We recently held our Annuity 101 training webinar, and I thought I'd take some time to share the top 5 takeaways.

I get so excited when I can help an agent write their first annuity, so please don't hesitate to reach out to me for more support after checking out this article. We'd love the opportunity to earn your business.

Takeaway #1: We can help you no matter what level you're at.

Before I even got into the nuts and bolts of the webinar, I let everyone know that this is the key takeaway: we can help you no matter what level you're at!

Whether you've never written one before, you've written one or two, or you're looking to expand on the book of business you already have, we can support you.

Agents new to annuities should know that we will hold your hand and help you get up and running.

And existing annuity producers should know we take communication seriously. GREAT TEAMS HAVE GREAT COMMUNICATION!

The annuity landscape changes constantly, which is why we keep all of our annuity agents current with our annuity tip sheets, the annuity rates on our site, a quarterly annuity update, and also personal communication via phone and email.

A few more things you can expect from us:

- Follow-up: We stay on top of application corrections, the transfer process, and everything in-between.

- Updated forms: We keep our forms updated and make sure you have the proper ones whether it's during the app process or at the time of a claim or a withdrawal.

- e-App help: We have a lot of carriers that use the same Firelight e-App platform, and we'll help you get started on that.

- Annuity resources: Our marketing team does a fantastic job of creating annuity resources for new and established agents.

- Top carriers: New Horizons represents dozens of annuity carriers. You can browse our vast selection here.

If you're not yet doing annuity business with us, I would welcome the opportunity to earn it.

Check out out guide to Selling Annuities In the Senior Market

Takeaway #2: Qualified money means it's qualified to be taxed.

Lots of agents getting familiar with annuity terminology get hung up on qualified vs. non-qualified money.

You can remember it however you want to, but I find this little trick to be the easiest.

Qualified money is qualified to be taxed.

It's just a little trick that can help you remember it. To expand a bit, qualified money has not been taxed yet, and Uncle Sam is going to want to tax it at some point. Examples would be a 401(k), traditional IRA, Simple IRA, SEP IRA, 403(b), 457(b), pension plan, or 412(e)3.

Non-qualified money is the opposite – it has already been taxed. I like to think of this as "bank" money. Lots of individuals fund an annuity with money from a savings account, a mutual fund, a certificate of deposit (CD), or some other type of investment. This money has already been taxed, so it is non-qualified.

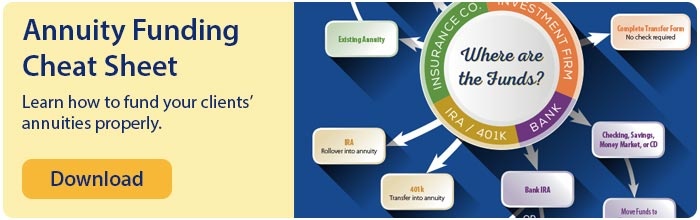

Takeaway #3: Grab the 1035 Exchanges/Transfers cheat sheet.

In the webinar, I talked a bit about 1035 exchanges and transfers. While it is helpful to hear all of that information, I would recommend downloading our cheat sheet.

It's the easiest way to ensure your clients fund their annuity properly.

Takeaway #4: Find out which annuity type is right for YOUR client.

Annuities aren't one size fits all. I put together a few bullet points to help you pinpoint which type of annuity is best for which client type.

- Older and looking for a guarantee? MYGA.

- A 4% return doesn't do much for your client? FIA.

- Hates to tie money up for a long period of time? Window annuity.

- Retiring but wants some growth for a few years, then a steady income? FIA with an income rider.

I can help you find out which type of annuity is right for your client, too. Talk to them, find out what you're working with, and consult with me. I'll help you select the annuity type and point you towards the most competitive carriers.

We hold your hand and do not take any of your commissions!

Takeaway #5: Ask simple questions to bring up the annuity conversation.

Selling an annuity is really as simple as asking a question.

We use our version of a fact finder, called a Client Needs Assessment, and that has prompting questions on it that reveal a potential need for an annuity.

But you can adjust that to fit your style. Here are a couple examples of questions you can ask to bring up the annuity conversation:

- Have you changed jobs in the past 5 years?

- Are you satisfied with your current rate of return on your investments?

I explain more about where these questions can lead you in the webinar recording, but the bottom line is this: just ask!

Watch the Annuity 101 Webinar Recording

Conclusion

We have so many resources for agents, including our annuity tip sheets, the annuity rates on our site, a quarterly annuity update, and also personal communication via phone and email.

Please know you can call us any time to check on rates or get advice on what's hot in the annuity space. If you're not yet doing annuity business with us, I would welcome the opportunity to earn it.

Thanks for reading, and here's to growing your annuity production this year!