For some clients, a regular MYGA annuity just isn’t interesting enough. They like the safety of it, but they want the opportunity to make bigger gains that only the stock market can produce.

Those clients are looking for a fixed annuity with an indexing option.

New to annuity sales?

Annuity sales are a huge opportunity for independent agents in the senior market. If you want to learn how to sell annuities to seniors, you've come to the right place!

Check out our complete guide here: The Ultimate Guide to Selling Annuities In the Senior Market

Here are a few FAQs before we jump into the 3 indexing options:

Q: What is the indexing option based upon?

A: The S&P 500.

Q: How long is the contract?

A: 5 years.

Q: Do you have to commit to the same indexing option for all 5 years?

A: No. You can switch between the regular fixed interest rate and the 3 indexing options.

Q: When can you change your indexing option?

A: On the anniversary date. You are committed to that indexing option for the year.

Q: Do you have to put all of your annuity funds into one indexing option, or can you split it up?

A: You don’t have to be all-in fixed or all-in indexed. You are allowed to diversify into multiple options if this is what you prefer, or you may use one option; it’s your choice.

Q: When is the best time to jump into this kind of annuity?

A: The best time to jump into an indexing option is when the market is down. This way, you have more of an opportunity to capture the gains.

Q: What’s the minimum/maximum single premium?

A: $5,000 is the minimum. The maximum is $1 million.

Q: What are the issue ages?

A: 0-90.

Here is a short clip of John Hockaday explaining each indexing option. You can also read about them below.

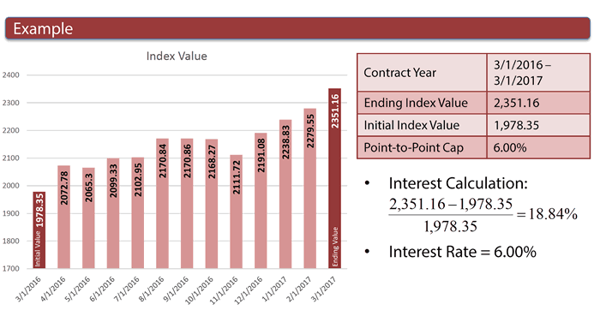

1. Annual point to point

The interest rate fluctuates with the S&P 500 over the policy year. If the market drops, it doesn’t affect your client’s earnings.

In essence, this interest is calculated by comparing the index value on the policy anniversary date to the index value on the previous policy anniversary date.

If the new index value is higher than last year’s, that increase is credited to your account up to the annual cap of 6%. If the new index value is lower, the account simply stays the same.

This is closest thing to participating in the stock market without suffering from any big losses.

The worst you can do is 0% interest. The best you can do is 6%.

Here’s an example of how this works:

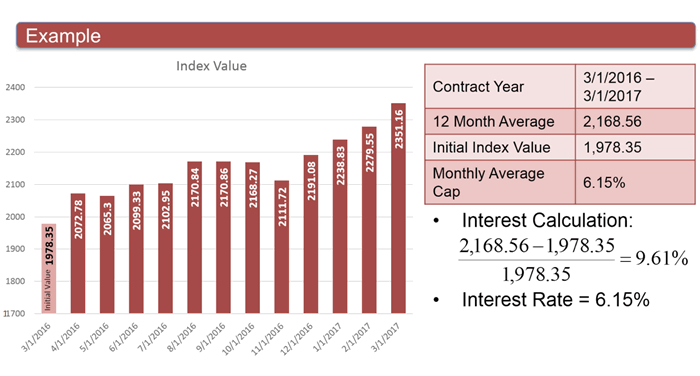

2. Monthly averaging

The interest rate is based on the average of the 12 monthly closing values in the S&P 500 over the policy year.

This option has more potential to yield higher earnings, especially if the market sees significant increases.

The worst you can do is 0% interest. The best you can do is 6%.

Here is an example of how this account works:

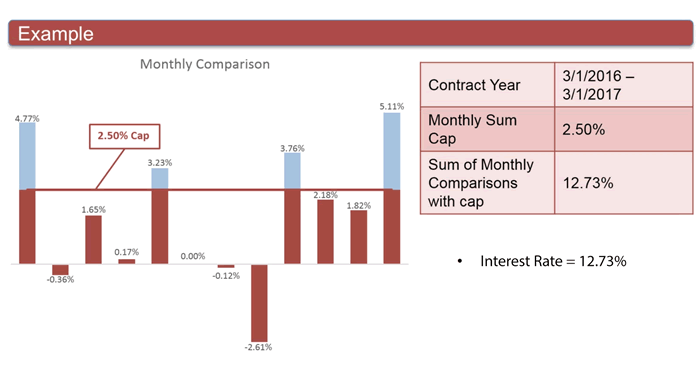

3. Monthly sum

The interest rate is based upon monthly changes in the S&P 500.

There’s a monthly cap of 2.25%, but there’s no cap going down.

For example, let’s say it’s January and the gains are 5.5%. That interest caps off at 2.25%. In February, you might see a dip to -1.5%. In essence, the interest made between January and February would be 0.75%.

Because of this, this option is the riskiest. However, it has the opportunity to earn the highest interest.

The worst you can do is 0% — even if you end up in the negative for the year, your account will simply stay the same.

The best you can do is 27% for the year. If the market is always at or above 2.25% each month, you will total up at 27% for that year.

Here’s a real life example from how the market performed last year. Keep in mind that in this example, the cap is 2.5%, while the current cap is at 2.25%.

There is a possibility with all of these options that your client could walk away with no gains. However, they have comfort knowing that even if the market dips below 0%, their money is still safe. It’s not possible to earn a negative interest rate.

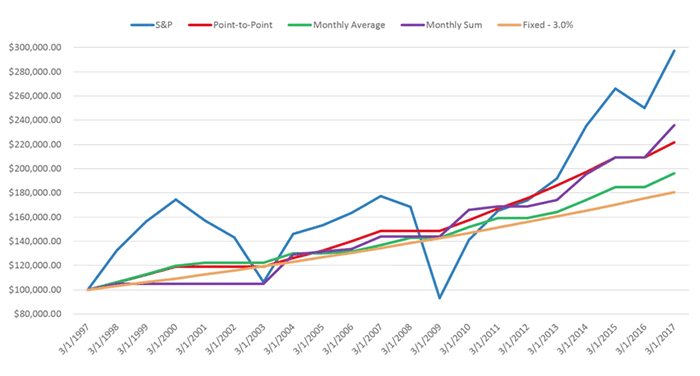

Here’s a chart showing how each indexing option performed in real life from 1997 to 2017.

This shows you how risky each option is compared to the other, but more importantly, that your client can do better than a traditional fixed interest rate annuity.

Optional Riders

Optional riders allow for flexibility in withdrawing funds. This helps your client get the highest interest rate possible while only using the features they want or need.

- Death benefit equals accumulation value rider

- Accumulated interest withdrawal rider

- Required minimum distribution rider

- 10% withdrawal option

The rider must be chosen at the time of application, and you can’t add on riders once the contract has started.

When the Contract Is Up & Renewals

If you do nothing, and the 5-year term is over, the contract will automatically renew for another 5 years.

However, 30 days before the contract ends, you can choose between a few options:

- Continue the contract for another 5-year term (do nothing)

- Apply the contract value to a settlement option (explained below)

- Take a partial withdrawal, with no MVA or surrender charges, and apply the remaining value to another 5-year term

- Surrender the contract without MVA or surrender charges

As far as the renewal process goes, you and your client will be sent forms with updated interest rate information 45 days before the contract ends.

From there, you can choose whether to do nothing and let it renew, or you can choose from one of the settlement options

Renewal commissions are automatic, and they are based on the renewal contract value and half of the original commission percentage.

Settlement Options

Option 1: Life Income Only

This is monthly payments for the rest of your life.

Option 2: Life Income with Guaranteed Period Certain

This is monthly payments for the longer of your remaining lifetime or the period certain.

Option 3: Period Certain Only

This is monthly payments for a period certain not less than 5 years.

After you choose your settlement option, there is no longer any accumulation value. A supplementary contract is provided for the monthly payments.

Death Benefits

Just like other annuities, the cash surrender value is paid to the beneficiary when the annuitant dies.

This can be claimed in the form of a lump sum, payments over 5 years, or installment payments using one of the settlement options.

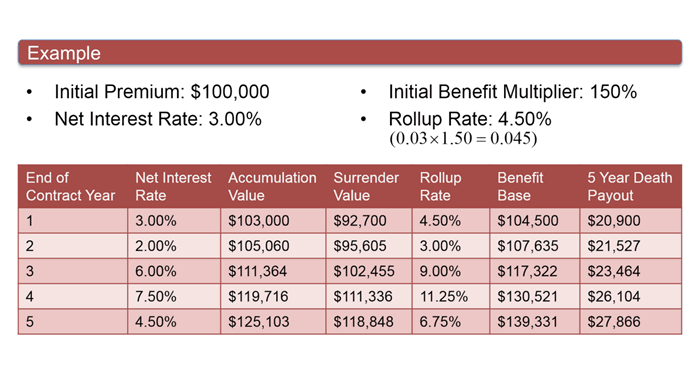

The interesting part of this type of annuity is the enhanced death benefit feature. Here’s how it works:

The beneficiary can choose to get what is called the Benefit Base in payments over 5 years. The Benefit Base is the initial premium plus the Rollup Rate minus withdrawals.

The Rollup Rate is the net interest rate multiplied by the initial benefit multiplier.

I know this can sound confusing on paper, so here’s an example:

The beneficiary can choose whether they want to have the money all at once, or they can elect to get payments over time.

Example Outcome

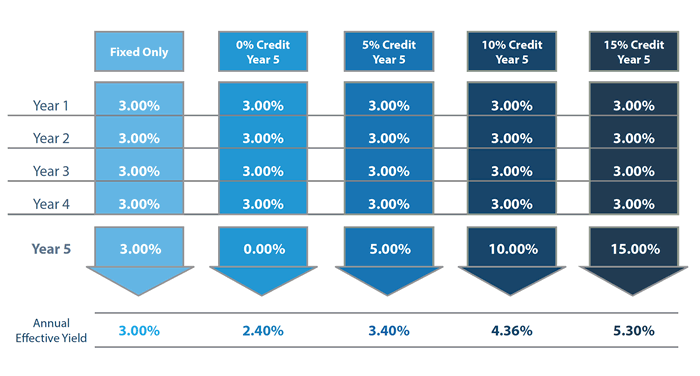

Let’s say your client wants to stay on the regular, fixed interest rate for the first 4 years of the contract. But, for the 5th year, your client wants to play the market.

He decides to go with the monthly sum indexing option.

Here’s a range of interest credits along with their annual effective yields:

As you can see, even if the market drops, your client will simply make 0% interest. This leaves him with a total yield of 2.40% for his 5-year annuity.

But, let’s say the market performs at 10% for the year. This leaves him with a total yield of 4.36% for his 5-year annuity.

Either way, the money he invested is still there, but now there’s an opportunity to make more than the standard, fixed interest rate.

![The Simple Question That Drove $9M+ in Annuity Sales [Case Study]](https://blog.newhorizonsmktg.com/hs-fs/hubfs/NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp?width=220&height=119&name=NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp)