In the heart of Wyoming lies the Teton Range, a mountain range of the Rocky Mountains, just south of the Yellowstone National Park.

"There's always a potential for growth with Fixed Index Annuity (FIA) products," says Dan Acker, President & Chief Marketing Officer at SILAC. "We use that mountain range to help associate the growth possible with our Teton series."

"There's always a potential for growth with Fixed Index Annuity (FIA) products," says Dan Acker, President & Chief Marketing Officer at SILAC. "We use that mountain range to help associate the growth possible with our Teton series."

The Teton Range extends for 40 miles, and it's still growing.

Not only does the new Teton™ Fixed Index Annuity have a great story behind it, but it's incredibly simple to understand. Dan says that's very intentional: "When we set out to design this product, our goal was to keep the product simple with a sole focus on accumulation and growth of retirement assets."

Let that be a beacon of hope for those of us who find FIAs particularly confusing. I promise you that you can understand this product – and present it to your clients – without losing your mind.

Jump ahead to any section at any time:

- A Quick Look at the Teton FIA

- How the 6 Indexed Crediting Strategies Work

- Which Indexed Crediting Strategies Should You Show Your Clients?

- Teton™ Fixed Index Annuity Interest Rates

- How the Nursing Home Benefit Works

- What's the Death Benefit?

- How Does the RMD Benefit Work?

- The Target Audiences for Marketing the Teton FIA

- Marketing Pieces: Ads, Emails, Presentations

- Is There an E-application?

- SILAC Teton™ Fixed Index Annuity Commission

- How to Run a Teton FIA Illustration

- Final Thoughts on the SILAC Teton™ Fixed Index Annuity

A Quick Look at the Teton FIA

Before we get into some of the details, let's just take a quick look at what this product is and how it works.

First of all, this is a Fixed Index Annuity (FIA). It's tied to the S&P 500, and there are 6 indexed crediting strategies to choose from (plus a fixed account if your client prefers a guaranteed rate). Don't be overwhelmed by that if this is new to you – we'll break them down and give you a couple suggestions.

Clients can choose from a 7, 10, or 14-year term, and there are two annuity lines that are completely identical except one features a premium bonus and the other does not (Teton vs. Teton Bonus).

This annuity comes with some amazing perks (no fees involved), such as:

- RMD friendly

- Full account value at death

- Home health, nursing home, and terminal illness benefits

- 5% accumulated value available after the first year

Again, the product has NO fees, so there's no way your client could ever lose money. The worst they can do is to stay steady if the stock market doesn't perform well.

While we will get into all the nooks and crannies of this product, we can't emphasize enough just how simple it is to understand AND present to your clients.

Grab our client presentation to see for yourself:

How the 6 Indexed Crediting Strategies Work

All of the indexed crediting strategies of this product are measuring the performance of the S&P 500.

Dan explains that the various strategies are all measuring the performance of the S&P 500 for a 1 year period.

Annual Point-to-Point with Cap

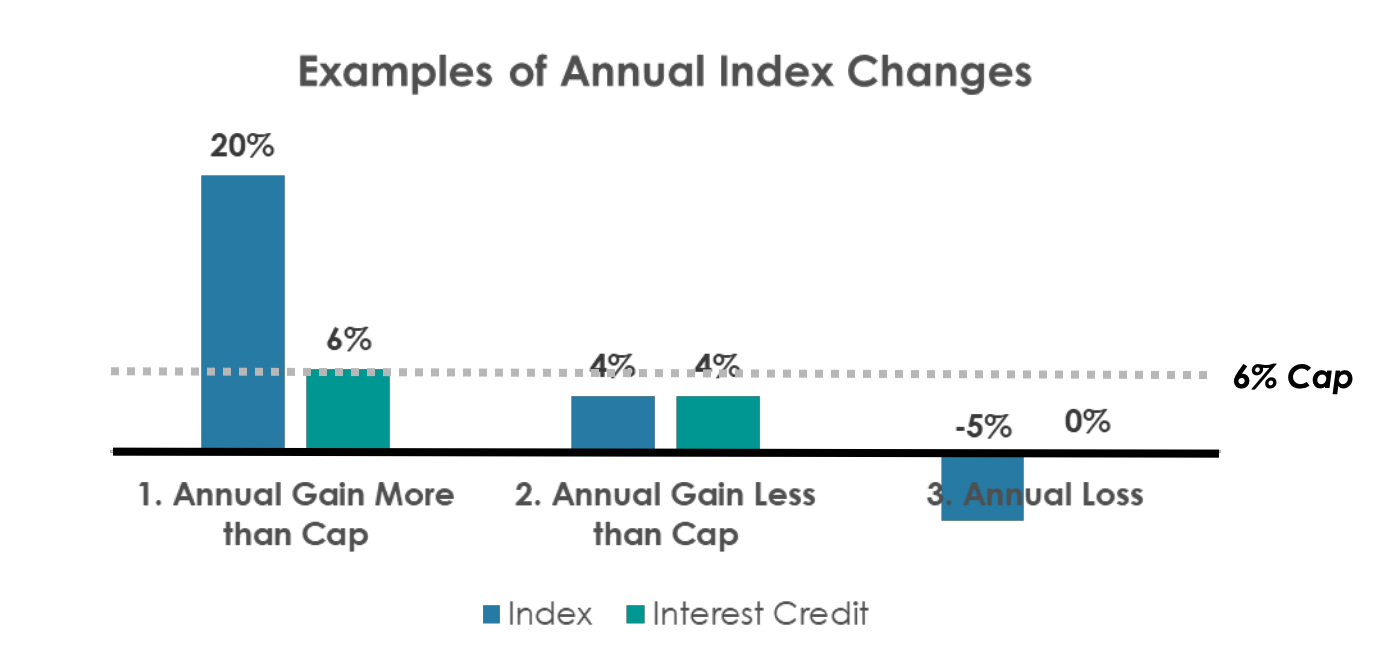

Out of the 6 indexed crediting strategies available to us, the simplest one is going to the Annual Point-to-Point with Cap. This strategy's starting point is your policy anniversary date, and the ending point is one year later.

The 1-year stretch is the "annual," the time between the two dates we're measuring is the "Point-to-Point," and the "cap" is going to be whatever the current cap rate is.

For example, let's say the S&P averages 20% over the course of a year. If you're capped at 6%, you'd be making 6% that year. Let's say the S&P averaged 4% over the year – you'd make 4%. Finally, let's say the S&P averaged -5% over the year. You'd make 0%.

From the SILAC "How Your Annuity Will Grow" download

Easy peasy, right?

While the Annual Point to Point with Cap is the simplest to understand – and it's the one we use in our client presentation (click below to download it), you still have 5 more to dabble with if you want.

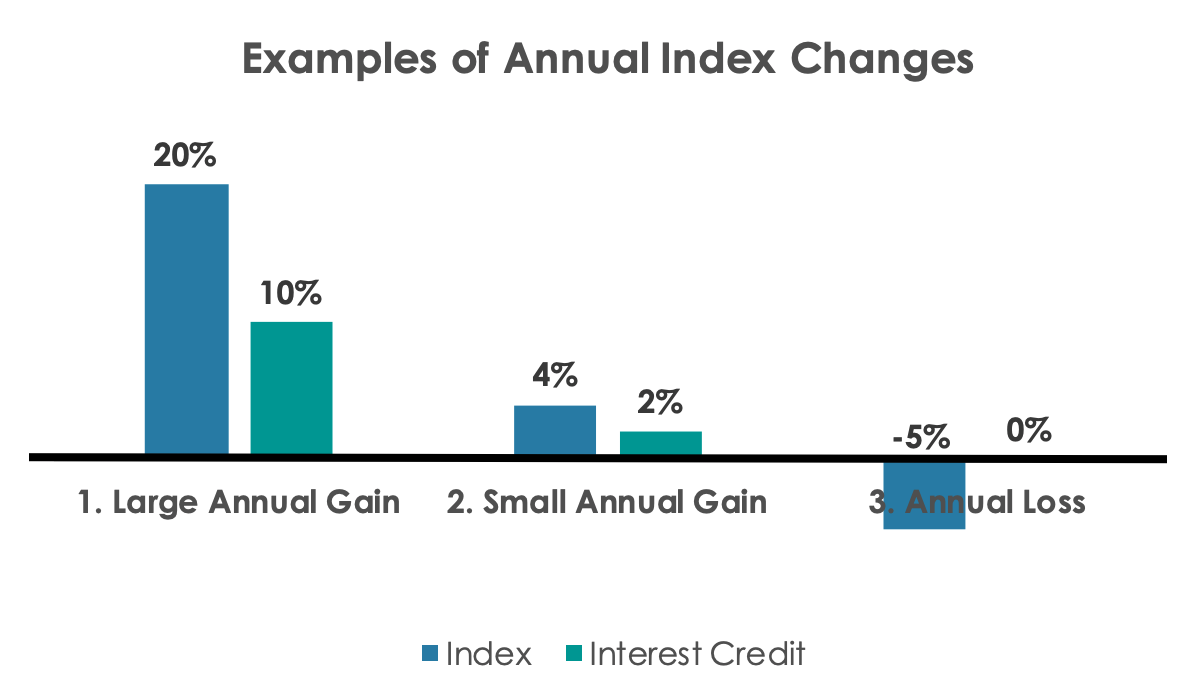

Annual Point to Point with Participation Rate

Let's say the participation rate is 50%. This means you'd be earning half of whatever the S&P 500 earns that year.

From the SILAC "How Your Annuity Will Grow" download

That's really it – see, not too bad!

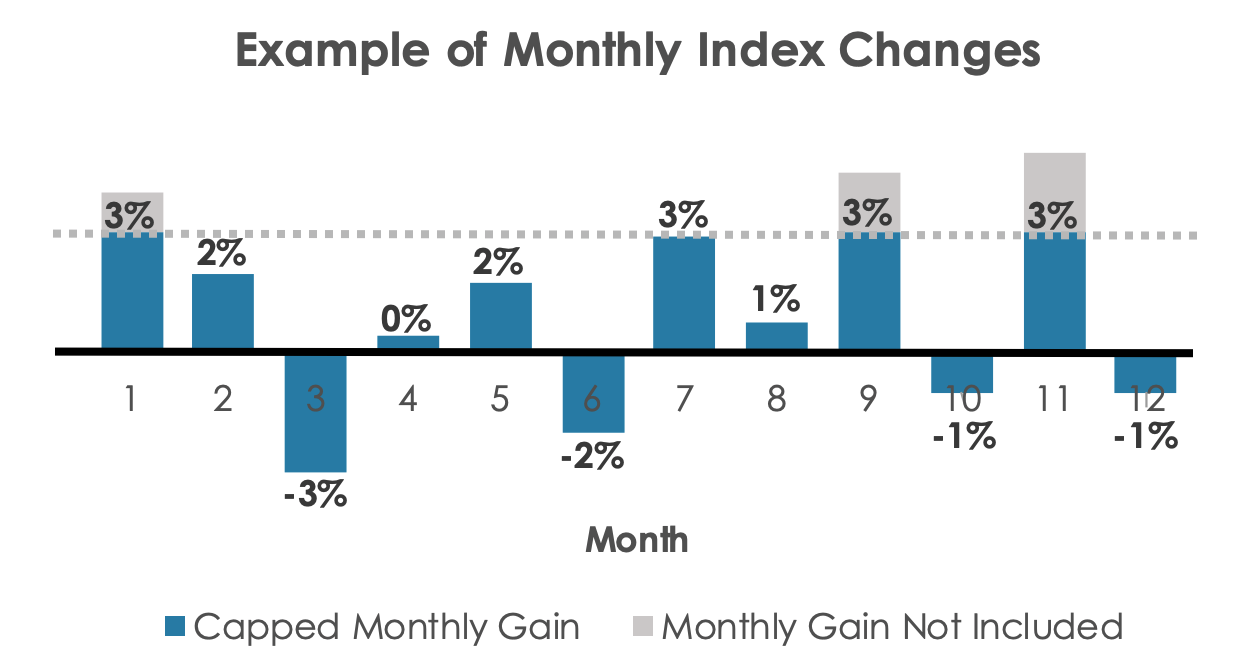

Monthly Point-to-Point with Cap

The rest of our indexed crediting strategies are going to be monthly, which means you'll be credited a sum of the monthly changes in the S&P 500.

So, let's say you have a 3% monthly cap.

From the SILAC "How Your Annuity Will Grow" download

Using the above example, you'd be earning a total of 10% that year.

Even though you see some months are negative, rest assured that if your total after a year is negative, you'd just stay steady. You cannot earn less than 0% with this product.

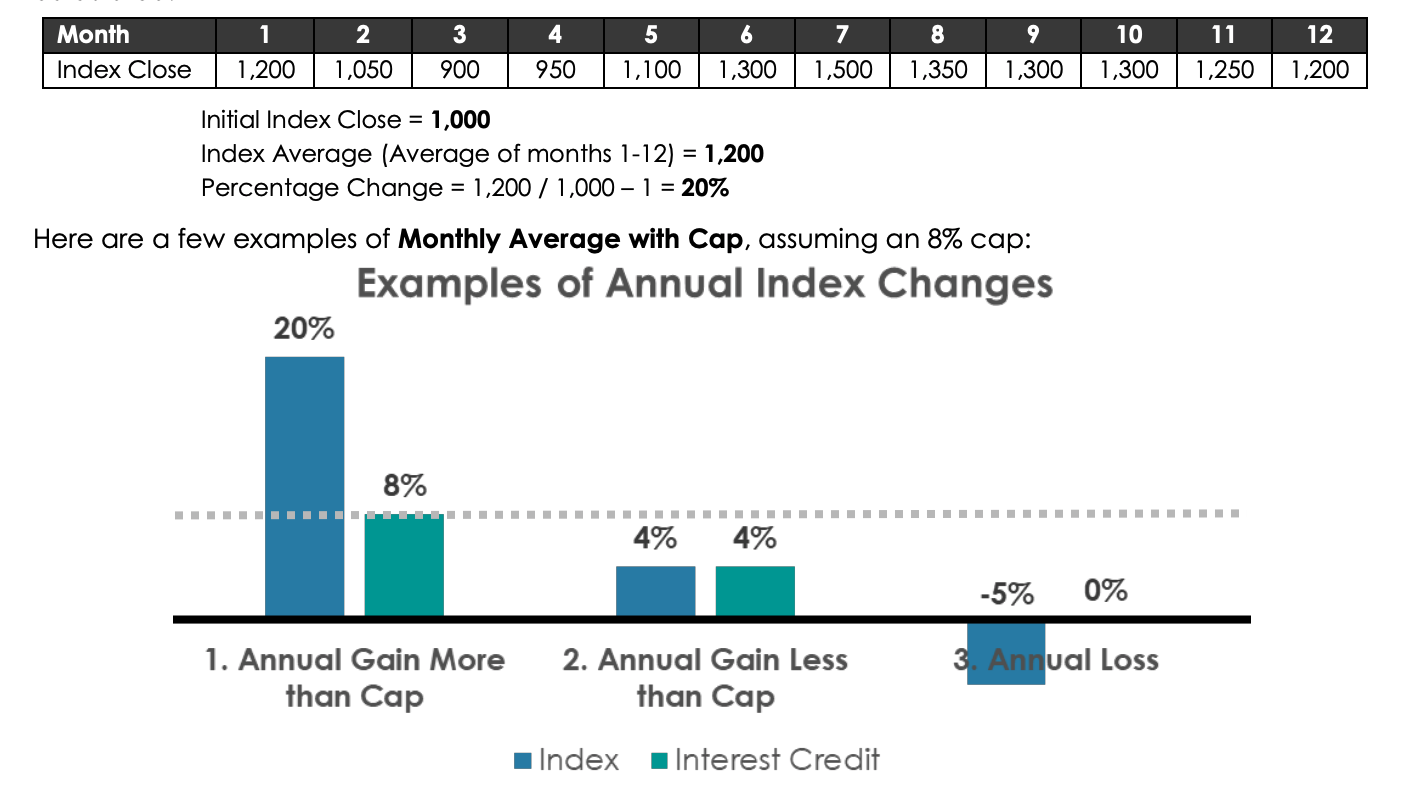

Monthly Average with Cap

The monthly average with cap credits you the percentage change of the index average based on the closing value each month.

From the SILAC "How Your Annuity Will Grow" download

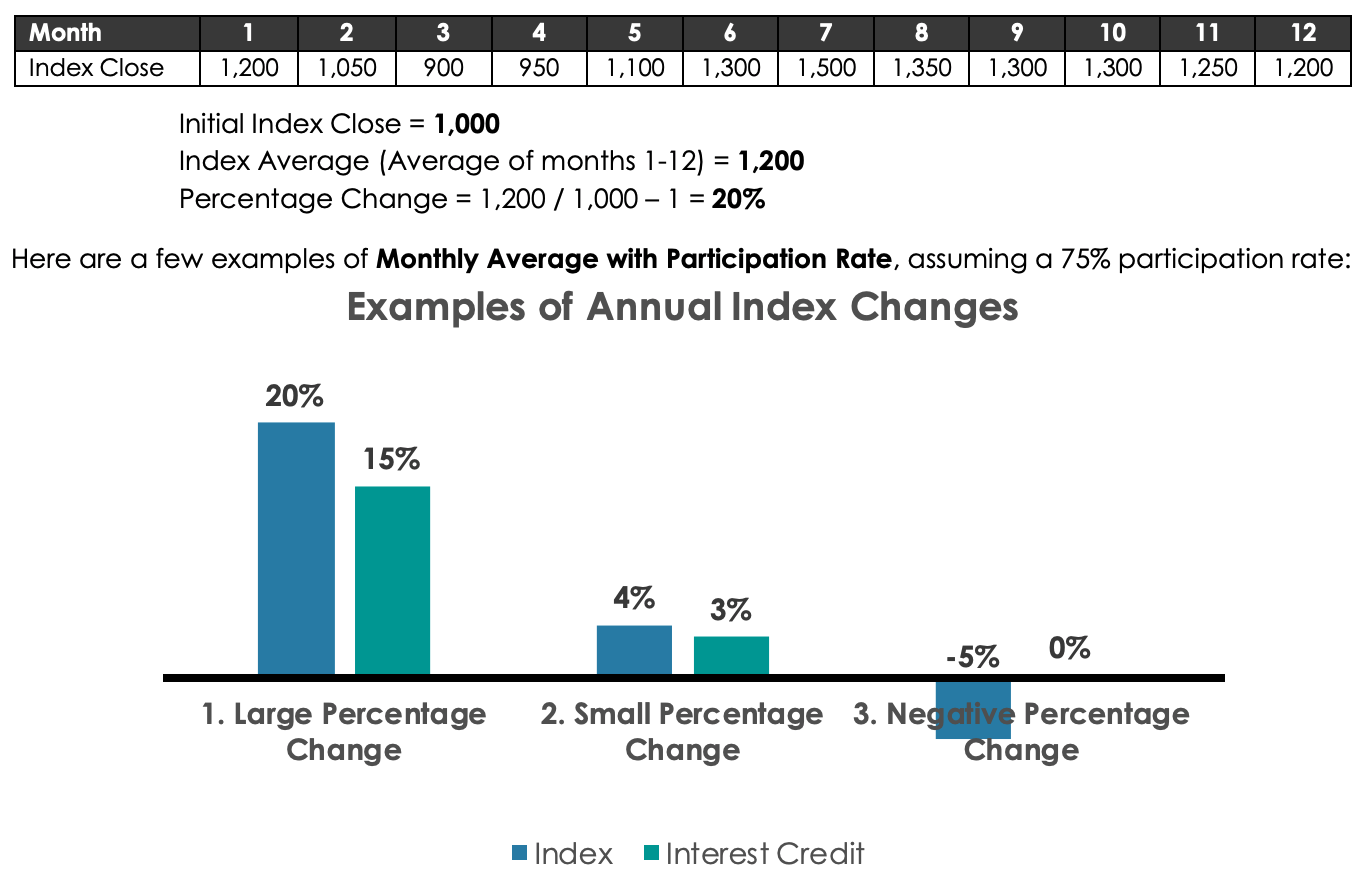

Monthly Average with Participation Rate

The monthly average with participation rate credits you the participation rate of the percentage change in the S&P 500.

Let's say your participation rate is 75% – here's how that would play out:

From the SILAC "How Your Annuity Will Grow" download

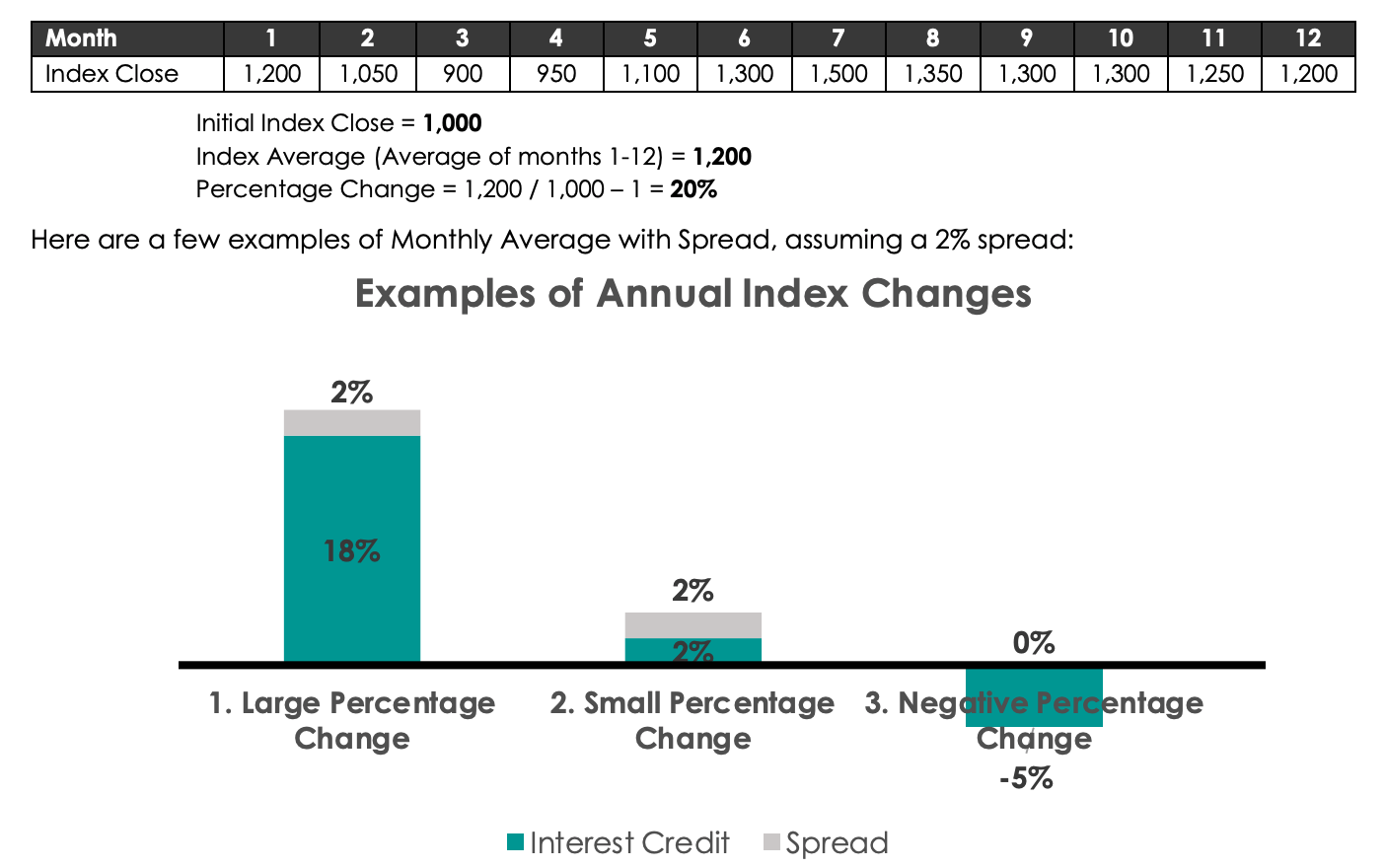

Monthly Average with Spread

With the monthly average with spread option, you're credited the closing value of the S&P 500 minus whatever the spread is.

Let's say the spread is 2%. Here's how that would play out:

From the SILAC "How Your Annuity Will Grow" download

Which Indexed Crediting Strategies Should You Show Your Clients?

Most of the time, clients look to you for advice. When they ask what strategy they should choose, what will you say?

On the flip side, perhaps your presentation style is to keep things as simple as possible. In that case, you may not want to explain all 6 strategies. Which strategies do you choose to feature?

Well, we asked Dan, and here's what he'd do: "I would probably split mine between the Annual Point-to-Point with Cap and the Monthly Average with Cap. The Point-to-Point is very straightforward, and it's easy to tell where you're at, and the monthly average does have the opportunity to provide some of the highest crediting interest."

There you have it!

Don't forget that every 12 months, your client can reallocate, so they can put all their money in the fixed account for a guarantee or they can change their crediting strategies.

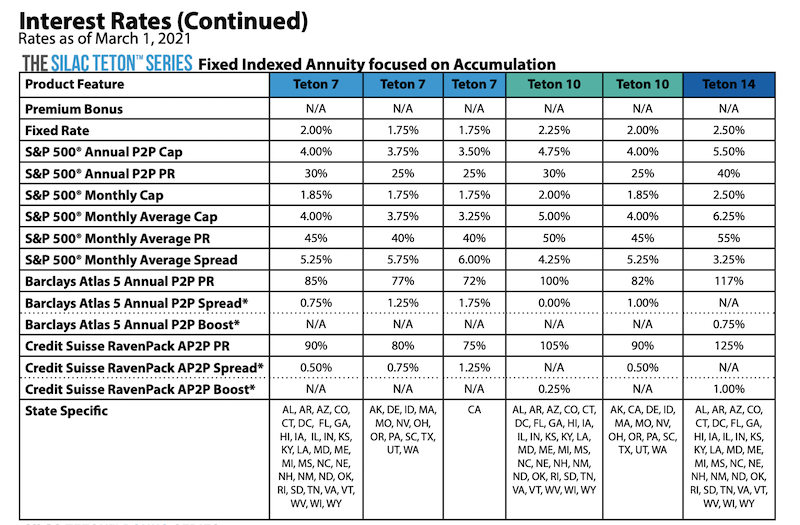

Teton™ Fixed Index Annuity Interest Rates

Full disclosure: rates can and do change as the market fluctuates, so be sure to confirm rates. You can do that any time by checking out the SILAC Annuity Rate Sheet. We'll drop in the current one here:

Dan explains that both the caps and the guaranteed rate can change after each policy year. "The rates are locked in for 12 months, and on your anniversary, you'd be notified of the current rates," he explains. At that point, your client could choose to reallocate their money by choosing different indexed crediting strategies or the fixed rate.

"It just depends on what the markets are doing, and by markets, it's generally the bond yield," Dan continues.

For new business, Dan says the fixed rate won't change too much. The caps will definitely change, but Dan says they're hoping that's no more than monthly. This is pretty similar to MYGAs, which change their rates frequently, so it's nothing new. Once the policy is issued, the rates and indexing adjustments are locked in for 1 year.

How the Nursing Home Benefit Works

Like most aspects of this FIA, the extra benefits that you get are very straightforward.

A Nursing Home Benefit, Home Health Benefit, and Terminal Illness Benefit all come standard with the product – there are no fees or charges to add them.

If your client can't perform 2 of the 6 Activities of Daily Living (ADLs), they would qualify for the Nursing Home or Home Health benefits. This benefit gives them access to 100% of their annuity's account value with no fees for withdrawing it.

To qualify for the Terminal Illness Benefit, your client would need a diagnosed terminal illness that results in a life expectancy of 12 months or less. That benefit is also access to 100% of the account value.

What's the Death Benefit?

The death benefit is full account value at death. It doesn't matter how quickly it happens after the policy begins. If the owner passes away, the benefit is the full account value – no surrender charges or penalties.

Spousal continuation is also an option as well if the spouse is listed as the beneficiary. If you're new to the lingo, this just means the spouse can continue the policy.

How Does the RMD Benefit Work?

Dan says they consider this product RMD-friendly. [RMD stands for Required Minimum Distribution, which begins at age 70 and a half.]

With SILAC, you can start taking out your RMDs right away without any penalties or surrender charges. Dan says with some annuity carriers, you have to wait until Year 2, so this is a great feature to offer your older clients.

The nitty gritty details of the RMD benefit are really just a simple form. Dan says agents who are very involved help their clients fill out that RMD form. However, he says it's so simple that many policyholders just go online, download the form, and fill it out themselves.

Reminders about the RMD requirement are also sent out to qualified policyholders.

The Target Audiences for Marketing the Teton FIA

Since Dan is the President & Chief Marketing Officer at SILAC, he has some excellent ideas about how to start marketing this product.

He begins by explaining 3 target audiences and how this product will appeal to them.

Seniors and Retirees Looking for Diversification

Dan explains that over the last several years the primary focus of index annuity sales has been on lifetime income.

Today's seniors and retirees are definitely worried about outliving their savings, so Index Annuities that provide lifetime income are very important. However, those are generally purchased by consumers that are a little older and have a fairly sizable nest egg. They're looking more for preservation than having income.

With the Teton product, the primary marketing would be for people to diversify. Maybe they already have an Income Index Annuity and would like to have an accumulation vehicle as well.

Working Individuals in Their 40s Building Their Nest Egg

Another potential marketing slant would be for slightly younger clientele – perhaps individuals in their 40s or even a little younger. These folks are still working on saving and accumulating their retirement nest egg.

This product will help them by allocating a portion of their retirement savings to an accumulation vehicle. Dan explains that with this product, he truly believes he'll start seeing agents going towards younger clients.

Individuals Coming Into an Inheritance

Finally, you can market to someone coming into an inheritance. This is an excellent way for them to grow that money without risking any losses.

Marketing Pieces: Ads, Emails, Presentations

There are tons of pre-approved marketing pieces in the SILAC agent portal. There are pieces for recruiting agents as well as consumers.

Dan explains that all of the ads are fillable, so if you want to use it, you can just download the ad and type in your own information.

Here's another example of an ad you could run:

"Agents are more than welcome to come up with their own pieces and submit them to us for approval," Dan says. The turnaround time is typically within 24 hours.

Plus, if you need help designing something, Dan says their marketing team is more than happy to help with graphics and layout work.

"We have an Ad Guidelines document in the portal, but if there's ever any question, just email sales@equilife.com, and you can submit sales and marketing questions there," Dan says.

Here's that Ad Guidelines document:

Finally, our team here at New Horizons created a client presentation with speaker notes – it's very simple to use, and an agent in our local agency has had a 100% success rate with it!

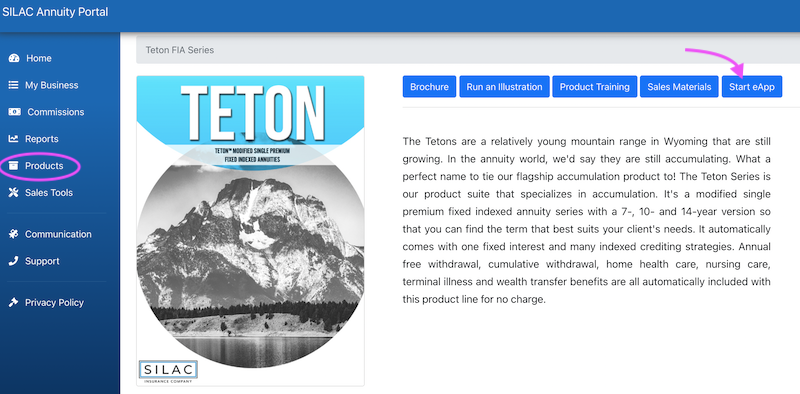

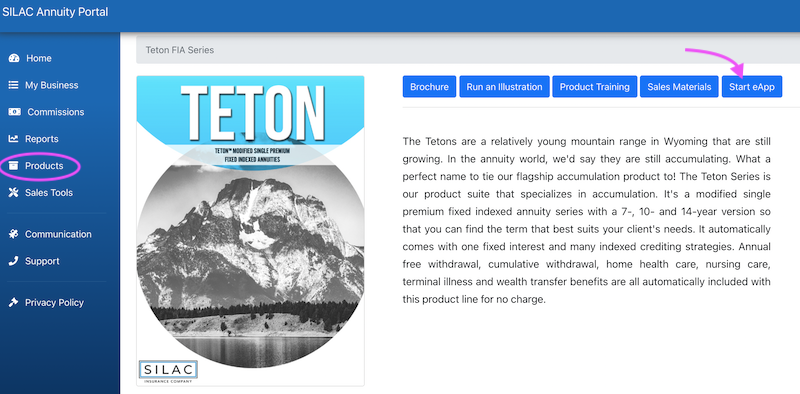

Is There an E-application?

Yes, SILAC offers an e-app for their annuity products. When you log into the agent portal, select the product you want to write, and click the "Start e-app" button.

It couldn't be easier!

SILAC Teton™ Fixed Index Annuity Commission

"Again, our goal is to keep it simple," says Dan. "We want to have enough pricing power in the product to offer the best rates and caps. We also want to provide a strong value to the agent as well. We want to make sure all parties win."

Contact us at any time to learn what your commission rate would be, but we'll say this – it's VERY strong. Fixed Index Annuities typically pay a significantly higher comp than MYGAs, and the Teton series is no exception.

How to Run a Teton FIA Illustration

The illustration software is extremely handy, and it's available right on the agent portal. The illustration software was actually designed by in-house actuaries, and there's no password needed to access it. When you do run an illustration, it will show you historical crediting periods for all crediting strategies.

All you have to do is simply log into the agent portal, click on "Sales Tools," and select "Illustration Software."

From there on, you'll just follow the prompts with your illustration information.

Let's go through a couple quick examples.

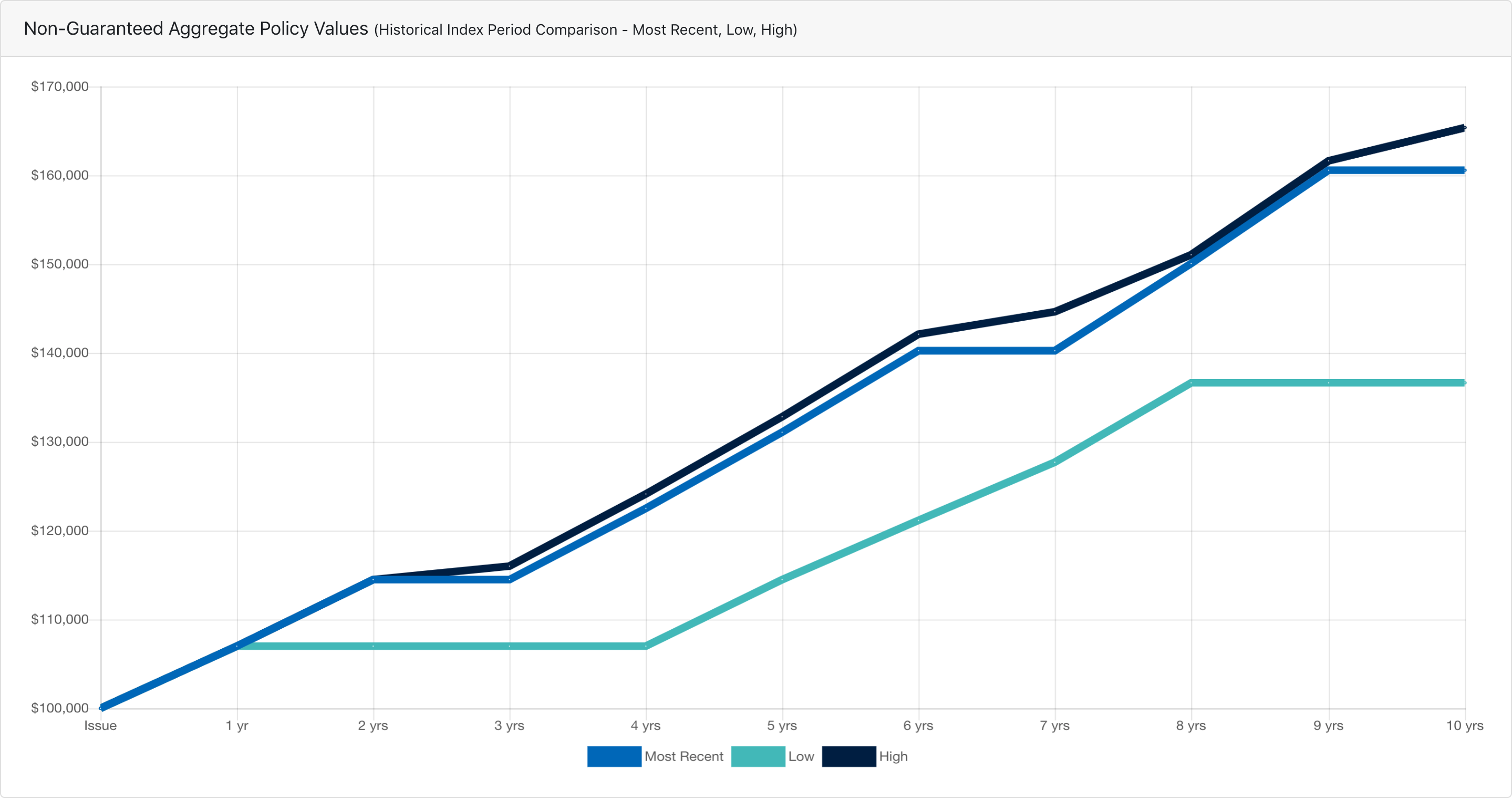

10-Year Teton Illustration: 65-Year Old, $100,000 Deposit

For our first example, we'll keep things very simple. We have a 65-year-old client with $100,000 to invest. She chooses to allocate 100% of her money in the Annual Point-to-Point with Cap. (Remember – that's the easiest one to explain and understand.)

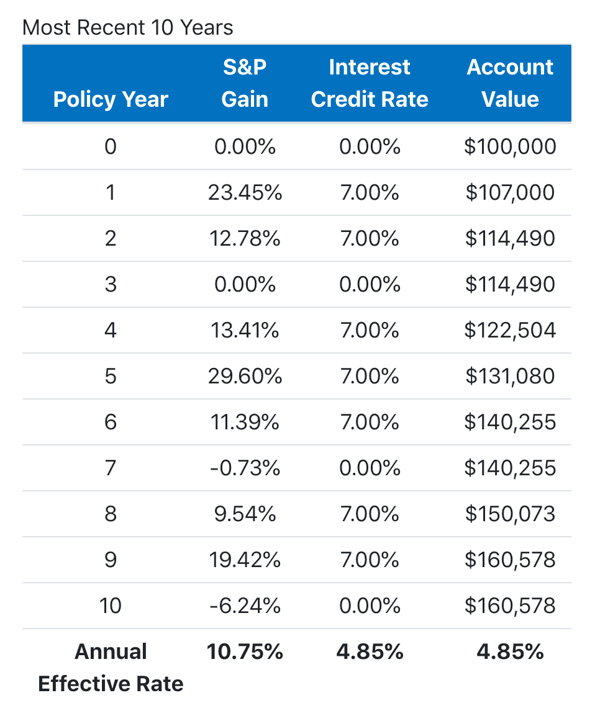

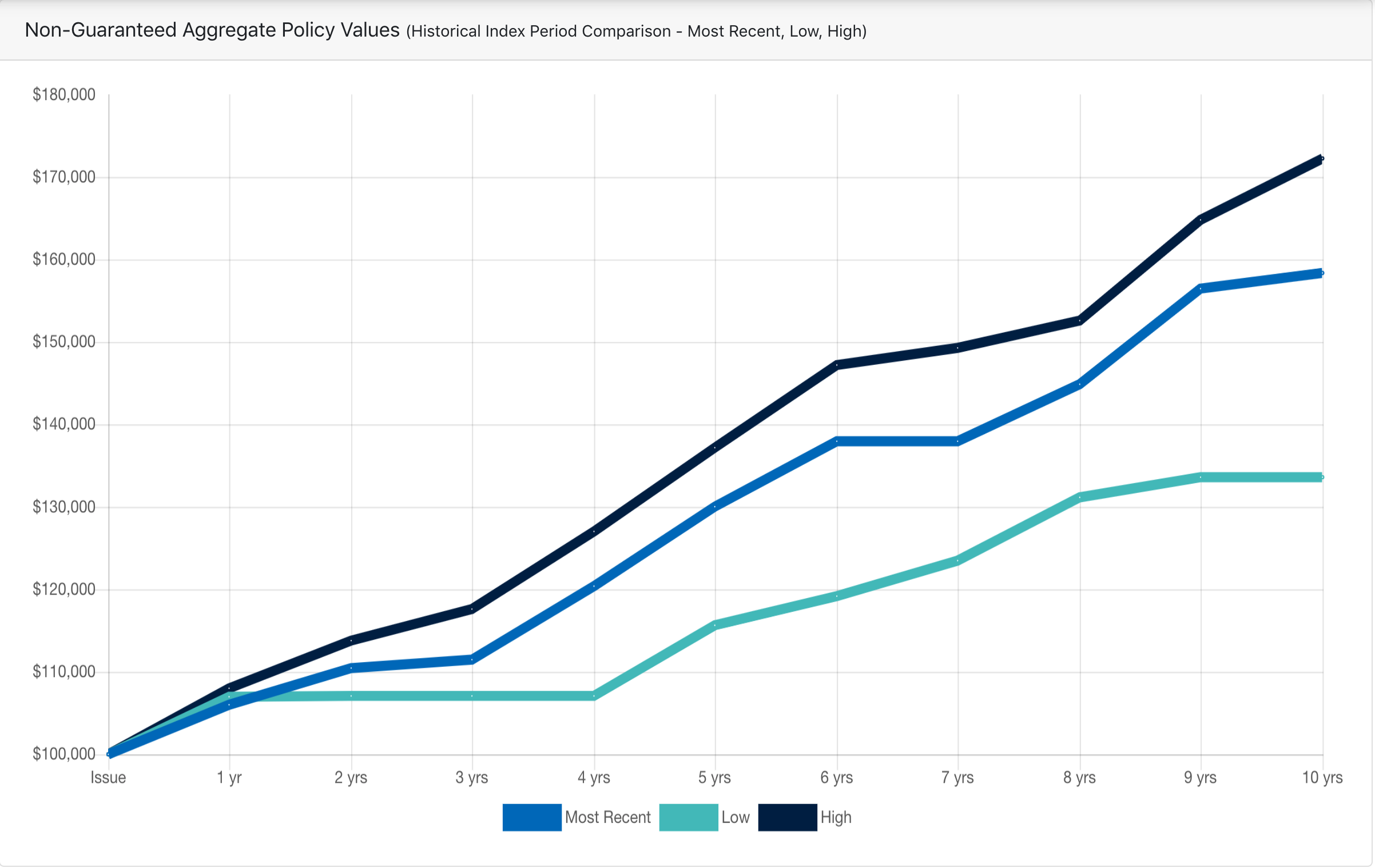

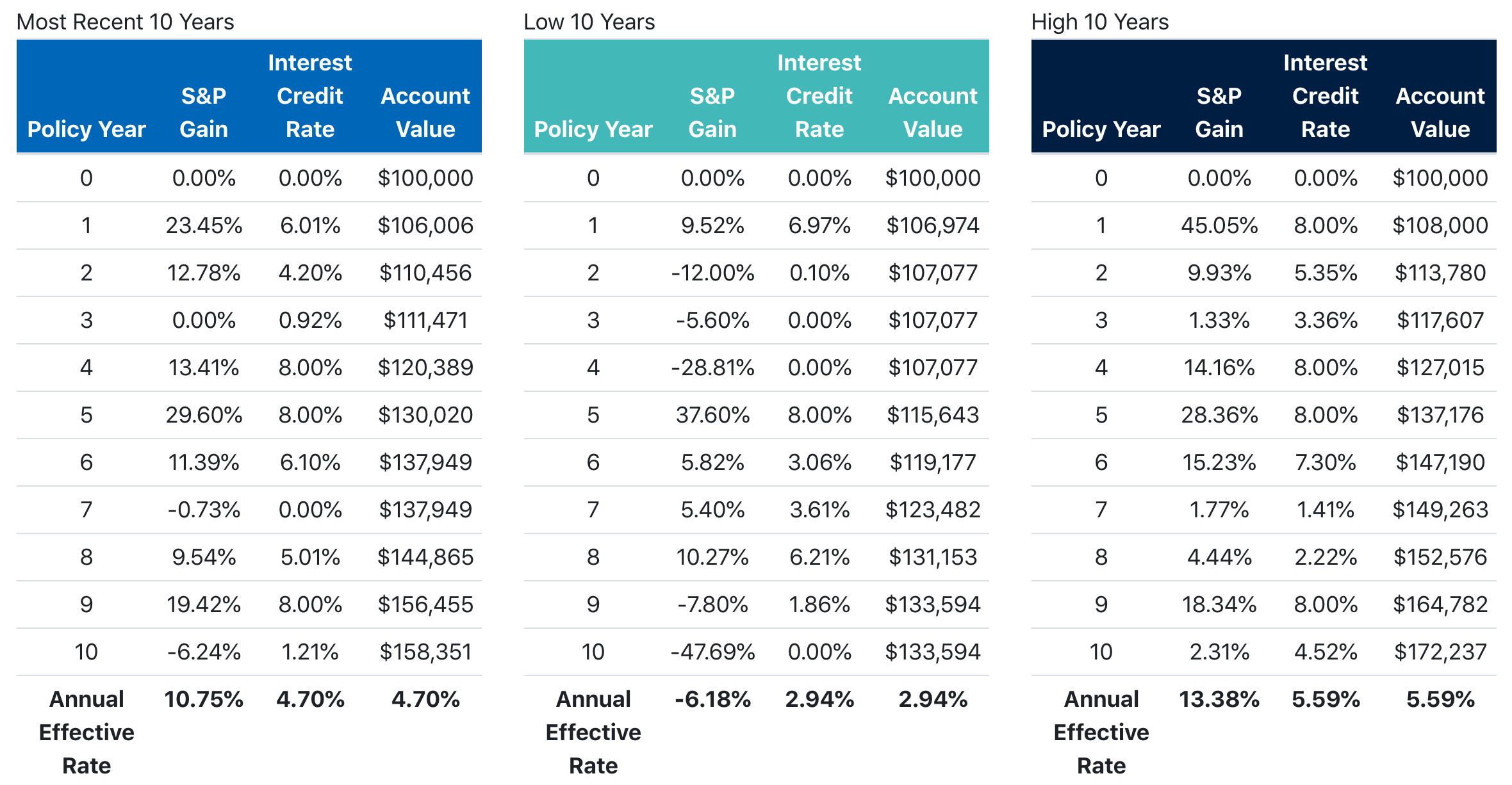

The first chart we get shows how her monthly would have theoretically performed in 3 situations: The best 10 years of interest rates (black line), the worst 10 years of interest rates (teal line), and the most recent 10 years of interest rates (cobalt blue line).

Then, we get the actual breakdowns of what the numbers would have been in each situation.

Take a look at the most recent 10 years:

Here, you can see really well how that cap works – when the market gained nothing or went under, the client stays steady at 0%. When the market goes way up, they're capped at 7%. Over the last 10 years, you can see the market gained an average of 10.75%, and the client gained an average of 4.85% – better than any MYGA out there.

Here, you can see really well how that cap works – when the market gained nothing or went under, the client stays steady at 0%. When the market goes way up, they're capped at 7%. Over the last 10 years, you can see the market gained an average of 10.75%, and the client gained an average of 4.85% – better than any MYGA out there.

Their account value climbed from $100,000 in Year 1 to over $160,000 in Year 10.

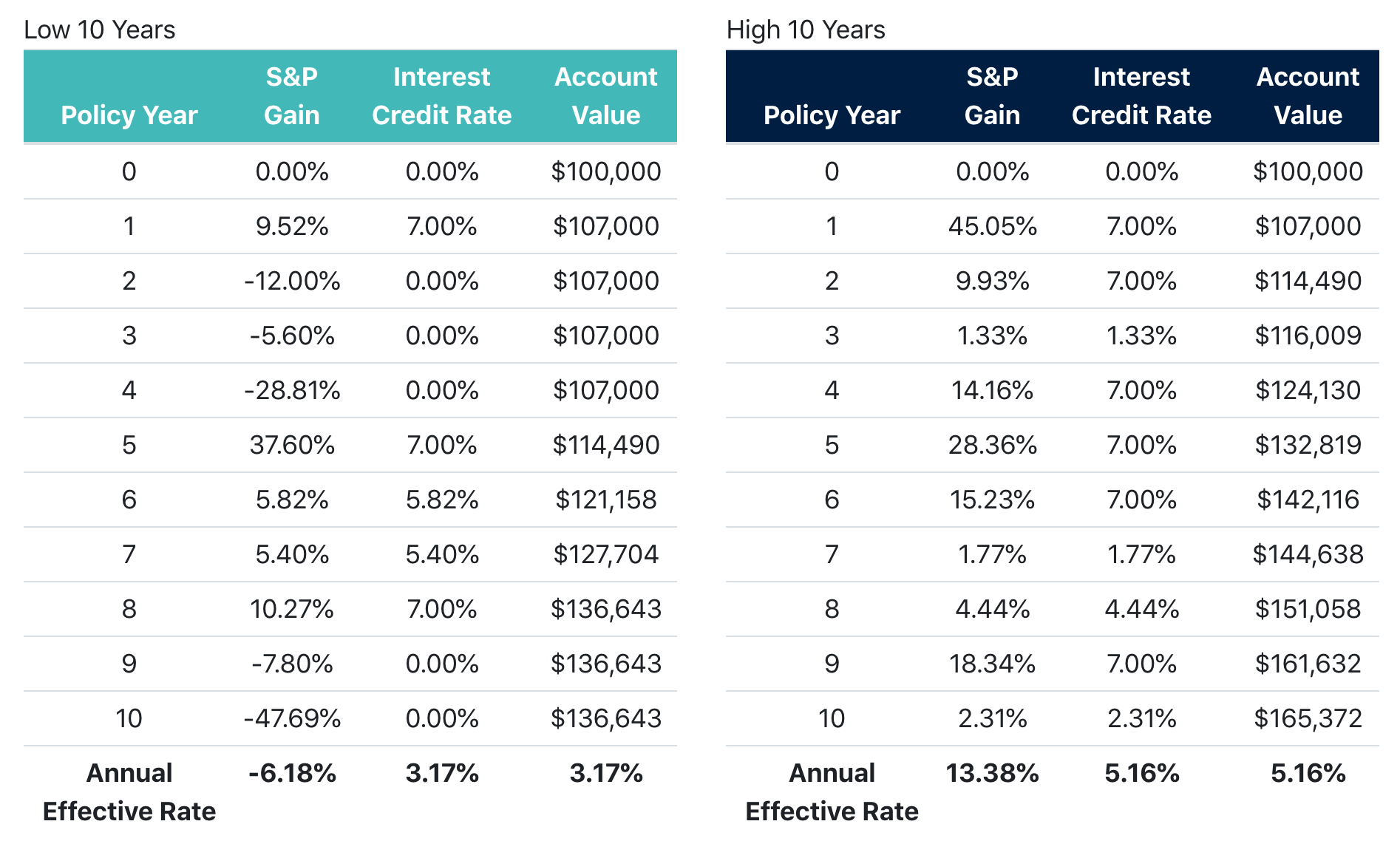

Quickly, here's a look at the lowest 10 years and the highest 10 years:

Pay attention to that tenth year in the "Low 10" example – if the client had put their money in the market, they'd have lost almost half of their investment. With the FIA, they were able to stay steady at 0%. That's powerful.

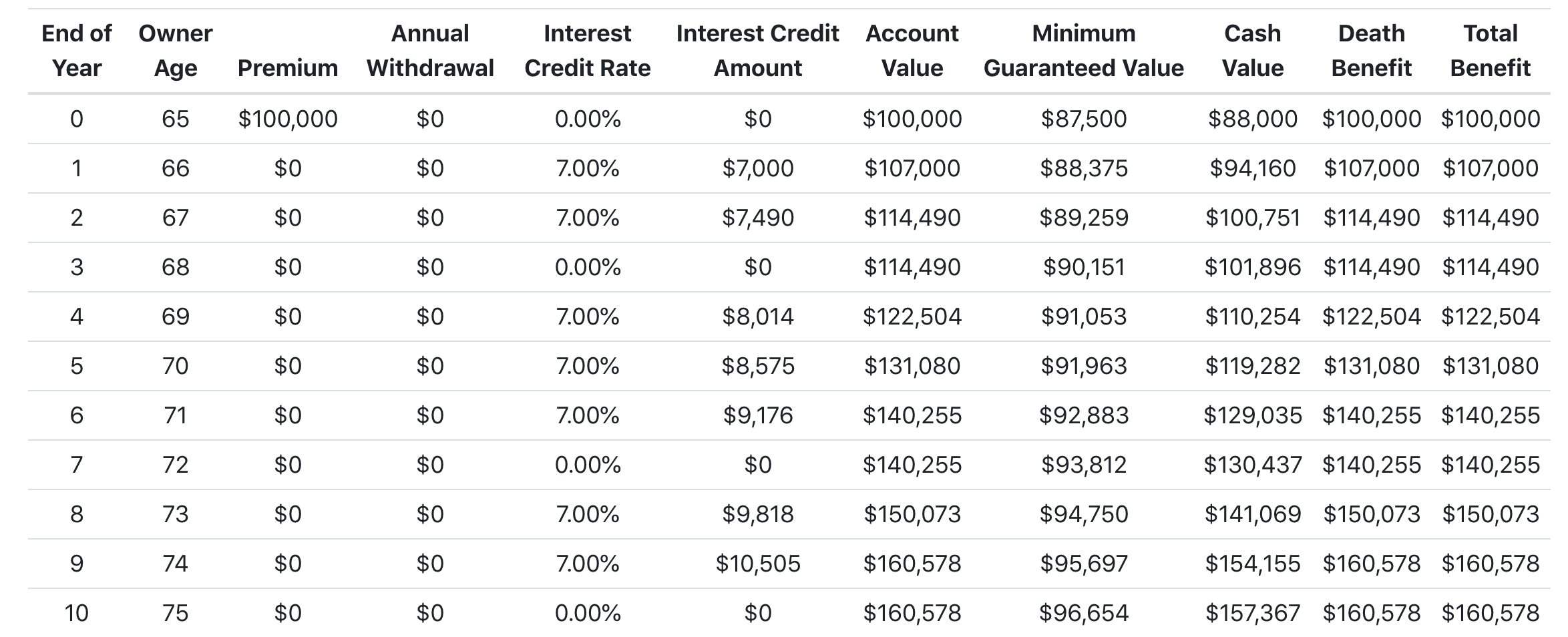

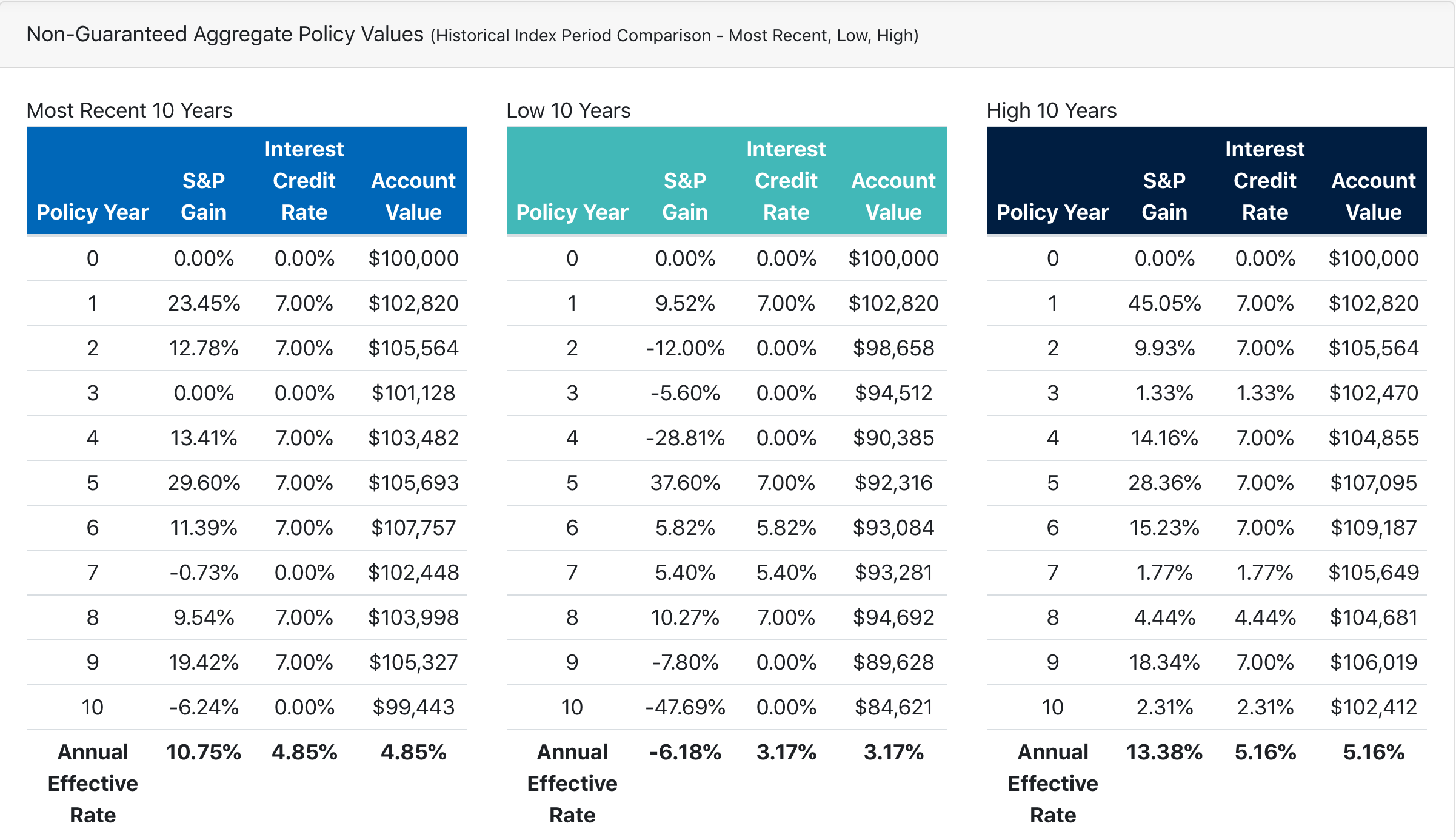

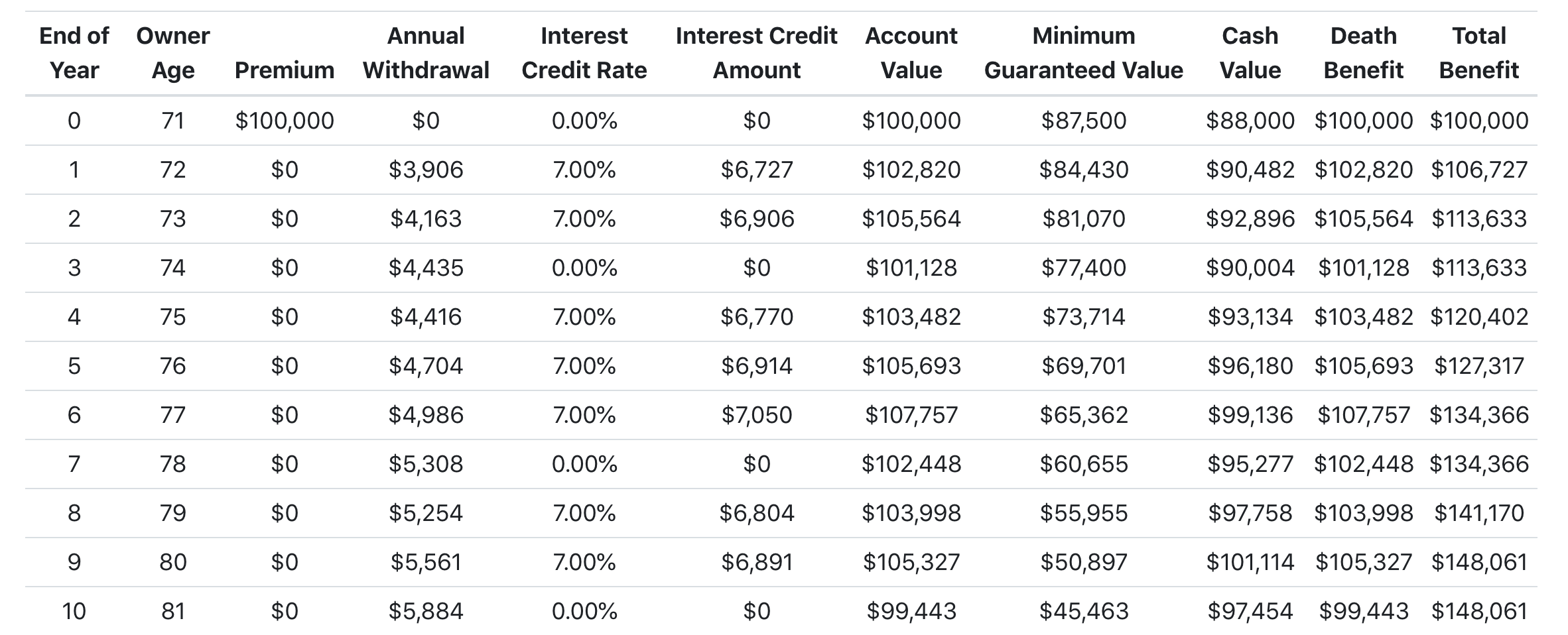

Finally, you get to take a look at the Non-Guaranteed Policy Values, which gives you and your client an in-depth look at everything: owner age, premium, interest credit rate, interest credit amount, account value, cash value, death benefit etc.

You can see here exactly what you saw in the Most Recent 10 Years chart, but just a little more detail. The Cash Value is the full account value minus the surrender charge. You also see that the death benefit is always the full account value, which is pretty awesome.

10-Year Teton Illustration: $100,000 Deposit, Annual Point-to-Point with Cap and Monthly Average with Cap

In our next illustration, let's switch things up a little bit by keeping everything the same, but by changing the index crediting strategy.

Let's take Dan's suggestion and put half of our money in the Annual Point-to-Point with Cap, and let's put the other half in the Monthly Average with Cap.

Here's the Policy Values chart that gives us a quick view of how the policy would theoretically have performed in those 3 scenarios (most recent 10 years, the lowest 10 years, and the best 10 years):

This strategy came out a little under in the Most Recent 10 Years and the Low 10 Years, but it really shined when looking at the High 10 Years. If the market is doing well, that monthly average allows you to capture more of the gains.

Neat tool, isn't it!

10-Year Teton Illustration: $100,000 Deposit with RMD Withdrawals

For our last illustration here, let's say that our 71-year old client needs to take out their RMDs. To account for RMDs, you just select "RMD" from the Type of Withdrawal dropdown.

This illustration has 100% of the client's money allocated to the Annual Point-to-Point with Cap.

We can see here how the policy would have performed in our 3 scenarios:

We also get to see exactly how much money they'd be withdrawing each year for their RMDs.

Seeing this in black-and-white is very helpful for clients who want to know exactly how the RMD withdrawals will work.

Final Thoughts on the SILAC Teton™ Fixed Index Annuity

At the end of the day, these Teton products were designed for accumulation. Dan explains, "The Teton series is unique, because it's really back to the basics of what a FIA is designed to do. That's to completely eliminate the downside risk. Our product has no fees, so we can truly say the client will never go backwards."

The interest rates are great, and the ability to join in on the stock market fun without any risk is a huge selling point.

To learn more about the Teton series, SILAC has put together a fantastic webinar that dives even deeper into the Illustration software. There's a recorded version in the agent portal (Support > Webinars > Click Here > Teton Annuity Training).

As far as current webinars, SILAC sends out an email once per week with the upcoming webinars.

All that's left to do is to get contracted!