When you're ready to retire or leave the business, you can sell your block of business. Your client base and renewable commission streams are valuable.

But how much can you get paid? Is there anything you can do now to increase the future value? And what about the value of Medicare Supplement vs Medicare Advantage or other product lines like final expense and annuities?

Here are 15 frequently asked questions about your book of business and its value.

1. Who is valuing my book of business, and who is buying it?

Our team here at New Horizons leans hard on ACCESS Capital, a fellow Integrity partner, to come up with the valuation. That's what they specialize in.

After the valuation, if you want to sell to us here at New Horizons, we work your book of business like an agency. We bring those customers in and serve them from our office via an incredible service team that does a wonderful job.

Our service team

Our service team

Our model is all about giving agents peace of mind that their policyholders will be taken care of going forward.

There are some agents who come to us but don't really fit our model, and in that case, ACCESS Capital can buy that book of business.

New to succession planning? Check out our guide: Succession Planning 101: How to Retire as an Independent Insurance Agent

2. What paperwork do you need to get a valuation?

You'll need commission statements for the last 12 months from each carrier you sell. You can send these digitally for a valuation or you can provide your agent portal login information.

3. How do you value a book of business?

ACCESS Capital, an Integrity partner, works with us to develop a valuation.

They gather up an agent's commission statements and go down to the individual policy level. They look at different data points like effective dates, policy types, commission schedules, carriers, and the state the client is in and feeds that into a valuation model.

This model will project out what the book of business will generate by way of revenue in a perfect world. Then, they apply discounts for persistency, death rates, and lapse rates. They look at claims statistics as well and then back into a present day value for that future commission stream.

A final purchase agreement will have a list of every single policy on the books.

4. How long does a valuation take?

It depends on the size of the book of business and how many carriers there are. But in general, it takes 3-4 business days to get the business valued and to generate an offer.

The biggest hangup can be getting the data. But once we have all the commission statements, you can get your business valued very quickly.

John Hockaday, Principal of New Horizons Insurance Marketing

John Hockaday, Principal of New Horizons Insurance Marketing

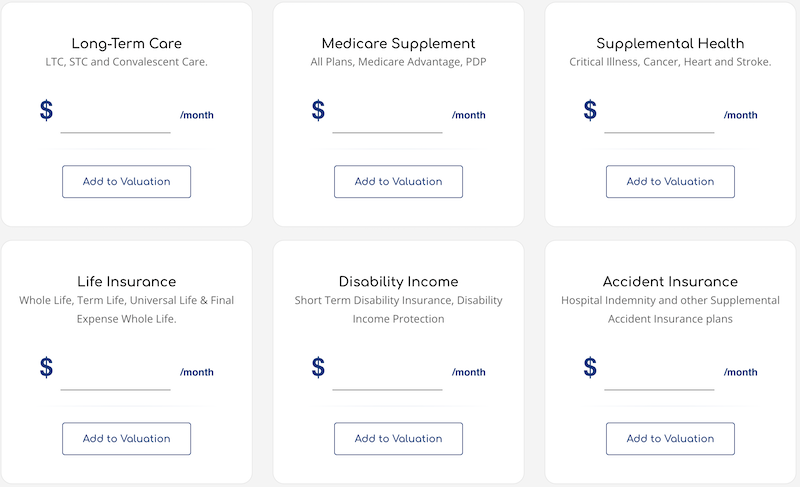

5. What types of products are best to sell to get the best valuation?

Generally, policies need to check three boxes in order to be valued:

- Individually underwritten

- Guaranteed renewable

- Has a vested future commission

Examples of products that can be valued include:

- Medicare Supplement

- Medicare Advantage

- All ancillary products, such as cancer, critical illness, hospital indemnity, dental, and more

- Long and short-term care/recovery care

- Life insurance products, including whole life and final expense

- Term life, but only if it has a renewal stream. (A lot of times, term products are first-year only, and in that case, it would not add any value to your valuation.)

Currently, we don't provide valuations on Property & Casualty (P&C) or underage health insurance (ACA) books of business.

6. What about annuities? How do those contribute to a valuation?

When it comes to annuities, it's difficult to put any value on that business because most annuities have no renewal stream.

When we buy a book of business that has annuities on the books, we structure the deal a little bit differently. Over the next 5 years, if we are able to renew the annuity where there is a new commission on it, we'll pay the agent a portion of the commission.

It's good for us and it's good for the agent. We know there's value in an annuity customer, but you can't pay upfront for a policy that doesn't generate future commissions.

7. How do you increase the value of your book of business prior to selling it?

The main drivers of value are the product type and the commission schedule. The best way to increase the value of your book of business is to keep it as fresh as possible.

Take a good look at your book of business and make sure you rewrite any business that's not generating a commission stream anymore.

8. What decreases the value of your book of business?

If there are any tiers in the commission schedule, such as a Medicare Supplement that cuts down to a lower commission in the 7th or 11th year, and the majority of policies are in their 5th or 6th year, that will drag down the value.

There's only so much commission life left at its current level when a policy has been on the books for a while.

We can work with agents where they try to move those policies and renew the commission stream to a higher level before they sell, and that adds a ton of value to the book.

John Hockaday (left) and Jeff Sams (right), Managing Partners of Integrity Marketing Group and Founders of New Horizons Insurance Marketing

John Hockaday (left) and Jeff Sams (right), Managing Partners of Integrity Marketing Group and Founders of New Horizons Insurance Marketing

9. Does it matter which carriers you sell in terms of your book's value?

ACCESS Capital looks at carrier-specific information, such as rate increase histories, to inform their valuation.

However, what state a policy is written in has a much larger impact on the valuation, because commission schedules are different from state to state.

10. Should I sell my business now, maybe before I'm ready, or later?

What happens with retirees is they should've sold their book of business 2 years prior, but they waited 2-3 years and haven't done a whole lot. That really hurts their valuation.

If they had sold it 2 years ago, they would've gotten a much higher value because more policies were in earlier years.

A block of business is not like fine wine! It really doesn't get better with age. As commission life runs out, the value decreases.

More on this topic here: How to Know When It's Time to Sell Your Insurance Business

11. Is there a certain time of year that's good to sell your business?

From September 1 through the end of the year, Medicare Advantage and PDP carriers will not do any transfers. This is basically a blackout period.

ACCESS Capital would need a month ahead of that to value your book of business and get all of the paperwork completed.

So, the best time of year to sell your business is anytime between January 1-August 1.

12. What's a typical payout multiple relative to current commissions?

In terms of a "multiple," it really depends on the product type and the makeup of the book of business.

For typical MAPD business, as an example, a purchase offer will generally land between 1.75-2.5x+ of the annualized renewal commissions.

That said, we don’t simply place a “multiple” on the book of business; the “multiple” is the end result of a policy-by-policy actuarial analysis and valuation.

For a better understanding of what you could expect in terms of a purchase price, try out our “Capital Calculator” tool here.

The Capital Calculator

The Capital Calculator

13. Can I get my book of business valued even if I have no intention of selling it right now?

Absolutely. The team at ACCESS Capital will run a valuation for you as many times as you need. Some agents will have their book of business valued 4 times before they decide to sell.

Even if you don't come to terms on a sale, at least you'll know the current fair market value of your book of business.

14. How much does a valuation cost?

The valuation service from ACCESS Capital is free, and there is no obligation.

15. How big does your book of business need to be to sell it?

There's no restriction on the size of your book of business! It can be very small or enormous. The size of your book of business is not a barrier to getting a valuation and an offer.

John Hockaday (left) and Jeff Sams (right)

John Hockaday (left) and Jeff Sams (right)

Conclusion

For those who want to know what their book of business is worth right now (this service is free), please visit ACCESS Capital's website to request a valuation.

If you want to talk to us here at New Horizons about preparing for retirement or selling your book of business, please schedule a discovery call!

Related Content: [Webinar Recording] What Your Book of Business Is Worth (Session 1)