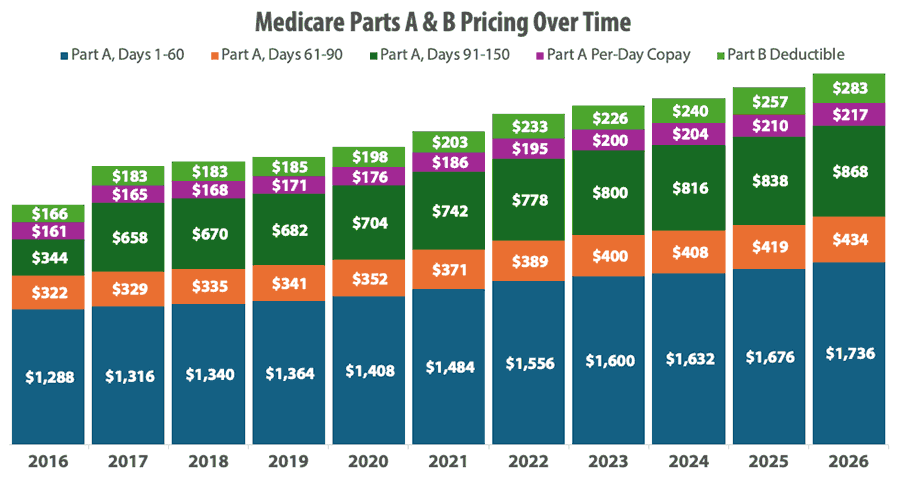

We put together a chart tracking Medicare Parts A and B costs from 2016 through 2026, giving us a full decade of data to analyze.

Seeing the numbers laid out visually tells a powerful story about the financial pressures your clients are facing.

The trends are striking, and they really showcase why your role as an agent has never been more important.

Medicare Parts A & B Costs From 2016-2026

Over the past decade, Medicare beneficiaries have watched their out-of-pocket costs climb steadily.

We put together a chart to help you visualize these costs over time:

So, are these increases just keeping pace with inflation, or is healthcare outpacing the rising cost of everything else?

The answer: it depends on which cost you're looking at.

Medicare Part A Costs vs Inflation

Since 2016, cumulative inflation in the United States has been approximately 37% (U.S. Bureau of Labor Statistics). So, something that cost $100 in 2016 costs around $137 today.

When we compare Medicare's cost increases to this, we see a mixed picture.

The Part A hospital deductible increased from $1,288 in 2016 to $1,736 in 2026, a 35% increase that's actually slightly below the overall inflation rate.

Daily coinsurance amounts tell a similar story. The daily copay for hospital days 61-90 rose from $322 to $434 (a 35% increase), while the lifetime reserve day copay increased from $644 to $868 (also 35%).

For skilled nursing facility stays beyond 20 days, beneficiaries now pay $217 per day compared to $161 in 2016 – again, right around the 35% mark.

Medicare Part B Costs vs Inflation

Here's where the story changes: the Part B deductible grew from $166 to $283 during the same period, marking a 70% rise, which substantially outpaces inflation.

In 2016, the standard Part B premium was $121.80 per month. By 2026, it reached $202.90 – a 67% increase.

That means a beneficiary paying standard premiums is now spending $972.12 more per year, compared to 2016.

The trajectory hasn't been smooth, either.

The biggest single-year jump came in 2022, when premiums increased by $21.60 per month to cover anticipated costs for new Alzheimer's medications, like Aduhelm (which is no longer on the market).

While premiums actually decreased slightly in 2023 (a rare occurrence), the overall trend is pretty clear: Part B premiums continue climbing faster than general inflation.

The 2026 increase of $17.90 per month was notably driven by projected price changes and utilization increases. Interestingly, it could have been about $11 higher per month if not for policy changes that reduced spending on skin substitutes by 90% (CMS Fact Sheet).

IRMAA Changes Over Time

About 8% of Medicare beneficiaries pay income-related monthly adjustment amounts (IRMAA) on top of standard Part B premiums. In a room of 25 clients, statistically two of them are paying these higher premiums.

IRMAA is based on modified adjusted gross income from two years prior, which means 2026 premiums are based on 2024 tax returns. The income thresholds that trigger IRMAA were frozen from 2011 through 2019, which meant more beneficiaries fell into IRMAA brackets each year simply due to inflation and normal income growth.

But starting in 2020, these thresholds began adjusting for inflation. In 2016, IRMAA was $85,000 for individuals. By 2026, that threshold increased to $109,000.

A client who took a large IRA distribution, sold a rental property, or converted to a Roth in 2024 could see their Part B premium jump from $202.90 to $284.10 (or higher) in 2026. That's $974.40 in unexpected annual costs.

However, there's an appeals process if a life-changing event, like retirement, divorce, or loss of income, has reduced their income since the tax return year.

Social Security Increases Over Time

The real concern about all of this isn't just that costs are rising. It's that seniors living on fixed incomes often see their Social Security increases go right back out the door to cover higher medical expenses.

From 2016 to 2026, Social Security recipients received cumulative Cost-of-Living Adjustments (COLAs) totaling approximately 30.5% (Social Security Administration).

But those increases haven't been consistent year to year.

In fact, 2016 saw no COLA at all, followed by a 0.3% increase in 2017. The big jumps came later, with an 8.7% COLA in 2023 and 5.9% in 2022 in response to inflation following the pandemic. The 2026 COLA is 2.8%, which will boost the average monthly benefit for a retired worker by about $56.

Compare that to the Medicare cost increases we've seen: Part A hospital deductibles rose 35%, Part B deductibles increased 70%, and most coinsurance amounts climbed roughly 35% during the same period.

While the Part A costs stayed relatively in line with Social Security adjustments, that Part B deductible significantly outpaced seniors' income growth.

For those on fixed incomes, this means healthcare is claiming a much larger share of their budget than it did a decade ago.

Why Medicare Costs Keep Rising

When clients ask why their Medicare costs keep going up, it helps to understand the forces at play. Because it's not just about inflation.

Breakthrough Medications

The 2022 spike in Part B premiums offers a perfect example. The $21.60 monthly increase – the largest single-year jump in Medicare history – was primarily driven by anticipated costs for Aduhelm, a new Alzheimer's drug that carried a $56,000 annual price tag.

Although the drug was later pulled from the market (and premiums decreased slightly in 2023), this example shows how just one new treatment can dramatically impact Medicare spending.

The "COVID Catch-Up"

The COVID-19 pandemic also changed things with what we now call "the COVID catch-up" or "the catch-up effect." During 2020 and early 2021, many beneficiaries delayed elective procedures, routine screenings, and preventive care.

When pandemic restrictions lifted, patients returned for postponed surgeries, cancer screenings, and treatments for conditions that had gotten worse during the delay. This pent-up demand drove costs higher in 2022 and 2023 as the system worked through the backlog.

Medicare had to account for both the deferred care finally being delivered and the complications that arose from delayed treatment.

Many More Factors

Beyond breakthrough medications and the recent COVID catch-up, there are several more factors at play:

- The baby boomer generation continues to age into Medicare at a rate of approximately 10,000 people per day, increasing the program's enrollment and overall spending.

- Medical technology advances offer better outcomes but often at higher costs.

- Chronic conditions like diabetes and heart disease require ongoing, expensive management.

- Healthcare utilization has also increased – people are living longer and often with multiple chronic conditions that require coordinated, ongoing care. The average 65-year-old today can expect to live into their mid-80s, meaning they'll rely on Medicare for two decades or more.

Medicare costs aren't going to stabilize anytime soon, making comprehensive coverage for your clients more valuable with each passing year.

What You Can Do to Help

This is where your value as an agent comes into play.

You're helping clients understand these trends and build a coverage plan that works for their budget.

Whether that's through Medicare Supplement plans that shield them from cost-sharing increases or Medicare Advantage plans with clear out-of-pocket maximums, your guidance is so critical.

You truly help those over age 65 figure out what to do in a landscape where costs consistently move in one direction: up.

Conclusion

The chart we put together tells a compelling story: Medicare costs are going up, and that trend isn't changing anytime soon.

With this historical perspective in mind, you can help your clients navigate their options with confidence and build coverage strategies that work for their budgets.

Good selling!