Ahh, underwriting. The bane of many an independent insurance agent's existence.

While many of us struggle to place tough cases as we bury our noses in underwriting guides, there are underwriters out there who have some valuable tips to make your life easier.

We've spoken to a few underwriters on the life insurance and Medicare Supplement side to gather some underwriting tips for agents. If you want to be in the good graces of the underwriter – and put yourself in their shoes for a few minutes – this one's for you.

Jump ahead:

Medicare Supplement Underwriting Tips

Revellie Pope and Erika Cox, Underwriters at Sentinel, have lots of tips for independent agents.

Their underwriting advice can be boiled down into four main points:

- Do a risk assessment before seeing your client.

- Get familiar with the field guide.

- Prepare your client.

- Include agent notes more often.

Do a Risk Assessments Before Seeing Your Client

In Revellie's perfect world, the agent would do a basic risk assessment before seeing the client. For example, let's say you know your client is diabetic, is on insulin, and takes a heart medication like carvedilol.

Call underwriting with that information before you meet with your client! They can tell you before you even start your appointment if your client would be a possible decline, and they can also arm you with additional questions to ask, like:

- Dow many units of insulin does your client take?

- Why is the heart medication taken?

"We really prepare the agent," Revellie explains. "Call us before you go meet your client, and we'll suit you up."

"We really prepare the agent," Revellie explains. "Call us before you go meet your client, and we'll suit you up."

Over time, Revellie and Erika explain that you'll need to call in less and less, because you become more equipped. "We know that by teaching agents how to fish, it'll eventually become easier for us," Revellie says.

By the end of your risk assessment call, you'll know what additional questions to ask your client, because they're the exact questions the underwriters will ask during a phone interview. Your client may still get a call, but at least you know what those answers will be.

Get Familiar With the Field Guide

Underwriters get it – you're busy, and flipping through a field guide isn't exactly your idea of a good time.

However, the field guide can save you from submitting an application that will inevitably be a decline.

The field guide includes the following kind of information:

- State rules

- Guidelines for GI and open enrollment

- Height/weight tables

- Application information

- Health questions

- Information on selective underwriting (the underwriters select cases and call the client for additional information)

The health questions section will go through everything you need to know, such as what is considered a controlled condition, diabetes with other conditions, cancer, conditions that lead to a decline, etc.

"We see agents submit applications for clients who use a defibrillator, but it's in the field guide," Revellie explains. "Agents submit someone using pulmonary (COPD) meds every day, and that's also in there. It's just a few pages of the field guide, and it'll save you a lot of heartache."

One area that causes a lot of confusion is clients who have diabetes. For Sentinel, this is Question 15e, and yes – Revellie and Erika know that by heart!

"Agents generally don't dig in enough on that question. We want them to mark 'yes' if the client has high blood pressure," Revellie says.

Many times, there will be a high blood pressure medication listed, but the agent doesn't ask if there's a history of an event. Maybe 10 years ago, they had a stroke, and that's what ends up leading to a decline.

"Agents don't always think about the history of events – they're worried about the treatment of existing conditions. But underwriters are worried about both the history of events and the current treatments," Revellie explains.

Revellie and Erika say that they trust agents to be really great field underwriters, and they're more than willing to partner up when they're meeting with a client. "If an agent is thrown a curveball during office hours, give underwriting a call! We want to make sure you're better out in the field," they say.

Prepare Your Client

When your clients are caught off guard by an 800 number, they typically won't answer it. That eventually turns into a cancelled application when the underwriters can't get in touch with the client.

Erika says that preparing your client for a potential phone interview is really important – even if you don't think they'll get one.

"Sometimes, the reports we pull aren't current, so we have to call to verify. Also, even if the client isn't taking any meds at the time, there could be something in the history that's concerning, so we'll call them. Agents aren't always preparing their clients for that, and they're not expecting the call," she explains.

Additionally, Erika and Revellie encourage agents to call underwriting when they're with the client if needed – just be sure to let them know this is NOT the phone interview. If the application isn't yet submitted, any calls with the underwriter are not going to count as the phone interview.

"The three of us can discuss the client's history and meds so I can give a proper risk evaluation. That helps clients feel more comfortable with the company," Erika explains.

It's great to to problem solve right there with the client, especially if it's a decline, because you can move to another company when they're there. Erika says these calls only take a few minutes, and there's almost never any kind of hold time.

Being proactive is always the way to go, so be sure to prepare your clients! It'll not only make your life easier, but it also makes sure the underwriters don't get sent to voicemail.

Include Agent Notes More Often

"Agents don't include agent notes often enough," Erika says.

If you're not sure what to include in the agent notes section, here are two things the underwriters would love to see more:

- Why a medication has changed, even if you don't think it's important

- An explanation for any kind of event in the medical history

Change in medication is typically an issue, especially for carriers that do an Instant Decision. However, by including an explanation in the agent notes, you may be able to save the application from being declined.

"Maybe it was a cost issue, it was a temporary medication and the health reason in't what it appears to be, or maybe there was even a change because the FDA discontinued the drug," Erika explains.

By including more information more often in the agent notes, you'll be able to save a lot of time – and potentially some applications!

Life Insurance Underwriting Tips

We were fortunate enough to speak with Stuart Buchanan, Chief Operations Officer and Business Development at KSKJ Life.

There are several things that underwriters want agents to know, and Stu boiled it down into 5 key points:

- Establish a relationship with the underwriters and department head.

- Call when you're submitting an especially important case.

- Be as thorough as possible on the application.

- If you disagree with the decision, do it respectfully.

- Submit cover letters more often.

Establish a Relationship With the Underwriters

If you take nothing else from this entire article, Stu says it's all about the relationship.

"We're in a relationship business. Agents need to have relationships with the companies they do business with. I've been doing this 38 years, and I can tell you that the agents who develop a relationship get the benefit of the doubt," he says.

"We're in a relationship business. Agents need to have relationships with the companies they do business with. I've been doing this 38 years, and I can tell you that the agents who develop a relationship get the benefit of the doubt," he says.

Ultimately, the underwriter and department head want to trust you, and you want to trust them. You don't have to be friends, but get to know them! Learn their habits, what they want and expect, and provide that.

Always be a step ahead of them, and it'll earn you the benefit of the doubt.

Call When Submitting an Important Case

Every case is important, but every once in a while, you get one that really stands out from the rest.

For example, if you close this particular life case, you know you have 10 more coming. Whatever the scenario may be, the underwriters want to help you, but they need to know if a case is especially urgent!

"Call them and tell them," Stu says. "We try to treat each case the same, but if an agent calls us and tells us it's a very important one, we keep our eye out for it."

Be Thorough on the Application

The more thorough the application, the faster the entire process will be.

Stu says that if the app paints a thorough picture of the client, the processing time can be as little as a week. If there are gaps in the application, it can take up to 3 months!

"I know that's a long time, but sometimes, it takes that long to get the information we need," he explains.

Generally, the underwriters get a good picture of the client's health from the tests they get, such as the prescription history. The biggest problem life insurance underwriters have is trying to fill in gaps. For example, the application says one thing, but the prescription history leads them in another direction.

There are a lot of medications out there, and many treat multiple conditions. Stu says that often times, experienced agents know what meds treat, so they make assumptions and write down the reasoning on the application without asking.

There are a lot of medications out there, and many treat multiple conditions. Stu says that often times, experienced agents know what meds treat, so they make assumptions and write down the reasoning on the application without asking.

If you're wrong, and that medication is treating something different, the underwriters will ask about it, and it'll extend the application process.

Additionally, Stu says that sometimes, agents don't give enough details on questions that are answered "yes."

"We need to know a little bit about those. For some agents, it's uncomfortable to ask about health. Just remember that people are generally very open if they're applying for life insurance, and odds are we're going to find out, so just deal with it upfront," he advises.

It's Fine to Disagree, But Do It Respectfully

"I never have a problem with an agent questioning something - it's their right," Stu says.

Where many agents go wrong is how they go about the questioning. "All too often, the agents get mad and go above underwriter. If you disagree with something, it's best to work with the underwriter than to go above them. It's all about trust," he says.

The best way to disagree is to ask the underwriter if they can review the application with their superviser. This helps keep the trust and the relationship you've established.

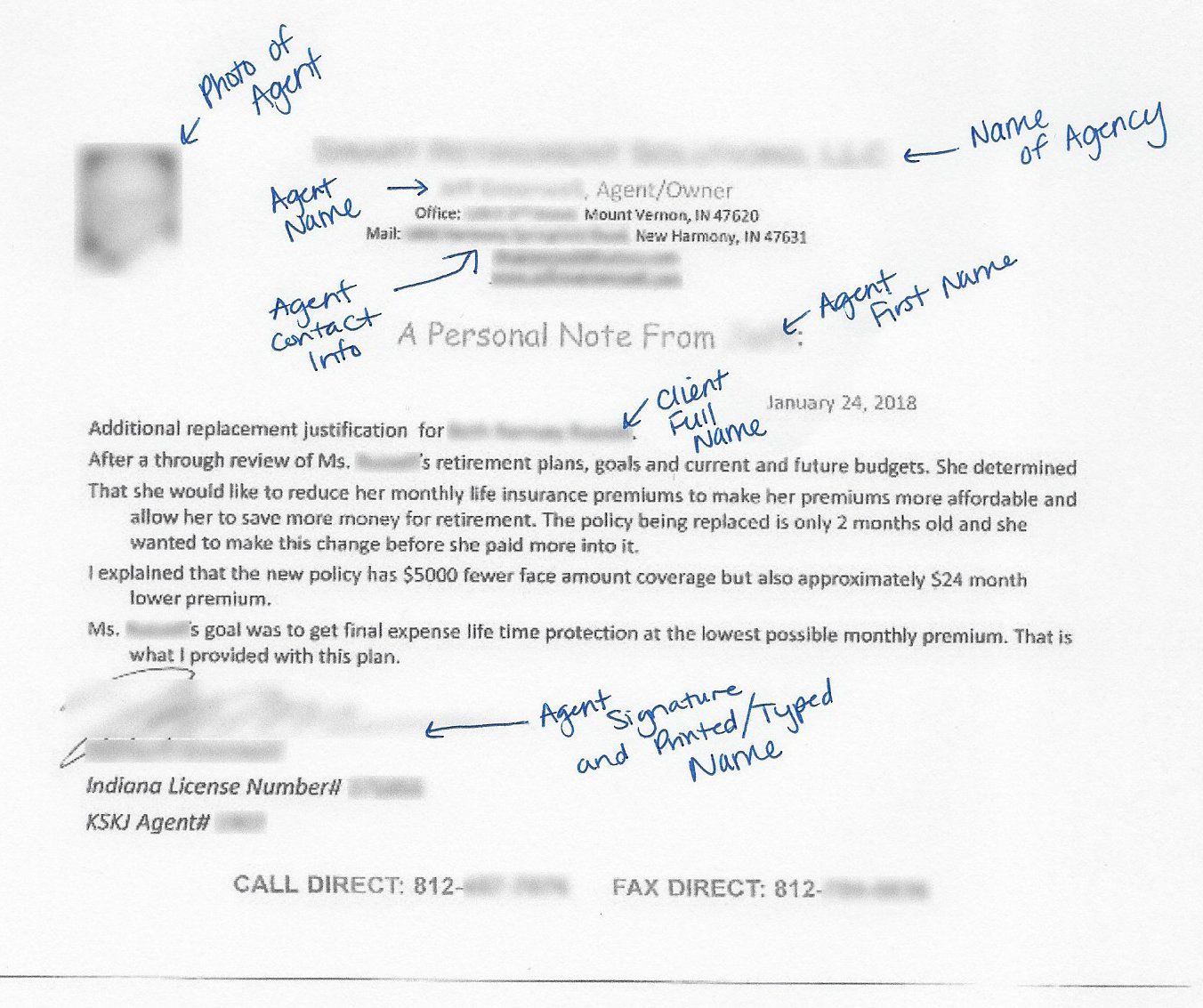

Submit Cover Letters More Often

Not many agents do cover letters. In fact, in Stu's experience, less than 5% of agents actually do it.

"Agents get afraid because they think it has to be long. It can be a paragraph or two... it can be handwritten! I'm thrilled when I see one," he says.

The purpose of a cover letter is to provide more information about the applicant, such as:

- Health history

- Family history

- Why they want this amount of life insurance

- Where the money is coming from to the pay for the policy

Cover Letter Example

For example, let's say it's a younger client, and they want a massive amount of life insurance. Why are they applying for that amount? Is there something behind the scenes that isn't apparent?

"You see a picture, and sometimes that picture doesn't always tell the whole story. It's what we're not seeing that we should know," Stu explains.

Another example is if someone is coming in for a $10,000 premium, but their annual income is only $60,000. "Maybe it's coming from another source we don't know about. We're going to ask, so if we know up front, it takes away that hurdle," Stu says.

While not every case requires a cover letter, including one definitely helps paint a better picture for the underwriter, and once again – it can speed up the entire process. Best of all? It helps establish that trust factor and relationship between you and the underwriter.

Typically, the agents who consistently send in cover letters are the ones who develop the best relationships with the underwriters.

You may also enjoy: