No agent wants to hear they've lost a client, especially when it's a rapid disenrollment at the beginning of the year.

In this article, we'll take a look at what a Medicare rapid disenrollment is and what you can do to prevent it from happening.

Rapid Disenrollment Definition

A rapid disenrollment occurs when a client buys a Medicare Advantage or Part D drug plan during AEP (between October 15-December 7) and drops it during the MA OEP (between January 1-March 31).

The MA OEP, or Medicare Advantage Open Enrollment Period, lasts from January 1 through March 31. Your client can switch from one MA plan to another or switch from an MA plan to Original Medicare (with or without a Part D drug plan).

Any changes made during the MA OEP take effect on the first day of the following month. If you make a change on January 15th, those changes would take effect on February 1, as an example.

Agent Consequences

When a client rapidly disenrolls from their plan, it has negative consequences for their agent in the form of a chargeback.

For business written during the AEP, half of the commission is typically paid in January and the follow-up payment is made in February.

If someone disenrolls, the carrier is allowed to take that commission back, which is called a chargeback.

Beyond the agent having to pay that unearned commission back, there are no penalties that we know of. Carriers do keep track of that data, but we have never seen them enforce any additional consequences based on disenrollments.

Why Rapid Disenrollments Happen

To understand how to prevent rapid disenrollments from happening, we need to first understand why seniors are switching plans in the first place.

Here are a few of the most common reasons people leave or switch coverage so quickly:

- They need better drug coverage

- They didn't even know they switched coverage (we'll cover sneaky call center tactics in the next section)

- They have problems getting their plan to provide and pay for care they need

- The plan's network doesn't include one of their doctors or hospitals

- They have trouble getting information and help from the plan (poor customer service)

CMS has provided a spreadsheet of disenrollment reasons by plan type, so if there's a specific plan in your county that you want to focus on, you may want to find it in the spreadsheet first.

To find the disenrollment reasons spreadsheet, visit this page and look for the current year's "Star Ratings Data Tables (ZIP)" file. When you download that, one of the spreadsheets will be labelled "Disenrollment Reasons."

How to Prevent Medicare Rapid Disenrollments

1. Warn your clients about sneaky call center tactics.

Call centers are not inherently bad by any means, but there are always bad actors that will exploit vulnerable seniors for their own benefit.

One common tactic scammy call centers use is to trick seniors into enrolling in a plan without them even knowing it.

They tell the beneficiary they can "add" certain benefits to their existing plan, but little do they know, they're actually switching plans entirely.

Cue the script:

Marketer: Would you be interested in adding dental benefits, a flex card with money preloaded onto it, and a Part B giveback to your existing plan?

Senior: Yeah, why would I say no?

Next thing you know, that senior is trying to make an appointment with their specialist in January just to find out they don't take their new plan.

Educate your clients and prospects about this by ensuring they know you can't add benefits to your plan without switching actual plans.

2. Send a letter in December to all Medicare Advantage clients.

One of our really great Medicare Advantage agents sends out a letter every December. All of his MA clients get it, whether they made changes to their plan during AEP or not.

His message is simple: if you realize you're not happy with your plan, call me. I have a huge selection of available plans and can help you.

You never know what may happen following AEP. Perhaps they get a phone call that convinces them of a better plan out there. Perhaps they visit their doctor in January and realize they don't take their new plan. Maybe they just started a new medication and their MA plan doesn't cover it.

Whatever the case may be, this letter lets clients know they have someone to lean on if they have questions or really want to change their plan.

3. Ensure you're covering the full Pre‑Enrollment Checklist (PEC).

The Pre-Enrollment Checklist (PEC) is essential to ensure your client understands what they're signing up for.

The checklist includes things like:

- Understanding the benefits: telling them about the Evidence of Coverage (EOC), provider directory, pharmacy directory, and drug formulary.

- Understanding important rules: ensuring they understand their premiums (including the Part B premium), network rules, when benefits or plan costs can change, and any special rules based on their plan type (D-SNP or MSAs, as an example).

Ideally, the PEC is an opportunity to wrap up all of the things you've already talked through with your client. If they understand their plan and know it meets their needs, they're much less likely to disenroll.

4. Use MedicareCENTER to add pharmacy, provider, and prescription filters.

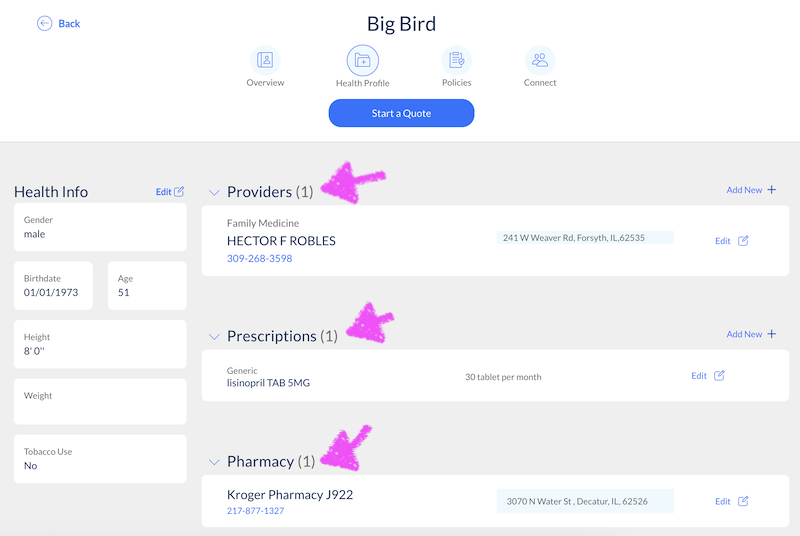

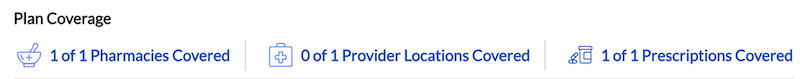

Hopefully, you're all set up in MedicareCENTER and are using it to quote and enroll your clients in Medicare health and drug plans.

If not, make sure you are contracted to sell through us and register for an account here.

Once that's finished, you can add your client into the free CRM. There, you can fill out their health profile, including their providers, prescriptions, pharmacy, and conditions.

Now, when you run quotes, you have a much better chance of choosing the most compatible plan for your client.

It's still a good idea to double-check that key doctors, specialists, hospitals, and pharmacies are in the plan's network. But this will certainly get you off to a strong start.

In this example, I can see the plan does not cover the client's provider – it's a really handy feature!

5. Coach your client on all of the benefits that come with their plan.

5. Coach your client on all of the benefits that come with their plan.

You'd probably be surprised to find out just how many beneficiaries don't use the extra benefits and perks that come with their MA plan.

Once you've matched your client with the most compatible plan, coach them on all of the benefits that come with the plan. MA plans are including more and more extras, like OTC benefits, free transportation, grocery allowances, dental coverage, and more.

Help your clients get the most out of their plan! If they get all the value they can, they're much less likely to drop the plan.

6. Educate your client on all of the options – even ones that aren't the best fit.

We see it all the time: you enroll your client in a plan that matches their needs and budget, but their family member or friend says their plan is better.

It's best to be proactive by educating your client on a wide variety of options. Perhaps the MA plan you believe is best has a small monthly premium.

Show them that there are other options with $0 premium, but you don't think they're the best fit for XYZ reason.

Now, when their family member says something like, "Why are you paying a premium for your plan? Mine is $0 premium – you should call and switch," your client will understand the big picture.

7. Prepare your clients for an upcoming Outbound Enrollment Verification (OEV) call.

After you finish the enrollment process with your client, let them know about the Outbound Enrollment Verification (OEV) call.

The carrier is required to make this call and ensure the applicant request enrollment understands their plan type and its rules. You can take a look at this example script to get a better idea of what the call entails.

If your client doesn't really understand the plan you've enrolled them in, they're more likely to disenroll at that time. Prepare them for the call so it doesn't surprise them and cause unnecessary confusion.

Conclusion

Be proactive with your clients to avoid rapid disenrollments. Educate them about potential pitfalls like deceptive call center tactics, and make sure they fully understand their new plan and its benefits.

You can even go the extra mile by sending a post-AEP letter emphasizing your willingness to help if anything goes wrong. All of these things will not only prevent rapid disenrollments, but it'll strengthen your client relationships.

Related:

![The Simple Question That Drove $9M+ in Annuity Sales [Case Study]](https://blog.newhorizonsmktg.com/hs-fs/hubfs/NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp?width=220&height=119&name=NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp)