Attention senior market insurance agents! Here’s your perfect opportunity to learn more about the new final expense product from Accendo Insurance Company, part of the CVS Health® family of companies and an Aetna affiliate.

Kirk Sarff, Director of Life & Annuity Sales, hosted this webinar sharing everything you need to know to hit the ground running with Accendo's new final expense product.

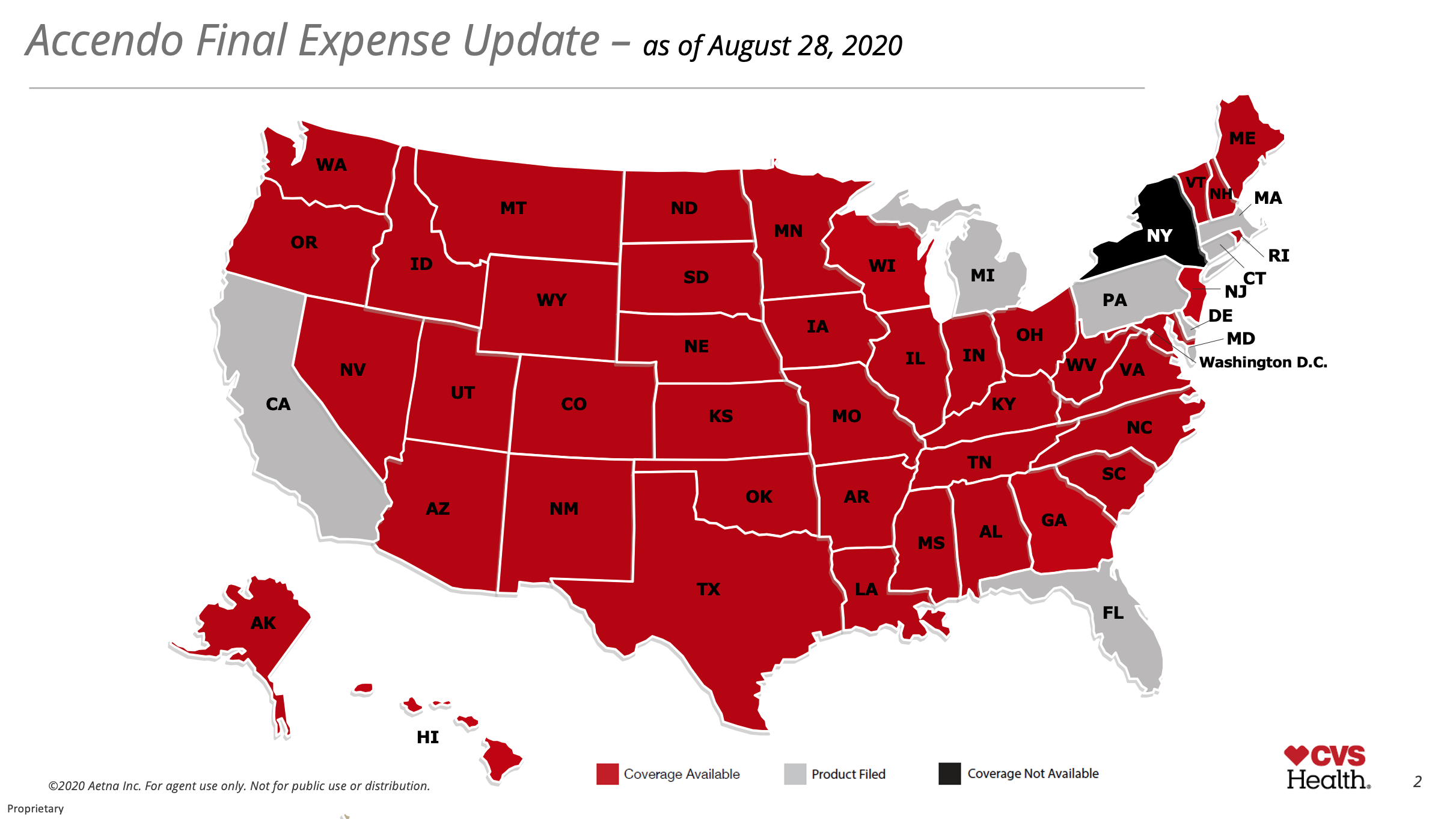

State Availability

Watch this section in the webinar recording: 2:28-3:06

The Accendo/CVS Health Final Expense product rolled out this summer (2020), and it has been expanding to new states ever since.

Here's a look at the state availability chart as of August 28, 2020:

Unique Features of the Accendo Final Expense Product

Watch this section in the webinar recording: 3:07-5:14

Most of the folks that were on the webinar have written a lot of final expense and already have an array of final expense carriers.

So I really wanted to point out the unique features of the Accendo FE product that we may not have with our other carriers.

Related Reading: Final Expense Insurance: Level, Graded, Modified, and GI (2nd Edition)

Issue Ages and Death Benefits

Something that jumps out to me is the issue ages. They go down as low as age 40 and as high as age 89. That's pretty significant as it represents the vast majority of our client base.

The minimum death benefit is somewhat unique as well at $2,000. And if you write someone between the ages of 40-55, you can write a death benefit as high as $50,000.

Our target market is that 66-75 age range, and you can write a death benefit as high as $30,000.

They will go in increments of $1,000 on the death benefit as well.

The modified benefit amount is up to age 75, so that changes a little bit from what's offered by some of our other carriers. The COVID-19 situation has also changed what some of our other carriers are offering, but that modified benefit is an option up to age 75.

Effective Date

Watch this section in the webinar recording: 5:14-6:26

Every application has to contain a requested effective date. With Accendo, you can actually request that 90 days into the future, based on the signature date. We don't have a ton of carriers that allow you to request an effective date 3 months in advance.

The initial draft date will be drafted on the day the policy is issued or if you have designated an effective date on the policy. If you don't select anything, the draft will occur on the policy effective date. That's when commissions will take place.

Super Preferred Rate

Watch this section in the webinar recording: 6:27-7:58

If your client qualifies for what we'd call "Select" or "Preferred" in the final expense world and have an Aetna or Accendo Med Supp or if they're applying for one, they may get the Super Preferred rate, which is essentially 10% off the Preferred rate.

If your client already has an Aetna or Accendo policy, you can plug their Social Security number in, and when they identify the client already has a policy, they'll apply the 10% discount (if they health qualify).

Strong Commission

Watch this section in the webinar recording: 7:59-9:02

If you have the Aetna or Accendo Med Supp contract, you already have access to the Accendo FE commission grid. You'll be very pleased with that, I assure you.

If you're not contracted to sell the Accendo FE product, the compensation is really strong.

Also, just so you know, the contracting for Aetna or Accendo Med Supp is compeltely different than the Medicare Advantage side. It's a completely different contract.

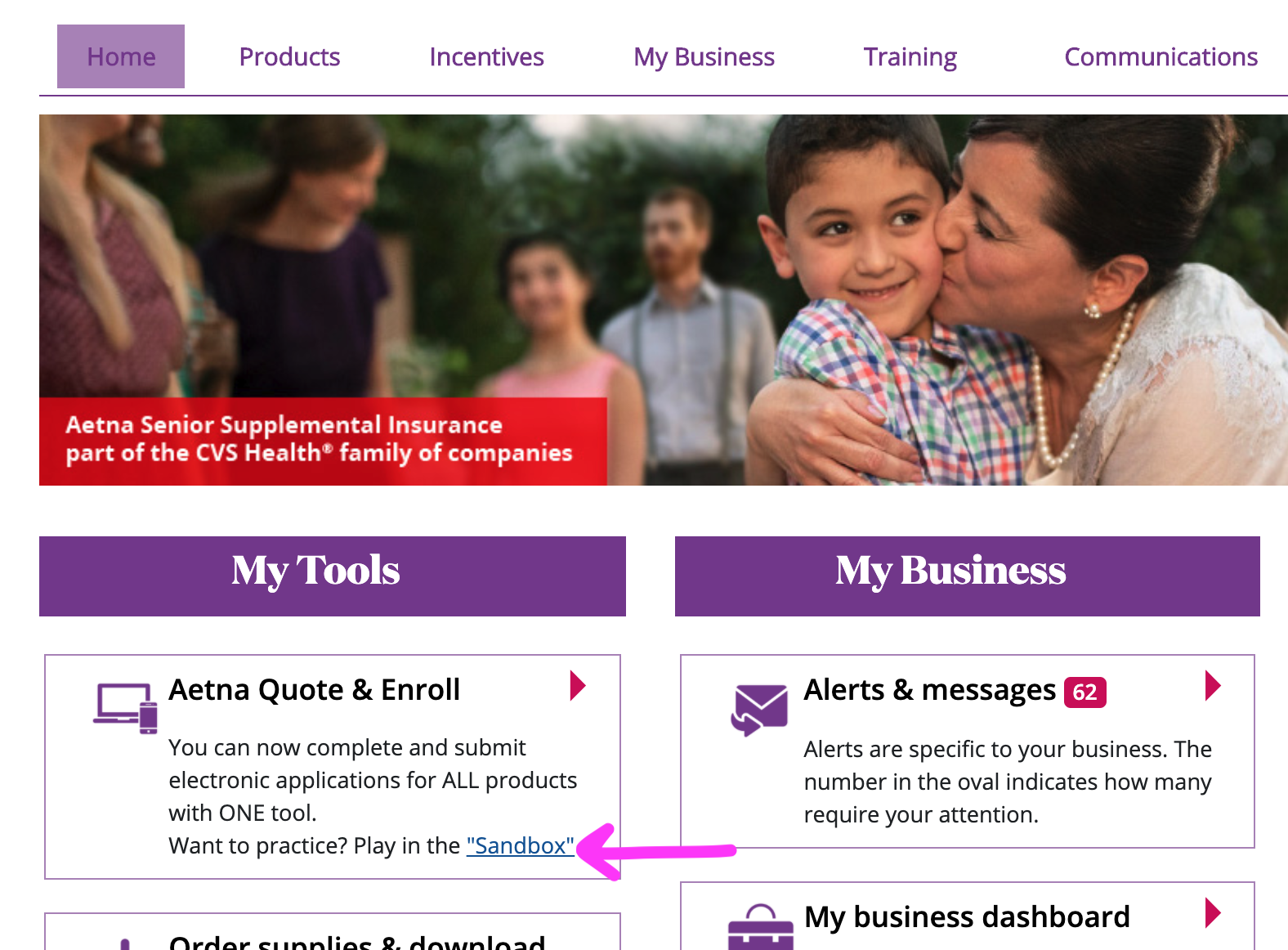

E-App Demo

Watch this section in the webinar recording: 9:02-21:11

If you want to try out the e-App, simply go to the Sandbox tool in the Aetna agent portal.

All of the Aetna family of products will show up in the e-App section, including:

- Medicare Supplement - Aetna Health Insurance Company

- Medicare Supplement - Accendo Insurance Company

- Final Expense - Accendo Insurance Company

- Dental, Vision, and Hearing - Continental Life Insurance Company of Brentwood, Tennessee

- Final Expense - American Continental Insurance Company

- Cancer Insurance - Continental Life Insurance Company of Brentwood, Tennessee

- Heart Attack or Stroke Insurance - Continental Life Insurance Company of Brentwood, Tennessee

- Home Care Plus - Continental Life Insurance Company of Brentwood, Tennessee

- Recovery Care - Continental Life Insurance Company of Brentwood, Tennessee

- Hospital Indemnity Flex - Continental Life Insurance Company of Brentwood, Tennessee

This makes cross-selling very easy, especially if you're already selling the Aetna or Accendo Medicare Supplement. I go through that in our quick e-App demonstration.

Drug List

Watch this section in the webinar recording: 21:17-23:12

One of the things I think is nice is their comprehensive medication list. This covers a lot of the meds you'll come across.

If no condition is noted under the Condition column, the medication is unacceptable for any condition.

You'll see some medications, like aclidinium, may not be acceptable for Preferred, but they can still qualify for Standard of Modified.

Use this drug list to qualify for your client before you get too far down the road.

Again, you can download the drug list by logging into our website, going to the Accendo/CVS Health Final Expense page, and scrolling all the way to the bottom where the Documents section lives.

FAQs

Watch this section in the webinar recording: 23:12-27:40

This PDF FAQ sheet answers many questions you may have. There were a few questions on that sheet that stood out to us which we went over on the webinar.

The first is about policy delivery.

Because of COVID-19, a delivery receipt is not required. The policy will be mailed right to the policy owner. Very rarely is the insured NOT the policy owner, but we do have them sometimes. So please know the policy will not be sent to the agent during this COVID situation. Everything will be mailed right to the policy owner.

Another one that caught my eye was the health history section – agents want to know if Section 6 is optional. It is optional, but I find it very beneficial to paint a picture for the underwriter. Believe it or not, you can build your reputation with underwriters by writing in a health history in the notes.

No height and weight is required. We don't have many carriers like that.

Another question is whether or not a Social Security number is required for beneficiaries. That can be a sticking point because grandparents don't know their kids SSNs. With Accendo, it's recommended because it helps at claim time, but it's not required.

Once you submit the application (if you choose 'Check Auto UW'), agents want to know how long it takes to get a decision. It should take 90 minutes. Hang in for 5 minutes, though.

Another common question for many carriers is are credit cards or debit cards allowed for payment? The answer is no.

The application fee is $40 and is figured into the rate, so if you're using our quote engine, it'll already be figured in. When you use the Aetna website to do the e-App, the app fee is also figured in.

Incentive Program

Watch this section in the webinar recording: 27:40-28:10

Accendo is running a $200 bonus, but it does end at the end of September 2020. You can check out any other incentives going on on our Incentives page.

Final Expense Sales Tips

Watch this section in the webinar recording: 28:10-30:48

This may not mean a lot to all of you, but the old legendary basketball coach Pete Carril said, "It's not what you teach, it's what you emphasize."

I promise you if you just start asking... if you write a Med Supp, just ask!

Related Reading: How to Cross-Sell Final Expense to Your Current Medicare Clients

John shared an older story in the webinar about an agent in Illinois who wrote a lot of final expense. He asked him how the heck he wrote so much, and his answer was simple: "I always ask one more question."

At the end of the Med Supp underwriting questions, he'd ask, "Do you want the death benefit with this?"

And the way this Accendo e-App is set up, it's so easy to just add that final expense on there. Don't make a big deal out of it – just ask for it!

![The Simple Question That Drove $9M+ in Annuity Sales [Case Study]](https://blog.newhorizonsmktg.com/hs-fs/hubfs/NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp?width=220&height=119&name=NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp)