beneficiaries, allowing many to access telehealth from the convenience of their homes.

For the first time in Medicare's history, 53 Medicare Advantage plans will offer increased access to palliative care and integrated hospice care to their enrollees through the Medicare Advantage Value-Based Insurance Design Model.

In 2021, about 730 plans will provide about 3 million Medicare Advantage enrollees with extra healthcare benefits such as adult day health services, caregiver support services, in-home support services, therapeutic massage, or home-based palliative care.

About 500 plans in 2021 will offer up to 2.5 million Medicare Advantage enrollees with particular conditions with access to lower copayments or additional benefits such as meals and transportation.

About 920 plans reaching 4.3 million beneficiaries will offer non-primarily health related benefits tailored to people with chronic conditions that may help them better manage their disease(s). Examples of these benefits include pest control, home cleaning services, meal home delivery, and transportation for non-medical reasons such as trips to the grocery store.

More than 440 Medicare Advantage plans will be participating in the 2021 Medicare Advantage Value-Based Insurance Design Model, with over 1.6 million beneficiaries projected to receive additional benefits such as healthy foods and meals, transportation support, reduced cost-sharing and rewards and incentives aligned with Part D drugs.

The bottom line is Medicare Advantage is only going to keep improving.

10. Great commissions.

Medicare Advantage compensation is higher than a Medicare Supplement.

Plus, unlike Med Supps, which stop paying after six years in many cases, MA comp keeps going for the life of the policy.

Contact us for more information on your commission. You can call us 888-780-7676, start a chat at the bottom right of the screen during regular business hours, or fill out the contact form on our website.

Conclusion

I hope I've conveyed to you why I'm so passionate about Medicare Advantage, and why you should at least consider getting involved.

It's certainly not going away, and with so many seniors moving from traditional Medicare to MA, I think it's foolish to turn a blind eye.

If you want some guidance about the opportunity in your county as well as which carriers to start with, I encourage you to schedule a Medicare Advantage consultation with me. Click the link below to begin.

We also have developed a full Medicare Advantage Sales Training program, available for free to all agents.

Click the image below to request access: