Life Insurance Awareness Month (LIAM) happens every September, and it's a great time to join the larger conversation about the need for life insurance.

If you've never done anything special for LIAM, perhaps this year is the time to start!

Here are 12 ideas from the New Horizons marketing team to help you make the most of LIAM in 2025.

1. Discover What Your Contracted Carriers Have – And Use It!

Have you spent time seeing what your life insurance carriers have already created?

Many carriers have a great library of marketing materials that you can download and use with little to no effort.

As an example, check out this infographic from Corebridge.

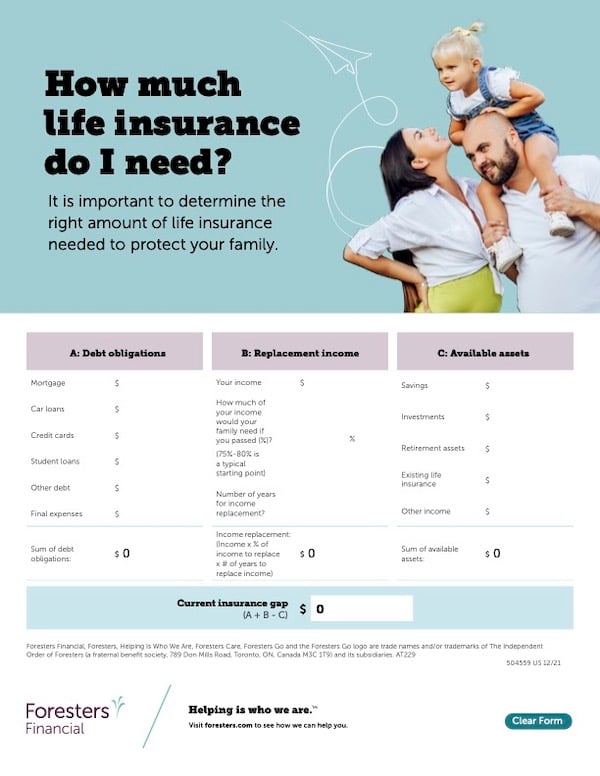

Foresters has some nice options as well, including a fillable Insurance Gap Worksheet you can send to your clients.

Foresters has some nice options as well, including a fillable Insurance Gap Worksheet you can send to your clients.

You might be surprised at the variety of downloads and marketing materials that carriers have available to you. Some even allow you to enter your contact information.

2. Download the Life Insurance Awareness Social Media Assets.

Spread the word about Life Insurance Awareness Month with our free social media assets. Choose from lots of different social media images and copy suggestions – mix and match to create your ideal LIAM message.

Be sure to use the "September Is Life Insurance Awareness Month" image so your followers know what the month of September is all about.

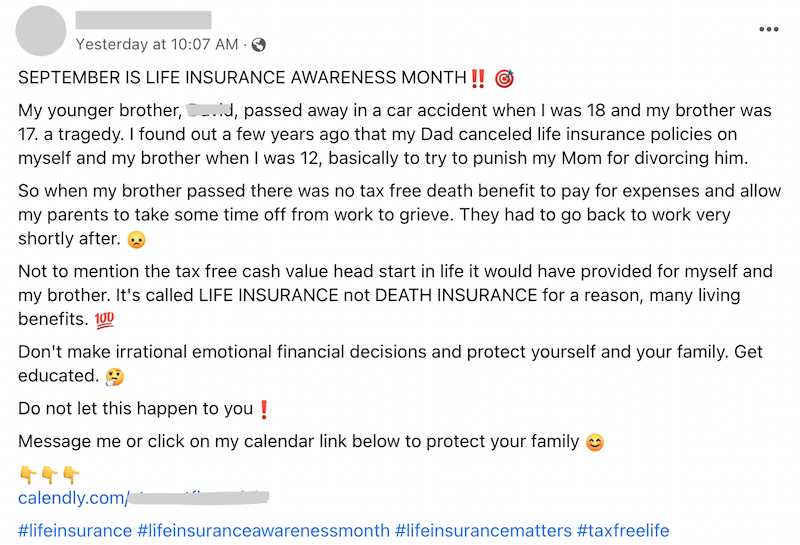

In addition to using the pre-made assets, consider telling a personal story.

Oftentimes, the Facebook posts that get the most engagement are the ones that are personal and tell a story.

If you don't have a story of your own yet, consider using someone else's. Check out this article for some ideas.

3. Check Out Campaign In a Box From Corebridge.

Corebridge Financial, formerly AIG Life & Retirement, has some amazing marketing materials as part of their Campaign In a Box initiative.

There are:

- Pre-built campaigns

- How-to videos

- Emails

- Social Media

- Blogs

- Videos

- Infographics

It's quite literally everything you need to promote their products, including life insurance and final expense. And there are lots of different campaign options to choose from.

They even come with a campaign calendar, so you could pass this project off to an assistant or intern with no stress.

If you aren't already contracted to sell Corebridge life insurance products, visit our Corebridge life insurance page.

4. Include a Unique Introduction in Your Email Newsletters.

If you send any email communications to your clients and prospects, add an introductory message about Life Insurance Awareness Month.

For example:

Dear <First Name>,

September is Life Insurance Awareness Month, a time of year where we focus our attention on the need for life insurance. Life insurance isn't just for newlyweds or homeowners – it's also important for those who are retired or are planning for retirement.

Life insurance can help with final expenses, estate planning, long-term care planning, and so much more. In this newsletter, you'll find several resources to help you learn more about life insurance after age 65.

5. Add a Line to Your Email Signature about Life Insurance Awareness Month.

Adding messages to your email signature is a great, free way to get the word out about important events or campaigns.

For the month of September, consider adding a line about Life Insurance Awareness Month.

Simple messaging like "Ask me about Life Insurance Awareness Month" or "It's Life Insurance Awareness Month – ask me about a free policy review" is a quick way to add to your momentum.

P.S.: Foresters has a really nice policy review worksheet, if you haven't seen it yet.

6. Check Out LIMRA for Marketing Materials.

LIMRA has several pieces of content you can use to spread the word about Life Insurance Awareness Month.

Visit this page to find images and animated posts that you can easily share on social media.

There are also several flyers available for download, like this one about misconceptions or this one with 2025 facts.

7. Include a Flyer About LIAM When You Deliver Policies.

For any policies that you deliver to your client, consider dropping in a flyer about ancillary products or life insurance.

It doesn't have to be Life Insurance Awareness Month to use this tip – many agents use the policy delivery as an opportunity to continue the conversation and schedule another appointment.

You can check out the free life insurance flyer available from Life Happens Pro, or you could create your own using a self-service design platform like Canva.

Just select a template you like, add your own copy and images, and you'll be all set.

Learn more: How to Design a DIY Brochure For Your Insurance Agency Using Canva

8. Ask a Simple Question During Existing Appointments.

You don't have to make a big splash online to make the most of Life Insurance Awareness Month.

Maybe this month is your opportunity to challenge and push yourself to bring up the topic of life insurance during your appointments.

Many agents use the Client Needs Assessment to start that conversation, and you can grab a copy for free:

But you can use any fact finder you want.

You can also decide which question fits your personality the best and modify whichever fact finder you decide to work from.

Here are some example questions:

- How much have you set aside for funeral costs?

- If you were to pass away tomorrow, how much debt would you want to pay off for your family?

- If you were to pass away tomorrow, how much of your income would you want to replace for your spouse/family?

- Can your spouse live on one Social Security check if you pass away?

- When was the last time someone did a life insurance review for you?

More ideas: 31 Best Questions to Ask Life Insurance Prospects Ages 60+

9. Make a Facebook Business Profile.

Facebook is a great platform to spread the word about life insurance, especially during LIAM in September.

A lot of older adults use Facebook – it's actually the most popular social media platform in the 50+ age range (AARP Research). On top of that, 60% of 55+ adults who are active on social media say they use Facebook daily (Creating Results).

Simply put: if you want to share a message, Facebook is a great platform to use.

If you don't have a Facebook business profile yet, it's time to create one.

Need a step-by-step guide? Download the Facebook page guide for agents.

First, you'll need to create a personal Facebook page if you don't have one yet. Then, create a Page and add all of your business information, including images and your logo.

You can also add a Call to Action button for your page, such as "Call Now" or "Get Quote." The last step is to ensure you have content to share on your page.

Head on to the next tip for some LIAM content.

10. Create Facebook Reels to Boost Your LIAM Reach.

Facebook Reels are exploding in popularity, accounting for 40.8% of social users' video consumption and earning about 200 billion daily views across Facebook and Instagram (Sprout Social, Cool Nerds Marketing).

With 3.5 billion Reels shared daily across Meta platforms, it's a great place to spread the word about life insurance!

Hook Your Audience with Negative Hooks

Research shows that negative hooks outperform positive ones. They're powerful because they tap into our natural human instincts. Our brains are wired to pay more attention to negative information than positive information, and they create a sense of urgency.

Try hooks like "Don't make this deadly life insurance mistake" or "Stop ignoring your family's financial future" to grab attention; then, follow with helpful solutions. Neutral hooks like "Life insurance secrets agents won't tell you" also perform well.

Create quick Reels showing real monthly costs versus daily expenses, busting common myths, or sharing stories about families who had to resort to GoFundMe pages after a loved one passed away.

Remember, people watch 74% of Facebook videos without sound, so focus on strong visuals and include captions or text overlays (Sprout Social) to grab attention even when audio is off.

Reel Examples

There's actually not a lot of great examples on Facebook (or the search functionality isn't awesome), but I did find some good ones with great engagement on TikTok. I'll share those here.

But this is such an opportunity to reach a new market, and hardly any other agents are taking advantage of it!

Here's a story time video example:

Here's another one that leads with a negative hook (this is what they don't tell you):

@rorydouglasofficial With so many Americans getting life insurance without any knowledge of how it works, the consequences can be devastating. Term life insurance may look like a good deal but it expires before most people die leaving their loved ones with no death benefit. Permanent life insurance provides a way to transfer wealth and create financial security for future generations, if you understand how it works. Take control of your future by educating yourself on term and permanent life insurance today! #LifeInsuranceAwareness

♬ original sound - Rory Douglas

And here's a video that uses a Q&A format:

@vgunvalson Replying to @luvmygabby Life insurance is a tax-free benefit. 💚 #LifeInsurance #CotoInsurance #FinancialEducation #Money #Rhoc #Learning

♬ original sound - Vicki Gunvalson

11. Host a Giveaway Celebrating LIAM.

This one may be a little intimidating, but you might consider hosting a giveaway that celebrates Life Insurance Awareness Month. It's a way to draw attention to the occasion, and it creates some excitement.

This will only work well if you get enough people to participate. If you have no followers on Facebook and hardly any appointments in the month of September, this isn't going to be the tip for you.

But if you have an online presence and clients will be in and out of your office all month, it could be a fun idea to try.

Here are a few things to figure out before you start your giveaway:

- Goal: what do you ultimately want people to do?

- Offer an exciting prize: what are you giving away?

- Entry requirements: how do people enter? Like you on social media? Subscribe to your email list? Drop their name in a raffle jar with the name of a referral on it (check anti-rebate laws in your state first)?

- Consider a giveaway platform: if you share your giveaway online, you can use a giveaway platform like Gleam to track everything.

- Share your giveaway: send an email, post on social media, tell customers that you see in person, etc.

Keep in mind that you are bound to any compliance rules and regulations about doing a giveaway as a life insurance producer. Those rules are state-specific, so check with your state and/or an attorney before diving in too deep.

As an example, Florida agents can't give a promotional gift worth more than $100 in a calendar year.

And this is the rule in Indiana:

Contests or raffles in which the consumer receives a free chance to win are acceptable as long as they are open to the public and there is no obligation for the consumer to purchase or renew insurance to enter, win, or claim the prize. Prizes are not limited to a $25 value; however, the value of the prize divided by the reasonably expected number of entrants must not exceed $25 per entrant.

12. Add a Slide About Life Insurance Awareness Month to Your Lobby Monitor.

If you have an office where you see clients, consider adding a LIAM message in your lobby area.

In our local agency, we have a TV on the wall where we play a slideshow that features fun facts, products we offer, the history of our agency, and more. It's a nice way to add value while our clients are waiting for their appointment.

Adding a quick slide about LIAM is a great way to stay relevant and freshen up your lobby experience.

Conclusion

Awareness months, like LIAM, are a great way to be a part of the larger conversation. Join in on the momentum and help educate and inform your clients and prospects about the need for life insurance.

From covering final expenses to estate planning to finding a way to prepare for long-term care costs, life insurance is a great tool for many seniors.

To learn more about selling life insurance, check out our library of life insurance articles for agents and our Ultimate Guide to Selling Life Insurance in the Senior Market.