When we start talking about terms like LLC, sole proprietorship, partnership... things can get muddy really fast.

That's why we talked with a local lawyer, Shane Mendenhall. He has some great advice for independent agents curious about which legal entity they should consider for their business.

Why Consider an LLC?

There are two main reasons you'd want to form an LLC as an independent agent:

- Protection – let's not lose our house if we get sued!

- Growth – it's so much easier to have employees.

Protection from Individual Liability

The key reason you'd consider forming an LLC as an independent insurance agent is to protect you from individual liability.

We live in a world today where anyone can sue anyone for anything at any time.

Mendenhall explains that even if there's no merit at all, it doesn't always stop someone from coming after you. "If the LLC is set up properly and is adequately insured, it helps protect you from individual liability," he explains.

In other words, that angry client shouldn't be able to personally go after you, your home, your vehicles, etc.

While E&O insurance does help protect you, an LLC offers extra cushion. Mendenhall explains, "I still recommend establishing an LLC and then having the entity purchase E&O insurance on behalf of the agent – it adds an additional layer of protection."

Your Business Grows With You

While the liability is first and foremost, the second benefit of forming an LLC as an agent is that it's much easier to grow your business.

Mendenhall explains, "If my business starts booming and I start hiring employees or assistants or even other agents, the LLC would be employing them."

The LLC would be covering workers compensation insurance, employment taxes, and so on rather than trying to orchestrate everything as a sole proprietorship.

Speaking of sole proprietorships...

Is an LLC the Right Entity for Independent Agents?

You have LLCs, corporations, sole proprietorships... it's a lot to consider, but Mendenhall makes it easy: "If it's a single agent or a few agents working together, I always recommend they set up an LLC."

Twenty or 30 years ago, everyone formed corporations. However, states started coming out with LLCs, or Limited Liability Companies, and there's less corporate structure with an LLC.

Mendenhall explains that with an LLC, you don't have to issue shares, hold formal meetings, and so on.

As for sole proprietorships, Mendenhall personally isn't a fan: "There is no legal entity, so there's nothing to shield you and give an added layer of protection from individual liability."

Here's an example. With an LLC, Mendenhall might call his agency "Shane Mendenhall Insurance Agency, LLC." With a sole proprietorship, it would be "Shane Mendenhall doing business as Mendenhall Insurance Agency."

Any time there's a potential for mistakes happening and costing people money for those mistakes, you want the added layer of protection that an LLC provides.

How Do You Set Up an LLC?

To set up an LLC, you have two options:

- DIY (do it yourself)

- Go to a lawyer

As with anything, there's always the risk of messing something up when you do it on your own. Mendenhall explains, "People don't really like to go to lawyers. I get it. But if I break my arm, I'm not doing surgery on myself – I'm going to a doctor."

Mendenhall says that all too often, people come to him for help and advice after it's too late. For example, they want to adjust something in a contract... that they've already signed. "That's the biggest reason to use a lawyer – let's do it right the first time," he says.

Additionally, it's essential to draft the Operating Agreement for the LLC.

"What are the procedures if someone passes away? What are the procedures if you want out or want to sell? Your partner should have the chance to buy it, and you may need a buy-sell agreement," Mendenhall explains.

Maintaining Your LLC

LLCs do require maintenance, but it's nowhere near as formal as a corporation. A corporation requires an annual meeting, corporate minutes, and more.

With an LLC, it's less corporate, so you don't necessarily have to do that. You can if you want, but it's not required.

You do, however, have to file a report with the Secretary of State, which is typically required on an annual basis. (It's annual in Illinois, though it varies in other states.)

LLC Annual Report and Corporate Records Book

If this report isn't filed through your state each year (or every other year depending on which state you live in), your business entity won't maintain an "active status" with the Department of State. Whether or not any changes have taken place, it's still required.

Mendenhall explains that if it's a single member LLC, there's really not a lot that goes into documenting the corporate book.

Corporate book refers to a corporate records book, which is the place in which you keep all important documents, such as articles of incorporation, bylaws, meeting minutes, and stock certificates.

If you're a somewhat organized person and feel comfortable maintaining your own book, you can get away with doing that yourself.

However, Mendenhall explains that not everyone is comfortable with that responsibility. "The agents who want me to do the maintenance are more concerned with running their business. They run it, I get the reports, and I send it to them and tell them what to do to complete it," he explains.

It's really one less thing to worry about.

However, where a lawyer is really essential is when there's more than one person in the LLC or there's a lot to document.

Documenting Purchases and Events In Your LLC Book

"Let's say you and I form an LLC, and I loan the LLC $50,000. That should be documented and put into the LLC book," Mendenhall explains.

Another example is if an LLC is going to buy vehicles or equipment. If there's any kind of substantial event that happens, it needs to be recorded and put into that corporate book. It keeps everything organized, and it's also extremely valuable if you ever go to sell.

Years ago, the attorney would always be involved in any corporate meetings. Today, Mendenhall explains that he has some clients that email him and tell him they had a meeting and attach the information. He then drafts up a document for everyone to sign, and he sticks it in their book.

Other times, people draft their own document and put it in their book.

"How formal people want to be and also the growth of their business matters. One client I can think of offhand that always asks me to draft their minutes and documents is a larger entity that has subsidiary entities," Mendenhall explains.

In sum, if you're running a small operation by yourself, you probably don't need a lawyer to be as involved. However, if there are multiple people involved and you're growing, a lawyer is going to make things much easier – and give you peace of mind that it's being done right.

"If there's a lot involved, I'd recommend that I help. Once a year, we should probably get together and at least talk about the company," Mendenhall explains.

What's Involved With Setting Up an LLC?

Once you've formed the LLC, there are a few "big ticket" items that you need to complete.

Mendenhall lists off three:

- Get a Tax ID number

- Get insurance

- Set up a separate LLC bank account

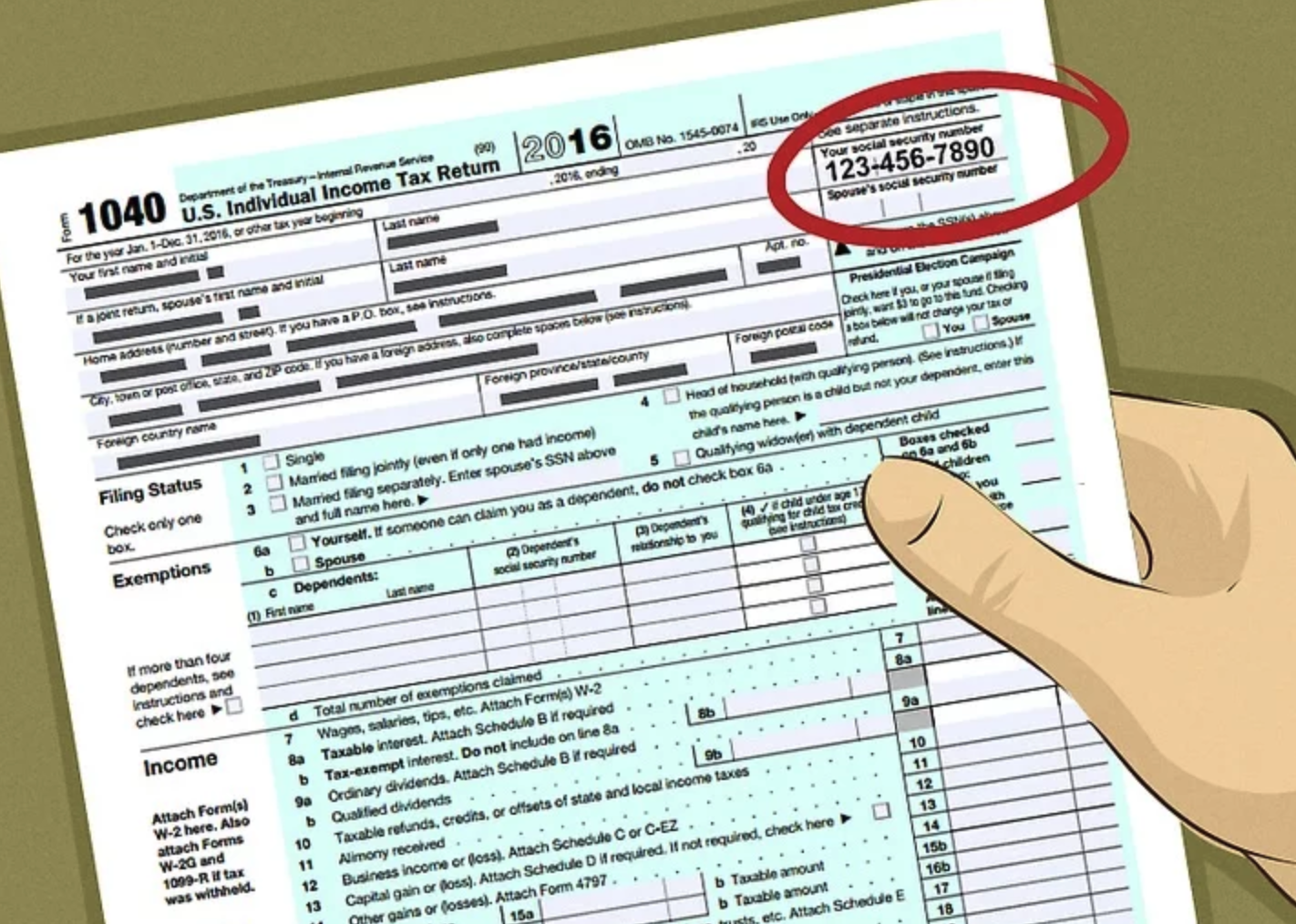

Get a Tax ID Number

A Tax ID number, also called Employer Identification Number (EIN) is used to identify your LLC for tax purposes.

Photo credit: WikiHow

It's used just like your Social Security Number is to identify yourself as an individual.

To obtain a Tax ID number, you just apply online with the IRS. While online is the easiest way to do it, there are other options available:

- Apply by fax with Form SS-4 to 855-641-6935 (if you have no principal place of business, the fax number is different)

- Apply by mail with Form SS-4 and send it to Internal Revenue Service; Attn: EIN Operation; Cincinnati, OH 45999

- Apply by telephone (international applicants only) at 267-941-1099

Get Insurance

Once your LLC is formed, it's really important to get insurance right away.

There are several types of insurance to consider, including:

- LLC insurance – professional and general liability

- Workers' compensation – covers employees medical costs, lost wages, disability, or death benefits that result from workplace injury or illness

- Commercial auto insurance – coverage for vehicles you or employees use on the job

- Property insurance – covers damages to your physical office

LLC insurance helps protect your new company against liability claims from injuries caused by professional error, your business, or your employees.

While your LLC protects you in a basic way, according to Trusted Choice, it doesn't protect you from things like:

- Negligence

- Fraud

- Personal guarantees

- Commingled person and business expenses

- Personally injuring someone

- Failing to deposit taxes withheld from employee wages

That's where a general liability insurance policy comes in.

In addition, nearly all states require an employer to have workers compensation insurance.

Set Up a Separate Bank Account

The separate bank account can make all the difference for your finances.

"It's a checks and balances for the agent. If you have your expenses always separated, it keeps you organized and nothing is ever commingled," Mendenhall explains.

If you don't separate your business and personal expenses, you can be personally liable for the actions of the business, but there are even more advantages to having that separate bank account:

- You can apply for business loans

- It's much easier to do calculations at tax time

- It builds credibility with clients

Anything I Need to Know for Tax Time?

As far as tax time goes, Mendenhall explains that there's not any particular advantage to having an LLC versus a sole proprietorship at tax time.

"An LLC is a pass-through, meaning it passes to you individually anyway. An LLC is not a separate tax entity like a corporation. LLC owners report business income and losses on their personal tax returns. I always advise people to talk to their accountant, but from the accountants I've worked with, they're generally in favor of an LLC," he explains.

How Much Does It Cost to Set Up an LLC?

Ah, what we're all really wondering: how much does it cost to set up an LLC?

You're in for a nice surprise, because it's not much.

It varies by state, but in Illinois, for example, an Application for Admission costs $150. (It used to cost $500, but it was reduced in 2017.) The required annual report is $75.

In Indiana, it costs $95 to file online, and the report is only required every other year (not annually). That only costs $31 to file online.

So, check with your state for an exact cost, but just know that it's not going to break the bank.

If you want to utilize a lawyer, such as Shane Mendenhall, consult with them on the cost of assistance with filing and also the potential maintenance throughout the year. It's not much, and it really pays to make sure all of your i's are dotted and your t's are crossed.

What Happens If I Want to Sell My Business?

If you have a corporation and you go to sell, you issue shares. You either have an asset sale or a stock sale.

With an LLC, you have units. Your units are just like shares.

Potentially, you'd have 100 units. If you own all 100 units, you're a single member LLC. You can sell your units or the assets of the LLC.

Mendenhall explains that most of the time with LLCs, people sell the assets – not the units – because they want to retain certain assets of the LLC, such as particular equipment or the LLC name. That way, they can do something else.

Before buying or selling an LLC (either through an asset or unit sale), you should speak to an attorney and accountant, because there are certain aspects of the sale that should be carefully considered, such as tax consequences.

If you're interested in selling your insurance business, we have a ton of content out there about what it's worth, who to sell to, and more.

-

Succession Planning 101: How to Retire as an Independent Insurance Agent

-

Ask Me Anything: 12 Answers to Your Succession Planning Questions

What If I Sell Insurance In Multiple States?

Let's say you live in Illinois, but you sell insurance in Illinois, Indiana, and Missouri.

You'll want to register in all of these states.

Mendenhall explains, "If 20% of my business is in Indiana, for example, I'll register a foreign LLC. It's really common – look at a company like Pepsi, for example. They're registered in a large number of states."

This is another situation where you'll want to consult with an attorney to make sure everything is set up properly.

Other content you might find helpful:

Shane Mendenhall is a personal injury attorney in the Decatur, IL area. He has many corporate clients and has assisted a number of independent insurance agents with their legal entities. If you're interested in his assistance, he can be reached via phone at (217) 429-4296, via email at smendenhall@brelaw.com, or on his website at shanemendenhall.com.

Shane Mendenhall is a personal injury attorney in the Decatur, IL area. He has many corporate clients and has assisted a number of independent insurance agents with their legal entities. If you're interested in his assistance, he can be reached via phone at (217) 429-4296, via email at smendenhall@brelaw.com, or on his website at shanemendenhall.com.