As an agent, underwriting feels like this big mystery. You may not know who the underwriters are, and the decisions they make can either make or break a relationship with a client.

One way to close the mystery gap is to write a personal note when you send in life insurance applications.

What Is a Personal Note?

A personal note is a short letter of explanation from the life insurance agent to the underwriter.

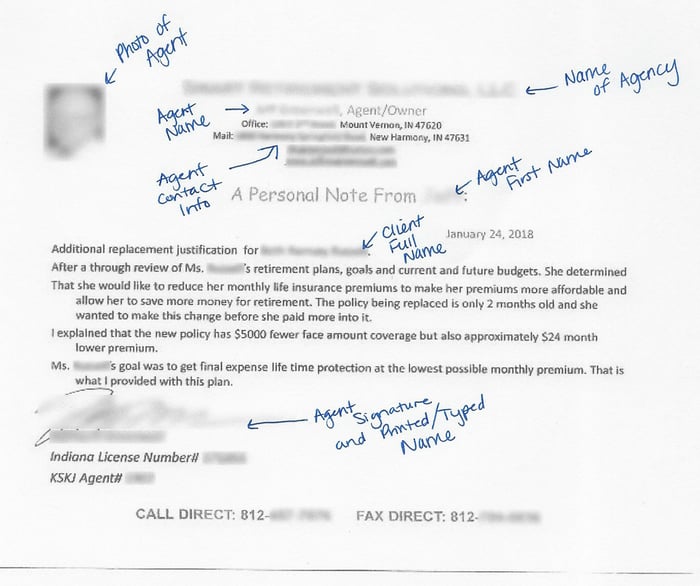

In the personal note, you’re explaining the client and the client’s situation – basically, anything that can help the underwriter understand the client better. You should include the purpose and goal for the application along with any explanations and justifications.

Some examples of things to include might be:

- Financial explanations,

- Perhaps why a family member is the payor,

- A medication that has dual purposes in which you outline the specifics,

- Any type of medical detail that can help the underwriter better understand the client, etc.

The personal note should include your contact information, the date it was written, and it should be signed.

There are typically remark sections on most applications, but a cover letter is always a good idea. The example we’ll show in a minute is a cover letter.

What’s the Purpose of a Personal Note?

Underwriters don’t know your client like you do. They don’t understand their goals and intentions, and it makes their underwriting job much more difficult.

The application, exam, and medical records don’t always give an underwriter the details they need in order to fully understand the client.

When you send in a personal note explaining why the client is choosing this life insurance policy along with any justifications and explanations, you’re helping that underwriter immensely.

Underwriters appreciate it when agents take the time to help them, and you can actually build your reputation with underwriters as cases progress.

An underwriter will eventually recognize the agent’s application, and they’ll look forward to working on their cases.

Personal Note Example

Here’s an example of a real personal note that was sent to an underwriter. Identifying details have been removed for the privacy of the agent.

Need further assistance? Contact Kirk Sarff, Director of Life Insurance Sales.

Email Kirk Call Kirk