When you're helping a senior with their Medicare coverage, your goal is simple: get them the best coverage at the best price. Yes, there's some give and take depending on the client's risk tolerance, their budget, and where they live. But ultimately, you're in the business of doing right by your clients.

The conversation gets a bit tricky when your best recommendation is a company they've never heard of. When you're selling Medicare Supplements, does brand recognition matter? Let's dive in.

The Big 6 – Medicare Supplement Market Share

In the Medicare Supplement world, six companies control about 82% of the entire market:

- AARP/UnitedHealthcare

- Blue Cross Blue Shield

- Humana

- Aetna

- Cigna

- Mutual of Omaha

The other 18% of the market is what all the other carriers are fighting for. It's important to understand the lay of the land, because if you control a huge chunk of the market, you don't have to compete as much.

A massive company that every senior has heard of doesn't have to compete on price. They can charge more for the same plan because everyone's heard of it.

Price and Underwriting

As agents, we know there are only two differences between Medicare Supplement companies: price and underwriting.

Your clients get the same plan benefits no matter which company they go with. It comes down to what the costs in your area and what the health questions are like (if they need to go through underwriting).

I'm going to go out on a limb and say that the best Med Supp rate in your area is not coming from one of the Big 6. Companies with brand recognition very rarely compete on price.

In fact, in our particular county in central Illinois, lesser-known carriers (still very reputable) charge at least $15 less per month for the same exact plan:

- Manhattan Life Assurance Company of America (MAC): $94.33/mo

- AARP, Insured By UnitedHealthcare: $109.32/mo

Is your client going to care about brand recognition if they're paying $15 more per month for the same exact thing? And here's the kicker – Manhattan Life has been around since 1850 and does $4 billion in premium. They do have some brand recognition, which can help clients feel more comfortable.

Rate Increase History

When looking at the rate increase history for Medigap plans, you'll find Tier 2 carriers like CSO, Lumico, MAC, Great Southern Life, and Capitol Life are a lot better.

The Big 6 control so much of the market, and when you dominate like that, you can set your own rules.

Some of the rate increase history information out there isn't accurate or reliable, but I can speak from personal experience here – clients with brand name carriers are often priced out in their 70s and 80s due to relentless rate increases.

Customer Service

Customer service is critical in Med Supp sales. Problems will come up, and as an agent, I want to work with carriers that get things fixed quickly.

From my experience, smaller companies give better service. You don't sit on hold and deal with transfer after transfer. That's what I'm looking for as agent.

It's the same on the FMO side, too. We're able to get in touch with some of those smaller carriers like Accendo, CSO, Lumico, MAC, Great Southern Life, and Capitol Life a lot faster, so we can service you and handle issues quickly.

Related Reading: Is It Hard to Sell Medicare Supplements?

Bonuses and Incentives

COVID has caused most incentive trips to be cancelled or delayed, but in normal times, smaller carriers have easier, more attainable trips.

If you enjoy taking incentive trips across the country and even the world, it makes sense to give more of your business to a smaller carrier.

When it comes to cash bonuses, there's not too much distinction between brand names and lesser-known carriers. However, I will say that the most attractive bonus out there right now is from CSO. You only need 1 app to qualify and you can earn $125-$225 per app.

Contract With a Good Mix of Med Supp Carriers

Having a couple big name carriers is good, because some people will demand it. Their mom, sister, friend, or neighbor had it, and no matter how much reason you talk into them, you're not going to get it through their head. So, it's good to have a couple well-known companies at your disposal.

However, the smaller companies compete where it counts – price. We always do what's best for the client, and making sure they have great coverage at a great price is what really matters, not the company name.

As a producer, you need a good portfolio of Med Supp options.

My advice is to contract with the top 1-3 carriers in your region. Use our quote engine and make sure you have the carriers with the best rates. Then, make sure you have a couple carriers with an underwriting niche as a fallback.

Our Med Supp Tip Sheets give you the underwriting highlights so you can effectively place more business:

If you write all over the country, you'll probably need more carriers, because pricing varies depending on where your clients are. But for most agents who write pretty regionally, you'll have 1-3 carriers for their rates and then a couple for different underwriting niches like cancer or COPD.

I'd say having 5 or 6 carriers to be contracted with is a good number.

But at the end of the day, it's better to have the contract when you need it versus needing it and not having it.

E-Apps and Marketing Materials

When it comes to e-Applications and the ease of writing business remotely, it's an even playing field. Tier 2 carriers have great e-Apps just like the big players.

In fact, the easiest e-App in the market is from MAC (ManhattanLife Assurance). They only require a mother’s maiden name and they do the rest. You can take an e-App on someone just sitting in their lounge chair – no computer required.

And when it comes to marketing materials, a good FMO can provide you with that. You don't need to rely on the carrier to give you flyers or mailers – rely on us.

You can browse our library of marketing materials, but here are links to our most popular pieces:

- Insurance Marketing Postcard and Email Template for Med Supp and Part D Clients

- Medicare Supplement Rate Increase Toolkit

- Client Guide to Medicare Parts A&B

- The ABC's of Medicare Handout

Brand Recognition at the Doctor

The only practical difference between big carriers and Tier 2 carriers is brand recognition at the doctor's office. In general, the doctor's office should look at the letter on the card – is it F, G, N, etc.? That's all they should be looking at, because the coverage is the same.

Occasionally, you'll get someone at the front desk that doesn't know anything and they might say they don't accept that carrier. It's pretty rare, but just stress to your clients that a G is a G is a G.

Use the Quote Engine to Get Market Data

While some of the best carriers on the market right now don't have a ton of brand recognition, they're definitely reputable.

For example, Lumico has a 50+ year track record helping insure individuals and families, and is part of Swiss Re, a global financial services organization.

ManhattanLife has been around since 1850, and most people have at least heard of them. They're building brand recognition in places like the Wall Street Journal, and they are reinsured by one of the largest carriers in the Medicare Supplement arena.

Accendo is part of the CVS Health® family of companies and an Aetna affiliate – most consumers have heard of CVS Health.

Another example is CSO. CSO is an older company, and they wrote Med Supp until 2005 and decided they wanted to venture elsewhere. They sold that block of business, but now they're back in the market. CSO has experience in this business, and when you use the quote engine, you'll see how many years they've been in the market (32 as of 2021!).

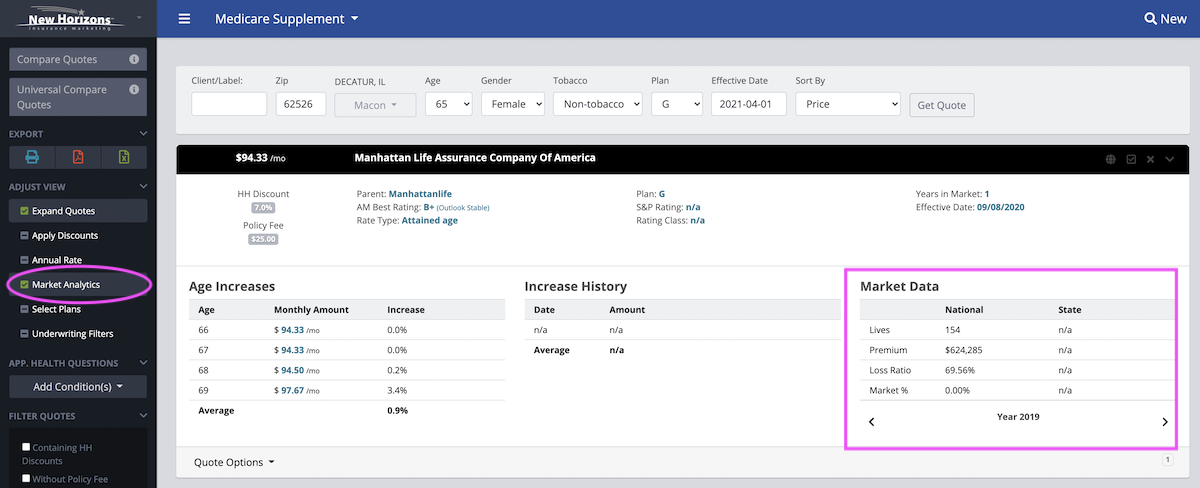

You can use our quote engine (CSG Actuarial) to see some market data that will give you extra fuel with your clients. Make sure you're logged in; then run a quote. Make sure "Market Analytics" is checked on the left, and you'll see an expanded view of each carrier.

For example, CSO has 32 years in the market and Lumico did over $21 million in Medicare Supplement premium in 2019. Data like this can go a long way when talking to your clients.

Conclusion

So, does brand recognition matter? Definitely. But is it really that important when selling Medicare Supplements? We don't think so.

In a standardized market like ours, price and underwriting write the story, not necessarily the brand name. Sure, brand awareness can help, but ultimately, you're going to do what's best for your client.

What are your thoughts? Let us know in the comment section below.