So, you're interested in becoming an agent in the Medicare and senior insurance space. You're your own boss, you can control your income, you don't need a college degree to get started, and you're helping a whole lot of people along the way.

One of your first steps to get started in this business is to get the proper licenses. Here's what you need to know about licensing and selling Medicare Supplements.

Everything is state-specific

As you get up and running, you'll quickly realize that nearly everything in the Medicare space is state-specific – including licensing.

Related: Want to Expand Your Med Supp Business? Consider These States

You definitely need your health license, but some states require an additional Medicare line (or equivalent) if you want to sell Medicare Supplements.

So the information in this article will give you a general overview of what you need as well as links to resources that'll help you understand everything at the state level.

Prelicensing

In order to get your health license, you'll first have to complete prelicensing education requirements.

Most states make you submit proof that you completed this prelicensing education before you can get your health license. In many cases, you can take those classes online.

There are lots of different vendors that offer prelicensing classes, and the costs vary anywhere from $99-$400+ – a whole lot less than a college degree!

A great place to start is by looking at your state's Department of Insurance website. They'll likely have a list of approved prelicensing courses.

Here in Illinois, we use ABRC. The following states use Sircon to list the pre-licensing courses they'll accept:

- Arizona

- California

- Colorado

- Georgia

- Indiana

- Iowa

- Maryland

- Minnesota

- Mississippi

- Missouri

- Nevada

- New Jersey

- North Carolina

- Pennsylvania

- South Dakota

- Texas

- Utah

- Virginia

- West Virginia

- Wyoming

If you need help finding a vendor in your state, don't hesitate to reach out to our contracting department.

In addition, veterans who qualify for the GI bill may be able to get up to $2,000 reimbursed after taking a license or certification test. You can read the details on this here.

Health and Life License

In order to sell Medicare Supplements, you need to take the health and life insurance exam. Where you take this depends on your state.

Many states offer the exam on Pearson Vue (online) for about $50. But others require you to take the exam in person.

Pearson Vue also offers practice tests for the Life & Health exam. It includes 50 questions on general topics and 25 generic state questions for $19.95.

The easiest way to quickly get the information for your state is to do an online search for "health and life insurance exam" in your state.

Once you take the exam at the testing facility and pass it, you apply for your license with your state.

Related: The Beginner's Guide to Selling Medicare Supplements

Non-Resident Licensing

If you live in Illinois, you'll take your exam and get your license in Illinois.

However, perhaps you live on the border of two states or maybe you sell remotely and the location of your prospects could be anywhere.

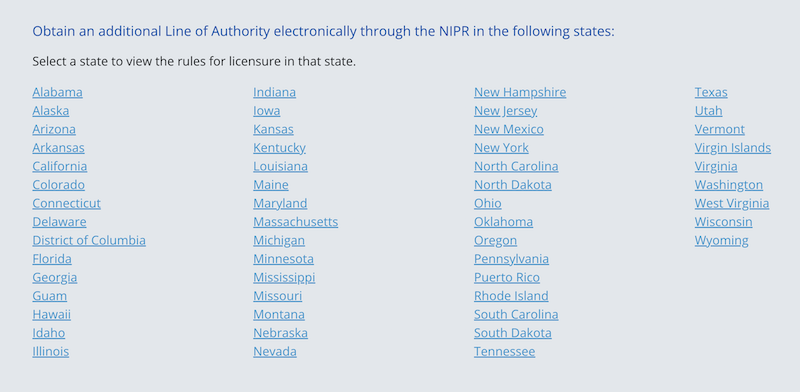

In that case, you'll want to get a non-resident license. This doesn't mean you have to take another exam – it's just an additional fee you have to pay in order to sell insurance products in that state.

You can check the license fee structure for your state on the NIPR website. This is also where you'll go to apply for your non-resident licenses.

We do want to note that in some states, you have to pay a fee for every carrier you get appointed with. As an example, in Kentucky, it's about $50 as an individual and $250 for a corporation.

Some carriers cover that fee for you, but many don't. That's why it pays to be a bit selective with which carriers you choose to get appointed with in some states. We can definitely help you determine the most competitive options in your state, if you'd like.

All that said, many agents don't want to go through the hassle and expense of licensing when they may only write a case or two. In that case, you have two additional options:

- Refer your client to a broker in that state: this requires connections, and you'll need to set up some kind of commission split, which can be difficult.

- Partner with us here at New Horizons: we're licensed in nearly every state and can enroll that client for you while giving you a commission split on the sale.

Medicare Supplement Contracting

When you decide to get contracted with Medicare Supplement carriers, you'll need to fill out their contracting paperwork.

That paperwork will ask you to enclose a current copy of each state agent/agency insurance license (life and health) in which you'll be selling those products. You will also need to confirm that you have E&O coverage.

E&O Coverage

In order to get contracted to sell Medicare Supplements (and other insurance products), you will need to get $1 million of Error & Ommissions (E&O) coverage.

We don't specifically endorse any particular company for the E&O coverage, but if you need any guidance, just send us a message and we'll help out as best we can.

Renewing Your License

In most states, your license is good for two years. In some states, like Iowa, it's good for three years.

In order to keep it active, you'll need to do continuing education (CE). There are a lot of CE vendors out there. We use ABRC here in Illinois, but there are a ton of them!

If you need help with that, just let us know and we'll take a look at the options near you.

Related: Is It Hard to Sell Medicare Supplements?

Conclusion

Getting prepared to sell Medicare Supplement products is a pretty painless process! Learning the ins and outs of Medicare is arguably the most difficult task, but the expense and time required to get your license is pretty minimal.

If you have any questions, don't be afraid to drop them in the comments below!

More reading: How An Agent Has Used Cold Calling to Grow His Insurance Production to $500,000 Per Year