Life insurance is not only a great way to increase your income, but it's a wonderful solution for senior-aged clients.

Of senior market insurance agents who make over $200,000 annually, 79% sell life insurance products.

Life insurance isn't just for young people with families. It's an excellent tool for seniors over age 60, but the trick is finding out the why: why does this prospect need life insurance, and what product would serve that need best?

That's what we're uncovering in this article today. Here are 31 simple questions to ask life insurance prospects who are around retirement age.

You can easily jump ahead to the various sections using these links:

- The Ultimate Conversation Starter

- Follow-Up Questions for Clients with Existing Life Insurance

- Protecting the Family Questions

- Final Expense and Funeral Cost Questions

- Term Life Insurance Questions

- Long-Term Care Cost Questions

- Single Premium Life Insurance Questions

- Budget and Affordability Questions

- Conclusion

Fast Start: Use the Client Needs Assessment

If you’d rather not browse through dozens of life insurance conversation starters, just download and use the Client Needs Assessment.

When you get to Question 7, follow the prompts and jot down notes!

When you get to Question 7, follow the prompts and jot down notes!

You'll know within a couple of minutes if your client needs life insurance and what type will serve their needs best.

Creating Questions that Fit Your Style

We hope the questions on this list provide you with guidance and inspiration, but you can also come up with questions that fit your personal style.

My advice is to make sure any leading question addresses need, budget, or goal. When it comes to life insurance, these are the three areas we’re trying to understand.

If you have any questions we don’t have on this list, please drop it in the comment section at the end!

The Ultimate Conversation Starter

1. Do you currently carry any life insurance?

Many prospects you meet with will already have some kind of life insurance coverage. That’s why we start the life insurance conversation with a simple, straightforward question: do you currently carry any life insurance?

It's the first question you should ask any life insurance prospect that's retirement aged. It’s also the question you’ll find on our Client Needs Assessment template.

All you're really looking for here is a "yes" or a "no."

If they say yes, you'll be asking some follow-up questions to determine what they have and why (see the next few questions). These follow-up questions are also included on the Client Needs Assessment.

Follow-Up Questions for Clients with Existing Life Insurance

2. What’s your death benefit?

If your client says they do have life insurance coverage, ask them what their death benefit is. This will tell you if your client really understands the coverage they have.

You’ll also start to get a picture of whether the client’s existing life insurance is sufficient for their needs. Continue by asking another follow-up question (see the next question).

3. What’s your premium?

This is another follow-up question to ask if your client has existing life insurance coverage. You’re still laying the groundwork for your recommendations, and hopefully, your client has a basic idea of what their current premium is.

If they don’t, you may need to ask for a recent statement.

4. Are you still paying premium?

You can switch up the simple question, “what’s your premium” by instead asking, “are you still paying premium?”

This often causes prospects and clients to get curious – they’ll often say, “yes – should I be?”

There are life insurance policies where you pay premium for a set number of years – say 10 years – and the premiums stop, and this question can be a conversation starter for that.

5. What’s your cash value?

If your client has life insurance coverage already, you should also inquire about its current cash value.

Many clients will have no idea, and you’ll then ask them to get a current statement. Oftentimes, these clients are the best ones to help as you can educate them on what they have and potentially improve their situation.

6. What purpose does your current life insurance serve?

For senior clients who have life insurance already, you’ll want to ask: what purpose does your life insurance serve?

The 5 purposes for life insurance after age 60 include:

- Income replacement: replacing your income for those who are dependent on it while you're living.

- Final expenses: allocating funds for your funeral and end-of-life medical bills.

- Outstanding debts: ensuring your loved ones don't get stuck with a mortgage, credit card, or car loan (less common with older clients, but possible).

- Help family financially: passing your wealth along to children or loved ones upon your death.

- Leave a legacy: funds can be passed on to a charity or church.

From here, you can determine if their death benefit is sufficient for the purpose, and you can beef up their coverage if needed. You may also be able to get them a better life insurance policy than what they have now, so consider offering a free policy review.

If your client doesn't have any life insurance, it's time to figure out if they need some.

7. How do you feel about upgrading your current policy?

We see it all the time with final expense plans. A client will have a final expense policy with a $10,000 death benefit, but when you really consider final expenses, it’s just not enough.

We’ll often ask this client how they feel about beefing it up a bit to ensure their family isn’t left with any unexpected costs.

As always, something is better than nothing, but if their budget can handle it, we’ll add on another small policy to ensure they have the death benefit they really need.

Protecting the Family Questions

8. Does anyone currently rely on your income?

Typically, this question will apply to married couples: does anyone currently rely on your income?

If the answer is yes, a natural follow-up question is: do you have a plan to replace that income upon death?

If the client has no income replacement plan, and the spouse wants to keep the same standard of living, a life insurance policy is a great solution.

You can roll into product recommendations from there, and if you're not sure what the best fit is, you can rely on me for help.

9. Do you want to pass any of your wealth to your family after death?

Life insurance is a great way to pass wealth on to family after you pass. Ask: do you want to pass any of your wealth to your family after death?

If the answer is yes, talk to them about life insurance options. I can also help you determine which life insurance company and product type is the best recommendation for that client.

Occasionally, an annuity can also be a good option as it avoids probate.

10. Will your spouse be able to live on one Social Security check if you pass away?

If your clients rely on their monthly Social Security check, or you have reason to believe they do, ask: will your spouse be able to live on one Social Security check if you pass away?

Many people don’t realize that when the first spouse dies, the survivor will only get the higher of the two monthly checks, not both. That discrepancy in monthly income can seriously affect the spouse’s standard of living, but a life insurance policy can make up for the difference.

11. If you passed today, would your family be able to cover any outstanding bills or debt and still maintain their normal life?

This question variation asks your client to consider standard of living.

Sure, he may have money saved that could cover monthly bills or any outstanding debts, but would the remaining spouse be comfortable? Or would the financial responsibility put strain on her life?

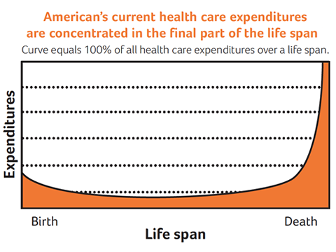

You can also talk about end-of-life bills here, including medical costs. Medical costs at the end of life are the highest they will ever be for a person, on average. Could the remaining family handle that surge in expenses?

Final Expense and Funeral Cost Questions

12. Have you made any arrangements to take care of final expenses?

A lot of people don’t have any arrangements to take care of their final expenses.

Start the conversation with your life insurance prospect by asking: have you made any arrangements to take care of final expenses?

The conversation will flow naturally from there, and if they have made some arrangements, ensure they have enough funds set aside. A lot of people underestimate the average cost of a funeral.

13. If you were to pass today, would your family have enough money to cover the cost of your burial?

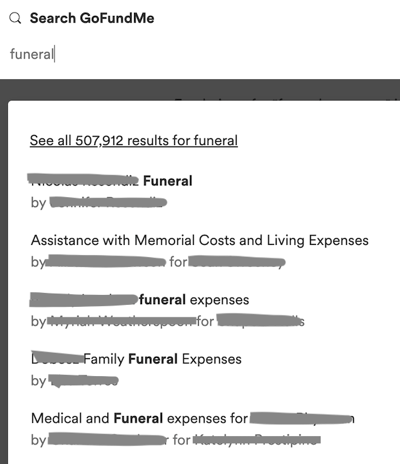

We see it all the time – the family is quickly trying to pull together funds, and bankruptcy, GoFundMe pages, and more follow.

In fact, at the time of this writing, there are over half a million GoFundMe fundraisers for funeral expenses.

It's not the legacy anyone wants, and final expense insurance is a great, inexpensive solution.

Ask this question to help your client visualize the burden their family may be left with if they die without any final expense plan.

14. Have you or your family been involved with or assisted in paying for a loved one’s funeral? If so, how were the expenses handled?

Occasionally, you’ll come across a client who was on the other side of the story. Maybe they were stuck with the funeral expenses of a loved one who had no final expense plan.

Asking this question can bring back those memories and reiterate that they don’t want this burden to be put on their family.

15. Have you pre-paid for your funeral?

Some people decide to prepay a funeral home for their funeral instead of opting for a final expense policy.

You can ask this question just to get the conversation flowing, but it’ll also give you valuable insight. If they've prepaid for their funeral – or plan to soon – you can inform them of the pros and cons.

Pros of prepaying funerals:

- Your price is locked in when you pay

- Your burial space is reserved

- Your family doesn’t have to make any decisions

Cons of prepaying funerals:

- The funeral home could go bankrupt leaving your investment in question

- You can’t change your mind if you want to be buried somewhere else

- Those funds are tied up

Have this conversation with your client, and potentially, you can fill a need here with a final expense plan.

Term Life Insurance Questions

16. Do you have any outstanding debts, such as a mortgage or car loan?

Outstanding debts are a lot less common among the senior crowd, but it's still possible. We rarely sell term life insurance to people over age 60, but if a client has a mortgage or another loan with a timeline attached to it, a term product is a perfect fit.

Ask that client: do you have any outstanding debts, such as a mortgage or car loan? If they do, ask them who would be responsible for taking on those debts if they passed.

Matching up the term life insurance death benefit to their outstanding debt can give that client a plan – and some peace of mind.

17. Have you ever heard of return of premium life insurance?

For clients who seem like a good fit for term life insurance – say they have a mortgage that has 8 years left – consider mentioning return of premium options.

These term life policies will refund the paid premium if the policyholder outlives their policy term. The monthly premium is a little higher, but this can be a very attractive feature for some.

Long-Term Care Cost Questions

18. Have you had a family member use home health care or go into a nursing home?

Life insurance with a long-term care rider attached is becoming one of our most popular long-term care solutions.

If your client has no plan for long-term care costs, a life insurance product may be their best solution.

Ask that client: Have you had a family member use home health care or go into a nursing home?

If yes, ask them how that family member paid for it. Then ask how they'd pay for it. It may not sound like a traditional life insurance question, but it gets the conversation started.

A hybrid life insurance policy with a long-term care rider added on can cover multiple needs; plus, a client can pay off the policy in 10 or 12 years.

19. Do you own a long-term care insurance policy?

Before you start inquiring about whether your client has a financial plan for potential long-term care costs, it can be helpful to find out if they have an existing LTCi policy.

They may share their premiums have skyrocketed, which is typically the case for anyone who does have an LTCi policy. Most companies have exited the LTCi market as the claims on these policies are massive.

The other possibility is the benefit isn’t enough, particularly if it didn’t have any kind of inflation rider. LTC costs are rising, and a policy bought 20 years ago may not come close to covering a nursing home stay today or in 10 years.

If they have a policy, gather all the information you can and consult with me. I can help provide some illustrations and recommendations on alternative options, especially if the premium is getting so high the client cannot afford it anymore.

20. Do you have any plans currently for potential long-term care costs?

Since hybrid life insurance policies can now be an ideal solution for long-term care insurance, consider rolling right into a long-term care discussion.

You may uncover existing coverage, or your client may have no idea just how expensive a long-term stay can be.

Educate your client, and feel free to download and use our client handout with facts and stats.

21. Did you know Medicare will not pay for long-term care?

Many individuals aren’t aware that Medicare will not pay for a long-term care stay.

Medicare only pays for a medically necessary skilled nursing facility or home health care services, and the kicker is the maximum benefit is 100 days. It also comes with some fine print, as most of you are aware of.

Ensure your client knows that even though a long-term care stay would be medically necessary, they’d be on the hook financially. While there are several options, including short-term care insurance/recovery care, a life insurance policy with a long-term care rider is often the best fit. The commission on these is also very attractive.

Case Study: Laura’s $21,000 Commission

22. Do you have enough retirement income to cover long-term care costs?

When you look at the cost of a long-term care stay, it's staggering. Exact estimates vary based on location and the quality of the nursing home, but the national average is around $85,000 for one year of care.

When you inform your prospect or client of these very real costs, they may start to realize that their retirement income isn’t going to cut it. In these cases, a hybrid life insurance policy can be ideal.

23. Would you have to spend down assets to make up any shortfall?

Almost anyone you talk to isn’t going to want to spend down their assets to help pay for a long-term care stay.

You can also follow-up with the next question:

24. How would you feel about spending down your assets to qualify for Medicaid?

When assets reach a certain point, a person can apply for Medicaid. Then, the long-term care facility costs are covered by our government. How does your client feel about this?

If they think it’s a solid plan, make sure they know about the two major downsides of Medicaid:

- Your client will lose all of their assets.

- Medicaid will look for the lowest cost facility, and these are often some of the lowest quality facilities.

Single Premium Life Insurance Questions

25. Do you have money saved in the bank, or in annuities or mutual funds, that you would like to pass to your heirs on a more tax-efficient basis?

Any time a client has extra funds and their goal is to pass it on to their children – without major tax penalties – I recommend Single Premium life.

It’s the perfect product fit, and this question can help guide your conversation toward the solution.

26. Are you interested in multiplying the amount that is eventually passed on to your heirs?

A Single Pay life insurance policy is a great way to take a modest deposit and turn it into a rich death benefit.

As an example, a 65-year-old female could deposit $37,318 for a $100,000 death benefit policy. I can help you run an illustration if you have a client that’s a good candidate for this.

27. Do you have savings that you don't currently need for regular living expenses or to maintain your quality of life?

When clients have extra funds lying around that they don’t need, we should try to find a way to make their money work for them. An annuity can be a great solution, but Single Premium life is also a great contender.

It really depends on their goal for that money, and this question can help you start the discussion.

28. Do you have money that you would like to pass to your favorite charity?

Occasionally, we come across clients who want to pass their wealth on to their church or other charity that’s close to their heart.

In these cases, a Single Premium life insurance policy can be a clean way to do that. Just contact me for product specifics, and I can help you through the process.

Budget and Affordability Questions

29. Do you know how affordable life insurance can be?

Sometimes, people avoid insurance conversations because they’re afraid of how expensive it will be. This is especially true for seniors who are on a fixed income and don’t have much wiggle room in their budget.

In these cases, it may be best to lead with the affordability of life insurance. Something is better than nothing, and a modest final expense plan can cost as low as $40 per month.

If you decide to go this route, I highly recommend you get contracted with KSKJ Life. They typically have the most competitive final expense rates, subject to state availability.

30. Which of these three options would be the most comfortable for you?

The best question to ask toward the end of your life insurance conversation is: which of these three options would be the most comfortable for you?

I recommend giving the client options in three price ranges. Most people will choose the middle option.

31. Would you be interested in higher premiums, but being able to fully pay off your life insurance in 10 or 12 years?

The concept of paying on a life insurance policy for the rest of your life can be intimidating. However, there are some fantastic life insurance options that allow your client to pay all their premium in 10 or 12 years (there are other ranges, but these are the most common).

Ask your client if that would be appealing for them, with the understanding that the premiums would be higher during those years.

Conclusion

Talking to prospects about life insurance isn't difficult, especially when you have the Client Needs Assessment as a guide.

Download Your Client Needs Assessment Template

Don't forget to lean on me for illustrations, product recommendations, and policy reviews. I can be your right-hand man in serving your client with the product that will fit their needs and budget the best.

What questions do you ask life insurance products over age 60? Let me know in the comment section below!