In the heart of Alaska lies Denali, the highest mountain peak in North America. Formerly known as Mount McKinley, this peak is part of the Alaska Range and is the centerpiece of the Denali National Park and Preserve.

Denali grew quickly and grows higher and faster than most other mountains. It's still growing today and is more resistant to erosion. The story of Denali inspired the brand new annuity product from SILAC which strives to provide strong accumulation and lifetime income.

If you're familiar with the Teton product line from SILAC, you already know 90% of Denali™. Just like Teton, Denali™ is clean and simple. This new annuity line is efficient, and it's laser-focused on retirement.

The most incredible part? Denali™ has no fees. That's a very rare find when we're talking about an annuity product that provides lifetime income.

SILAC is accepting Denali applications starting June 22, 2020, and the first buy-date is July 1, 2020.

Jump ahead to any section at any time:

- What Is the Denali™ Series?

- Denali™ State Availability

- Denali™ Product Highlights

- Denali™ Lifetime Withdrawals, Explained

- Denali™ Wellness Withdrawals, Explained

- How to Run Denali™ Illustrations

- What Makes Denali™ So Special?

- Conclusion

Are you brand new to annuity sales? We recommend checking out our guide to selling them before diving into this more advanced article.

What Is the Denali™ Series?

The Denali™ Series is a Fixed Indexed Annuity (FIA) with a Lifetime Withdrawal Benefit. The Denali™ Bonus Series is a Fixed Indexed Annuity (FIA) with a Premium Bonus and a Lifetime Withdrawal Benefit.

If you know the Teton product, you already know 90% of Denali™.

With Denali™, SILAC set out to do retirement differently. They wanted a simple, understandable product that offered lifetime withdrawals, one account, and no fees.

There are a lot of charges and fees on income annuities, but SILAC wanted to see if they could find a way to do this with no fees. Spoiler alert: they did it!

At New Horizons, we love SILAC because they have some of the best service in the industry. They also have one of the most user-friendly agent portals out there. Now that they have a lifetime income annuity... game over, folks. This is going to be a very hot product.

These are the key components of Denali™:

- Clean & simple

- Laser-focused on retirement

- Competitive lifetime income

- Consistent

This product is ideal for someone who is focused on the long-term.

According to a survey from Alliance for Lifetime Income:

- 80% of Americans are worried about retirement

- 73% of Americans are concerned about not having a lifetime income

- 71% of Americans are concerned about the risk of a financial surprise

These are the clients who would benefit most from Denali™.

Denali™ State Availability

States have their own regulations and rules, so the Denali™ product may be available in a state, but not all contract lengths may be available.

Here's the state availability information for the Denali™ Series:

Denali™ is available in most of our key states, including Illinois and Indiana.

Rates are slightly different depending on which state you're in. The rate sheet has that information, but MA, MO, SC, and TX has slightly less favorable rates than the rest of the states (AL, AR, AZ, CO, CT, DC, FL, GA, ID, IL, IN, KS, KY, LA, ME, MI, MS, NC, NE, NH, NM, ND, OK, RI, SD, TN, VT, WV, WI, and WY).

Also, some states do not have the 14-year option. You can download the most recent rate sheet in the SILAC agent portal.

Denali™ Product Highlights

Denali™ has eight key features:

- Guarantees – your client can choose a fixed interest rate

- Growth potential – your client can choose to earn interest based on the performance of an external market index

- Protection of principal – unlike most income annuity products with fees, you will never have a negative interest rate (zero is your hero!)

- Tax deferral – defer taxes until you access the annuity funds

- Income that can't be outlived – the lifetime withdrawal benefit ensures income for life

- Higher income in a time of need – if certain health conditions are met, you can get higher withdrawals for a period of time

- Access to funds – multiple liquidity options

- Wealth transfer – full account value after death or spousal continuation

This checks a lot of boxes for older clients getting ready to retire. They want their nest egg to grow, but they also want the security of income for life.

If this is a good fit for your client, there are really only two steps:

- Decide your contract length – 7, 10, or 14-year withdrawal charge periods

- Decide how you want your money to grow – fixed index account or one of many crediting strategies

The indexed crediting strategies are the same options as the Teton product.

You can read more about the original 6 indexed crediting strategies here. And you can read more about the new Barclays Atlas strategies here (due to Barclays compliance, you will have to log into our website to read this one).

Issue Ages and Premium Amounts

| 7-year | 10-year | 14-year | |

| Min. Issue Age | 0 | 0 | 0 |

| Max. Issue Age | 90 | 85 | 80* |

| Min. Premium | $10,000 | $10,000 | $10,000 |

| Max. Total Premium** | $1M | $1M | $1M |

*Max. issue age is 64 in Florida

**Without home office approval

Access to the Money

Denali™ offers a 5% free withdrawal after Year 1. Free withdrawals are not subject to withdrawal charges, market value adjustments, or bonus recovery percentages.

Required Minimum Distributions (RMDs) can begin immediately and are considered a free withdrawal, even if they exceed 5% of the account value.

If your client has a health problem, they can utilize one of the following free riders – they come built-in with the product:

- Nursing Home Benefit* – After the first policy year, you can withdraw up to 100% of your annuity’s account value if you become confined to a qualified care facility for at least 90 consecutive days and meet the eligibility requirements. There is a waiting period of 1 year after policy issue date, and you cannot be confined at the time the policy is issued.

- Terminal Illness Benefit – After the first policy year, you can withdraw up to 100% of your annuity’s account value if you are diagnosed with a terminal illness that results in you having a life expectancy of 12 months or less and you meet the eligibility requirements. You cannot be confined at the time the policy is issued.

- Home Health Benefit* – After the first policy year, you can withdraw up to 100% of your annuity’s account value if you need home health care services and meet the eligibility requirements.

*Not available in South Dakota

Withdrawal Charges

As we mentioned earlier, Denali™ is designed for a long-term retirement savings plan.It comes with a withdrawal charge period of 7, 10, or 14 years. If you have a client who decides to terminate or take an excess withdrawal during this period, then withdrawal charges and bonus recovery will apply.

If you have a client who doesn't want to withdraw money regularly, the cumulative withdrawal on the Teton is a probably a better fit for them.

But, if you have clients who want a long-term plan, Denali™ makes a lot of sense. If your client withdraws more than the free withdrawal amount during the withdrawal charge period, they'll be charged.

The withdrawal charge allows SILAC to invest the money long-term, which generally credits higher interest than an annuity with a shorter term.

Denali™ Lifetime Withdrawals, Explained

For the last 25 years, the percentage of workers covered by a traditional pension has been declining (SSA.gov). While pensions are still pretty common for government workers, they're largely a thing of the past in the private sector.

The Denali™ Series allows your clients to create their own pension. They can set up lifetime withdrawals to ensure they never outlive their income.

You can begin taking lifetime withdrawals after the first year. The lifetime withdrawal amount depends on your current account value and your age when you start the withdrawals.

Withdrawals are guaranteed for life as long as you don’t take any excess withdrawals – even if your account value falls to zero. An excess withdrawal will lead to a recalculation of the lifetime withdrawal.

When you begin lifetime withdrawals, you can decide if the withdrawals will last for your life (single) or as long as you or your spouse is alive (joint). Withdrawals can be taken monthly, quarterly, semi-annually or annually.

Once you turn on income, it's locked in for life.

Denali™ Wellness Withdrawals, Explained

Wellness Withdrawals are basically an ADL benefit that becomes available after the second policy year. This benefit comes with the product – there's no fee for it.

Basically, the lifetime withdrawal amount can be increased for up to 5 years if your client can't perform 2 of 6 Activities of Daily Living (ADLs).

The income doubles for a single, and there's a 50% increase if it's joint.

Denali™ isn't a long-term care product, but this sure does give your clients some peace of mind that they'd get an income boost if they find themselves in a nursing home or home health care situation.

How to Run Denali™ Illustrations

This product isn't one-size-fits-all – that's for sure.

- You could have a 55-year-old that puts in $50,000, lets the account grow for 14 years, and then turns on lifetime income.

- You could have an older couple with some money at the bank, and they want to take $10,000 out every year.

- You could have a 65-year-old that rolls their 401(k) into this so they can take advantage of the RMD withdrawals.

There are dozens more examples of client scenarios that would benefit from Denali™.

Let's just take that third example to run a quick illustration.

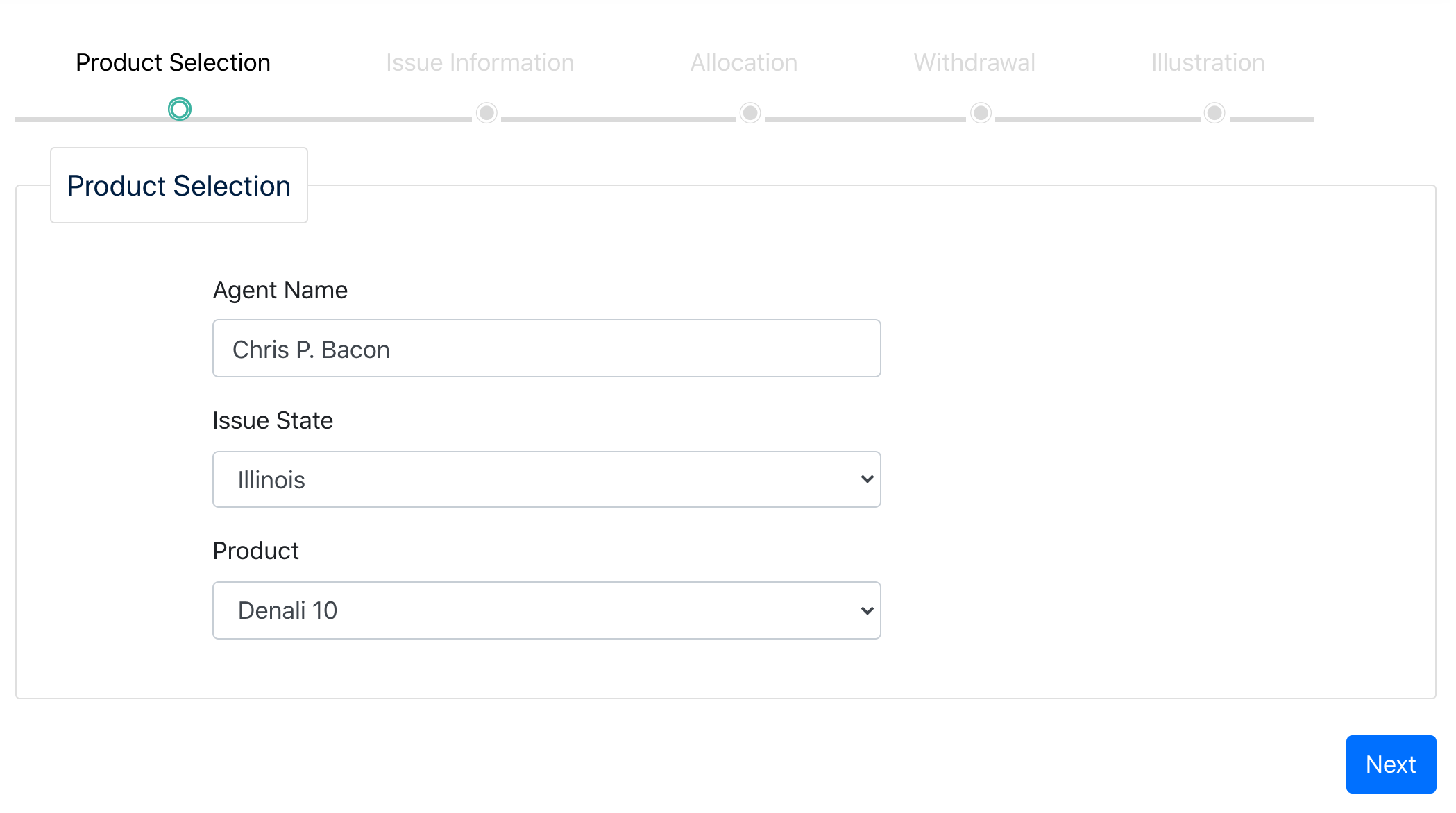

Sign in to the SILAC agent portal, and click "Run an Illustration" on the home page.

Fill in your agent name, the issue state, and the product (Denali or Denali Bonus, and the withdrawal period).

Fill in your agent name, the issue state, and the product (Denali or Denali Bonus, and the withdrawal period).

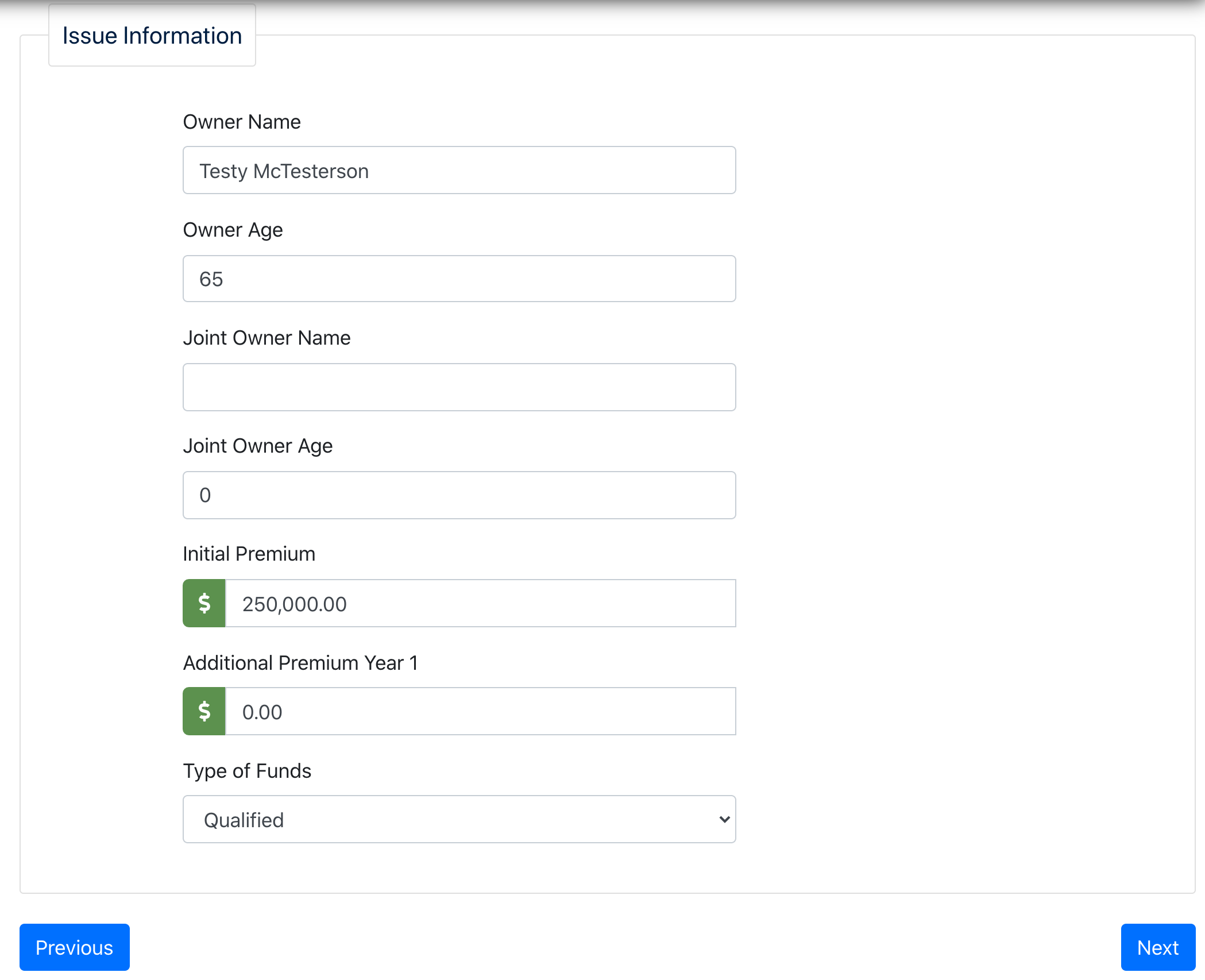

Fill out the issue information. Qualified money is money that hasn't yet been taxed (401k). Non Qualified is money that's already been taxed (money sitting in a savings account at the bank).

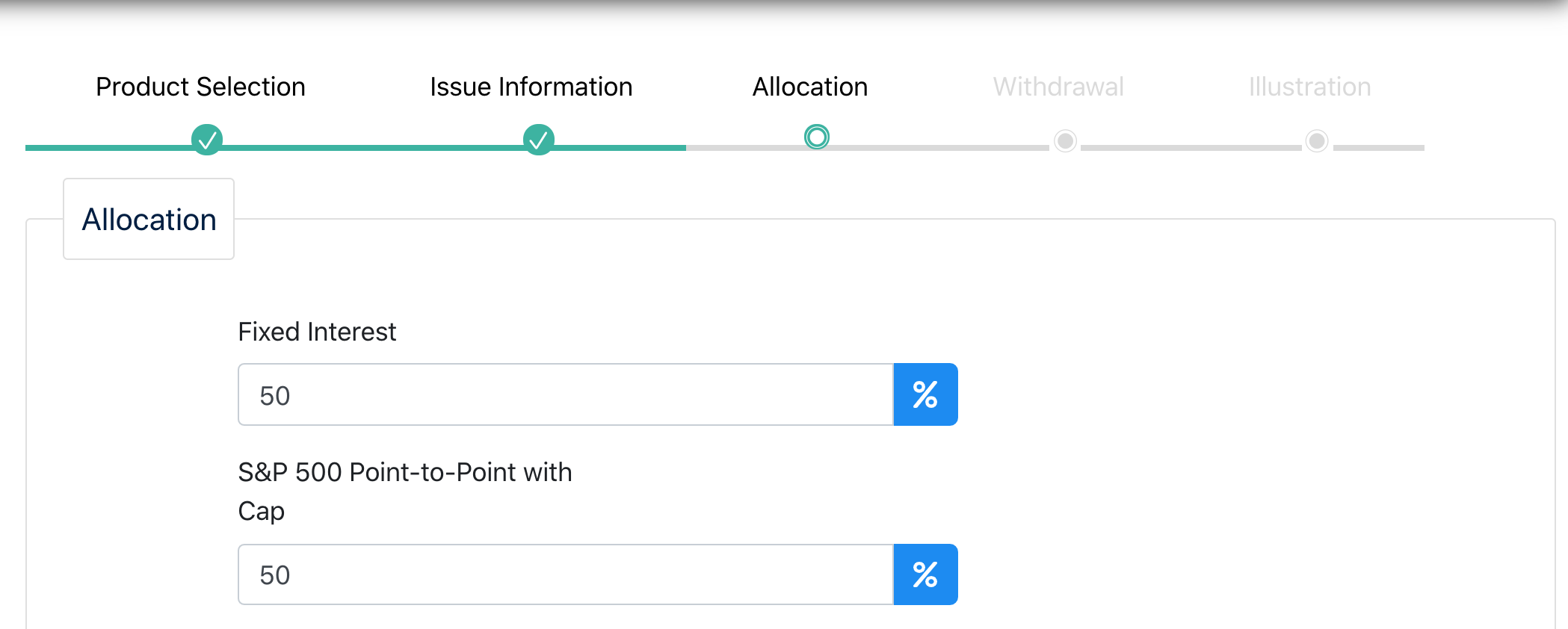

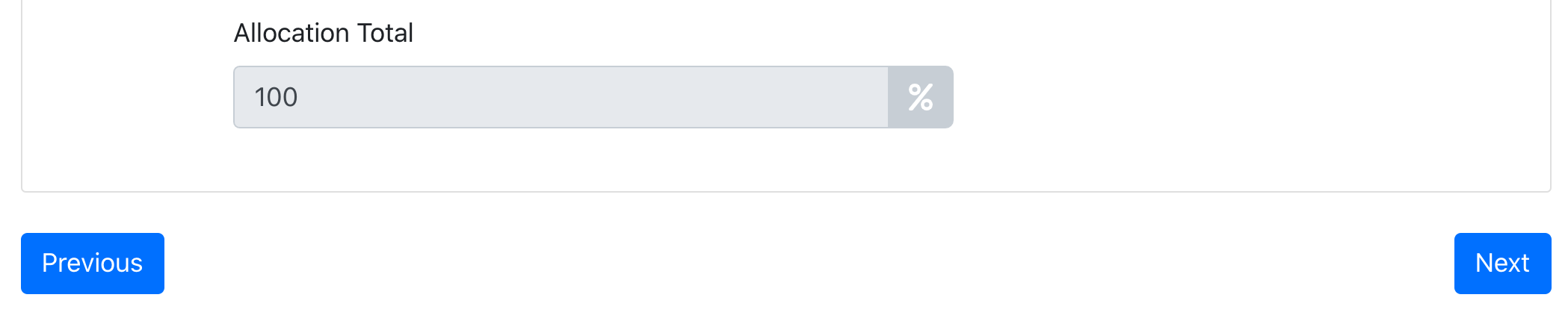

Now, it's time to select the allocation. This is done in percentages. For simplicity's sake, we'll do 50% in a fixed account and 50% in the S&P 500 Point-to-Point with Cap.

Now, it's time to select the allocation. This is done in percentages. For simplicity's sake, we'll do 50% in a fixed account and 50% in the S&P 500 Point-to-Point with Cap.

You should end up with a total of 100% before you continue.

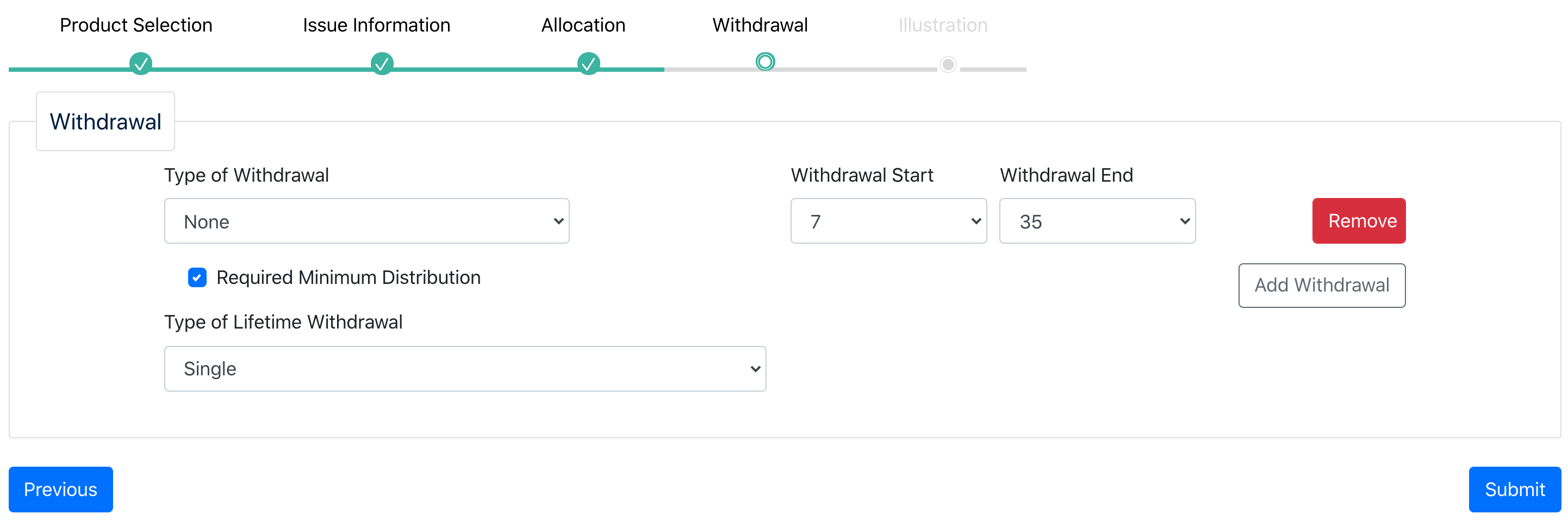

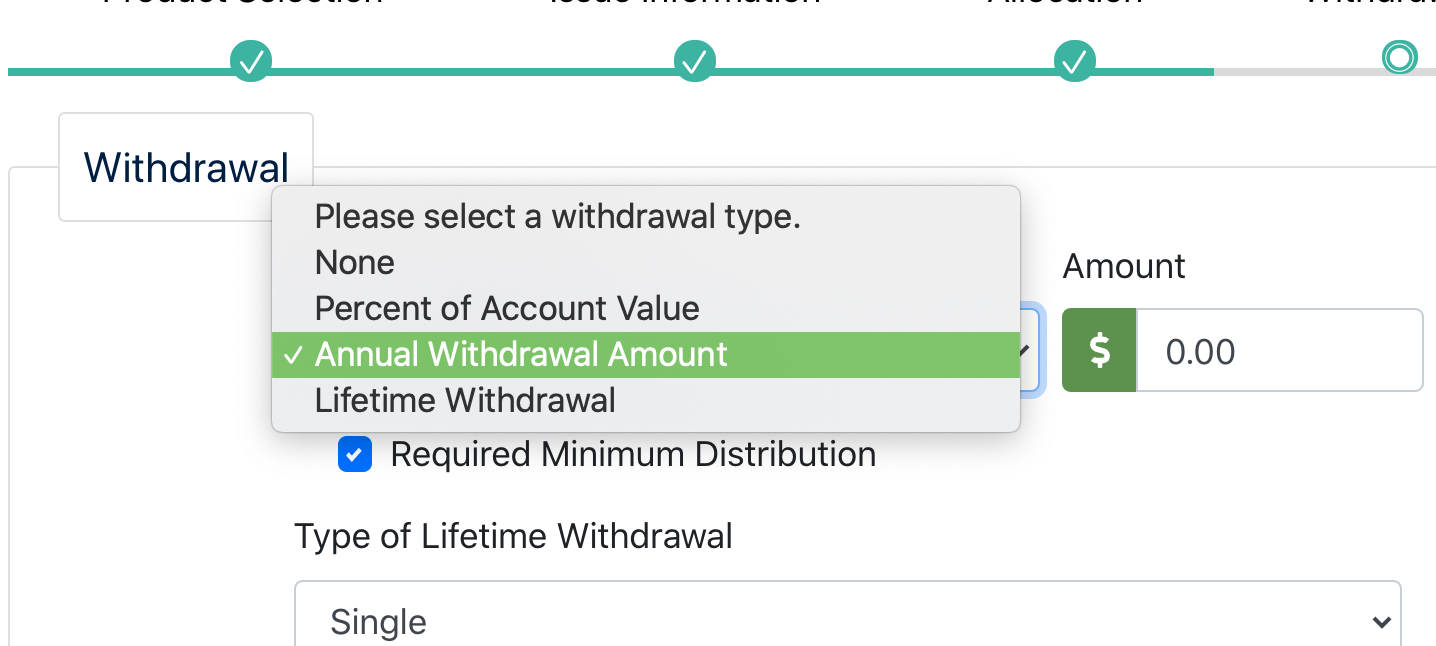

Now it's time to select the withdrawal type and timeframe.

For this client, the goal is to start taking out RMDs in Year 7. Let's say they want this to last until they're 100 years old. So, I'll start the withdrawals in Year 7 and end them in Year 35. I've checked the RMD box and set the type of withdrawal to None.

If my client wanted to turn on "Lifetime Income", I'd choose that option in the dropdown. If they wanted to get $10,000 per year no matter what, I'd choose "Annual Withdrawal Amount" and enter that figure.

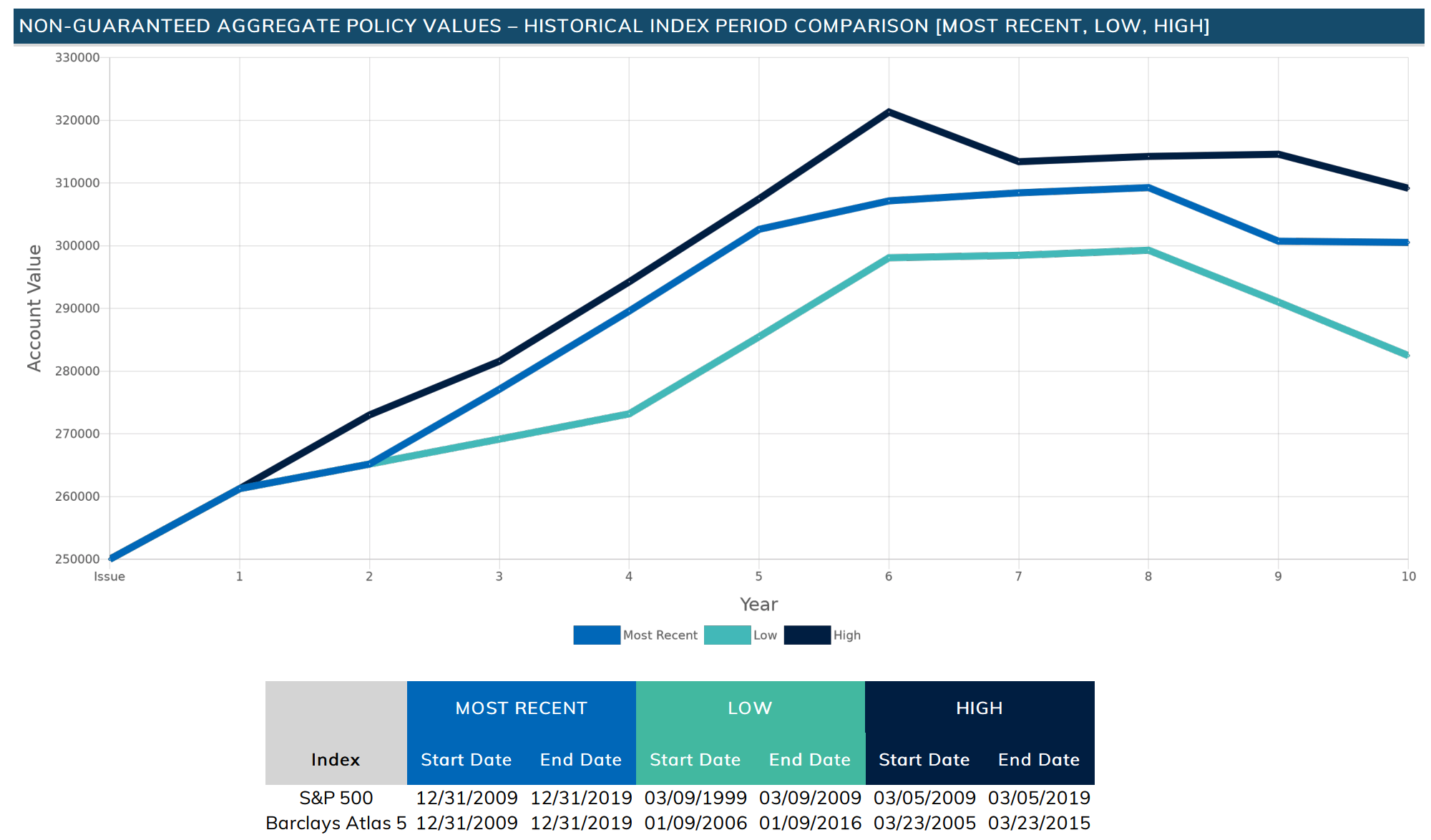

Back to my client. They want to withdraw their RMDs at age 72, and we've marked the boxes appropriately. Now, it's time to view the illustration. The illustration page on the portal shows:

- Crediting strategies you chose

- Non-guaranteed and guaranteed policy values

- Historical information on the most recent, lowest 10, and highest 10 years

Downloading and printing the illustration PDF can be helpful, and just check your pop-up blocker if you have trouble downloading it.

Here's the chart on page 10 of the illustration page showing some historical comparisons from the most recent 10 years, the lowest 10 years, and the highest 10 years.

If you have any trouble or if something confuses you, please reach out to me (Kirk Sarff), and I'll make sure you're all set.

What Makes Denali™ So Special?

Denali™ is so dang special because there's no fee! Almost all annuities with lifetime income have fees that drag the product down over time.

.jpg?width=158&name=carrie%202018%20(002).jpg) Carrie Freeburg, ASA, MAAA, the VP of Annuity Products at SILAC, explains that paying for all the Denali™ features with a fee would have been easy. But they decided not to do that, because a fee brings down the account value. By bringing down the account value, you bring down everything – the death benefit, RMDs, free withdrawals... it hurts everyone.

Carrie Freeburg, ASA, MAAA, the VP of Annuity Products at SILAC, explains that paying for all the Denali™ features with a fee would have been easy. But they decided not to do that, because a fee brings down the account value. By bringing down the account value, you bring down everything – the death benefit, RMDs, free withdrawals... it hurts everyone.

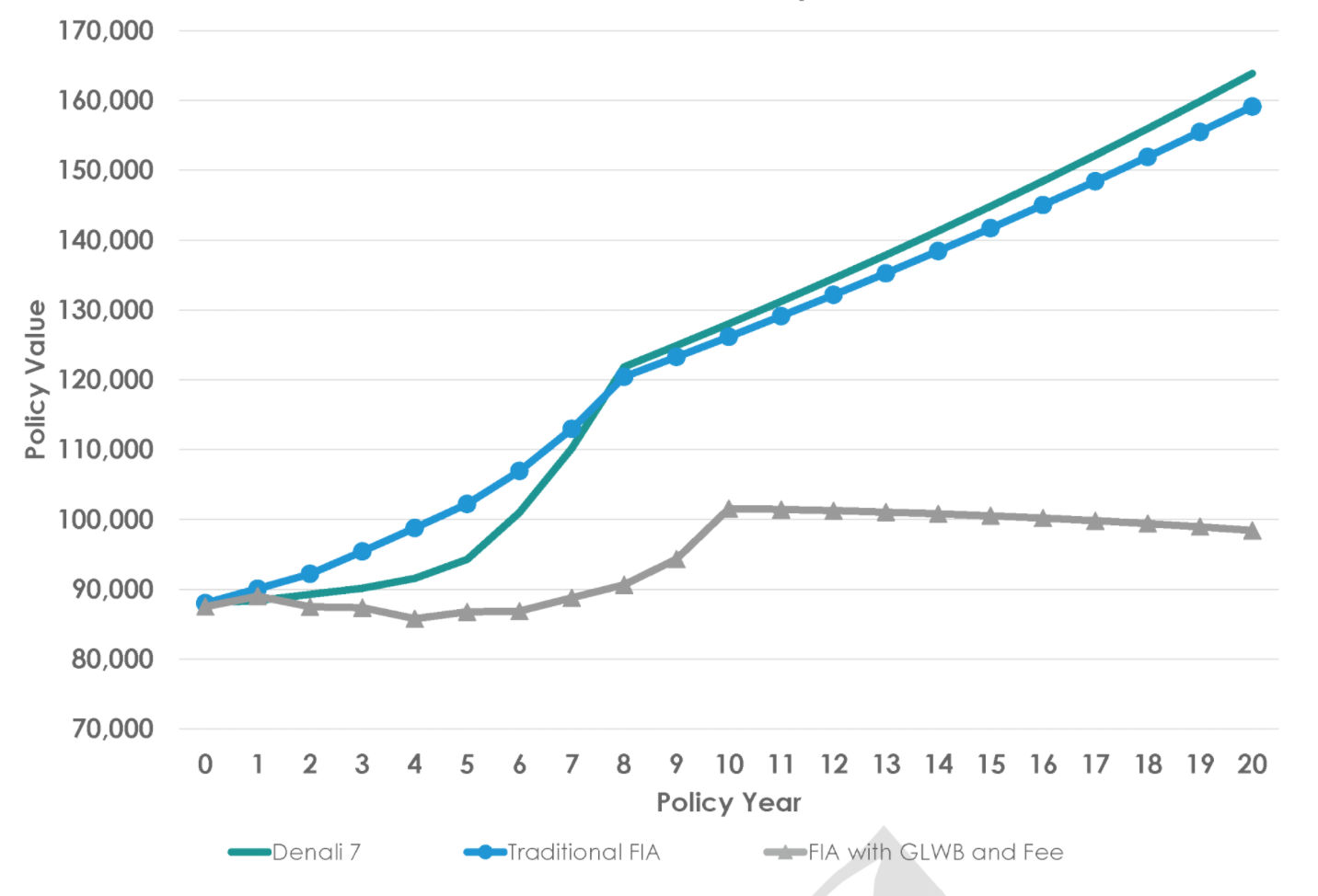

You can see this play out in this chart*, which compares the cash value of the Denali™ 7 (in green), a Traditional FIA (in blue), and a Denali™ competitor that has a fee (in gray):

The FIA with GLWB and Fee is dragged down around Year 10 by that fee. The Denali™ continues to grow and benefits from that long-term plan. This wouldn't be possible if the product was weighed down by a fee.

*Key assumptions include: issue age 60 and $100,000 initial premium. Traditional assumes a fixed interest rate of 2.35%. DenaliTM 7 assumes a fixed interest rate of 2.50%. FIA with GLWB and Fee assumes a 1.8% fixed interest rate and 1.20% fee.

Conclusion

Denali is a great fit for clients who want a long-term retirement savings plan. If you want to be able to tell your clients that they cannot lose money on their principal, this is a great option. So many income annuities have fees, and your client could actually lose money in a worst-case scenario. Not with Denali.

There are so many additional baked-in features that make this annuity a wonderful option. SILAC is great to work with, and if Denali isn't the right fit, SILAC has other great annuity options that might be perfect, including Teton or the Secure Savings line.

Don't hesitate to consult with me on whether or not this is the best product fit for your client's situation. I know we are all very excited to see the reaction from the field and from consumers who are looking for a way to grow their savings without worrying about fees.

![The Simple Question That Drove $9M+ in Annuity Sales [Case Study]](https://blog.newhorizonsmktg.com/hs-fs/hubfs/NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp?width=220&height=119&name=NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp)