As an agent in the senior market, you need to know how to sell Medicare Part D. Even if you're a die hard MAPD fan, you're still bound to come across clients who prefer a Med Supp or the MSA, in which case they'll probably want to add Part D coverage.

In 2018, nearly 25 million Medicare beneficiaries were covered under a standalone prescription drug plan – that's 41.6% of all Medicare beneficiaries that chose to enroll in a Part D plan (KFF).

While Part D isn't a big money maker (you can only make up to $78 on a sale in 2020), it does have some redeeming qualities. For instance, Part D is the single largest lead generator for our local agency.

In fact, Michael Sams' largest annuity sale EVER came from a client who originally needed help with Part D. "It's our best lead source because it's so complicated. There are very few folks who know how to find the best drug plan for themselves," Michael explains.

In fact, Michael Sams' largest annuity sale EVER came from a client who originally needed help with Part D. "It's our best lead source because it's so complicated. There are very few folks who know how to find the best drug plan for themselves," Michael explains.

Don't underestimate the power of selling Medicare Part D. To help you get started, we've compiled (just about) everything we know. Jump ahead, take notes, bookmark this for later – the world is your oyster.

- What Is Medicare Part D?

- How Medicare Part D Plans Work

- Why Help Clients With Part D?

- To Sell or Not to Sell?

- Certifications to Sell Part D

- Part D Compliance for Agents

- How to Use Medicare.gov's Plan Finder Tool

- Finding Leads at the Pharmacy

- Get Started With Medicare Drug Plans

What Is Medicare Part D?

Medicare Part D is optional prescription drug coverage. It's also called a Prescription Drug Plan, or PDP for short. You may also hear it referred to as stand-alone PDP. Part D plans are run by private insurance companies that follow rules set by Medicare.

You can add Part D coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private Fee-for-Service (PFFS) Plans, and Medicare Medical Savings Account (MSA) Plans.

In our experience, it's most common to see a client end up with these two Medicare plan "bundles":

- Original Medicare + Medicare Supplement + Part D

- Medicare MSA + Part D

If your client chooses a Medicare Advantage plan, odds are they're choosing one with drug coverage included. That's called MAPD, or Medicare Advantage with Prescription Drug coverage.

How Medicare Part D Plans Work

As we mentioned, Part D plans are run by private insurance companies (think WellCare or SilverScript) that follow rules set by Medicare.

The Basics

Every individual drug plan has a formulary. That's a list of drugs they agree to cover. Formularies can differ from plan to plan, which is why choosing a drug plan isn't one-size-fits-all. Your list of drugs might be covered by Plan A but not Plan B.

A drug plan can also choose to change their formulary, but they will notify you if it affects the drugs you take.

Within that formulary, or list of covered drugs, the drugs are categorized into tiers. Drugs in higher tiers are the most expensive – these are your brand names. Drugs in lower tiers are less expensive – these are your generics.

Some plans require prior authorization, which is basically a sign-off by your prescriber verifying that your drugs are medically necessary. This can be a huge hurdle for clients, and we advise avoiding drug plans that require prior authorization.

Most drug plans have preferred pharmacies, which is a group of pharmacies that agree to give a larger discount on drugs than other pharmacies. For example, Humana/Walmart is a well-known pair. If you have a Humana drug plan, you'll get the best drug prices when you fill your prescriptions at Walmart. The same goes for AARP/Walgreens and WellCare/CVS.

Most Medicare Part D plans have a broad array of preferred pharmacies, such as SilverScript, which has over 65,000 pharmacies including CVS, Walgreens, Walmart, and many small, mom-and-pop pharmacies.

Costs

Medicare Part D plans have all the typical costs you expect from insurance (plus a few quirks):

- Monthly premium

- Yearly deductible

- Copays or coinsurance (paid at the pharmacy)

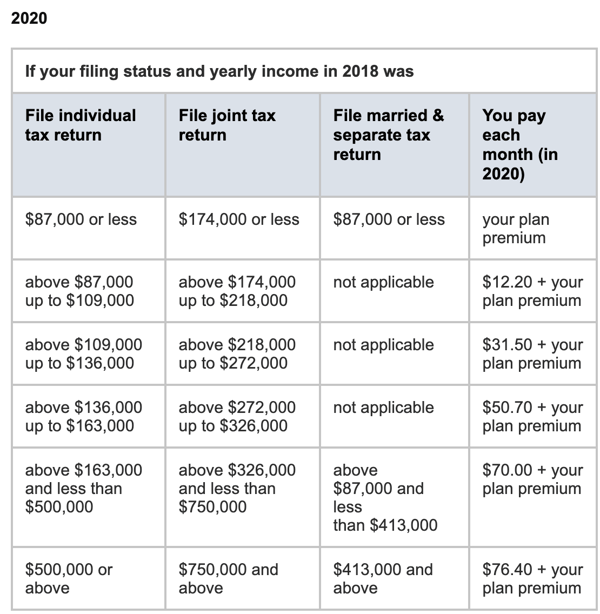

Your Part D monthly premium can be deducted from your monthly Social Security payment. People with a higher income pay a higher premium – this is called the Part D IRMAA, or income-related monthly adjustment amount.

The yearly deductible is the amount you pay for your prescriptions before your drug plan pays its share. In 2020, no drug plan can have a deductible higher than $435.

The amount you pay for a prescription at the pharmacy is going to be either a copay or coinsurance. With copays, you pay a set amount depending on the drug tier.

There's something called the donut hole, which is just a fancy term for a coverage gap. It's kind of confusing to explain, but lucky for you, the donut hole is going away. In 2019, it went away for all brand-name drugs, and here in 2020, it's going away for generics as well.

Now, when your client reaches the coverage gap, which begins after you and your drug plan have spent $4,020 for covered drugs (as of 2020), they will be responsible for 25% of the cost (Medicare.gov).

That coverage gap ends when you've spent $6,350 out-of-pocket in 2020. At this point, you get catastrophic coverage, and you only pay a small copay or coinsurance amount for covered drugs for the rest of the year.

Penalties

Even if your client doesn't use prescription drugs now, they might consider joining a Medicare drug plan anyway. If they decide not to join a Medicare drug plan when they're first eligible, and they don’t have other creditable prescription drug coverage or get Extra Help, they’ll likely pay a late enrollment penalty if they join a plan later.

The late enrollment penalty is an amount that’s permanently added to the Part D premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there’s a period of 63 or more days in a row when you don’t have Part D or other creditable prescription drug coverage. You’ll generally have to pay the penalty for as long as you have Part D coverage.

The cost of the late enrollment penalty depends on how long you didn’t have creditable prescription drug coverage. Currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($32.74 in 2020) by the number of full, uncovered months that you were eligible but didn’t join a Medicare drug plan and went without other creditable prescription drug coverage.

The final amount is rounded to the nearest $.10 and added to your monthly premium. Since the “national base beneficiary premium” may increase each year, the penalty amount may also increase each year. After you join a Medicare drug plan, the plan will tell you if you owe a penalty and what your premium will be.

Example: Mrs. Martin didn’t join a drug plan when she was first eligible—by June 2017. She doesn’t have prescription drug coverage from any other source. She joined a Medicare drug plan during November 2019, and her coverage began on January 1, 2020.

Since Mrs. Martin was without creditable prescription drug coverage from July 2017–December 2019, her penalty in 2020 is 30% (1% for each of the 30 months) of $32.74 (the national base beneficiary premium for 2020), which is $9.82. The final amount is rounded to the nearest $.10, so she’ll be charged $9.80 each month in addition to her plan’s monthly premium in 2020.

Why Help Clients With Part D?

It's really no secret Part D commissions aren't that attractive. The maximum you can earn from a Part D sale is $78 (as of 2020), and the maximum renewal you can earn is $39 (as of 2020).

However, it's rare that a client only needs help with a Part D plan. Typically, they're also looking for a Medicare Supplement.

And once you've established this Part D lead as a client, you never know what you might uncover down the road. Michael Sams, a senior market producer and sales trainer, sold an $850,000 annuity – his largest annuity sale ever – to a client who originally only wanted Part D help.

"People want leads all the time, and this is the best lead generator you'll ever have," he explains.

While there is a benefit to be had by offering Part D help, don't forget this is extremely confusing to people aging into Medicare. There are typically over two dozen plans to choose from, every formulary is a bit different, they want to keep their favorite pharmacy but don't know how... you're really helping these folks.

If you're passionate about serving others and truly helping people, offering a Part D service is a no-brainer.

To Sell or Not to Sell?

A lot of agents don't want to mess with selling Part D because of the red tape around it.

Part D and Medicare Advantage plans are regulated by CMS, which means you have to adhere to their marketing regulations and compliance guidelines.

If you don't follow the Medicare marketing rules, you risk not being paid commission, being terminated from your contracted drug plan, being fined, or even losing your insurance license (CMS).

To avoid making a mistake and dealing with compliance, some agents choose to offer Part D help for free. They guide them through Medicare's website, and when the client chooses their desired plan, the agent checks the box that they're simply assisting them.

However, most agents want to be paid for their time, and if you do a lot of Part D comparisons during AEP, it can add up. If you choose to get the necessary certifications to sell Part D, you need to be well-versed in the marketing regulations and compliance hurdles.

Whether you decide to be compensated for your time or not, we strongly urge you to help seniors with Part D. Avoiding it altogether is a massively missed opportunity!

Certifications to Sell Part D

In order to sell Medicare Part D, you need a few certifications. All agents and brokers that sell Medicare products must be trained and tested every year on Medicare rules and regulations. That includes employees, subcontractors, downstream entities, and/or delegated entities (CMS).

First up is the AHIP. In order to sell Medicare Advantage and Part D (Prescription Drug) plans, you'll need to receive your AHIP certification and submit it to the carriers you want to offer.

The AHIP covers MA and PDP explanations, marketing and compliance guidelines, and laws on fraud in Medicare. It costs $175 if you don't utilize any discounts or offers. The AHIP has 50 questions, and you have a maximum of 2 hours to complete it.

Don't sweat it – it's an open book test, and you have 3 tries to pass (90% or better).

After you complete the AHIP, you'll need to get certifications with each Part D carrier you want to sell.

There might be 25-30 drug plans available in your area, and it doesn't make a lot of sense to get certified to sell plans from each and every carrier. My advice is to learn which carriers are the most competitive that year, and get certified to sell the top 3.

Our team here does several comparisons when the new plans are announced, and we put out a quick article before AEP on which Part D carriers are the most competitive. Plus, if you have any additional questions, you can always reach out to us for advice.

Part D Compliance for Agents

If you decide to get certified to sell Part D, you'll need to follow the Medicare Communications and Marketing Guidelines (MCMG).

Here are a few notes on what you are allowed to do, which includes:

- Holding sales presentations

- Holding marketing/sales events (more on that shortly)

- Holding educational events (more on that shortly)

- Having one-on-one appointments with prospects (more on that shortly)

- Giving business reply cards at educational events

- Creating and sending out communication materials

- Distributing marketing materials as long as they've gone through CMS approval

- Using materials created by CMS

- Advertising via conventional/direct mail

- Email advertising as long as you have an opt-out function (i.e: people can unsubscribe)

- Call individuals who have given permission for an agent to contact them (ex: filled out a business reply card, emailed you requesting a return call, etc.)

And here are some basics that you can't do:

- No door-to-door solicitation, including leaving flyers or leaflets at the door

- No approaching people in common areas (parking lots, hallways, etc.)

- No giving gifts worth over $15 to beneficiaries for marketing purposes

Finally, here are some common guidelines that trip up agents most often:

- You cannot do any marketing at the pharmacy counter area where patients interact with providers to get medications

- Scope of Appointment (SOA) parameters and documentation are required for one-on-one appointments, and they must be secured and documented prior to meeting with potential enrollees

- Your discussions may only concern plan products documented in the SOA, and you may only market health-related products – not life insurance or annuities

- You can't do any of this prior to October 1

- You can't use the word "free" to describe a zero-dollar premium

More on Marketing/Sales Events

A marketing/sales event is designed to steer potential enrollees toward a plan or a limited set of plans. This is different from an educational event, which is designed to inform beneficiaries only.

If you hold a sales event, you have to adhere to a few guidelines:

- Submit scripts and presentations to CMS prior to the event

- Sign in sheets must be clearly labeled as optional

- You can't do any health screenings or anything that could be perceived or used for "cherry picking"

- You can't require attendees to give you their contact information as a prerequisite for attending the event

- If you collect contact information for a raffle or a drawing, you can't use that information for anything other than the raffle or drawing

More on Educational Events

Educational events are meant to inform your clients about Part D (or Medicate Advantage as well as other Medicare programs if you choose). You have to advertise the event as strictly educational, and you can't do any kind of marketing or sales activities during the event. You also can't hand out any marketing materials or enrollment forms.

This is pretty common sense stuff, but here are a few more tidbits:

- The educational event can be hosted in a public venue

- It may include communication activities

- You can answer questions if the beneficiary asks them

- You can set up future marketing appointments (you'll need to do a Scope of Appointment!)

- You can hand out business cards or your contact information

- You can't have a sales event immediately following the educational event in the same place

More on One-on-One Appointments

Before you have a one-on-one appointment, you need to complete a Scope of Appointment (SOA).

A Scope of Appointment (SOA) is a form that includes the date of your appointment, the product types you'll discuss, contact information for both parties, and a few disclaimers which the beneficiary must sign prior to the appointment.

The SOA must state that there's no obligation to enroll, current or future Medicare enrollment status will not be impacted, and automatic enrollment will not occur.

You can complete an SOA using the e-Scope tool available in our quote engine. Here's a quick tutorial on how that works:

An SOA can be completed with a signed hard copy, a recorded telephone call, or through an electronic signature.

A new SOA is required if, during an appointment, the beneficiary requests information regarding a different plan type than previously agreed upon.

How to Use Medicare.gov's Plan Finder Tool

In our humble opinion, there is only one way to run a Medicare Part D comparison correctly, and that is to utilize Medicare's website.

It can be intimidating at first, but let's navigate through the Plan Finder tool to show you just how easy it really is to run a drug comparison.

This can be broken down into four easy steps:

- Go to Medicare.gov

- Enter in your zip code

- Enter in your your prescriptions

- Enter in your pharmacy

When you add in those things, it will automatically calculate all of your options for Medicare Part D in order according to cost.

Step 1: Visit the Medicare Plan Finder.

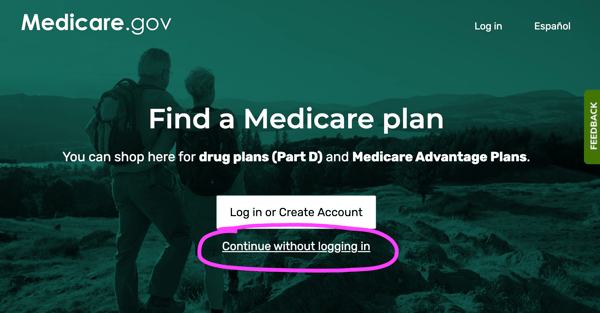

Go to https://www.medicare.gov/plan-compare.

If you're with the client, you can help them create an account or log in. One of the biggest advantages of Creating an Account is storing their drug list for the next year. They'd also get other perks, like viewing Medicare claims and always being able to see what plans they have.

If not, or if they opt to skip that step, click "Continue without logging in."

Step 2: Follow the Prompts.

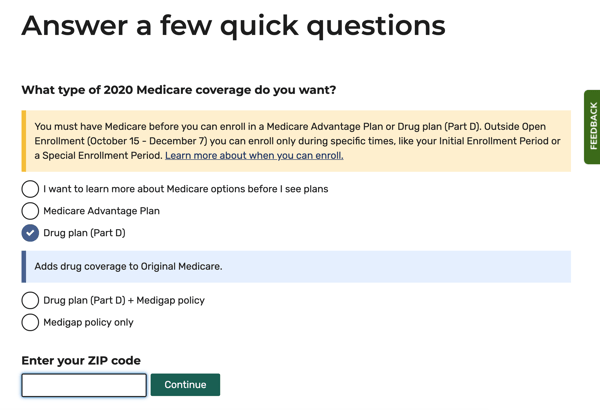

After continuing, select “View plans. I know what type of plan I want.” Then, select “Drug plan (Part D).”

Follow the remaining prompts including zip code, your Medicare # (not required), date of birth, and whether or not you get financial aid.

Click Next.

Step 3: Select Search Preferences.

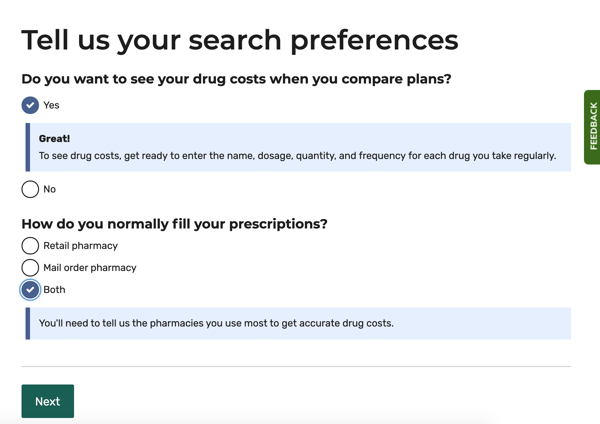

Select “Yes” under “Do you want to see your drug costs...?

Select “Both” under “How do you normally fill your prescriptions?” Choosing both allows you to see pricing for retail and mail order pharmacies.

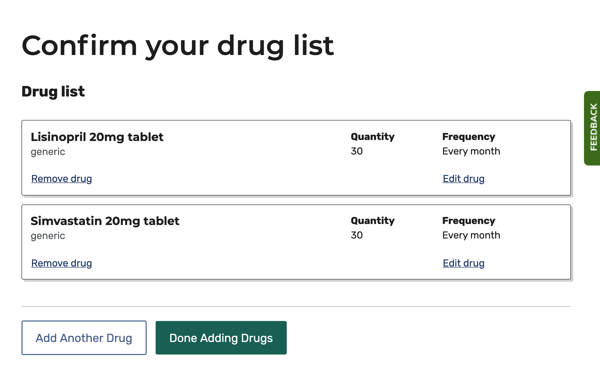

Step 4: Enter Your Prescriptions.

Enter all of the drugs for your comparison, including dosage and frequencies. As you start typing the name of the drug, suggestions will start popping up, and you can select your drug from the list.

When finished, click “Done Adding Drugs.”

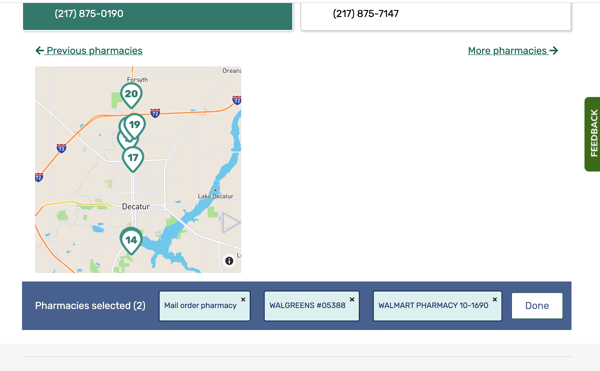

Step 5: Select Up to 2 Pharmacies.

Medicare's system allows you to select up to 2 pharmacies. This allows you to compare pricing between them. If you're not seeing the pharmacy you want on the first page, click "More pharmacies."

You can also look at the pharmacies on a map if your client isn't sure which location is most convenient to their home.

Click "Done" when you're finished.

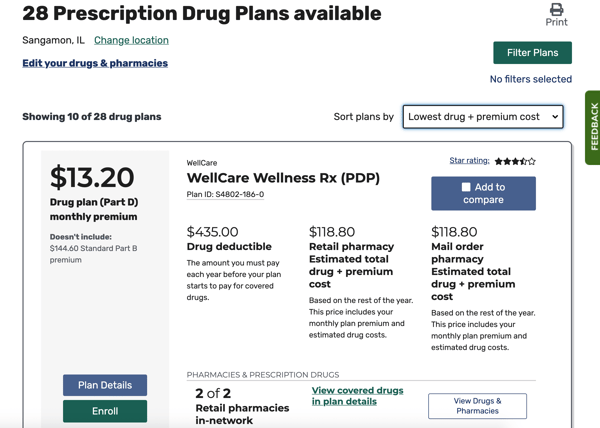

Step 5: Sort the Results.

Sort plans by "Lowest drug + premium cost." This sorts all of the plan options so you can easily see which plan is the least expensive for your client. After you've selected the desired plan, hit the “Enroll” button.

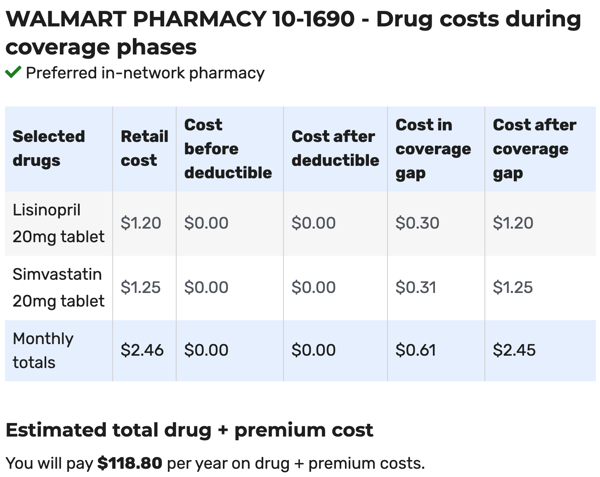

You'll see in the example above that there are three columns inside each drug plan's card:

- Drug deductible

- Retail pharmacy: Estimated total drug + premium cost

- Mail order pharmacy: Estimated total drug + premium cost

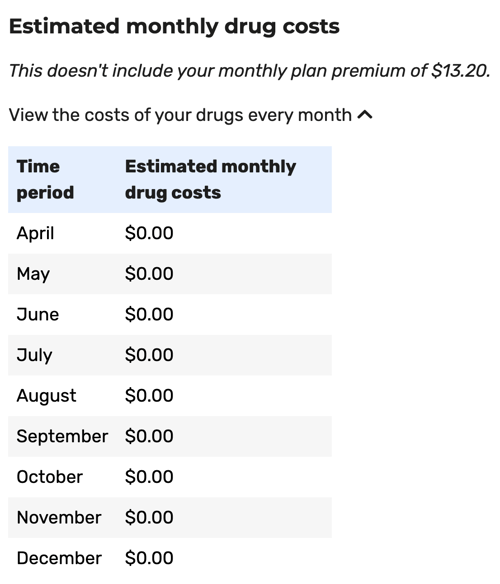

Most clients choose a retail pharmacy, so we're typically concerned with that middle column. That dollar figure – $118.80 – represents the TOTAL out of pocket costs this client would have from now until the end of the year. That includes their monthly premium in addition to copays or coinsurance at the pharmacy. That amount is also prorated based on when you're doing the comparison.

That amount is also coming from the cheapest pharmacy option, so be sure to click on Plan Details to find out which pharmacy your client should be going to.

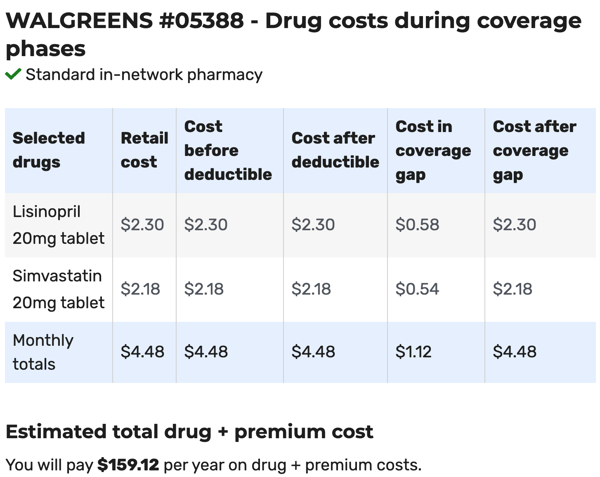

In this same example, we can see that Walgreens would actually be $159.12 for the rest of the year, because there's a $4.48 copay each month.

However, if you look at Walmart, there's actually no copays – the drugs will cost $0 for the client. They are only responsible for that monthly premium.

Some agents opt to print off the Plan Details page for their clients so they remember which pharmacy is the most cost effective as well as how much they'll need to pay at the pharmacy each month.

If you want to a printer-friendly version of this tutorial, download it here:

A Note on the Medicare Part D Cheat Sheet Download

Many agents actually hand this Part D Cheat Sheet out to their clients so they can run their own drug comparison. It can help lighten the load during AEP, and more often, people actually want to compare plans on their own.

However, just be careful about how you present it. There are still a lot of people who will want you to do it, and some will want you to verify their findings and confirm they have the best plan. Whatever you do, make sure your clients know you're there to deliver excellent service – this is simply a resource should they desire it.

Finding Leads at the Pharmacy

Partnering up with a local pharmacy can be an excellent way to grow your business.

For small, mom-and-pop type pharmacies, having an agent available during AEP is a great service. The agent can give the clients the best plan available, and the pharmacy gets to promote that as a value-add. Plus, they're better able to retain their customers.

Remember that if you choose NOT to be compensated for your time, offering a Part D service is still worth it. For starters, you won't have to worry about the compliance red tape. You can also discuss additional Medicare plans, such as Medicare Supplements.

We have a full how-to guide on this subject that covers:

- setting up a relationship with the pharmacy,

- why it's critical that the pharmacist is on board

- what to take with you

- how long you'll need for each appointment...

It's all here: The Independent Agent's Guide to Prospecting at Local Pharmacies

Get Started With Medicare Drug Plans

To start selling Medicare PDPs, you'll want to:

- Complete the AHIP (utilize discounts!)

- Choose a few reliable Part D carriers to contract with

We can help you select the best carriers in your zip code, so please reach out to us when you're ready:

- Call us at 888-780-7676 and ask for Luke

- Start a chat with us using the chat bubble at the bottom of the screen

- If you already know what carriers you want, begin online contracting

We hope you'll reach out to us for support. Good selling!