By Kirk Sarff and Michael Sams

Annuity sales are a huge opportunity for independent agents in the senior market. If you want to learn how to sell annuities to seniors, you've come to the right place!

Everything you ever wanted or needed to know about senior market annuity sales is right here. Feel free to jump ahead at any point:

- Annuity Basics

- Types of Annuities

- Annuity Training and E&O Insurance

- How to Choose Annuity Carriers to Contract With

- Starting the Annuity Conversation

- Annuity Training Script for Practicing Your Presentation

- 10 Common Client Objections

- 401 (k) or IRA Rollovers

- Annuity Paperwork and Forms

- Annuity Commissions

- How to Market Annuities to Seniors

- Staying Current on Annuities

Annuity Basics: What It Is and How to Set It Up

For those of us who currently are or have been Medicare Supplement-only agents, it can be difficult to branch out and introduce new products to your clients.

However, I strongly encourage you to at last look at annuities. They're not only a great solution for a huge number of seniors, but they can help you reach your production goals.

For Michael Sams, annuities are his most-sold product – even more than Medicare Supplements. In 2020, Sams did $5,675,878 in annuity production alone.

We weren't kidding when we meant this is a huge opportunity!

What is an annuity?

An annuity is a retirement savings vehicle. It’s not technically an investment, because you’re not actually investing in the market.

However, you do receive a return on your money that is designed to help you save for retirement.

You can also use an annuity to pass on money to your beneficiaries. Annuities can help you avoid probate at death, which can be expensive and time consuming.

Most individuals use annuities as a retirement savings vehicle, while keeping the peace of mind that that money can be easily transferred or dispersed to named beneficiaries at death.

How do you set up an annuity?

An annuity requires a contract between the consumer and the insurance company.

The consumer deposits a lump sum (or periodic payments), and the insurance company delivers on their promise as it’s indicated in the contract.

A common example of a contract is a certain rate of return on the money. For example, the consumer might deposit a lump sum of $50,000. The insurance carrier then delivers on their promise of a 4% interest rate over the course of, say, 5 years.

Types of Annuities: Fixed, SPIAs, and Variable

There are 3 main types of annuities, which include Fixed annuities, Single Premium Income Annuities (SPIAs), and Variable annuities. Within the category of "Fixed" annuities, there are 3 additional types, including Traditional Fixed, Multi-Year Guaranteed Annuities (MYGAs), and Fixed Index Annuities (FIAs).

The three we deal with the most are the following:

I'll just say now that we don't endorse Variable annuities for seniors, but we'll cover that a bit more shortly.

Fixed Annuities

There are actually 3 types of fixed annuities: Traditional Fixed, MYGAs, and FIAs.

Traditional Fixed

Traditional fixed annuities are pretty "vanilla." You have a guaranteed rate of return each year. You will not get more or less than that rate. That's really all there is to it.

MYGA (Multi-Year Guaranteed Annuity)

With a Multi-Year Guaranteed Annuity (MYGA), you have a guaranteed rate for an entire surrender charge period. Common MYGA contracts are 3, 5, or 10 years long, but there's also everything in between.

For New Horizons, MYGAs are our most popular form of annuities across the board. Seniors like the return (generally a little better than 3%), it has 0 risk, and most people feel comfortable with putting their money in a contract for 5 years.

Once that 5-year contract is up, you can take that money out with no surrender charge, or you can automatically renew the contract for another 5 years.

As you can tell, MYGA annuities are very simple to understand. Seniors won’t buy an investment product they don’t understand, which makes this type of annuity particularly great for not only this market, but for anyone wanting to safely protect their money.

Since MYGAs are our most popular annuities, we put together a handy cheat sheet that we keep up-to-date. It features the current interest rate, the company's rating, and key features about that product.

FIA (Fixed Index Annuities)

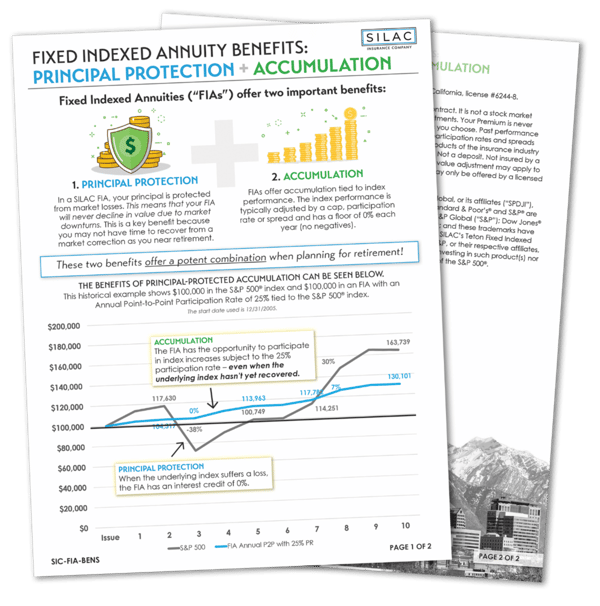

With Fixed Index Annuities (FIAs), you have the choice of adding “interest crediting strategies” which are usually based upon the S&P 500. This option is not risky because the worst you can do is stay the same. You can't lose money.

That's why we say that FIAs are "the safest way to be risky," as they appeal to seniors who like to be a part of the stock market but can't afford to lose everything at the drop of a hat.

There are 3 main indexing option types:

- Annual point-to-point

- Monthly average

- Monthly sum

Here's a short clip of John explaining how these strategies work. It's a little easier to understand in video form:

The gist is you might get 0% returns, but you have the potential of earning higher returns based on how the stock market performs. You never experience the losses, but you can safely experience the gains.

We’re pretty excited about FIAs, because it allows seniors to experience the gains of the stock market without taking on any risk. Over the last couple years, they've been quickly gaining popularity, and we can see why!

If you want to dive into FIAs a bit more, we have several additional resources for you:

- [START HERE] The Safest Way to Be Risky: Fixed Annuities with an Indexing Option

- 6 Reasons You Should Begin Selling Fixed Index Annuities

- How to Actually Present a Fixed Indexed Annuity (FIA) to a Client

And if you want to dive more into actual product information, we recommend checking out these carrier-specific articles (SILAC's FIAs are our favorite):

- What is the SILAC Teton™ Fixed Index Annuity, and How Does It Work?

- How to Sell Barclays Atlas 5, a New Addition to SILAC's Teton FIA

- What Is the SILAC Denali™ Lifetime Income Annuity, and How Does It Work?

SPIAs

A Single Premium Income Annuity (SPIA) works like this:

- You pay the insurance company a lump sum

- The company pays you a certain amount of money (periodically) for the rest of your life

It’s easy to remember what a SPIA is, because the “I” stands for income, and the contract is set up to provide an income for the rest of your life.

The beauty of SPIAs compared to other options like stocks or bonds is that they allow for a higher withdrawal rate, they’re completely safe (no risk), and they’re predictable.

If you know you need $2,000 per month during retirement, you can plan for exactly that.

Clients often have their hard-earned savings in a CD or savings account at their bank, where it's earning pennies on the dollar. We created a client handout you can download that shows a bit more clearly how a CD compares to a SPIA.

Variable Annuities

Because we’re in the senior market, we don’t even offer variable annuities.

They are much more confusing than the other 2 we’ve gone over, you have to have a securities license to sell them (or even talk about them to clients), and they’re not a safe way to make a return on your money.

In sum, variable annuities are registered as a security. The premium is invested into “sub-accounts,” which are similar to mutual funds.

The sub-accounts are portfolios of stocks and bonds. There is a higher potential for gains, but seniors will not like that there’s also the chance of experiencing losses.

You’re participating more in the risk of the underlying index. Your money is now at risk. Unlike the other annuities we’ve covered, zero is no longer the worst you can do – you can actually lose money.

Variable annuities also can have embedded fees that are troublesome. These aren’t “bad” products per say, and they certainly have their place with a certain age range and type of investor, but it’s not a safe way to fund a retirement.

You can read more about our take on variable annuities here:

Training and E&O Insurance for Annuity Sales

In order to sell annuity, you do need to check a couple items off your to-do list.

- You will need E&O insurance.

- In Illinois, you need to take a 4-hour Annuity Suitability course.

- You need to complete the product training provided by each company you contract with.

When you choose with carriers to contract with, we'll confirm the specific training you will need in order to start selling.

How to Choose the Best Annuity Carriers to Contract With

Once you have your E&O insurance as well as the training out of the way, it's a good idea to figure out which annuity companies you should get contracted with.

A great place to start is actually our annuity tip sheet, which helps pinpoint which carriers are the most competitive right now. If you're looking for the best 5 year fixed annuity rates, this is where it's at!

Of course, you can always contact me (Kirk Sarff) for more insight.

Most annuity carriers will allow a just-in-time appointment. However, Ginny here in our office would always suggest an agent get the contracting submitted and the training completed before business is submitted.

Starting the Annuity Conversation With Senior Clients

Annuities can be a tough sell for the following reasons:

- People are generally pretty private when it comes to their money

- Annuities often have a bad public perception

- They’re more of an investment/retirement product than a Medicare product

Because of these hurdles, you have to make sure you’re starting the conversation right and that you’re handling client objections proactively.

We recommend using the education-first approach (as we do with all products), and it all starts with the Client Needs Assessment (CNA).

Using the Client Needs Assessment to Sell Annuities

There’s a question in this assessment – the last one actually – that asks the client if they’re satisfied with the current rate of return on their investments.

Sometimes, I switch the wording up by asking if they happen to have any CDs or money markets in the bank. If they say no to that, I’ll ask if they have any money in the stock market.

Once you know where their money is located, you can explain why a fixed annuity – in many cases – is better than their current situation.

CDs, Money Markets, or Stock Market vs. Annuity

The goal is to explain that CDs and money markets offer really low interest rates, and that they can do better.

If they have money in the stock market, the goal is to explain that the return might be great, but that there’s risk there. Even if they say they have moderate to low risk, there's still risk.

You could lose half your rear overnight, but there is an option out there where you can earn around 4% (as of 2019) on your money with ZERO risk.

Before I ever try to make a sales pitch, I’m focused on education. I’m simply explaining to my client what their options are without any feeling of pressure, obligation, or even a hint of selling. I want them to see me as a resource right now – not a salesman.

And I’m genuine about this – I’d rather my client make their own, informed decision than to try to make up their mind for them.

What I’ve found is that people don’t know what they don’t know. They might be happy with their current set-up, but if they don’t even know about annuities, I’m doing them a disservice if I don’t at least educate them.

Annuity Training Script for Practicing Your Presentation

When you're ready to practice your presentation, you can use the following annuity training script as a guide. Because this is based off of the CNA, this script begins after you've asked the annuity question about their current investments.

You want to follow up with: "Are you dealing with the stock market, or are you dealing with the banks?"

From there, here is the information you want to relay.

Stock market

Right now, in the stock market, things are booming – they’re doing very, very well. But surely a correction is coming very soon – we hear that every day.

We don’t want to be in the stock market when the bottom falls out. We’re not really trying to get rich anymore. We just want a safe place to park your money where it’s going to earn some interest.

We still want your money to be working for you, but we want 100% safety.

CD/Bank

CDs have historically been very good. Number one is the safety of them, but also the interest rates – they used to be very competitive.

Now, there’s not a bank in the country that’s offering a competitive interest rate on a CD.

Finish the Presentation

We have a guaranteed contract that gives you 100% safety – zero risk – and you can earn right around 4% interest on your money right now.

There are three types of annuity contracts, and I think it’s very important to understand the difference.

The first is a variable annuity. I can’t recommend this, because it’s tied to the stock market. The fees are excessive, so we’re going to rule that out.

The second is an indexed annuity. It’s tied to the stock market as well, and there are also fees involved, so I can’t always recommend this, either.

The third is a fixed annuity, and this is what I’d like to recommend to you. It’s a guaranteed, fixed interest rate with no fees, and no risk.

Note: if you're confident with Fixed Index Annuities, you can tweak the end of this presentation. In addition, many agents get a feeler for their client's risk profile, and if you know they're a good candidate for a FIA, you can explain that product a little more and offer it as a recommendation.

10 Common Client Objections When Selling Annuity Products

In our experience, if you know the common objections going into it, you can proactively avoid them by addressing them in your presentation.

Objection #1: “Annuities are too complicated.”

Anything can be simple or complicated, but when it comes down to it, the kind of annuities we offer are very simple.

When you bring in all the different flavors of annuities, the conversation can get complex.

But individuals nearing retirement are looking for safety, a guarantee on return, and access to that money. No surprises.

Multi-Year Guaranteed (MYGA) annuities are easy to understand, and they account for about 95% of the annuities we do for seniors.

If a senior doesn’t understand something when it comes to their money, they aren’t going to do it. And that’s why we do so much annuity business – everyone can walk away with confidence in it.

Objection #2: “I don’t want to be stuck in a contract.”

Michael often avoids calling it a “contract.” He’ll instead start by calling it a program. For example, “We have this wonderful 5-year program that offers 4% interest on your money.”

Another way to handle this is to explain that there are different lengths, so you can even go as short as 1 year to get a feel for the product before choosing a 3 or 5-year contract.

Objection #3: “There are too many hidden fees.”

The kind that we write have no hidden fees. In other words, if you’re going to buy a 5-year annuity, and you start it off with $100,000, that entire chunk of money will start earning money tomorrow.

You get to tell your clients that 100% of their money earns interest starting on Day 1. The insurance company pays the agent directly, but none of that reflects your money. You aren’t charged any fees or anything like that.

There are, however, surrender charges.

If it’s a 5-year contract, and you decide you want all your money back before that 5 years is up, you’ll have to pay a penalty. That’s just the nature of a contract.

The amount depends on the carrier and the time you want to pull everything out, but you can research that beforehand and go over it with your client before they sign on the dotted line.

Objection #4: “I make more in the stock market.”

That can definitely be true. But the flip side of that is that there’s risk involved. That’s the trade. There is no risk with MYGA annuities. It’s always going to be worth a little more than what it was the day before.

Every time you go to bed, you’re going to make a little bit of money. You’re never going to go the other way.

That’s why most seniors aren’t as concerned about making more money as they are about preserving what they’ve made.

Read more: How An Annuity Could Have Kept Your Client’s Money Safe From the Stock Market Correction

Objection #5: "I'll be penalized if I withdraw my money from my CD."

You definitely want to address this issue, but put it into perspective.

The penalty is going to be the last 6 months worth of interest, but if you’re only being paid 0.5% on your money, that penalty won’t be much.

You’re much better off taking the penalty to start earning around 4% interest.

I'll often write down the numbers on a piece of paper so the client can see that the penalty is not a real concern.

Objection #6: "I'm worried about the safety of my money in an annuity. I at least know my money in the bank is safe."

Many times, the FDIC is a hot topic. If your money is in the bank, and the bank goes belly-up, you’re still reinsured up to 250k.

You get to say that every insurance company pays into the Guaranteed Trust Fund. This means you’re reinsured up to 250k, which is the same safety as a regular bank account.

However, keep in mind that you are reinsured up to $250k per person per insurance company. So, if you have $750k that you want to put into annuities, you would need to divvy it up between 3 separate insurance companies. This is the only way to be completely reinsured.

Objection #7: "The idea of a contract scares me. What if I need to access some of my money?"

You obviously need to check for suitability before entering in the annuity conversation.

However, if they have no plans for this money, but they still want the security of being able to access it, you get to explain the 10% withdrawal option that generally starts after year 1.

You can even split it up into monthly withdrawals if you want, as long as it doesn’t exceed the 10% for the year.

Please note that there is a minimum withdrawal. It varies by the carrier, but a good rule of thumb is $100. So, if a monthly withdrawal was less than the minimum, say $40, you may have to switch to quarterly withdrawals.

Objection #8: "My money is in there 5 years? Forget it."

Never start your presentation with the length of the term. Begin with the product highlights first:

- 4% interest

- Zero risk

- Access to 10% of your money after the first year

- And on and on...

Towards the end, your client will wonder what the term is. You get to say, “Your interest rate is guaranteed for 5 years. After those 5 years, we get to evaluate if there’s a better interest rate out there.”

If your client seems wary of a 5-year term, you can shift your focus to a 1 or 3-year term. We address that in a bit more detail here: Annuity Q&A for Agents: Top Sales Experts Answer Your Trickiest Questions

Objection #9: "I don't want to be taxed if I move my savings into an annuity."

Money that is in savings will not count as a taxable event (taxes have already been paid on that money).

Any money in a money market, a CD, or a savings account can be transferred to the client’s checking account. Then, the client writes a check to the insurance company, and no taxable event has occurred.

Retirement accounts like an IRA or a 401k have not been taxed yet, which makes this is a little tricker.

In order to avoid a taxable event, the money needs to be transferred directly to the insurance company (never to the client first). If a check is written, it needs to be made out to the insurance company, not the client. (Very important!)

Objection #10: "But the company is B-rated! My money won't be safe."

This one's easy! Remind your client that they’re reinsured up to $250k, so their money is safe.

When Your Client Is Still Hesitating

Sometimes there's no real objection, but you can feel your client's hesitation. They just don't seem ready to move their money, even though you know it's the best opportunity for them.

Try addressing the fact that we’re creatures of habit. We’re used to doing what we’ve always done, but sometimes we have to break that habit to get into a better situation.

Just addressing this can cause a light bulb to go off for your client.

Rolling Over a 401 (k) or IRA Into an Annuity

One of the biggest senior market annuity opportunities out there are clients with a 401 (k) or IRA. Many clients will ask, "Can you roll a 401 (k) into an annuity?" And the answer is yes!

There are two major benefits for the client when doing a 401 (k) rollover:

- The client has someone looking out for their investment

- Their retirement savings are safe and secure

Clients want a more hands-on approach, and they want to know what’s going on with their investment. I can’t tell you how many times I’ve sat down with a client, and by the end of my presentation, they’re just in shock and awe that they finally understand how all of this works. That makes my job worth it.

When a client retires, they’re moving from an accumulation stage to a preservation stage. When we move into the preservation stage, we have to adjust our investment strategy. You want to be more conservative and put safety as a higher priority over risk. Safety first, competitive interest rates later.

You can much more about how the rollover process works here: How to Help a Client Roll Their 401(k) or IRA Into a Fixed Annuity

Annuity Paperwork and Must-Have Forms

When it comes to annuities, there are 4 forms that must be included:

- Annuity application

- Annuity suitability questionnaire (you will learn about this in the mandatory 4-hour Annuity Suitability course)

- Annuity disclosure statement

- Policy owner identification verification

There are other forms that you may need, such as a 1035 Exchange or the IRA 70 1/2 Required Minimum Distribution Form, but please don't get overwhelmed.

Our office staff will let you know if you need any of those extra forms. When you work with us, you’ll never have to worry that you’ve missed anything. We’ve got your back.

We've also put together a handy annuity funding cheat sheet so that you know how the money needs to be transferred depending on where it comes from.

You can read more about must-have forms and additional forms you may need to complete here: The Ultimate Agent Checklist for Annuity Sales

Annuity Commissions

The great thing about the kind of annuities we sell is that nothing comes out the client's deposit – 100% of their deposit starts earning interest on Day 1. The annuity carriers pays the agent separately, which gives your client peace of mind that there are no fees.

Commissions vary a lot depending on the specific product and carrier, so we recommend you contact us to find out what your commissions would be.

Fixed Indexed Annuities are typically a little higher than Multi-Year Guaranteed Annuities, but in either case, you're doing the right thing for your client, and you're giving your business a boost.

Annuity Marketing Ideas | How to Market Annuities to Seniors

While you can employ all of the typical marketing strategies, such as radio ads, TV commercials, billboards, digital ad campaigns, social media, email marketing, and direct mail, the best place to start is your current book of business.

The Client Needs Assessment is the best annuity marketing tool, because you'll uncover opportunities you never knew you had.

I can't tell you how many times I've heard about agents who thought their client had no money, yet they had millions sitting around in the bank. Don't make assumptions!

Beyond going back to your current book of business, there are tons of annuity marketing materials and ideas available to you – we'll show you some examples here.

Our team has developed a CD vs. SPDA client guide to show your clients what they're missing out on if they have money in the bank. This is great to display on your desk or to use as a handout when discussing annuities with clients. We can customize this with your information if you have at least one contract with us!

You can also utilize our annuity awareness social media posts, which are especially great during the month of June (National Annuity Awareness Month). They can be used anytime, though, to drum up interest and get your clients thinking.

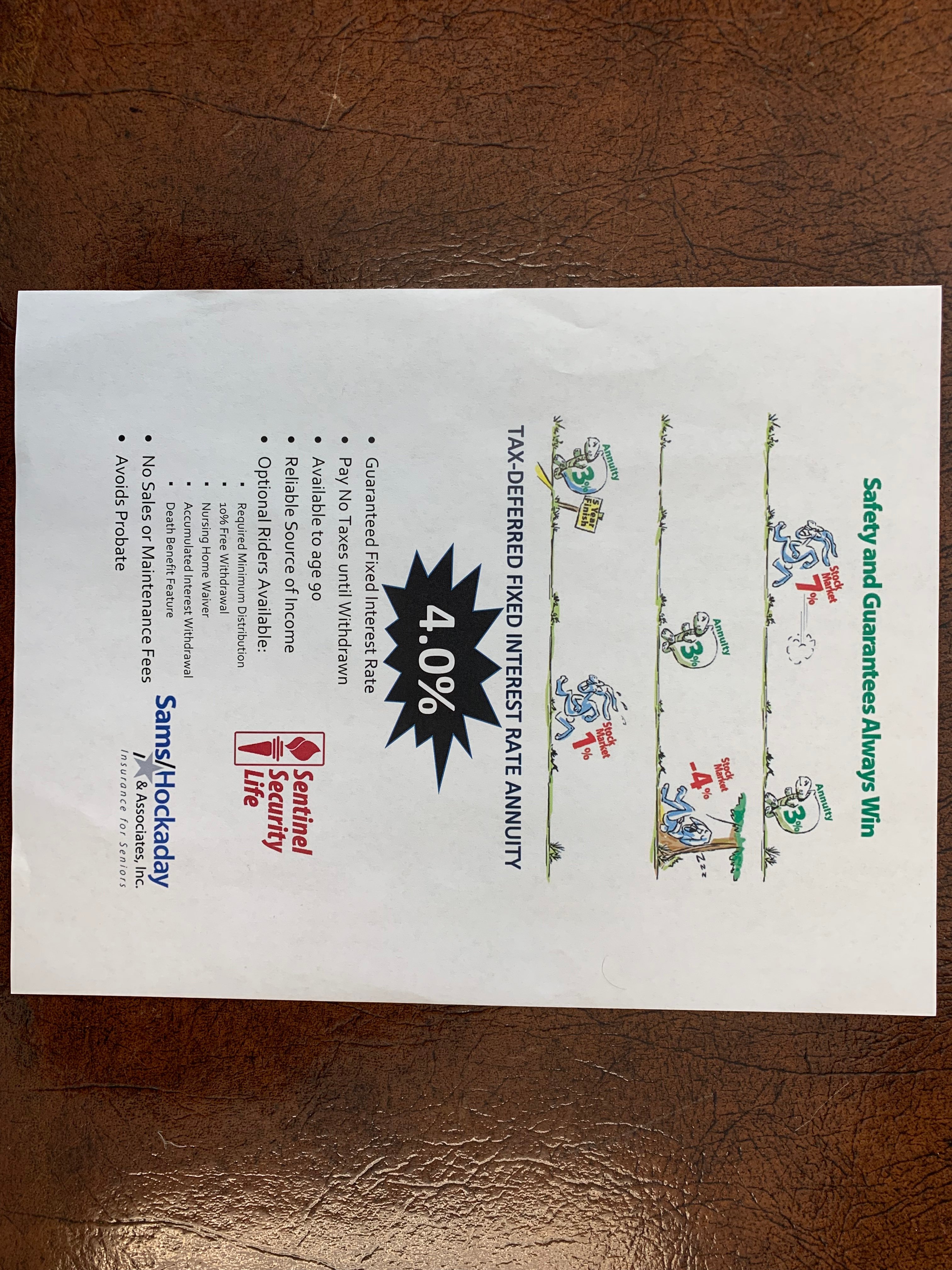

Annuity carriers often have marketing materials and ads you can download and use as well.

For example, SILAC has lots of handouts and flyers you can use to educate your prospects and clients about Fixed and Fixed Index Annuities.

You can download this flyer and more on our SILAC product page.

You can download this flyer and more on our SILAC product page.

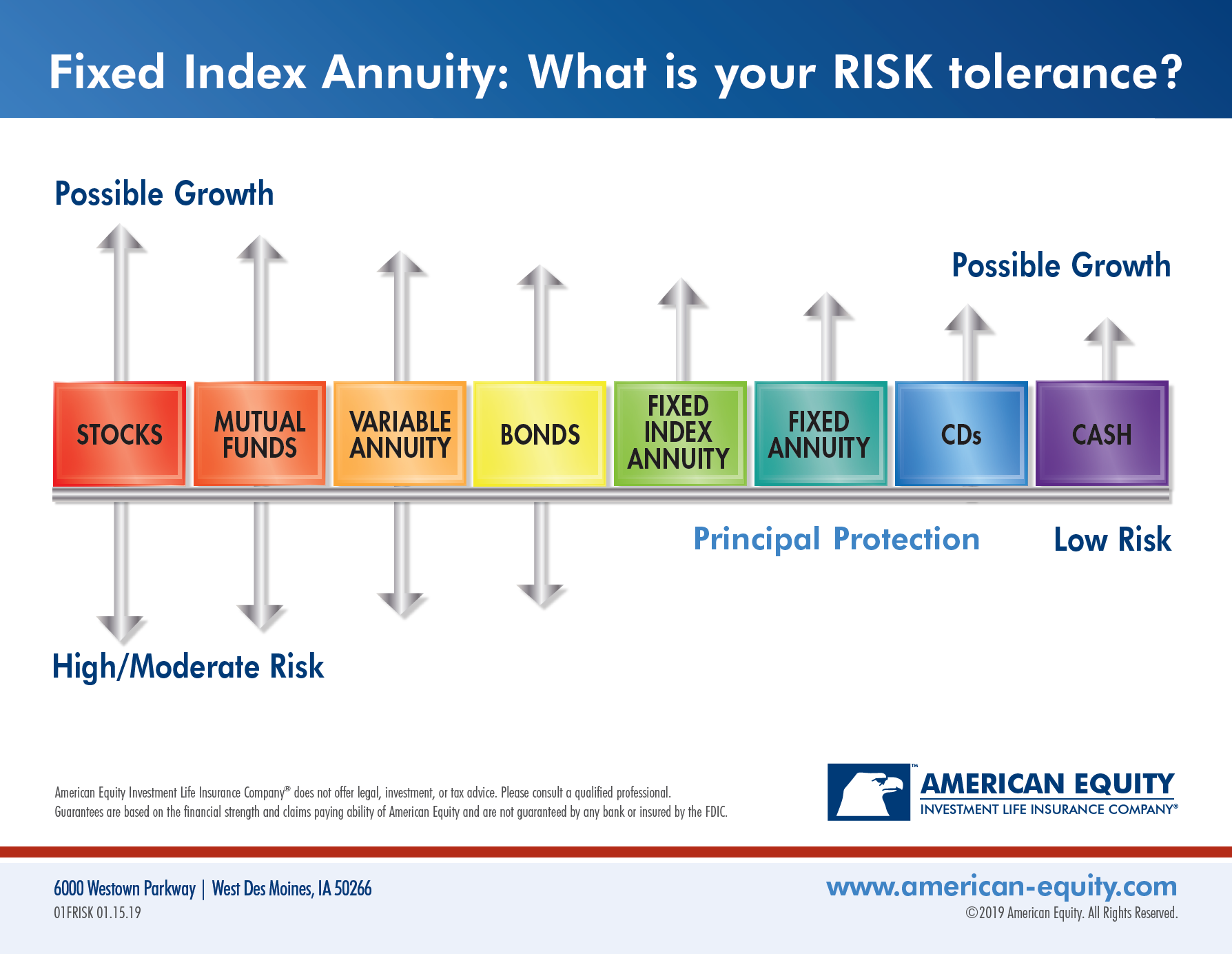

American Equity has a ton of great informational flyers about the Fixed Index Annuity (FIA), including:

- How Does a Fixed Index Annuity Work?

- Traditional IRA 2019 Fact Sheet

- Preservation and Accumulation Chart

- The Rule of 72 Explained

- Don't Go Backwards Flyer

- Help Protect Your Top Assets Flyer

All of these can be downloaded from their Agent Portal in the Marketing Materials section. They also have a flyer that helps your client determine their risk tolerance:

'What is your risk tolerance' flyer from American Equity

American Equity also offers customized Ad Slicks or postcards with your information on it. You can choose ads that focus on annuity awareness, risk tolerance, FIAs, or specific products.

Here's an example of a product-specific ad slick that you could have customized:

Also, if you have an office that clients come to, you can put a picture frame on your desk that highlights interest rates and other product information. Oftentimes, the client will ask you about it before you even bring it up.

Here's an example of what our agents use here in Decatur, but you could also have one of those Ad Slicks customized, which would make a great flyer here.

As you can see, many annuity carriers have advertising materials you can customize and download from their agent portals.

If there's a marketing piece you really need but can't find, please let our marketing team know! If it's something that many agents would find useful, we may be able to create it and customize it for you.

Stay Current on Annuities

Annuity rates and other product details are constantly evolving, so in order to stay up-to-date, we have several resources for you:

In the quarterly annuity update, I'll shed some light on any significant changes in the last quarter, and we'll cover what's hot and what most agents are currently writing. It's a good way to keep your finger on the pulse of the senior market annuity arena.

We keep our annuity rates page up-to-date, so at any time, you can check out what the current interest rates are. We've highlighted in yellow the options that are the most competitive right now, so that's a good place to start.

There's always a link at the bottom of our newsletter that'll take you to the current annuity rates. In addition, you'll be able to see if any new content is released about annuities.

If you ever have any questions about anything at all, we are your support team! Give us a call at 888-780-7676 and ask for Kirk Sarff, Shannan Weaver, or Ginny Dunker. They can help with any annuity-related questions!

Thanks for reading, and congratulations on taking the first step towards becoming an awesome annuity producer.

Additional content you may be interested in:

Updates: This article was updated in March 2020 with Michael Sams' 2019 annuity production numbers. This article was also updated in June 2020 with links to new articles about Equitable's FIA offerings (Equitable is now SILAC as of 2021). This article was updated in June 2021 with new marketing materials available from both New Horizons and SILAC as well as Michael Sams' 2020 annuity production numbers.

![The Simple Question That Drove $9M+ in Annuity Sales [Case Study]](https://blog.newhorizonsmktg.com/hs-fs/hubfs/NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp?width=220&height=119&name=NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp)