During the 4th quarter, you're going to be very busy seeing a lot of clients and prospects. We understand that many agents generally don't slow down to take care of anything other than the pressing Medicare needs.

Plus, if you're selling MA or PDP plans, it's not always compliant to bring up other products during your appointment.

That's why we've gathered up 10 client leave-behinds you can take with you on your appointments. You can also mail them to clients if you prefer.

After the craziness of AEP passes, you can go back to your client and address their needs, from single premium whole life to cancer to annuities and more.

Are Leave Behinds During AEP Compliant?

It is compliant to leave information behind with a client about any other products you offer. Just take caution to not talk about them during your sales meeting if you are selling Medicare Advantage or PDP and it is not a product type on your scope of appointment form.

Alternatively, if you are meeting your clients in your office, you can utilize any of these flyers as a desk display.

Download the full bundle of client leave behinds in this article here:

Why Use Client Leave Behinds?

Sometimes, you can't cover everything during an appointment – that's particularly true during AEP. A client leave behind allows you to introduce an idea to your client without diving into a full presentation right then.

Plus, if you're selling Medicare Advantage and/or PDP, you could run into compliance issues by pitching other product types not covered under your scope of appointment (SOA).

A great way to introduce new products and inform your clients about what you offer is to leave a flyer behind.

Related Reading: How to Prepare for AEP This Fall

1. Fixed Annuity Rate Desk Display

Do you see clients in an office setting? Display the highest fixed annuity rate on this easily customizable flyer. The rate will draw your client's attention, and they'll be asking you about annuities – not the other way around!

A desk display can be especially helpful during high-traffic seasons, including the Medicare Annual Enrollment Period (AEP).

If the highest rate available changes, you can easily modify the rate, re-print, and update your desk display. View all of the current fixed annuity rates here.

You can also utilize this flyer as a client leave behind. Add it to your policy delivery packet or give it to your client to mull over or show their spouse.

2. Bank CD vs. Fixed Annuity Client Leave Behind

If you're looking for a non-branded annuity leave behind, the Bank CD vs. Fixed Annuity flyer our team created might fit the bill.

This leave behind gives an overview of how a bank CD compares to a Multi-Year Guaranteed Annuity (MYGA), and we go over the following categories:

- Safety (both are generally safe)

- Timeline/Contract Lengths (CDs can go shorter than MYGAs)

- Interest (very compelling!)

- Tax Savings (MYGAs grow tax-deferred – CDs are taxable)

- Liquidity (both have surrender charges/penalties, though MYGAs often offer free withdrawals up to 10%)

- Maturity (both can be renewed, or cash can be removed after contract)

This handout is customizable with your logo and contact information, so it's easy for them to get in touch without fumbling around for your business card.

No specific annuity carriers are mentioned on this handout, so you're free to recommend whichever company is the most competitive for your client.

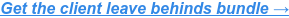

3. SILAC FIA Client Leave Behinds

Fixed index annuities are a great option for clients who want to have the potential for higher gains without any risk of losing their principal.

SILAC's Denali product comes with some amazing perks, including an income rider and absolutely no fees.

Again, these FIAs have NO fees, so there's no way your client could ever lose money on their principal. The worst they can do is to stay steady if the stock market doesn't perform well.

As long as you're a contracted agent with SILAC, you can log into the portal, select your product, and choose from a variety of marketing materials.

Here's the FIA vs. MYGA handout:

Log into the SILAC Agent Portal here!

4. Final Expense Client Leave Behind

This final expense client leave behind is non-branded, and it goes through all the important statistics about final expenses.

Some of the topics addressed on this flyer include:

- The median out-of-pocket costs for a traditional funeral in 2017 is $8,755 (National Funeral Directors Association).

- The average out-of-pocket expenditure for end-of-life necessities is $11,618 (National Bureau of Economic Research).

- The total final expenses for the average person – including funeral costs and other out-of-pocket costs – is just under $19,000 (Data collected from National Funeral Directors Association, National Bureau of Economic Research, Tax Foundation, and GOBankingRates).

- Social Security only pays a lump-sum death payment of $225 to the surviving spouse or child (Benefits.gov).

All of these stats (and a few more) are laid out neatly, and at the end of the flyer, some basics facts about final expense insurance are shared. It's a great progression and makes the case for making sure final expenses are planned for.

5. KSKJ Single Premium Whole Life Client Leave Behind

When it comes to Single Premium Whole Life Insurance, KSKJ Life has been our tried-and-true. We love their Single Premium Whole Life Insurance flyer* as it clearly outlines the excellent policy features:

- $10,000 minimum premium amount

- No monthly payments – you're fully covered with one single premium

- Lifelong protection

- Guaranteed cash values and death benefits

- Issue ages 20-90

*Please visit the KSKJ Agent Portal as this flyer is different for each state; the one shown below is for Illinois.

Many seniors also like the fact that KSKJ is a not-for-profit organization, and they focus on giving back to members and the community.

If you're not already offering single premium whole life... I'd strongly consider it. It's easy to understand, it fills a need for your client, and the compensation is very compelling.

6. Life with Long-Term Care Rider Client Leave Behind

The need for a long-term care plan is critical, but we all know that traditional long-term care insurance isn't as feasible as it once was.

Many insurance carriers have stopped offering the product altogether. If your client does apply, there's about a 50/50 chance they're approved, and if they do get the product, rate increases can really take a toll on their finances.

We love a life with LTC option, because it takes away most of those issues, and the best part is that your client knows the benefit will be used. Either they'll get long-term care benefits while they're living, or their beneficiaries will get the death benefit when they pass. That's a lot of peace of mind.

This client leave behind goes through all the important stats and facts with an emphasis on how life with long-term care can be a great solution.

Stats mentioned include:

- There is a 68% chance that a senior over the age of 65 will need some kind of long-term care (AARP: A Report to the Nation on Independent Living and Disability).

- The average amount of time a person will spend in a nursing home is 3 years (American Association for Long-Term Care Insurance).

- Projections estimate that 20 years from now, a 3-year stay in a nursing home would cost $554,256.

7. Cancer Insurance Client Leave Behind

The cancer insurance handout answers the question "Why is cancer insurance important?"

All of the statistics are from reputable sources like the American Cancer Society, the National Cancer Institute, and the Yale Journal of Biology and Medicine.

This "Why Is Cancer Insurance Important?" client handout outlines every facet of your presentation:

- The real risks of cancer

- How Medicare handles cancer costs

- The truth about indirect cancer expenses

The information on this handout will certainly get your clients thinking, and as usual, this non-branded handout is customizable with your logo and contact information.

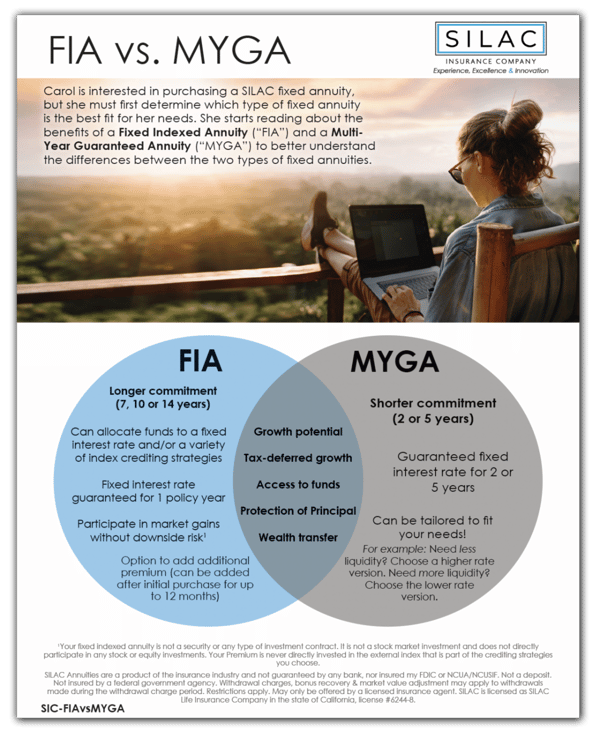

8. GTL Ancillary Products Flyer

Guarantee Trust Life (GTL) has some great ancillary products, including Hospital Indemnity and home health care insurance policies.

While plans are subject to state availability, there is a nice consumer flyer available in the agent portal (available under every product) that gives a brief explanation of each policy type.

This kind of flyer can be a great introduction to filling the gaps of an MA plan or talking about the cost of home care or nursing home stays later in life.

9. Dental Insurance Flyers

Lots of carriers have great dental plans, and consumers are searching for these plans. The carrier you should get appointed with will be influenced by what state you're in, so just reach out to us for a recommendation.

Companies have found that consumers respond to dental mailers at a much higher rate than any other product type, and that's information we shouldn't ignore!

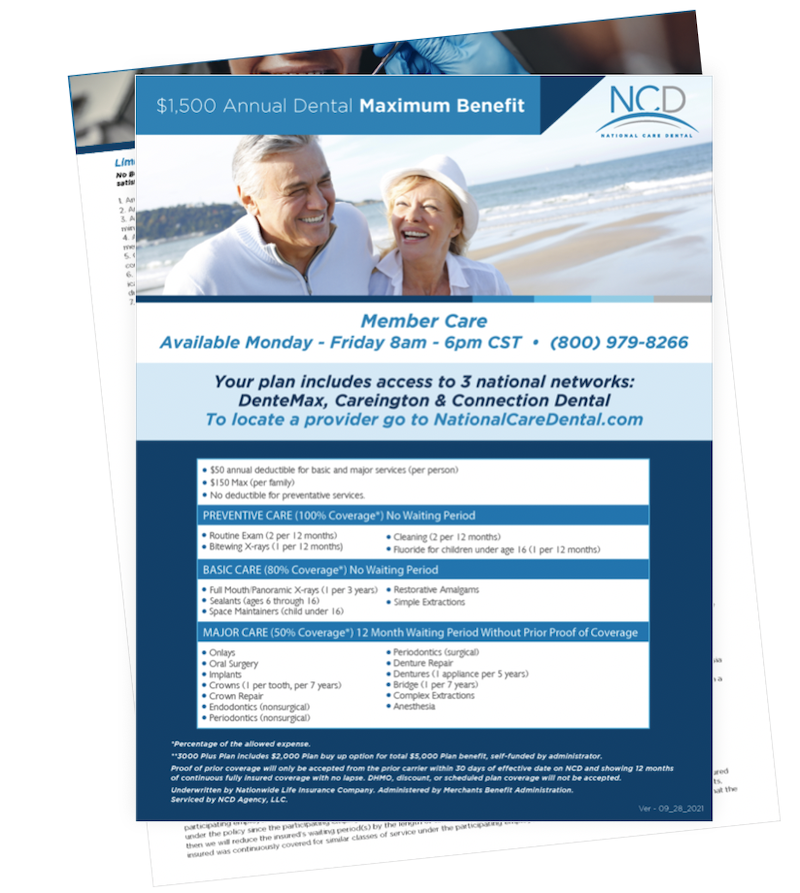

As an example, National Care Dental has a nice flyer in their agent portal that quickly shows the value a beneficiary can receive from a dental plan.

Especially for agents who are serving Med Supp clients this AEP, I'd strongly suggest bringing up dental.

10. Short-Term Care Client Leave Behind

Last but not least is our brand new Short-Term Care leave behind.

You can use this handout to help your clients understand the value of having a short-term care insurance policy.

Medicare doesn’t cover long-term care, but long-term care insurance is expensive and hard to qualify for. Enter short-term care: an affordable way to protect finances from an unexpected situation in the future if your client needs extended care.

This STCi client leave behind outlines every facet of your presentation:

- Your odds of needing extended care after age 65 are high

- The costs associated with extended care are the biggest threat to your nest egg

- Medicare isn't enough

Conclusion

During the Medicare AEP, the last thing you want to do is stretch out an appointment and cover new products with a client. Plus, if you're selling Medicare Advantage and/or PDP products, you really can't talk about other product lines without violating compliance regulations.

Client leave-behinds and desk displays are the perfect solution. They inform your client about what you offer and give them an opportunity to read through the information on their own time.

Don't forget to download our bundle of leave behinds:

Thanks for reading, and good selling!