The problem is Medicare is complex, with plans and parts and regulations and enrollment periods... it's a lot.

If you've been wanting to get into senior market insurance sales, namely Medicare Supplements, you'll need a comprehensive understanding of Medicare first.

In this Medicare Guide, you'll learn all about Medicare, including:

- Why Enter the Medicare Market?

- The Parts of Medicare

- What Medicare Doesn't Cover

- Medicare Enrollment Periods

- How Medicare Supplements Work with Medicare

- Medicare Part D – Prescription Drug Plans

- The Alternative Choice – Medicare Advantage Plans (Part C)

- What Next?

Plus, if you're already a Medicare pro, we've sprinkled in some fun facts about Medicare throughout this article. If nothing else, this article will help you become a Medicare trivia whiz.

If you're already in the insurance industry (or are a financial professional) and are just new to Medicare, you'll likely catch on quickly. Once you get the basics down, you're golden – until new regulations are passed and everything changes.

Just kidding – sort of! We'll keep you up to date on major changes, and if you ever have any questions, don't hesitate to contact our team!

Why Enter the Medicare Market?

If you're here, I'm guessing you're toying with the idea of selling Medicare products to seniors.

We all need some reassurance now and again, so I want to supply you with some data telling you that the Medicare market is hot-hot-hot.

10,000 New Prospects Per Day

First of all, around 10,000 baby boomers are turning 65 every single day and that's not slowing down any time soon.

Every year, we put out a summary of the Medicare Trustees Report, and the most recent one told us that there are nearly 60 million people on Medicare.

If you're worried that there's a shortage of prospects... well, don't!

Fun Fact: Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

Seniors Need Help

Secondly, there's a built-in need for someone like you. Medicare is confusing. Even if you're a Medicare agent, it's still intimidating when it's your turn to turn 65.

What happens to your mailbox as age 65 approaches is overwhelming, to say the least. Every day, you'll walk out to your mailbox overflowing with mailers, adverts, postcards, signup forms – it's really hard to discern what's junk and what's worth looking at.

In addition, Medicare alone doesn't offer enough coverage – individuals aging into Medicare need a secondary.

The Money Is Great

Last but not least, you also may be here because you hear that Medicare sales can be lucrative. Right you are!

However, most new agents don't make much in the first year or two, which explains why such a high percentage of new agents quit within the first year.

Medicare Supplements have renewals, which means every year a client keeps their policy, you receive additional commission. Over time, your income starts growing as you earn renewals and add new clients. It's not unheard of to be making 6 figures after several years of working your tail off.

Fun Fact: In 1965, when Medicare was first signed into law, the budget was about $10 billion. Today, the budget is over $700 billion.

The Parts of Medicare

Medicare is overseen by CMS, the Centers for Medicare & Medicaid Services. CMS sets marketing rules and regulations for Medicare Advantage (Part C) as well as Part D drug plans, but we'll get into those a bit later.

Quick note: We are talking only about Medicare in this article. Medicaid is a medical assistance program that helps many people who cannot afford medical care. You can read more about Medicare vs. Medicaid here.

Original Medicare is made up of two main parts: Part A and Part B.

Medicare Part A is hospitalization coverage, or hospital insurance. Any Medicare-approved expenses that happen in an inpatient setting, such as inpatient hospitalization, skilled nursing care, and sometimes even at home, are going to be partly covered.

If you'd like to see specifics on what's covered by Medicare Part A, you can scroll through the Part-A covered services section from the 2022 Medicare & You Handbook.

Medicare Part B is going to cover medical and doctor services, so it's generally referred to as medical insurance. Any Medicare-approved expenses that happen in an outpatient setting, such as doctor visits, outpatient procedures, medical equipment, labs, and X-rays are going to be partly covered by Medicare Part B.

Again, to see specifics on what's covered by Medicare Part B, look at the Part B-covered services section in the Medicare & You Handbook.

So, that's "Original Medicare" – Part A and Part B.

Fun Fact: The original Medicare program included Part A (hospital insurance) and Part B (medical insurance). That's why today, these 2 parts are called "Original Medicare." Over the years, new parts have been added, but A and B are considered original.

In addition to that, there is a Part C, also called Medicare Advantage, and a Part D, which is prescription drug coverage. We'll go over those in more detail later on. Both of those plan types are optional.

Medicare A and B Cost Responsibilities

We mentioned earlier that Medicare enrollees need a secondary, and that's because Medicare leaves a good chunk of the financial responsibility on the table.

For Medicare Part B, you can essentially say that Medicare covers about 80%, and the enrollee is responsible for the remaining 20%. That's the coinsurance split.

Part B also has a monthly premium, $170.10 per month in 2022, as well as a deductible, $233 in 2022. The monthly premium goes up on a sliding scale based on your income.

Fun Fact: When Medicare Part B originated, its premium was $3 per month.

For Medicare Part A, it's not quite as cut-and-dry. Medicare covers different amounts depending on how many days you need inpatient care.

First of all, there's a deductible, $1,556 in 2022, and it's premium-free as long as your client worked for at least 10 years and paid Medicare taxes during that time.

Beyond the deductible, the first 60 days have $0 coinsurance, and the coinsurance amount goes up from there. In 2021, Days 61-90 have a $389 coinsurance per day, and Days 91+ have a $778 coinsurance per "lifetime reserve day" which caps at 60. Once your client hits their lifetime reserve day maximum, they're responsible for ALL costs.

This explains how Medicare does NOT pay for long-term care.

What Medicare Doesn't Cover

Medicare doesn't cover everything. In most cases, it's covered if it's medically necessary, but there are still some exclusions.

Medicare will not cover:

- long-term care

- most dental care

- eyeglasses

- dentures

- hearing aids

- cosmetic surgery

- acupuncture

- routine foot care

The big ones are most definitely long-term care, as well as dental, vision, and hearing. Many seniors opt to purchase separate insurance policies for these items.

If a Medicare enrollee is at the doctor's office or the hospital, the physician must present them with a form explaining that a certain item or service is not covered by Medicare.

This helps Medicare enrollees know that everything is covered unless they are presented with a waiver they have to sign saying otherwise.

A perk of being new to Medicare is the "Welcome to Medicare" preventative visit. This visit is completely free and can be used within the first 12 months of having Medicare Part B.

Fun Fact: In 1988, Congress passed a bill establishing an actual limit to Medicare's total out-of-pocket expenses for Part A and B. That bill was repealed less than a year later after backlash from senior groups. To this day, there is no cap for Medicare's out-of-pocket costs.

Medicare Enrollment Periods

Enrollment periods can be confusing. However, if you ever have a client that has a unique situation, or you just need a refresher, don't be shy and call us. We love helping out agents!

Initial Enrollment Period (IEP) – Turning 65

Three months before, the month of, and three months after you turn 65, your client has their Initial Enrollment Period (IEP). They automatically get Part A of Medicare when they turn 65, which is $0 premium for most people.

Fun Fact: In 1972, Medicare expanded to cover the disabled and people with end-stage renal disease (ESRD) requiring kidney dialysis or kidney transplant.

About 3 months before they turn 65, they'll receive their Medicare card. If a person is already drawing Social Security, it'll have Part A and Part B included.

Read: How to Help Your Clients Sign Up For Medicare Part B

Working Past 65?

As a quick side note here, if a person plans to work past age 65, they may not want to enroll in Part B, because they'd be double-covered. If their employer's plan offers that coverage and they're signing up for Part B, they'd be paying for two insurances.

Fun Fact: About 1 in 5 Americans over age 65 continues to work, which is the highest percentage in over 50 years.

In that case, the individual would check the box on the back of their Medicare card saying "I do not want Medicare Part B at this time" and send it back.

It's important to walk through that client scenario to determine if it's best for them to go on Medicare Part B or if it's best to stay on their employer plan.

More often than not, it's attractive for a person to stay on their group plan versus going to Original Medicare while working. It's different for everyone, so it's important to look at what they're paying for what coverage.

Special Enrollment Period (SEP)

If your client didn't sign up for Medicare Part B when they were first eligible because they were covered already by another kind of insurance (such as an employer group plan), there is something called a Special Enrollment Period (SEP).

This is effective anytime a person is still covered by a group health plan or during an 8-month period that starts the month after your employment ends (or the coverage ends).

If your client signs up during an SEP, they don't pay a late enrollment penalty.

Fun Fact: There are 25 circumstances that qualify a person for a Special Enrollment Period.

General Enrollment Period

If your client didn't sign up for Medicare during your IEP – and they don't qualify for an SEP – they can sign up for Medicare between January 1 and March 31 each year. This time is called the General Enrollment Period (GEP).

Coverage wouldn't start until July 1 of that year, and they'd be penalized for enrolling late.

Fun Fact: Or not-so-fun fact – the Part B late enrollment penalty is a 10% premium increase for every 12 months you decide not to have Part B (but could've had it).

How Medicare Supplements Work with Medicare

Medicare is always going to be primary, and as a general rule, Medicare offers roughly 80% coverage, and the Medicare Supplement picks up roughly 20%, or what's left after Medicare.

Fun Fact: About 35.1% of Medicare beneficiaries have a Medigap plan (as of 2017, which is the latest data published by AHIP).

That's also why Medicare Supplements are sometimes called Medigap plans – they cover the "gap" left behind after Medicare. A Medicare Supplement and a Medigap policy are exactly the same thing.

Medicare Supplements are not a part of Medicare – they just work with Medicare. These supplements are not sold by CMS. Instead, they are sold by private insurance companies like Cigna, Aetna, or Blue Cross Blue Shield.

Fun Fact: 59% of Medigap policyholders are women, whereas only 41% are men.

A Medicare Supplement is doctor and hospital coverage only. It does not include prescription drug coverage or any coverage outside of what is approved by Medicare.

Medicare Supplement Plan Types

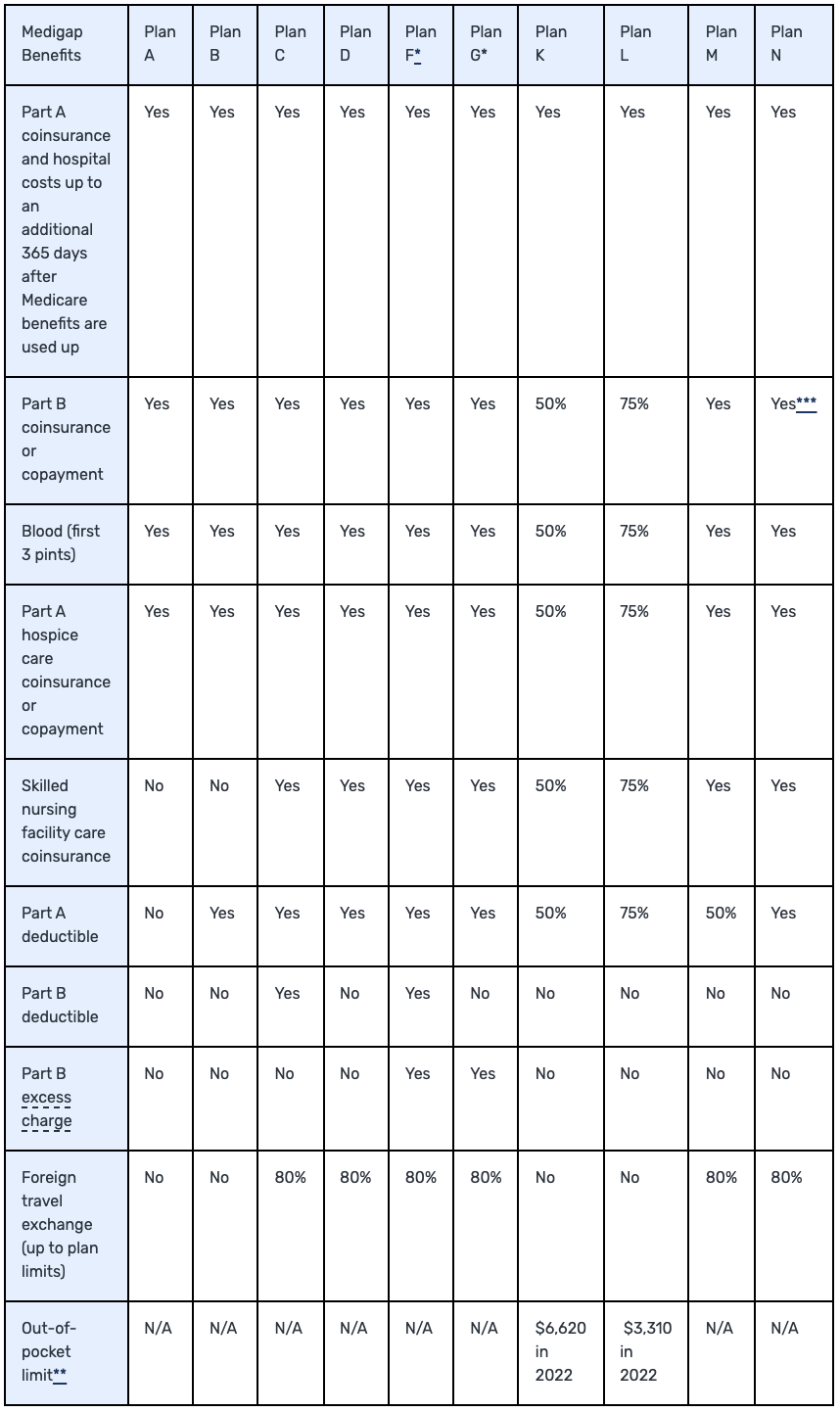

There are several Medicare Supplement plans on the market, organized by letters A-N.

Notes:

-

Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,490 in 2022 before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

-

For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.

-

Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in inpatient admission.

- Massachusetts, Minnesota, and Wisconsin offer different standardized plans.

Each plan has slightly different coverage, but you'll quickly find out that most of the business is going to come from Plan F, G, and N (at least in our neck of the woods, but the national numbers would also agree).

It's important to know that there are only 2 main differences in Medicare Supplements from carrier to carrier, and those are cost and underwriting. If a person has a Plan G, we know by law that every company has to provide those same Plan G benefits.

Since plans are standardized, the only difference between one company and another is how much they charge for the plan and what their specific health questions are.

Want to get started with Medicare Supplement sales? Be sure to check out The Beginner's Guide to Selling Medicare Supplements

Which Medigap Plans Are Most Popular?

To paint a better picture, we can look at the 2020 State of Medigap report from AHIP about what kinds of plans people are buying.

Plan F has always been a chart-topper with its comprehensive coverage. With Plan F, all Medicare-approved expenses – including the A and B deductibles – are covered. Plan F accounts for 53% of all Medigap plans sold (as of 2018, which is the latest published data).

Plan G is the second most sold plan, accounting for about 17% of all plans sold. Plan G offers the same coverage as F except for the Medicare Part B deductible. Plan G has been steadily increasing in popularity since 2013 when it accounted for only 6% of all plans sold.

Finally, Plan N is the third most sold plan, with 10% of the Medigap marketshare. Plan N is a the lowest premium of these three options, but it does come with copays at the doctor and the emergency room, which many seniors don't like. (It also has excess charges, but you can read more about Plan N here.)

Percentage of Enrollment in F, G, and N Medigap Plans (2013-2017)

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|---|

| Plan F | 55% | 56% | 57% | 55% | 55% | 53% |

| Plan G | 6% | 6% | 8% | 10% | 13% | 17% |

| Plan N | 6% | 7% | 8% | 9% | 10% | 10% |

It is important to know that as of January 1, 2020, Medigap plans sold to new people with Medicare won’t be allowed to cover the Part B deductible. Because of this, Plans C and F are no longer available to people new to Medicare starting on January 1, 2020.

If a person has either of these 2 plans (or the high-deductible version of Plan F) or are covered by one of these plans before January 1, 2020, they can keep their plan. If they were eligible for Medicare before January 1, 2020, but not yet enrolled, they may be able to buy one of these plans.

Fun Fact: California, Florida, Texas, Illinois, and Pennsylvania are the Top 5 states when it comes to number of Medigap enrollees.

Open Enrollment vs. Guaranteed Issue (GI)

The difference between open enrollment and Guaranteed Issue (GI) can be confusing, so again, if you're not sure, just give us a call.

For a comprehensive understanding, you can always take a look at this article: An In-Depth Explanation of Guaranteed Issue (GI) and Open Enrollment

But here's the quick summary: When someone signs up for Part B for the first time, they're in open enrollment. There’s a federal regulation that exists allowing anyone – regardless of health – to be accepted for any Medicare Supplement.

Guaranteed Issue (GI) situations occur when something happens to the person’s existing insurance. Here are 2 common examples:

- A person is in a Medicare Advantage Plan, and they move out of the plan’s service area.

- Their employer’s group health plan is ending.

In these circumstances, that person has a 63-day window to choose a plan without having to pass medical underwriting. They have the right to buy Medigap Plan A, B, C*, D*, F*, G*, K, or L that’s sold by any insurance company in your state.

*Plans C and F are no longer available to people who are new to Medicare on or after January 1, 2020. However, if you were eligible for Medicare before January 1, 2020 but not yet enrolled, you may be able to buy Plan C or Plan F. People eligible for Medicare on or after January 1, 2020 have the right to buy Plans D and G instead of Plans C and F.

It's possible to be GI AND open enrollment at the same time. For example, a person might be getting dropped from their employer’s group health plan, so you decide to enroll in Medicare Part B for the first time. Technically, they are GI and open enrollment.

It’s in your client's best interest to always opt for open enrollment if they can because they can choose from any Medigap plan rather than just a select few.

Fun Fact: The Midwest has the highest percentage of Medicare beneficiaries with Medigap plans, often over 35%. As you travel closer to the coast, the percentage drops, often under 20%.

SELECT Plans

In some scenarios, some insurance companies provide what's called a SELECT plan. This states you have to go to a select list of hospitals, or you have to live within a certain radius of a select list of hospitals in order to be eligible for the plan. A SELECT plan is not common, but it's cheaper than a regular plan.

Just to give you an idea, in 2016, there were just under 700,000 Medicare SELECT enrollees. There are over 13 million Medigap enrollees, so the SELECT policies make up a very small percentage of the business.

Medicare Part D – Prescription Drug Plans

Medicare Part D is prescription drug coverage sold by private insurance companies. It's often called a Prescription Drug Plan, or PDP for short.

Surprisingly, Part D is one of the best lead sources our local agency has. It's a huge service to clients, because it's difficult to understand! They need our help, and it's often the door opener to bigger opportunities.

Fun Fact: Over 45 million people have a Medicare Part D plan, or about 70% of all Medicare beneficiaries.

In order to make a commission off of Part D plans, you'll need to be AHIP certified in addition to completing carrier certifications each year. There are also some marketing rules and regulations set by CMS that you must follow, but most of that you'll learn through the AHIP certification.

Fun Fact: As of 2019, brokers are officially allowed to ask for referrals during one-on-one appointments. Just remember to fill out a Scope of Appointment (SOA) form before any appointment where marketing activities will ensue.

Medicare Part D Costs

CMS sets some regulations about Medicare Part D costs. Here are some numbers to help understand Part D costs in 2021.

- The yearly deductible cannot exceed $480 in 2022

- Your client may pay more for Part D premiums if they have a high income

- Once your client and their plan spends $4,430 combined on drugs (including deductible), they'll pay no more than 25% of the cost for prescription drugs until their out-of-pocket spending is $7,050, under the standard drug benefit (as of 2022)

The average plan premium for a Part D plan in 2021 is $33.

Part D plans also have copayments, which vary depending on which carrier you choose. For example, you might pay a $2 copay for all generic drugs. Alternatively, you might pay a coinsurance, such as 20% of a drug's cost. However, you won't have both. Medicare.gov explains you'll either have a copayment OR coinsurance.

Part D Enrollment

To help a client enroll in a Medicare Part D plan, you can use the Plan Finder tool on Medicare.gov and/or MedicareCENTER's enrollment platform.

We've created a Medicare Part D Cheat Sheet that shows you each step when using the Plan Finder tool.

Read More: The Insurance Agent's Guide to Medicare.gov's Plan Finder

In general, you can only enroll clients in a Part D plan during AEP, which is from October 15-December 7 each year, or when a client is new to Medicare and is signing up for the first time.

If you're dealing with a person on Medicaid, a plan will be auto-assigned to them and you will not need to select a plan for them.

The Alternative Choice – Medicare Advantage Plans (Part C)

Medicare Advantage plans, or Part C of Medicare, are managed care plans that are network-based and are sold by private insurance companies. This is an alternative to Original Medicare with a Medicare Supplement.

Fun Fact: About 42% of Medicare beneficiaries have chosen to enroll in a Medicare Advantage plan (as of 2021). That percentage has nearly doubled over the past decade as MA popularity soars.

When someone purchases a Medicare Advantage plan, they technically still have Medicare, but they no longer receive benefits from Medicare. This can be a tad confusing, but all claims are billed directly to the private Medicare Advantage insurance carrier.

All Medicare Advantage plans are required to cover at least what Medicare covers, and some offer additional benefits.

Fun Fact: Medicare Advantage plans first became available in 2006.

Just like Part D, there are marketing rules and regulations set by CMS. For example, you can't sell MA plans door-to-door or discuss other products during the appointment.

You must be AHIP certified in addition to carrier certifications to sell these plans, and those certifications will lay out those rules in more detail.

Fun Fact: As of 2019, CMS is now allowing brokers to initiate contact via email in addition to conventional mail and print media. If you choose to initiate contact via email, the only caveat is that you must provide an opt-out opportunity.

Medicare Advantage plans that include drug coverage are called MAPD plans (Medicare Advantage plans with prescription drug coverage). Medicare Advantage plans without drug coverage are simply referred to as MA plans.

Fun Fact: About 89% of Medicare Advantage enrollees are in plans that have prescription drug coverage.

Differences Between MA Plans

The two main differences between MA plans are the cost of the plan and who's in the network.

MA plans will have a maximum out of pocket, a premium, co-payments, and a deductible.

Fun Fact: As of 2021, most Medicare Advantage enrollees are in plans operated by UnitedHealthcare (27%), Humana (18%), or BCBS affiliates (14%).

Networks are one of the most important things to consider. Depending on the plan, there will be a select list of hospitals, doctors, specialists, and skilled nursing facilities your client is allowed to visit. If the plan includes drug coverage, there will be in-network pharmacies as well.

Your client may pay a higher amount if they go out of network, or they may not be covered at all depending on the specific plan.

Before a client enrolls, you want to call and confirm that their usual doctors and hospitals are in the network. This is extremely important!

Further Reading: 10 Reasons You Should Seriously Sell Medicare Advantage

Ideal Client Profile for an MA Plan

One nice thing about MA plans is that there aren't underwriting questions. It doesn't matter what your weight is, if you smoke, or anything else.

The ideal client profile for an MA plan is someone who:

- Sees underwriting as a potential concern

- Can't really afford the premiums of a Medigap plan

- Doesn't travel much

- Likes the extra benefits that often come with MA plans

That client profile is key when trying to determine which path to go down: Medicare Supplement or Medicare Advantage?

Many times, people are passionate about one option over the other, but there's no one-size-fits-all option. Both products have their place depending on what fits the client's needs the best.

Read more: Medicare versus Medicare Advantage

Medicare Advantage $0 Premium Options

Medicare Advantage plans are funded by the federal government, and premiums can sometimes be as low as $0. Many wonder how an MA plan can be any good if it's $0 premium.

Fun Fact: About 60% of all MAPD enrollees pay $0 premium.

The federal government says that the average cost for a Medicare beneficiary is around $14,000 per year. They try to save money by sending less than that amount to the private insurance company, who now takes on the risk of that individual.

In sum, the government sends money to the insurance company – let's call it $12,000 per year – to get you off of Medicare, and they hope to save money in the long run.

Keep in mind Medicare Advantage enrollees still pay the Medicare Part B premium, even though they don't get benefits from Original Medicare.

Enrolling in a Medicare Advantage Plan

As a rule, a person can only sign up for a Medicare Advantage plan if they're in their IEP, they qualify for an SEP, or it's AEP. Acronym overload!

As a reminder, that's when you're signing up for Medicare for the first time, if you qualify for one of 25 special enrollment periods, or from October 15-December 7 each year.

If you determine a client profile matches up with an MA plan, you will use the Medicare Plan Finder tool and/or MedicareCENTER to enroll them.

Fun Fact: New 2019 CMS guidelines allow brokers to schedule future appointments during educational events. However, brokers are still prohibited from distributing enrollment forms and marketing materials other than business cards and contact information.

If a client wants out of their MA plan, they can use the Medicare Advantage Disenrollment Period (MADP). This is from January 1-March 31, and it allows a person to get out of their MA plan and get into something else.

What Next?

After you're familiar with how Medicare works, it's time to take the next step. Logistically speaking, that means getting the proper licensing and certifications completed.

Read more: Step-by-Step Guide to Getting Started In Medicare Sales

In addition, Jason Ferguson, CMO, put together an e-book that goes through everything from getting started in senior insurance to growing your business once it's off the ground.

Finally, once you have a solid understanding of Medicare, you can expand to offer many more products that are needed by your target clientele.

In order to get the training you need, we recommend looking into our All-Star Program. You can learn about that program in more detail below.

If you need any help at all or are interested in getting into this market, please contact us! We can definitely help you by pointing you in the right direction, helping you get contracted with competitive companies in your area, and more.

Fun Fact sources:

https://www.medicareresources.org/basic-medicare-information/brief-history-of-medicare/

https://www.cms.gov/About-CMS/Agency-information/History/

https://nypost.com/2018/10/09/1-in-5-americans-over-65-are-still-waiting-to-retire/

https://www.ahip.org/wp-content/uploads/2018/06/State_of_Medigap18_FINAL.pdf

https://www.ahip.org/wp-content/uploads/AHIP_State_of_Medigap-2020.pdf

http://medicaresupp.org/wp-content/uploads/2016/12/2016-Med-Supp-Facts-PROTECTED-copy.pdf

https://www.excelsiorinsurance.com/medicare-marketing-guidelines/

https://www.kff.org/medicare/issue-brief/a-dozen-facts-about-medicare-advantage/

https://www.kff.org/medicare/issue-brief/a-dozen-facts-about-medicare-advantage-in-2020/

https://www.ahip.org/wp-content/uploads/IB_StateofMedigap2019.pdf