Some prescriptions can be outrageously expensive, despite having Medicare drug coverage.

While common generics are typically a few dollars, some of the most expensive drugs on the market can reach $30,000-$80,000 per month.

Prescriptions like Mavenclad, used to treat relapsing forms of multiple sclerosis (MS) tops out at $60,371 for one cycle of treatment. And Vitrakvi, a cancer drug used to treat patients with a specific gene mutation, costs $547 per capsule, or $32,800 per the standard 60 capsules per month.

While most clients aren't dealing with such painfully expensive drugs, many clients take the generic for Cymbalta (duloxetine, $123.78), Timolol ($31.48), Restasis ($727.07), Xiidra ($705.03), or Diclofenac ($52.96), among many others.

These drugs can be pricey (though not crippling), and we can help our clients find savings using these 5 steps.

Step 1: Inquire About a Generic

The first step toward your helping your client lower their prescription drug cost is to inquire about a generic.

Generics have the same active ingredient as the brand name equivalent, but the price is typically 80% less or more.

The quality, dosage, and strength of a generic drug are the same as the brand name. Drugmakers must prove that the generic can offer the same benefits as the brand name to pass FDA testing.

However, there are times when you can't get the generic alternative. Generic drugs can only be introduced once the patent on the name brand expires. For most drugs, this is 20 years from the date of the patent submission.

After that, generic drugs can only be sold after they have gone through FDA testing and approval.

If a generic isn't available or your client is already on the generic and it's still a little pricey, move on to step 2!

Step 2: Inquire About a Substitute

The second step is to inquire about a substitute. This is a good strategy if your client is prescribed a new medication partway through the year. Ideally, during AEP, we want to match our clients up with the best drug plan based on their medications.

But if they get a new prescription, it may not be on their current drug plan's formulary.

In these cases, it's worth asking about a substitute. Even if the substitute is a brand-name drug, it could be on their drug plan's formulary.

As an example, lansoprazole (generic Prevacid) is used to treat heartburn and GERD and costs $130.94. Your client might inquire about switching to omeprazole, the generic for Prilosec, which costs $62.66.

Both medications treat GERD and reduce stomach acid, but the costs are quite different, despite being generics.

Step 3: Ask for Samples

If you don't have any luck with Step 1 or Step 2, see if your client can ask their doctor or physician for samples.

Samples are only available for expensive, brand-name drugs, and typically, doctors are instructed to give patients only enough to get started.

As you can see, samples are not that reliable, but you might get a good 6-month stretch of medication for no cost.

Because samples are not a permanent solution, we recommend reserving this as a Plan C. It'll at least buy your client some time to find another solution or switch drug plans during AEP.

Step 4: Check GoodRx and Canada Drugs Online

The next step is to check GoodRx and Canada Drugs Online for any potential cost savings.

If your client uses a coupon from one of these sites, they can't use their Medicare drug plan, so what they pay won't count toward their plan deductible. That said, if the cost savings are significant enough, they won't really care about that!

GoodRx offers discounts and coupons you can use to save on your prescription. They also show you the prices available at different pharmacies so you can price shop. Sometimes, using the discounts or coupons from GoodRx is significantly less expensive than getting the drug through your insurance.

Canada Drugs Online is another website to check to see if your client can find their prescription for a lower cost.

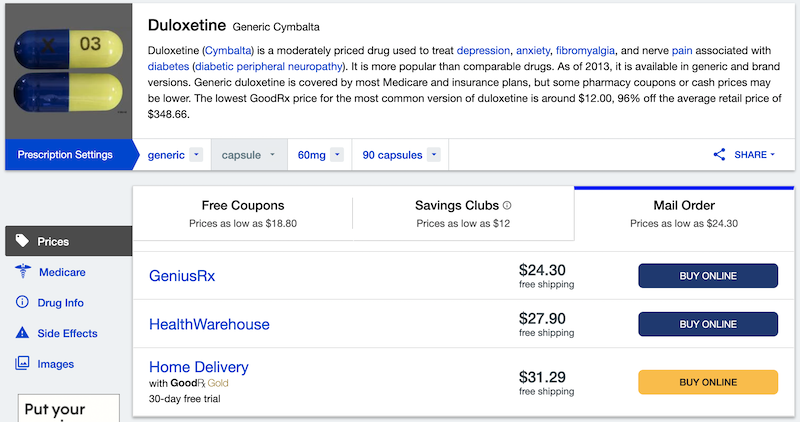

As an example, duloxetine retails for $348.66 for a 3-month supply. I was able to help a relative get the drug for just $24.30, mail-ordered, thanks to GoodRx. She was pleased, to say the least!

Tip: Don't order insulin from Canada Drugs Online. My grandfather received the insulin room temperature, and it needs to be refrigerated.

Step 5: Apply for a Special Enrollment Period

The last step is to apply for a Special Enrollment Period (SEP). This is really your last result because it takes so long to get results. You're waiting for several months before you even know if your request has been accepted. All the while, your client needs these drugs.

Also, while you can request an SEP, it doesn't mean it'll be accepted.

One of my clients was given Eliquis – it's $589 retail and $494 on GoodRx – and it was not covered by her drug plan.

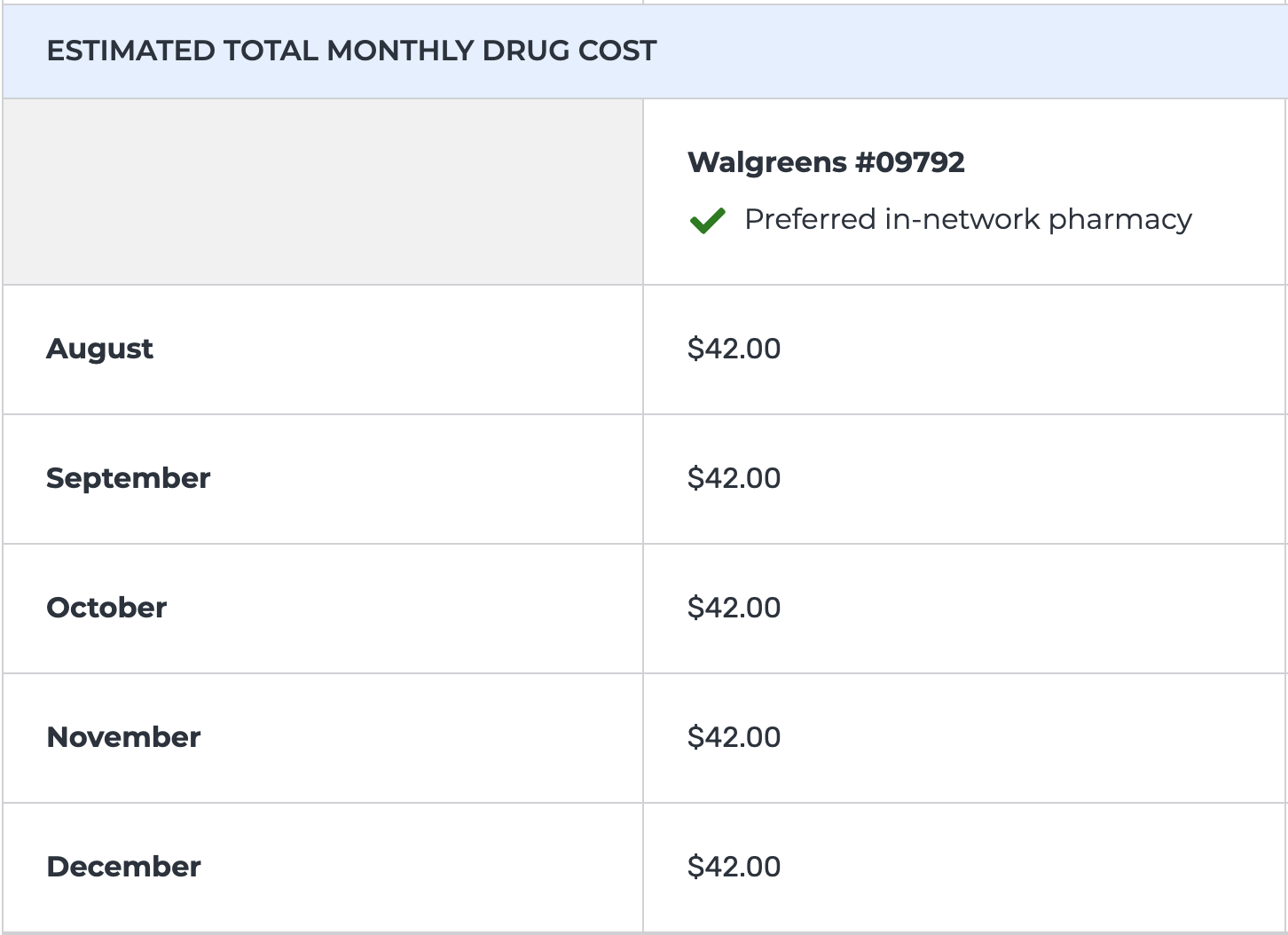

If that client had a drug plan that was compatible with Eliquis, it could have cost as low as $42, which is worth trying to get approved for an SEP.

If you're still not getting anywhere after trying all of these steps, ask your pharmacist what the cash price is for the drug. It may not help, but it's at least one more thing to try.

Conclusion

There's nothing better than helping a client save hundreds of dollars on their expensive prescription. You've probably already saved them on their Medicare plan, and now you're coming in like a hero for Round 2!

I hope these tips help you help your clients. If you have any other suggestions, please leave them in the comment section below.

Related articles:

![The Simple Question That Drove $9M+ in Annuity Sales [Case Study]](https://blog.newhorizonsmktg.com/hs-fs/hubfs/NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp?width=220&height=119&name=NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp)