Introducing a new product to your insurance offerings can feel daunting, but with short-term care, it's easier than you think.

Discover a sales strategy that involves just one question, a tool that lets you pre-qualify your clients in a snap, and learn how just one sale per week could increase your annual income by over $40,000.

1. Visualize the impact on your income.

Most agents share with complete transparency that dollar signs are what motivates them to sell a new product line.

Once they sell those first few policies, it becomes less about the money and more about how much those policies are helping and protecting their clients. That's where the passion in this industry comes from, especially when you see the impact of a claim for the first time.

But still, if you need that initial nudge, short-term care sales can be quite lucrative if you take a look.

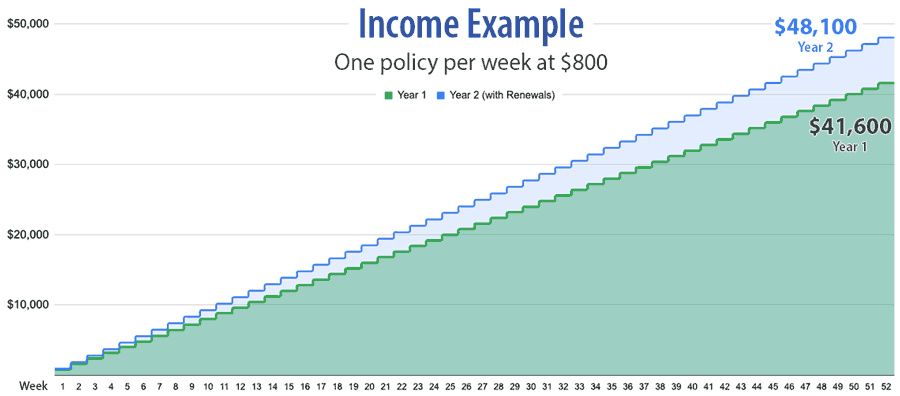

The average commission on a typical short-term care sale is about $800, and the renewals from years 2-5 are around $125 annually.

If you were able to cross-sell one short-term care policy a week, your income could jump up by $41,600 in a year's time.

And this is easy work since the product basically sells itself.

2. Selling short-term care can be as easy as one question.

There are a lot of different strategies for bringing up short-term care insurance. One of the most common ways agents do this is by asking a question like this:

"If you needed care, would you rather go to a nursing home or stay at home?"

This gets the conversation going in a casual and non-intimidating way. It's also a really important topic for seniors to think about and plan for. Most people would rather stay at home, but do they have a plan for how to cover those costs?

Short-term care policies with home health benefits are a perfect solution.

Learn more: Agent Guide to Home Health Care and Medicare Coverage

You can also utilize the questions in the Client Needs Assessment to get your client talking.

3. Short-term care plans are very affordable.

Unlike long-term care plans, short-term care policies have very affordable premiums. An average short-term care plan has a yearly premium of $1,500, or $125 per month.

Of course, you can get a bigger plan ($300/day for 360 days each of home health care and facility) with a premium closer to $2,500 per year.

But the average short-term care sale is around that $125/month mark. Plus, some carriers, like Wellabe, offer a household discount if the husband and wife both get a policy.

If you're already selling a Medicare Supplement, ask as you're wrapping up the application: "Do you want the short-term care benefit with this?"

Read more about this "Supersize It" sales technique and three others here: 4 Sales Techniques Every Savvy Insurance Agent Uses

4. Short-term care plans are very needed.

Long-term care insurance is essentially a product of the past as premiums are sky high, underwriting is impossible to pass, and most companies have dropped out of the market.

But the need for an insurance policy that helps pay for care in a nursing home, assisted living facility, or at home is stronger than ever.

The latest statistics share that 7 out of 10 people will require long term care in their lifetime. The average cost of in-home care is around $5,000 per month, and a private room in a nursing home is dangerously close to $10,000 per month.

Medicare's coverage is very limited. We all know that Medicare doesn't pay for long-term care, though it will cover the first 20 days in a skilled nursing facility.

A short-term care plan can fill that gap in coverage, and since 70% of seniors will need long term care at some point, it's a very compelling addition to their insurance lineup!

You can get long-term care cost estimates by state on Genworth's website.

5. Family and friends can be paid as caregivers.

Over the last couple of years, short-term care plan benefits have gotten exponentially better.

In fact, we now have a plan that will even pay family or friends who step in as a caregiver.

Nearly 17% of the U.S. adult population provides unpaid care to an adult over the age of 50 (A Place for Mom). That's a staggering number, which is why it's such a huge selling point for seniors who have family to rely on.

6. You probably already have contracts with the best short-term care carriers.

Last but not least? You may already be contracted with the best short-term care carriers in our portfolio.

Manhattan Life, Wellabe (previously Medico), and Aetna have rock solid plans, and these carriers also have other ancillary products that are some of the best in the industry.

Note: Manhattan Life's new Omniflex product is a different contract from the Medicare Supplement contract.

If you want to start cross-selling ancillary products, you really only need a couple of contracts to have access to everything you need.

Conclusion

Are you ready to start offering short-term care insurance to your clients? Don't pass over ManhattanLife's new OmniFlex Short-Term Care product.

If it's not available in your state, we can help you find the most competitive plan in your market.