What separates the agents who struggle to hit their Medicare Advantage goals from those who consistently dominate their markets year after year?

We went straight to the source, reaching out to agents who've cracked the code on MAPD sales. These aren't just any agents – we're talking about producers who are consistently at the top of the production reports.

Their secrets? Surprisingly simple strategies that most agents overlook completely. Here's what they told us.

1. Master the Art of Active Listening

The most successful agents understand that selling Medicare Advantage isn't about pushing products—it's about truly understanding your client's needs.

As Greg Dane from The Dane Agency explains, "I wouldn't say that I have to handle many objections these days. It comes down to listening, and if I achieve active listening, the customers pick the plan best for them among the choices I give them. I hate the phrase 'closing'. My 'closing' amounts to active listening."

When you listen actively to their concerns, health situations, and financial considerations, the right plan becomes obvious to both you and your client.

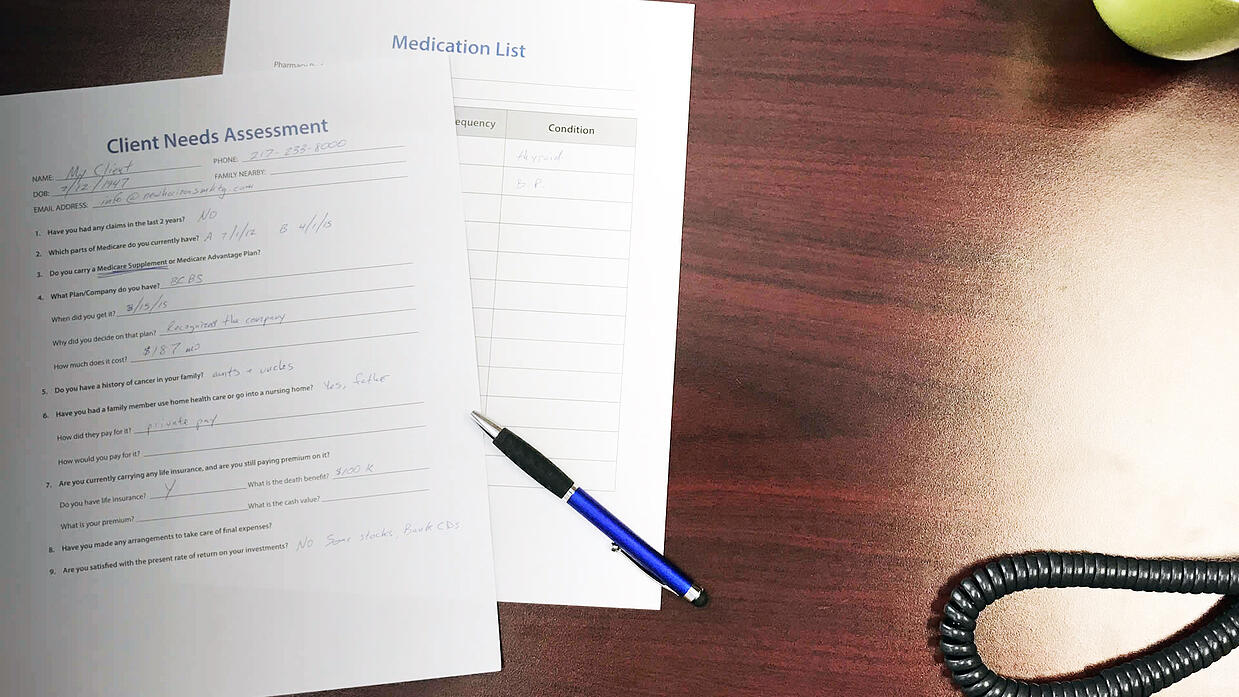

2. Complete Thorough Needs Assessments

No two clients are the same, and successful agents recognize this reality.

No two clients are the same, and successful agents recognize this reality.

As Angie Petts points out, "Each household is so different, so you can't be biased. Completing a worksheet to gather the beneficiary's information to understand their personal situation as to whether they are on just Medicare, or if they would qualify or currently have Medicaid."

A comprehensive needs assessment that covers their current coverage, health status, financial situation, and eligibility for programs like Medicaid ensures you're recommending the most appropriate plan for their unique circumstances.

Related: Insurance Fact Finders: An Essential Tool for Senior Market Agents

3. Simplify Complex Benefits with the "Two Bucket" Method

Medicare Advantage plans can seem overwhelming with their various costs and benefits.

Greg Dane breaks down the financial implications into simple categories. For most of his prospects and customers, he talks about two buckets:

- The first bucket is allocating emergency funds for the maximum out-of-pocket for the unexpected medical expenses they may face.

- The second bucket is the number of copays and co-insurances they could face.

He can then discuss what he deems needed essentials like hearing, vision, dental, and OTC.

This approach helps clients understand what they're really looking at financially without getting lost in complex benefit details.

Related: How to Maximize the New Medicare Advantage Midyear Statement (2025)

4. Be Completely Transparent in Your Presentations

Transparency builds trust and leads to better long-term client relationships.

Angie Petts emphasizes the importance of "being very transparent with my clients and allowing them to make a choice between plans."

She goes so far as to demonstrate on the computer screen a comparison so the client can see exactly what she's doing.

Steve West takes a similar approach, explaining that he simply presents "the two options in generic form (Supp and MAPD) and let the client decide."

Show clients side-by-side comparisons and be honest about both the advantages and limitations of each plan option. This no-pressure approach helps clients make informed decisions they'll be happy with long-term.

5. Use Grassroots Marketing to Build Trust

Face-to-face education in community settings builds trust and positions you as a helpful resource rather than a salesperson.

Greg Dane has found that grassroots marketing works best for him: "I find that speaking at churches, senior centers, and independent living communities has garnered the most prospects for me. I usually just give a brief Medicare 101 presentation and then stick around to visit."

These venues allow you to demonstrate your expertise while meeting potential clients in comfortable, familiar environments.

Related: 10 Medicare Sales Event Tips for a Smooth, Compliant Seminar

6. Prioritize Face-to-Face Meetings

While technology makes remote meetings possible, nothing replaces the trust and rapport built through in-person interactions.

Angie Petts explains, "I prefer face-to-face meetings with my clients so I can establish a relationship with them and allow them to get to know me as well."

Face-to-face meetings allow you to read body language, address concerns immediately, and create lasting relationships that lead to referrals. As Angie notes, after each appointment she tells clients that "the best thing they could do to help me is to pass me forward."

7. Plan Your AEP Schedule in Advance

Annual Enrollment Period success requires advance planning.

Greg Dane shares his strategy: "For AEP, I start two months ahead of time lining up face-to-face and phone appointments so my calendar is already booked through December 7th. This allows me to sprinkle in referrals so I am not overwhelmed during the enrollment period."

By scheduling existing client reviews and new appointments well ahead of AEP, you can manage your workload effectively and still have the capacity for referrals that inevitably come during the busy season.

Related: 9 Ways to Ask for Referrals to Grow Your Insurance Agency

8. Develop Expertise in Dual Eligible Plans

Dual-eligible special needs plans (D-SNPs) represent a significant opportunity, but they require specialized knowledge.

As Angie Petts explains, "The dual eligible plans require a lot of knowledge from the professional sales reps to gain a precise understanding as to which plan they are eligible for at the time of discussion."

Understanding the nuances of these plans and the eligibility requirements positions you to serve an underserved market effectively and ensures your clients get the maximum benefits they're entitled to receive.

Read More: New D-SNP and C-SNP Agent Training Guides Available for Download

9. Create Consistent Touchpoints with Clients

Regular communication keeps you top-of-mind with existing clients while providing ongoing value.

Greg Dane has found that most of his referrals come from a weekly email he sends titled "Medicare Mondays," where he covers topics specific to Medicare.

He explains: "This prompts my customers to think of others who need my help. In those same emails, I will often ask them to think about someone turning 65 or someone that's unhappy with their current plan."

Educational content like weekly emails not only provides value but also naturally generates referrals as clients think of friends and family who could benefit from your expertise.

Related: Browse Our Free Marketing Materials

10. Let Your Passion Drive Your Success

Genuine passion for helping seniors navigate Medicare is perhaps the most important ingredient for long-term success.

Greg Dane puts it simply: "I would say that anyone who knows me, knows that I am passionate about what I do. When that passion is felt by others it makes them feel more comfortable. Passion doesn't require selling!"

When clients feel your authentic desire to help them, selling becomes secondary to serving—and that's when both client satisfaction and business success naturally follow.

This commitment to service is especially important in the Medicare Advantage market, as Steve West notes: "With MAPD, I have to offer my expertise because so few seniors are interested in tackling billing/coverage/network issues."

Greg also notes that he specializes in serving veterans and stays active in his community through pickleball and bowling, where "fellow seniors see me and ask questions that lead to appointments."

Conclusion

Success in Medicare Advantage sales comes down to combining product expertise with genuine relationship-building skills.

As these top agents demonstrate, the most effective approach focuses on understanding each client's unique needs, providing transparent information, and building lasting relationships based on trust and service.