Note: Originally published January 31, 2023. Updated April 8, 2025.

I sat down with multi-million dollar producer, Michael Sams, to find out what a day in his life is like. With over $8 million in annuity production and a hefty number of Medicare Supplement policies to boot, I have to admit: I'm super curious how he does it!

Join me as Michael walks us through his day, from morning chores to bedtime and everything in between.

Morning Routine

On a typical day, Michael wakes up at 6 a.m. and starts doing morning chores, including feeding his horses and cattle.

A fun update since our last interview is he now has an enclosed tractor and an enclosed skid steer. Now that he has heat and Bluetooth inside the equipment, morning chores aren't so bad!

Check out these Watusi cattle:

He's typically in his office and ready to start his day in senior market sales around 8:30 a.m. However, his start and end times can really vary based on the season.

"Being able to schedule appointments at the times that I want to makes me so grateful for this job," he says.

In the winter, he schedules appointments earlier so he can work on the farm mid-day when it's warmest. Vice versa for summertime!

In any case, he begins his day in the office by checking emails and getting up-to-date on any recent communications: "There's always outstanding requirements on submitted business, mostly for financial products. I'm just replying to those emails and taking care of all of that."

Michael does quite a bit in annuity production, so most days, he's facilitating the transfer process and ensuring everything is progressing as it should.

"I don't want the hangup of funds getting transferred to be because of me," he says.

After some of that initial busywork, he gets right into appointments.

Mid-Morning to Lunch

Michael stacks his appointments every hour, so he typically fits in about three before lunchtime (9-10 a.m., 10-11 a.m., and 11 a.m.-12 p.m.).

Since our last interview a few years ago, Michael admits that not much has changed: "It is unbelievable how my routine is such that I walk people out to the elevators, and my next round of clients are walking off the elevator at the same time. My appointments are still right at one hour each."

One thing that has shifted slightly over the last couple of years is Michael's blend of appointments. It used to be a good mix of new clients and annual review appointments. These days, the majority are new clients, and he's more sparing with the annual reviews.

"I'm mostly seeing people that are turning 65 or they're getting ready to retire. There's a lot of opportunity with these new folks," he says.

As for the annual reviews, he's trimmed them down a bit so he's prioritizing seeing clients who are experiencing a rate increase.

He spends the bulk of his time educating them so they understand Medicare and retirement prep. During these initial appointments, it's pretty standard for him to help them with a Medicare Supplement and a 401(k) rollover.

"I used to be intimidated by talking about money, but it's so routine now. I feel like a day in my life really isn't that exciting – it's such a systematic approach that it may seem like a hidden secret, but it's not. I'm just meeting with people, providing education first, and through that education, they make an informed decision," he says.

The Anatomy of an Appointment

I was curious about the flow and timing of Michael's appointments – after all, that's where all the magic happens.

A few years ago, Michael visited with clients for up to 30 minutes (yes, half the appointment!). The main purpose of that was to establish rapport and trust. It's worth saying, too, that for Michael, he genuinely was and is interested in his clients' lives.

"Now that they're here, I want to know what's next. Is their idea of retirement doing nothing? Where's the dream trip? What are they planning?" Michael shares.

That said, he's trimmed down the 30 minutes of small talk to about 10 minutes. Why? He feels he's built his reputation up enough that the trust is pre-established.

"People come to me because they've been to a seminar or they're a referral. Either way, credibility has been established. I don't feel the need to go as deep into the warm-up as I did before," he says.

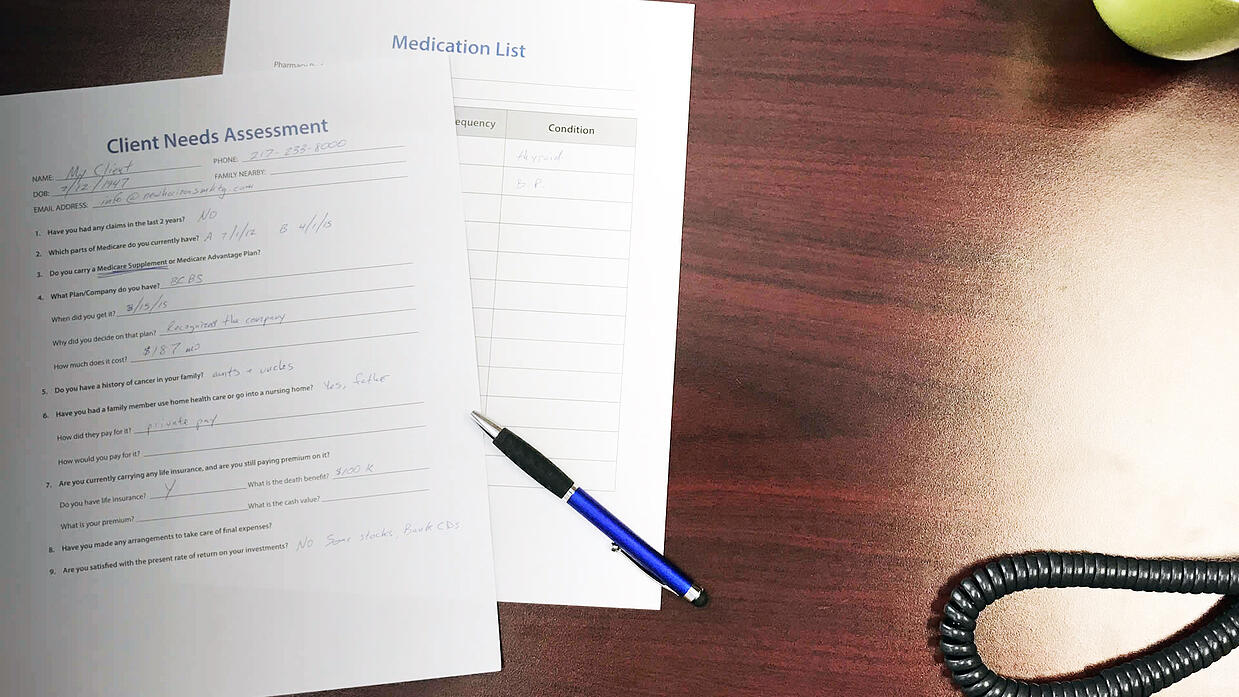

Next, he transitions into the Client Needs Assessment. He asks about when they plan to retire, drawing Social Security, and so on (more on this shortly). You can get a copy of the exact assessment Michael uses here.

Ultimately, Michael's goal is for his clients to be comfortable and confident in their decisions:

"So many people feel like they went into an office, it all went over their head, the guy talked too fast, and I just went with it. I don't want that at all. I want every client to say, 'Wow, I really understand it and I feel confident in my decisions.'"

Second Half of the Workday

After lunch, Michael usually does three more appointments, which are again, stacked every hour. During the winter months and slower seasons, he may schedule just two appointments after lunch to end early and be home by 3:30 p.m.

"A typical day likely has 2-3 Med Supp sales and an annuity or two. But it's honestly hit or miss. One day last week I did over $800,000 in annuity sales, and it was just after lunch. I didn't sell any Med Supps that day, though. So, it just depends, but an average day is a good blend," he explains.

If you've followed our blog for some time, you may be familiar with the Client Needs Assessment, which is our version of a Fact Finder. Michael fills out a new assessment with every client at every appointment, and the client's answers to those questions guide his discussion and recommendations.

More on this here: Top 10 Client Needs Assessment Tips for Medicare Agents

"This approach takes all of the sales pitch out of it. I'm just following this system, and at the end of the day, my clients feel comfortable referring others to me," he says.

Adjustment to Annuity Presentation

One adjustment Michael has made over the last couple of years is how he presents annuity options to clients.

He used to present two options at the same time: the best MYGA and the best FIA. He'd then let the client choose.

Now, he really has embraced the FIA and typically leads with that as his recommended option.

Related: A Beginner's Guide to Selling Fixed Index Annuities (FIAs)

"I'll present the Denali or Teton with SILAC. The client can choose to do the fixed portion in that product or the S&P. I'm not really presenting two products anymore, but both options are still there," he says.

The main exception is for clients over age 85. In that case, Michael typically only presents a MYGA.

After Work

Michael and his wife, Jill, have four kids, so after work, you can typically find him picking up his role as father and husband.

Basketball practices and games cap off a normal day, though throughout the year, Michael may be gearing up for an educational Medicare workshop at his ranch.

While most of Michael's new clients come from referrals, these workshops have boosted his credibility in the community and bring in a few new clients each month.

Most seminars have around 10 attendees, but even if it's a light month and there are only 5 attendees, he says it's entirely worth it. "The opportunity that comes from just one meeting is always very positive," he says.

Soon, he'll be experimenting with offering virtual webinars to those who can't come to his in-person ones.

At the end of the day, he does chores on the ranch, dinner with his family, and he aims for bedtime by 9 p.m.

The Elephant In the Room

After looking at Michael's day, there's a lingering question: when exactly does he answer phone calls? Schedule appointments? Run reports on clients who are going to have a rate increase?

The answer is Michael doesn't do any of those things.

There is an individual in an agent services role that handles all of these types of tasks, which frees up Michael to spend almost all of his day doing what he does best: connecting with clients and selling products that fit their needs.

Michael estimates that if he didn't have someone in this secretary-like role, he would lose at least 50% of his day to busywork.

"I'd be using so much of my time and energy just trying to get it all done. I don't want to spend any time getting things done that don't make money," he says.

Michael says he could never reach the production numbers he has today if he were responsible for running reports, setting appointments, and fielding phone calls.

"Others in a supporting role make it possible," he says.

New Challenges

As successful as Michael has become, he faces challenges that many top producers encounter.

"I'm at a comfortable place with sales and income," he shares. "When you get to that place, it can actually be dangerous. You see a lot of agents in our industry reach a certain number or goal and they just coast on easy street. It doesn't take much to maintain that level of success."

One of Michael's biggest challenges now is staying hungry and motivated.

"In the past, I'd use material goals to drive me—a John Deere Gator or tractor, all those toys became things I used to motivate myself, always working toward that next thing," he explains.

More recently, though, Michael has been wrestling with deeper questions about success and contentment.

"I've been digging a little deeper on the biblical side of things," he says thoughtfully. "I struggle because you want to find contentment and be happy in all things and all seasons—not always wanting more."

He mentioned 1 Timothy 6:6-7:

"But godliness with contentment is a great gain. For we brought nothing into the world, and we cannot take anything out of the world."

Michael closes: "I wrestle with that balance."

Conclusion

When you really consider a day in the life of a multi-million dollar insurance agent, it's not all that surprising. It boils down to a few key points:

- Spend your time wisely: the majority of your time should be in front of clients, making sales. Don't be afraid to hire part-time help to outsource some of that busywork, which stops you from being productive.

- Have a systematic approach, like using a Client Needs Assessment or other fact finder: this guides Michael's appointments and helps him make personalized recommendations to his clients. He says he never feels like he's a salesman. He's really not selling anything – he's providing solutions to his clients' problems.

- Don't be afraid of talking about money: you can't ignore the annuity production that Michael puts up – it's staggering. If you're meeting with retirees and helping them with Medicare, it's time to start offering annuity products.

I hope this was helpful, and a huge thank you goes out to Michael for letting us in and showing us what his days are like. Good selling!

![The Simple Question That Drove $9M+ in Annuity Sales [Case Study]](https://blog.newhorizonsmktg.com/hs-fs/hubfs/NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp?width=220&height=119&name=NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp)