Fixed Indexed Annuities aren’t new, but they’re fairly new to me, and I’ve just started presenting them to my clients.

As I go through the learning curve of how to actually present a FIA to clients in a way they can understand, I thought it might be best to share that information with you.

It’s pretty easy for a client to get lost, especially if you don’t take the right approach. For example, explaining too many details can kill the deal, while leaving too much out can get you in trouble.

I have a simple set of steps I tend to go through when giving the FIA presentation, and perhaps seeing how I approach it will help you feel more comfortable in front of your own clients.

[RELATED: Case of the Week: Jeff Greenwell’s $250,000 FIA Sale From Start to Finish]

Reiterate The Client’s Needs and Goals

This past week, I met with a couple that have been my clients for a number of years. They will soon have $180k from the husband’s 401(k) – he’s getting ready to retire in a few weeks. That means that he’s still contributing to the 401(k), but when he’s done, we plan to transfer the funds.

So, I’m already familiar with their needs, but in order to actually start the conversation, I like to reiterate those needs and goals. That ensures that we’re all starting on the same page.

So, I said, “I’ve heard you both on what your goals are. I understand when you need to use your money and how much you need to withdrawal when the time comes.”

That sets the precedent that I’ve heard them and am making a personalized recommendation – not a one-size-fits-all suggestion.

Introduce Fixed Indexed Contracts

Once I’ve established that I understand what their goals are, I bring up the actual product recommendation.

Because FIAs are fairly new to me, I actually let my clients know this. That establishes a few things:

- It shows that I’m honest

- It will make sense if they have a question that I don’t know the answer to

- It explains why I haven’t recommended this before

So, I say something like, “I’m going to be telling you about something that is newer to me. It’s not new – it’s just newer to me. It’s called a Fixed Indexed Contract.”

It’s as simple as that. From here, I’ll go into a few bullet points about the product I’ll be recommending or talking about.

Give Some Product Highlights

I had already chosen a specific FIA, so I was able to give a few product highlights right off the bat. The annuity I chose was the Athene Performance Elite 7-year.

The highlights I mentioned included:

- No fees – most FIAs have fees, but this one does not

- After 30 days, there’s a 10% free withdrawal – most don’t have that until after the first year

For most clients, fees and access to money are pretty important, so by laying down these “ground rules,” I’ve already addressed two potential objections – and that’s before I’ve really gotten into the full presentation.

Note that as I mention these bullet points, I’m writing them down on a piece of paper that my clients can look at while I’m talking.

Explain How the FIA Works

Because every single FIA contract works differently, it helped that I had already picked one out to present. This gives me the chance to lay out the product clearly – I avoid all generalizations, which tends to confuse clients even more.

How interest is credited

So, the next thing I did was to explain how the interest will be credited.

I said, “This is going to be something that gets credited every 2 years. So, you won’t look at your account every year – you’ll look at it every 2 years.”

The major benefit of a FIA

Then, I explain the major benefit of this product over a traditional MYGA – which they happen to have already.

I said, “This is going to give you the opportunity to earn a better return than a fixed contract, which is right around 3.5%. The worst you can do – if the market tanks – is 0%. What do I mean by that? The worst you can do is you remain with your principal. You can never lose your principal. Because you have no fees, you know you can never end up with less than what you started with.”

It might not seem like it, but this can take a second to sink in. I like to pause here and gauge how my clients are doing. If they look confused, I’ll take another second to say the same thing in a slightly different way. If they are nodding their heads and seem like they’re on track with me, I’ll continue on:

“The reason this is so attractive is that you can capture the gains when the market is doing well. Every 2 years, you’ll have interest credited to you.”

Real-life examples of best and worst scenarios

Then, before I say anything else about the product, I go through a real-life scenario to make sure my clients fully understand. This is always included in the FIA illustration packet (you can get illustrations by contacting our partners at Broker’s International – that contact info is at the end of this article).

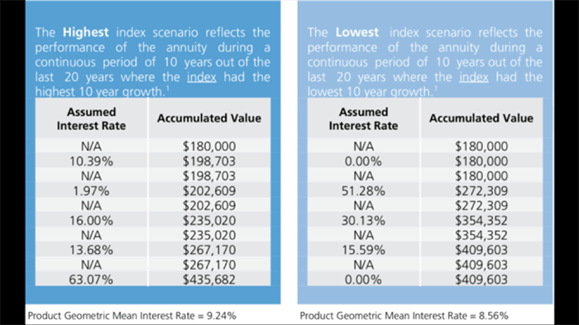

The best and worst scenarios illustration (usually around page 10 in the illustration packet) will show how your exact product performed over the last 20 years – the highest index scenario and the lowest index scenario.

Now, that doesn’t mean it’s the worst the product could ever do – it’s just showing how the product performed over the last 20 years.

Historical Index Movement Comparison - Highest and Lowest Periods

I then point out how the interest is being credited every two years, and I show them that in some cases, the market didn’t do as well, and in others, it did great.

I then explain how the interest is actually calculated.

I said, “The insurance company takes the average of each one of these and comes up with what is called the geometric mean. I don’t want us to get lost in the weeds with definitions, but that’s just the average of these returns. You know you only get interest every other year, so what would that end up being if you averaged it all out? In the highest interest example over the last 20 years, it would be 9.24%. In the lowest interest example from the last 20 years, we see that it would be 8.56%.”

Keep in mind that while I’m talking, I’m using my little illustration paper as a guide. It gives the clients something to focus on and follow along with.

I reiterate probably 7 or 8 times (maybe even more) throughout the presentation that there is no risk of losing your principal. You can never lose money with this product.

Explaining caps or participation rates

I’ll then close up my presentation by explaining how the interest is capped. For the product I’m presenting, there is actually a participation rate.

So, I explained to my clients: “If I were to put my own money into this, there’s one thing that I want to be aware of. It’s called a participation rate. So, if the market goes up 10%, how much of that growth do I get to participate in? In some scenarios, it’s going to be 85%. So, I get 85% of 10%, which would be an 8.5% return for me.”

Again, I look at my clients to see how they’re digesting this information. In the presentation I just did with my clients, I explained this one additional time in a slightly different way. I also explained it a bit more slowly.

Then, I’ll continue on.

“This contract starts out with a 100% participation rate, meaning if the market goes up 10%, you get all 10%. But every 2 years, that participation rate can differ. If I’m in your shoes and it comes time to allocate money in my second go-around, how do I know it won’t be 70%? Well, I know 70% can still be really good, but that’s one thing that you and I don’t know at the start of the contract.”

Once I said this, I reviewed the participation rate information again, because my clients didn’t look like they fully understood it all. There’s nothing wrong with explaining something twice.

What next?

By the end of the presentation, which lasted maybe 10-15 minutes, they were pretty excited about the Athene contract.

They didn’t have a need to sign any paperwork then, because we weren’t going to transfer those funds until he and his employer were done contributing to the 401(k). However, we did schedule a follow-up appointment to complete the paperwork.

If you get anything from this article, I want to emphasize one thing: you have to pick and choose what to explain to your clients.

There’s so much info on these products, and you don’t want to confuse the clients. If you explained every nook and cranny of this contract, your clients would probably never feel comfortable with it. Even when you explain something simple, it can take a few times for the client to grasp the concept.

For this reason, some agents won’t even explain the participation rates that may or may not change every 2 years. The thought process behind this is that it can be confusing, and we don’t even know if it will change during their contract. Some agents say that their clients wouldn’t even remember a detail like this after 2 years have passed, so if it does become an issue, they go over it at the annual review.

So, my recommendation would be to explain the things I’ve outlined in this article. If you go much deeper than that, you might lose your client.

This week, I presented this same FIA to a church who had lots of donations in a CD, and they weren’t earning much interest on that money. Unlike some other companies, Athene will accept money from a 501(c), and after I gave them a similar presentation to the one I’ve outlined here, they loved it!

Update: Since posting this article, I've had a few agents ask me how this works. The Treasurer of the board will be the annuitant. The owner is the church or the nonprofit organization. There are only a few carriers who will do this, though, so make sure to give us a call to find out which products are available in your state.

I’m actually going to record a video presentation for them so that they can show it to the rest of their board members; this can be a great tool for you if you present to an individual and they need to be able to relay that information to others.

I’d encourage you to just put yourself out there and give the presentation. Once you give it a couple times, you’ll feel so much more comfortable about it. I know I do.

Finally, please take advantage of our partnership with Broker’s International. The awesome team there will help with product selection, illustrations, questions, and concerns. Please contact Ryan Witte at RWitte@BILtd.com if you haven’t already.

New to annuity sales?

Annuity sales are a huge opportunity for independent agents in the senior market. If you want to learn how to sell annuities to seniors, you've come to the right place!

Check out our complete guide here: The Ultimate Guide to Selling Annuities In the Senior Market

![The Simple Question That Drove $9M+ in Annuity Sales [Case Study]](https://blog.newhorizonsmktg.com/hs-fs/hubfs/NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp?width=220&height=119&name=NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp)