Cross-selling insurance isn’t difficult. It can be intimidating at first, because you need the product knowledge, a solid stable of carriers in your portfolio, and a process.

However, with the right cross selling model, you can be successful.

This insurance cross-selling guide is all about better serving your clients. Yes, it’s easy to get excited about the income potential, but at the end of the day, we’re meeting the needs of our clients.

Our recommended cross-selling process makes it easy (no slick sales pitch required).

This is a pretty long, in-depth article, so feel free to jump ahead using the table of contents below.

- What is cross-selling in insurance?

- What is an example of cross-selling?

- What are the benefits of cross-selling insurance?

- Cross Selling Model for Insurance

- Cross Selling Strategy: Identify Health Conditions

- Cross Selling Strategy: Find Out What They Have

- How to Cross Sell Cancer Insurance

- How to Cross Sell Long Term Care Insurance Solutions

- How to Cross Sell Life Insurance

- How to Cross Sell Annuities

- How to Cross Sell Medicare Part D

- Cross Selling Tips: Using the Client Needs Assessment

- Conclusion

What is cross-selling in insurance?

Cross-selling in insurance is helping your clients fill more coverage gaps by selling additional insurance products.

For example, you might sell a Medicare Supplement and cross-sell a cancer plan and a final expense plan.

Many agents get comfortable with a particular process and limit themselves to it – for example, they may always package a Medicare Supplement with a final expense plan. While that’s better than not cross-selling at all, it’s best to look out for all of your client’s potential needs.

- What would they do if they needed home health care?

- Are they aware of the non-medical cancer costs Medicare won’t cover?

- Do they have a plan for preventative dental and vision expenses that Medicare doesn’t pay for?

Covering all the bases and offering solutions – even if your client declines them – is the best way to serve your clients and cross-sell effectively.

That's why we recommend having the following products at your disposal:

- Medicare Supplements and Medicare Advantage

- Life insurance (including final expense insurance)

- Annuities (MYGAs and FIAs)

- Cancer insurance

- Dental, vision, and hearing insurance

- Long-term care solutions (long-term care insurance, short-term care insurance, or life insurance with an LTC rider)

- Hospital indemnity

- Prescription drug plans (Part D)

No single client will need all of these products but having access to them all will allow you to serve your clients to the best of your ability.

What is an example of cross-selling?

An example of cross-selling would be selling a client a Medicare Advantage plan and pairing it with a hospital indemnity plan. You might also determine the client has a CD at the bank and would benefit from the better interest rates of a fixed annuity.

Now, you have three products with the client instead of one. Cross-selling builds loyalty while solving more needs and increasing your commission stream.

What are the benefits of cross-selling insurance?

Agents who make more than $200,000 annually offer six or more products (New Horizons Independent Agent Report). If money is a driving factor for you, cross-selling is the fuel.

To be a million-dollar producer, you either need 650-1,000 clients, or you need to sell more policies per client.

Beyond the money, cross-selling insurance has the benefit of helping your clients avoid financial crisis.

A cancer diagnosis is stressful beyond what I can fathom but pile on extra expenses like traveling and hotel stays, and it’s even worse. A huge relief would be a $20,000 check showing up to help pay for those out-of-pocket costs.

I’ll never forget the story of a daughter who called her mother’s insurance agent. Her mother just passed away, and she found out there was no life insurance policy. She was calling that agent to ask why he failed the family – why they’d have to figure out how to cover the burial expenses on their own.

Cross-selling is more than just increasing your bottom line: it’s making a real difference in people’s lives. You’re providing a helping hand on many people’s worst day.

So, what are the benefits of cross-selling insurance? I’d say the No. 1 benefit is serving your clients to the best of your ability. A side effect of that is the opportunity to earn a higher income.

Cross-Selling Model for Insurance

I think the most intimidating part of cross-selling is feeling like you have to give a slick sales pitch. You have to come up with these sneaky ways to ask for yet another policy, and it’s not fun! It doesn’t feel right, even if your intentions are pure.

We developed a cross-selling model for insurance that allows you to stop selling.

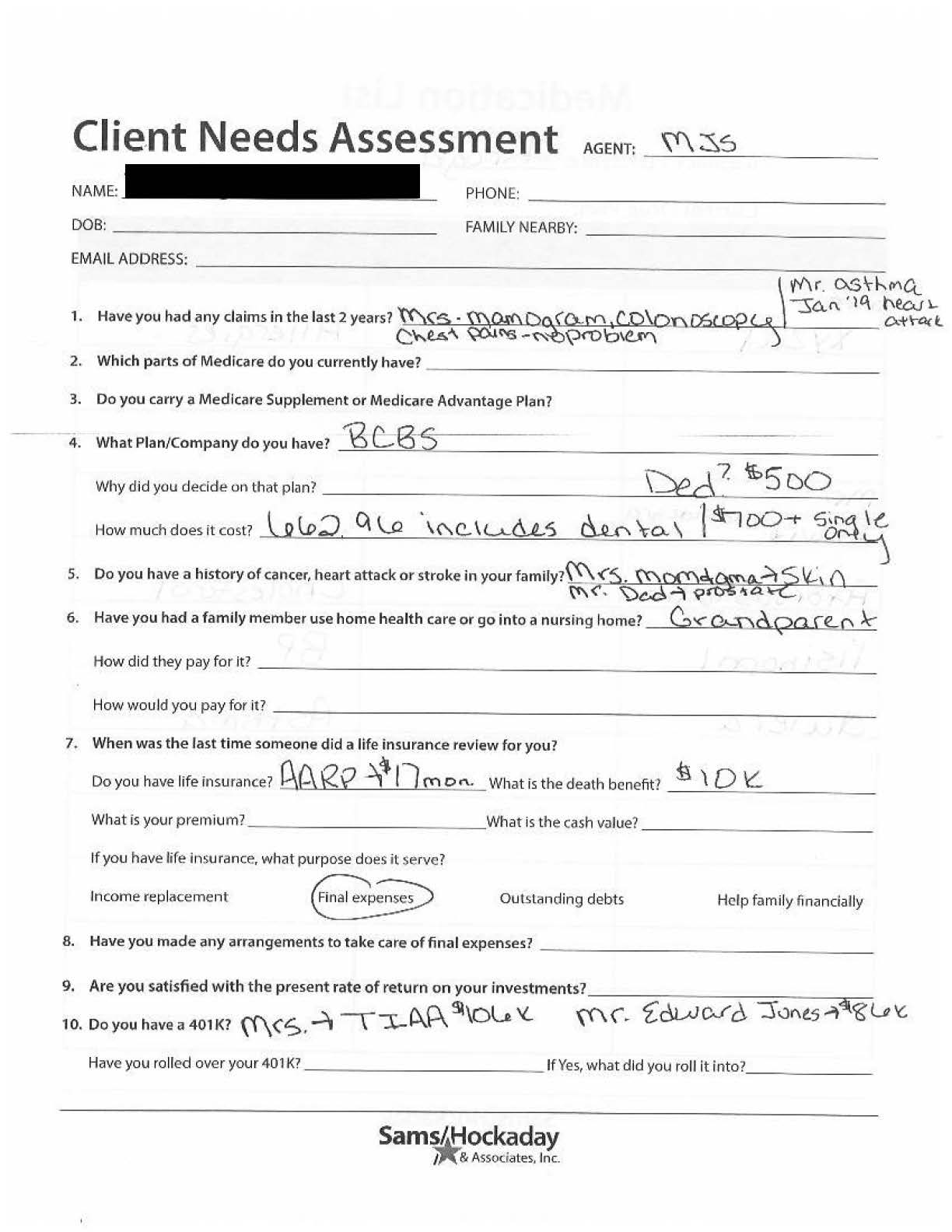

The foundation of this cross-sell model is what we call the Client Needs Assessment. Some agents also refer to this kind of worksheet as a Fact Finder.

The Client Needs Assessment

The Client Needs Assessment (CNA) is a 10-part questionnaire for new and existing Medicare-age clients that uncovers their current insurance needs.

If you’re looking for an insurance cross selling script, the Client Needs Assessment is essentially that script. It outlines all of the questions you need to ask, and the client’s answers facilitate genuine conversations.

One of the biggest advantages of the Client Needs Assessment is that it lays out all of the client’s needs right off the bat, so you don’t look like a greedy salesman when you try to sell something new each time you see them.

You’re uncovering every single need from day 1, and you can say up front, “We’re going to take care of the most urgent need, and we’ll come back to everything else with time. There’s so much to digest right now, so let’s just take it one step at a time.”

There are other variations of this questionnaire out in the world, and some agents call it a Fact Finder. What makes ours a bit different is it’s short (1 page), and it’s conversation-driven (not data driven).

A lot of assessments or fact finders are all about gathering a ton of data, and the conversation with the client is dry and boring. Our Client Needs Assessment has been refined over time to help facilitate conversations. This business is all about relationships, and the CNA is a reflection of that.

It’s still meant to gather information, but in a way that’s comfortable for your clients. Once we go through each question, you’ll understand how powerful these questions are.

Most importantly, the Client Needs Assessment is the best cross selling strategy out there. If you’re hunting for a reliable, proven cross selling model, this is it.

Cross Selling Strategy: Identify Health Conditions

The beginning of the Client Needs Assessment, which is the foundation for our recommended cross selling process, asks about recent claims.

Have you had any claims in the last 2 years?

The purpose of asking this question upfront is identifying what products your client can and can’t qualify for.

They may have a need for cancer coverage, but if they had cancer last year, they can’t qualify, so there’s no need to go through a presentation. If they have Parkinson’s, you’re not going to pursue long-term care insurance.

An initial snapshot of your client’s health will help you determine what needs you can actually fill.

Cross Selling Strategy: Find Out What They Have

The next couple of questions on the Client Needs Assessment are all about finding out what coverage your client already has. This section is specifically about their Medicare plan.

- Which parts of Medicare do you currently have?

- Do you carry a Medicare Supplement or Medicare Advantage Plan?

- What Plan/Company do you have?

Even if you already know the answers to these, we’ve found it helps to ask them anyway. It’s more of a conversation-starter, and it helps your client get comfortable.

This section is also where you find out about any special circumstances, such as:

- Are they still working?

- Are they getting any employer-sponsored retiree benefits?

- Are they a veteran?

If your client already has Medicare coverage and you ask about their current plan/company, you can ask some follow-up questions, like:

- Why did you decide on that plan?

- How much does it cost?

Their answers to these basic questions will set up a good foundation for the rest of your appointment. If you know they’re paying more than they should, you can offer more competitive premiums for the same coverage.

How to Cross Sell Cancer Insurance

Cancer insurance is one of easiest policy types to cross sell, because the need is so compelling. Most people know someone close to them who has suffered from a cancer diagnosis.

We also have plenty of cancer facts and statistics to back up the need for additional coverage.

The best way to cross sell cancer insurance is to ask: Do you have a history of cancer, heart attack or stroke in your family?

We ask about cancer, heart attack, and stroke because the critical illness plan we recommend typically covers all three conditions.

If the client has a family member that’s had one of these conditions, they already know the costs associated with it. This question brings that to the forefront of their mind.

Note that you’re not asking, “Do you have a cancer plan?” or “Have you ever thought about getting cancer insurance?”

You’re moving the discussion from the product to the need for the product, and you’re making it personal.

If you have a good conversation about this, consider packaging a cancer, heart attack, and stroke plan with a Medicare Supplement. If they don’t need a Med Supp, simply suggest adding on a critical illness plan to what they already have.

While this video is from way back when (2016!), the cancer cross selling tips from this big producer still apply:

Make sure you get contracted to sell cancer plans to your clients. One of our favorite cancer plans is from Aetna, so you may already be prepared to sell if you have an Aetna Agent ID!

How to Cross Sell Long Term Care Insurance Solutions

While traditional long term care insurance (LTCi) isn’t as popular as it once was, there are still plenty of long term care insurance solutions we can offer our clients.

Our two favorite options include short-term care (often includes home health care coverage) and a life insurance policy with an LTC rider.

The best way to cross sell a long term care insurance solution is by asking: Have you had a family member use home health care or go into a nursing home?

For most clients, the answer is yes. Ask some follow-up questions to continue the conversation:

- How did they pay for it?

- How would you pay for it?

We don’t recommend just flat-out asking if they have long-term care insurance. Only 5% of the population does, so there’s a good chance they’d say no. Plus, the follow-up question, “How would you pay for it?” would uncover any existing coverage.

If by some chance your client has no experience with home health care or nursing homes, you need to create the need in your presentation. It’s not hard to do – long term care costs are one of the most devastating financial losses a senior can face.

You can utilize our long term care client leave behind if you need some references and statistics for your discussion.

Check out our short-term care insurance products and start the contracting process. We also have a page for long-term care insurance products, which includes life insurance products with an LTC rider. Be sure you are prepared to sell!

How to Cross Sell Life Insurance

Unlike long term care, many clients already have some kind of life insurance coverage. That’s why we start this cross selling product discussion with a straightforward question:

Do you currently carry any life insurance?

If they say yes, ask the follow-up question:

Are you still paying premium on it?

That usually gets the ears to perk up, because a lot of people ask, “Should I be?”

If you’re not comfortable with this particular question, we’ve seen agents change it to: When was the last time someone did a life insurance review for you?

After you ask your initial question, it’s time to gather some more information about what they have. Ask follow-up questions like:

- What is the death benefit?

- What is your premium?

- What is the cash value?

- If you have life insurance, what purpose does it serve?

The four purposes of life insurance we’ve identified on the Client Needs Assessment (just circle them) are:

- Income replacement

- Final expenses

- Outstanding debts

- Help family financially

If your client says the purpose of their life insurance is to cover final expenses, but they only have a $5,000 policy, you can start a conversation about funeral costs. We have a client handout that talks about final expenses, but your goal is to beef up their current policy since funerals cost much more than that.

If the client doesn’t have a life policy, you can reference those four purposes above to find out if they need life insurance.

Some conversation starters might be:

- Does anyone currently rely on your income? Would they be in financial trouble if you passed?

- Do you have any big debts right now, such a mortgage? Who would take on that debt if you passed?

- Do you want to leave money to your family or a charity upon your passing?

Check out all of our life insurance carriers and start the contracting process today.

How to Cross Sell Final Expense

Final expense is a type of life insurance, and it’s often covered by asking the question mentioned in the previous section: Do you currently carry any life insurance?

If that’s the case, you can skip the next question on the Client Needs Assessment. If not, you can continue by asking:

Have you made any arrangements to take care of final expenses?

It’s very simple to add a final expense policy when you’re selling a Medicare Supplement policy. (Use this handout to help.)

Plus, if the client has no plan for their final expenses, you’re doing their family a huge favor by talking about it. When someone has no plan for their final expenses, we see the family taking on debt and starting Go Fund Me’s to cover the cost. It’s not the legacy most people want.

If the client says they have a pre-paid funeral in place, they likely do not need final expense insurance.

Our final expense tip sheets make it easy to place cases. Plus, you can reference them if you're interested in getting contracted. It can help you decide which carriers to start with:

How to Cross Sell Annuities

Annuities are my No. 1 product sold. So many senior clients are looking for a safe place to put their money. The stock market is volatile, but the banks don’t offer much interest.

A fixed or fixed index annuity is ideal for retirees for that reason – it’s safe, and it offers a more attractive interest rate than your typical CD or Money Market.

The easiest way to cross sell annuities with your senior clients is by asking:

Are you satisfied with the present rate of return on your investments?

The goal with this question isn’t really to get a “yes” or a “no” – it’s to find out where their money is now. We know if it’s in the stock market, there’s concerns there about volatility.

If it’s in the bank, we know the client isn’t getting much interest.

Your question will get them talking, and we know that regardless of their answer, you can probably help them with an annuity product.

For more information about annuities, check out our ultimate guide to annuity sales. We’re also coming out with an Annuity Training Hub soon, so be sure to subscribe to our email newsletter!

How to Rollover 401(k)s and Other Retiree Accounts

The final question on the Client Needs Assessment is an extension of the annuity question.

You ask:

Do you have a 401(k)?

We’ve seen tremendous traction with these follow-up questions:

- Have you rolled over your 401(k)?

- If so, what did you roll it into?

Some clients might not even know they can move their 401(k) once their employer is no longer making contributions. If they have a 401(k), it might be advantageous to take it out and roll it into an annuity.

Not really sure how to do this? Check out this guide: How to Help a Client Roll Their 401(k) or IRA Into a Fixed Annuity.

How to Cross Sell Medicare Part D

The Client Needs Assessment has a back side where you can record all of your client’s medications. This helps when it comes to prequalifying them for different products, and it helps you run a drug comparison.

Some agents don’t bother with cross selling Medicare Part D, but I’d strongly suggest you do. Don’t even give a second thought to the low commissions; instead, focus on providing value to your client and building your credibility.

MedicareCENTER makes it easy to sell Part D plans. Be sure to register for an account and check out upcoming trainings!

If you can help a client make it through the maze of Part D, they’re much more likely to trust you with products like annuities. Plus, Part D is often a great lead generation tool, because even the most savvy of shoppers have a hard time making sense of it.

I often get doctors and lawyers coming to me, shocked that they just can’t figure out how to select the best prescription drug plan. There are dozens of plan options, each plan has different preferred pharmacies, and formularies vary. People need help, and you’re in the perfect position to give it.

Plus, sometimes people will say they’re healthy as a horse, and then their medication list reveals otherwise, so this is also a way to truly measure their health.

Cross Selling Tips: Using the Client Needs Assessment

The Client Needs Assessment is a cross selling roadmap. Go through each question with your client using all of our tips and strategies outlined in this article.

We have a few more tips for you to make sure you get the most of out of this cross selling tool.

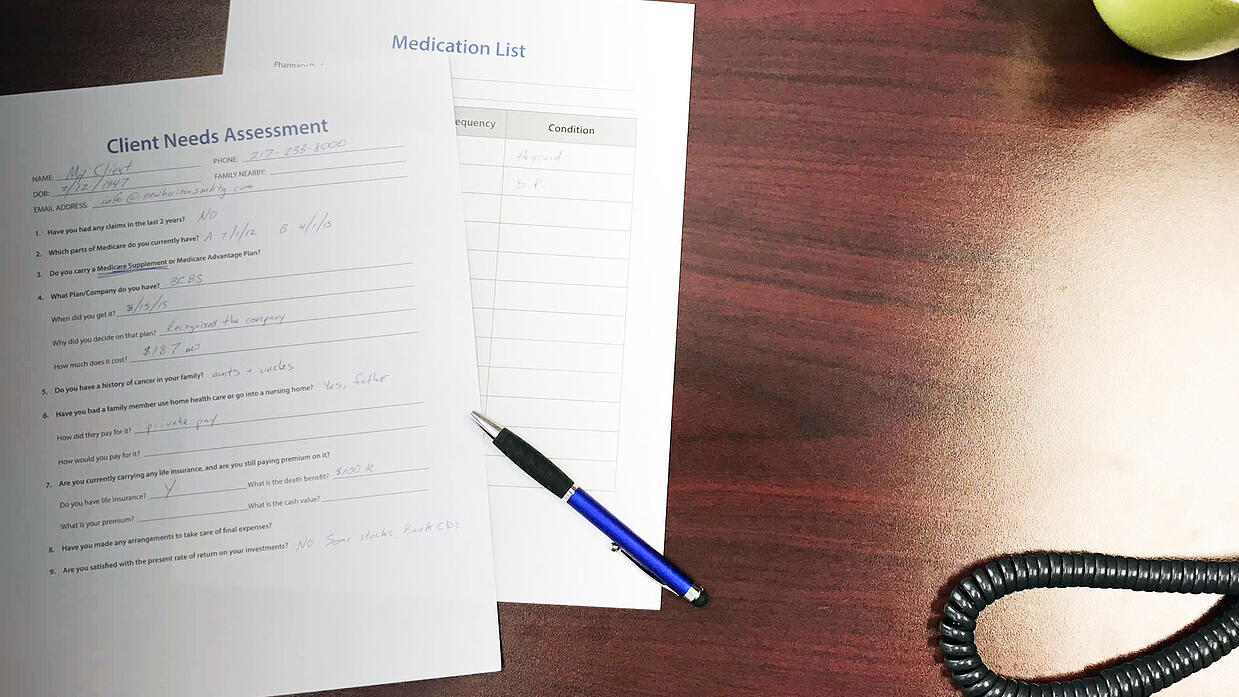

1. Make sure your client can see you physically filling out the form.

When you physically fill in the Client Needs Assessment in front of your client, it has an impact. It lets them know you’re catering your service to their needs, and you’re not just doing some standardized pitch to every client.

2. Go through the entire Client Needs Assessment before doing any product presentations.

If you were to stop in the middle of the assessment and start presenting a product based on an uncovered need, it would disrupt the entire flow of your appointment.

I recommend asking all of the questions on the assessment, and don’t stop! Just write down your findings or ideas as you go, and circle back when you’re finished.

It’s really awkward to start a presentation halfway through and then pick back up where you left off.

3. Don’t be afraid to make changes to the Client Needs Assessment to fit your style.

If you find that a certain question doesn’t feel natural to your personality, tweak it!

Many of our agents have adjusted questions in the CNA based off of what feels best and what has seen better results for them personally. We encourage you to experiment and let us know what’s working for you. We’ve made several changes to the Client Needs Assessment over the years based on agent feedback and success stories.

Plus, if you're a contracted agent or agency with us, we can add your logo to the bottom of the assessment.

4. Scan a copy of your finished assessment into your CRM.

Make sure to scan the completed needs assessment into your computer so you have a digital copy to refer back to. If you have a CRM, upload the scanned copy to that client’s record.

Here’s an example of a filled-out assessment:

If you don’t have a CRM yet, check out our article: Best CRM Software for Insurance Agents In the Senior Market

Conclusion

We used to go to someone’s door and see if we could sell a Medicare Supplement. And if that person didn’t need a Medicare Supplement, we were done.

This approach – using the Client Needs Assessment as a roadmap – uncovers the entire portfolio of the client. You can brag on them about the things they’ve covered already, and then you can talk about the things they need some help with.

There’s no better cross selling method in the industry, and the results have been incredible for agents who use it.

Read more:

.jpg?width=700&height=378&name=NH-The-Ultimate-Guide-to-Cross-Selling-Insurance-in-the-Senior-Market%20(1).jpg)