What if there were a roadmap that gave structure to your appointments? And what if that roadmap also helped you cross-sell with minimal effort?

There is, and that roadmap is called a fact finder.

Here's everything you need to know about fact finders in the senior market, from fact finders you can download right now to best practices on using them effectively.

What is a Fact Finder?

An insurance fact finder is a questionnaire you use with prospects and clients to understand their needs and make personalized coverage recommendations.

Because we're in the senior market, our fact finders are heavily focused on topics that include Medicare, retirement savings, and long-term care.

But a fact finder can be whatever you want it to be – you can add your own questions or remove them. You can also rewrite questions so they better fit your style and personality.

If there's a need you want to uncover with your client, you can add a question that addresses it to your fact finder.

Related: The Ultimate Guide to Cross-Selling Insurance in the Senior Market

Psychology of Fact Finder Questions

Our team prefers fact finders with psychologically-charged questions.

We want agents to have meaningful conversations that flow naturally, and we also want to invoke emotion with our clients.

If your questions are matter-of-fact, your relationship with your client likely won't develop, and they'll be less likely to open up.

Here's a quick example:

Typical question: Do you currently have a long-term care policy?

Psychologically-charged question: Have you had a family member use home health care or go into a nursing home? Followed up with: 1) How did they pay for it? and 2) How would you pay for it?

It's easy to see which option will help your client open up and really visualize the need for a long-term care financial plan.

Related: 8 Questions to Get Your Clients and Prospects Talking Every Time

Fact Finder PDFs and Downloads

There are lots of different fact finders out there. We've developed one and many carriers provide agents with their version to use or adapt. Some of our Integrity partners also have some great fact finders to check out.

If you don't see exactly what you're looking for, take bits and pieces from everyone and make your own!

Here's a quick look at a variety of fact finders you can download and start using today.

Related: Ultimate Guide to Cross-Selling

Client Needs Assessment

Over the years, we've developed and fine-tuned what we call the Client Needs Assessment.

It's specifically for a well-rounded agent in the senior market who is prepared to help a client with the following needs:

- Medicare (whether it's a supplement or Advantage plan)

- Cancer insurance

- Long-term care insurance (or short-term care)

- Life insurance, including final expense

- Annuities

- Part D

We also ask a quick health question at the beginning. This way, if that client would never qualify for a cancer policy as an example, you skip over that question.

If this sounds like a good fit for you, you can download it for free here:

A lot of agents like the simplicity of this fact finder as it addresses all of a client's needs, yet it's only 1 page.

Needs Analysis

This needs analysis is an in-depth tool designed to enhance your client consultations.

Here's what this 11-page, editable worksheet offers:

-

Comprehensive Client Profile: Capture essential details like current health coverage, life insurance, and Medicare eligibility, ensuring no gaps in your clients' protection.

-

Streamlined Assessments: Quickly assess client needs across multiple areas, from term life insurance to Medicare Advantage plans, making your recommendations more targeted and efficient.

-

Medicare Penalty Alerts: Easily track Medicare enrollment dates and potential late penalties, helping your clients avoid costly mistakes.

-

Customizable Coverage Review: Tailor your suggestions based on specific client needs like prescription drug coverage, long-term care, or final expense plans.

This fact finder ensures no stone is left unturned, allowing you to offer extremely personalized services. Plus, you don't have to print it since the PDF is editable.

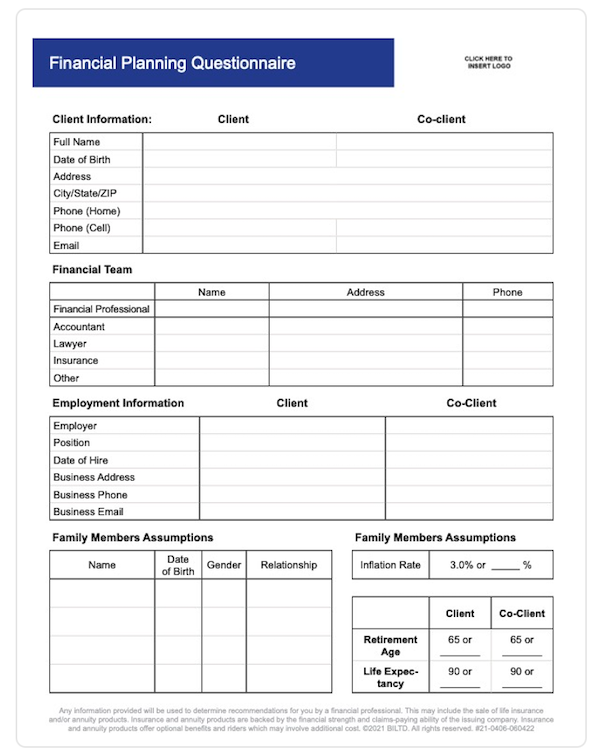

Financial Planning Questionnaire

If you're more focused on retirement/estate planning and products like long-term care, life insurance, and annuities, this 9-page Financial Planning Questionnaire is a very in-depth fact finder you might take a look at.

It's definitely all about the facts and less about getting conversations going.

But if you need to gather information such as family members, assets and liabilities, monthly income, Social Security benefits, retirement expenses, existing life insurance policies, and more, this is a good way to make sure you don't miss anything.

The last page also lets you check off which documents you need your client to bring to the next meeting.

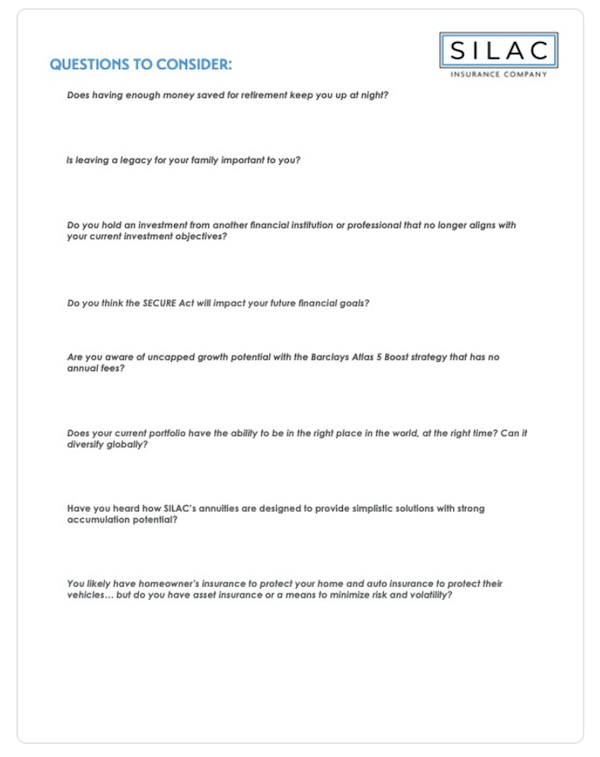

Annuity Annual Review

If you're interested in selling annuities, this review packet from SILAC can be a huge help in structuring that appointment.

You can jot down your client's goals, the big financial picture, and answers to questions like "Does having enough money saved for retirement keep you up at night?"

It's obviously created to help you sell SILAC's products, but it can also give you some additional ideas of things to ask your client and information to gather.

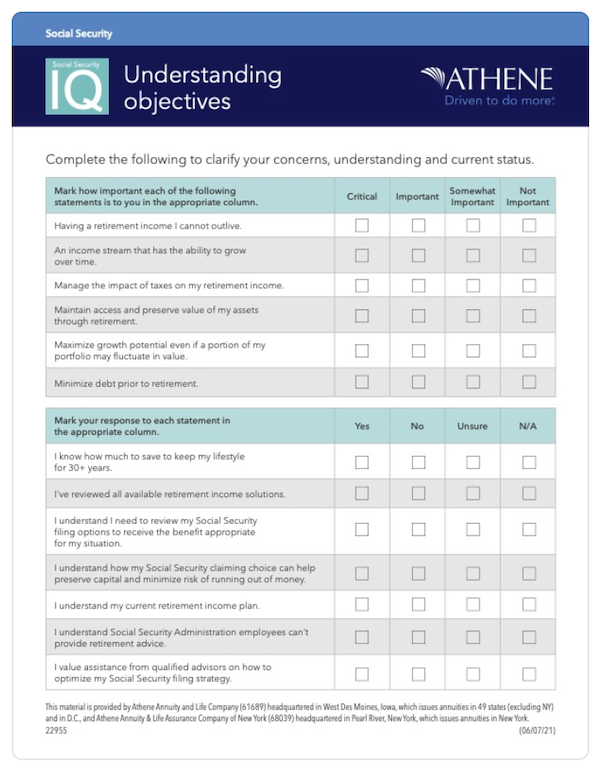

Understanding Objections Client Questionnaire

Another great fact finder for agents who sell annuities and assist with retirement planning is this questionnaire from Athene.

It actually allows your client to take charge of the fact finder as they need to fill out the worksheet.

Their answers can help you talk about the need for an annuity, and it'll also give you a good idea of which type of annuity might help them reach their goals.

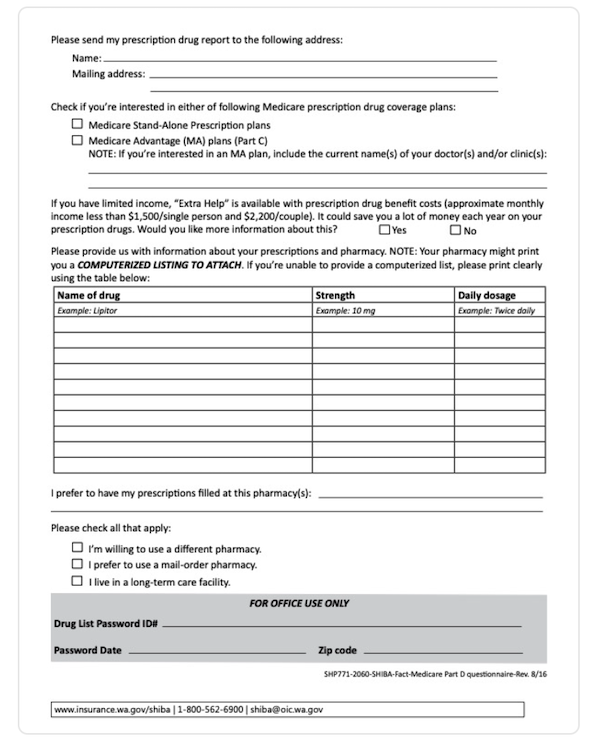

Medicare Part D Fact Finder

If you're doing a prescription drug appointment, this Part D fact finder could be a good way to quickly gather information and have it on hand.

It is developed by Washington State, so there is a line in there specific to Washington, but the rest of it is applicable no matter where you are.

It has a section to write down their current prescriptions as well as their pharmacy of choice. Even if you don't use this specific fact finder, perhaps it'll give you some inspiration for creating a version of your own.

Other Questions You Can Add to Your Fact Finder

Not seeing the questions you'd really like to ask? Here's a list of other questions you can copy and add to your own, unique fact finder.

Medicare health plan questions:

- Do you travel often? If you do, where do you go?

- What funds do you have reserved to cover unexpected hospital bills?

- If I could find a plan that was exactly what you're looking for, how would you describe it?

- How much did you spend on healthcare last year?

- Is it important that you keep your current doctors?

- When was the last rate increase on your Medicare Supplement plan, and how much was it?

Hospital indemnity plan questions:

- Does your Medicare Advantage plan cover an inpatient hospital stay for days 1-5?

- What's your out of pocket cost for an inpatient hospital stay for 5 days?

Life insurance questions:

- How much have you set aside for funeral costs?

- If you were to pass away tomorrow, how much debt would you want to pay off for your family?

- If you were to pass away tomorrow, how much of your income would you want to replace for your spouse/family?

- Can your spouse live on one Social Security check if you pass away?

- When was the last time someone did a life insurance review for you?

More ideas: 31 Best Questions to Ask Life Insurance Prospects Ages 60+

Annuity questions:

- Which is the most important to you: earning interest, protecting your principal, or not outliving your savings?

- Out of the following three options, which one would you eliminate if you could: my nest egg grew, my nest egg stayed the same, my nest egg lost money?

- If your nest egg is in the stock market, would you accept a slightly lower interest rate in exchange for safety and no risk of losing your principal?

Long-term care questions:

- If you need long-term care, who do you plan on caring for you?

- If you needed long-term care, would you rather be in a nursing home or stay at home?

- If you need long-term care, which one of your assets would you intend to use first?

Best Practices for Using Fact Finders

When using a fact finder, there are a few tips to make sure you get the most out of it.

First, don't fill out your fact finder digitally, if you can help it. Fill it out by hand in front of your client. This lets them know you’re catering your service to their needs, and you’re not just doing some standardized pitch to every client.

Second, go through the entire fact finder and ask all of your questions before going into sales presentations. Stopping halfway through to talk about the need for long-term care insurance will disrupt your entire flow and derail the appointment.

Second, go through the entire fact finder and ask all of your questions before going into sales presentations. Stopping halfway through to talk about the need for long-term care insurance will disrupt your entire flow and derail the appointment.

Ask all of your questions and give a summary of recommendations at the end.

If there are several needs, start with the most pressing so you don't overwhelm your client. Here's what Michael Sams, a high-volume producer, says in this situation:

"It's a little overwhelming to address all of these needs in one setting, so let's start with the most pressing need, which is [Insert Product Here]. We can talk about the other needs at a later appointment."

Lastly, scan your finished fact finder into your CRM or other management system. You want to be able to reference your client's answers in the future.

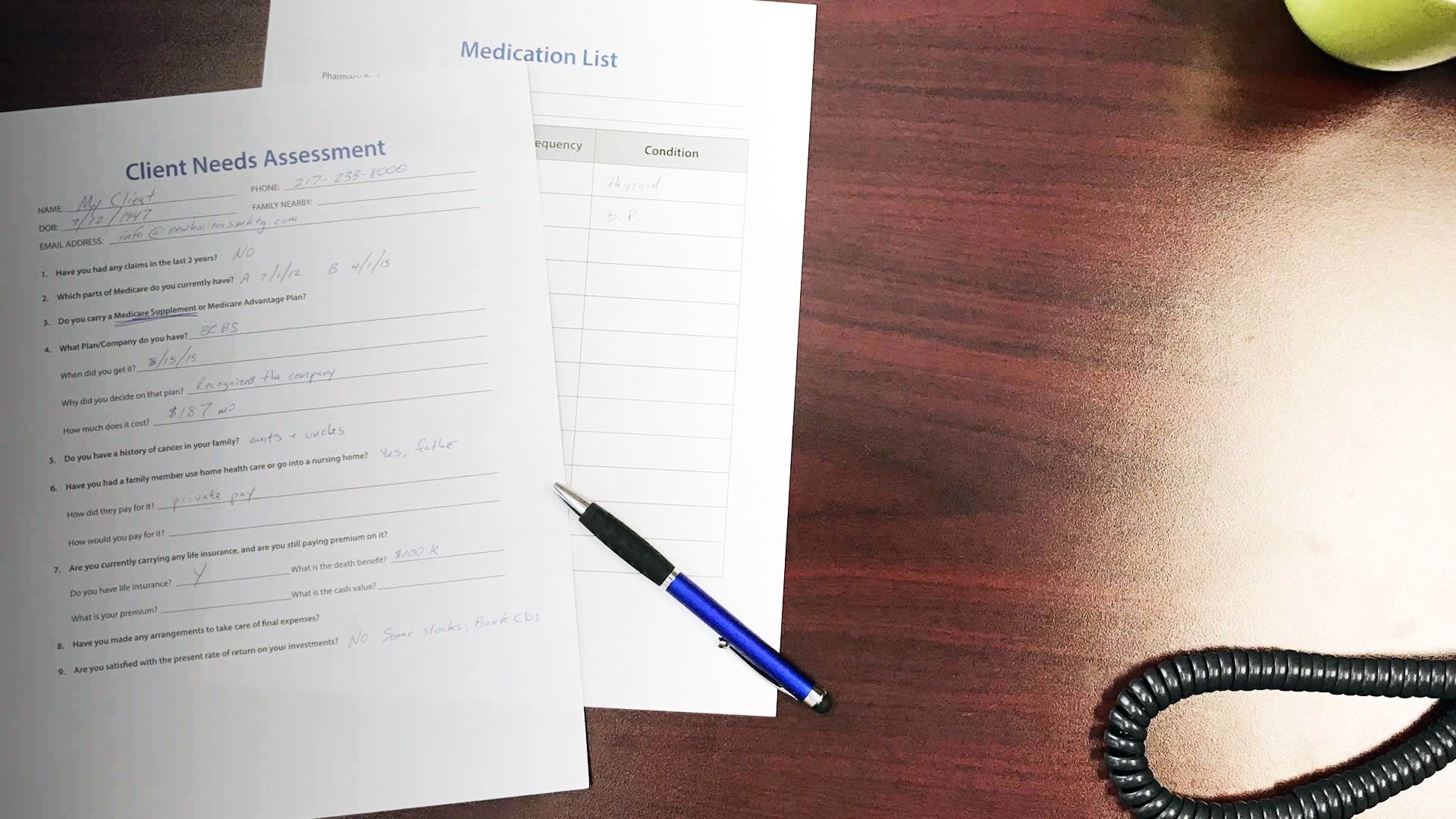

Here's an example of a scanned fact finder:

Get more tips here: Top 10 Client Needs Assessment Tips for Medicare Agents

Conclusion

Using a fact finder is great way to guide your appointment, get the essential information you need about your clients, and cross-sell to fill their needs.

Whatever fact finder you use, the important thing is that you're asking the questions and understanding your client's big picture. That'll allow you to make the best recommendations for your client's life, health, and wealth.

The bottom line? You'll never know if you don't ask.