Originally published November 9, 2020. Last updated September 12, 2023.

Dipping your toes into the Medicare supplement sales arena doesn't have to be intimidating; in fact, it can be your golden ticket to a booming career.

Whether you're an insurance newbie or just looking to build on your current offerings, we've put together a great beginner's guide on how to start selling Medicare supplement insurance.

Feel free to jump ahead to the section you're more interested in:

- Who Is This Beginner's Guide For?

- Why Medicare Supplement Sales?

- What Are Medicare Supplements?

- Medicare Supplement Plans A-N, Explained

- The Ideal Medicare Supplement Client Profile

- Medicare Supplement Sales Tips

- How to Quote a Medicare Supplement

- How to Get Medicare Supplement Leads

- Getting Contracted to Sell Medicare Supplements

- Medicare Supplement Marketing Materials

- Medicare Supplement Sales FAQs

- Conclusion

Who Is This Beginner's Guide For?

This guide is perfect if you want to start a career in senior insurance, but it's especially great for those already offering products and services relating to insurance and finances.

For example:

- Property & Casualty (P&C) Agents

- Auto Insurance Agents

- Certified Financial Planners (CFP®)

- Agents with a "niche" such as Final Expense

- Health Insurance Agents

If you already have a book of business, you're primed for Medicare Supplement sales. People already want and need supplemental insurance, and they're going to go somewhere to get it – they might as well get it from you.

If you've never sold insurance or are brand new to the senior market, I highly recommend downloading our e-book:

Why Medicare Supplement Sales?

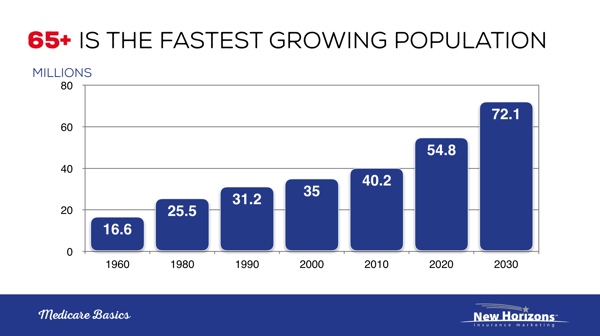

There are a ton of prospects in the Medicare market. Ten thousand seniors turn 65 every single day – that's a lot of prospects that need Medicare Supplements.

When we look at a person that is going onto Medicare, it's pretty confusing and overwhelming. Seniors get a ton of Medicare-related mail. It's truly information overload.

It's a serious sense of relief when that senior has someone that can explain how Medicare works.

These prospects are very overwhelmed when they're trying to figure it out on their own, and you don't have to come up with some slick sales pitch to get them to buy from you. You're already a tremendous asset, and your help is truly wanted and appreciated.

A lot of prospects have retired from large companies that no longer pay for their post-65 health insurance. Many companies now offer a reimbursement so that the retirees can go out and buy their own insurance. It works great, but it leaves the retiree with a lot questions, and they need our help.

In sum, there are three great reasons to get into the Medicare Supplement market:

- There are lots of prospects

- Medicare is standardized

- There's a built-in need for a secondary insurance with Medicare

What Are Medicare Supplements?

Medicare Supplements are insurance policies sold by private insurance companies. They're meant to supplement Original Medicare coverage, because Medicare does not cover everything!

As an example, Medicare Part B generally covers about 80% of the bill – the remaining 20% could wreck a senior's finances in an instant. A Medicare Supplement plan can cover that 20% in full.

Medicare Supplement plans are also called Medigap for this reason; they fill in the gaps left behind by Medicare.

A few quick things to know about Medicare Supplements:

- They don't include drug coverage – a separate, Part D prescription drug plan is needed.

- Plans are lettered from A-N (Plan F, G, and N are the most popular options).

- Benefits for each plan letter are standardized by the federal government in most states, meaning you get the same exact benefits no matter which insurance company you buy from.

- In Massachusetts, Minnesota, and Wisconsin, standardized plans can be changed without federal approval.

A Word on Medicare Advantage

You should be aware there are two main routes a senior can take when it comes to their health insurance:

- Original Medicare with a Medicare Supplement and a Part D drug plan

- A Medicare Advantage plan

We're not going to get into Medicare Advantage in this article, but you will want to consider both options when helping a senior with their insurance plan.

If you're interested in Medicare Advantage sales training, we have an on-demand video course you can take for free (just click the image):

Medicare Supplement Plans A-N, Explained

There are currently 11 Medicare Supplement plans available:

- Plan A

- Plan B

- Plan C

- Plan D

- Plan F

- High-Deductible Plan F

- High-Deductible Plan F

- Plan G

- Plan K

- Plan L

- Plan M

- Plan N

I always find it the most interesting to find out which plans people are buying the most. What is the most popular?

I'll narrow it down to the top 3:

- Plan F (for those who are eligible)

- Plan G

- Plan N

It's much easier to narrow it down to a couple plans so that you don't have to understand the benefits of them all.

IMPORTANT: As of January 1, 2020, Plans C and F are no longer available to people who are new to Medicare. If you already have either of these 2 plans (or the high deductible version of Plan F) or are covered by one of these plans before January 1, 2020, you’ll be able to keep your plan. If you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans.

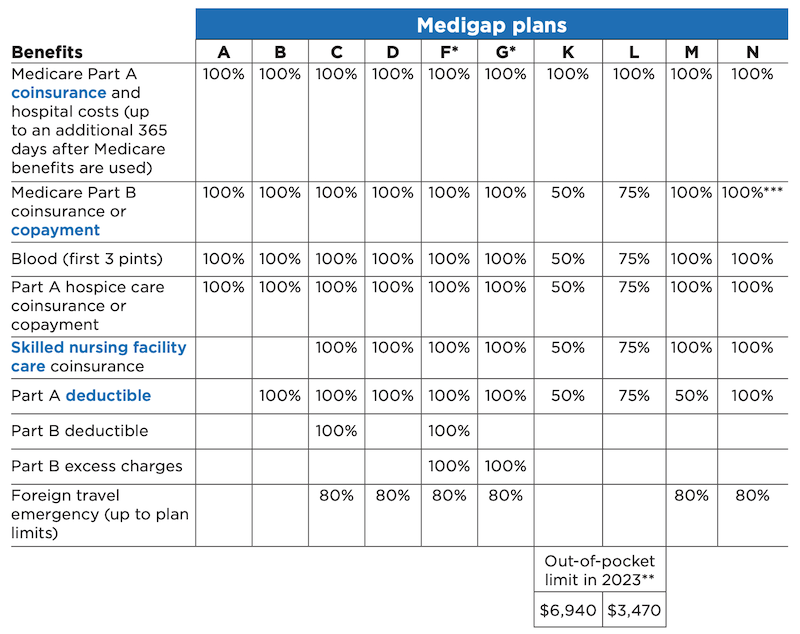

Here's a chart showing the coverage that comes with each plan (you can find this chart in the Medicare & You Handbook).

[RELATED: How to Sell Medigap Plan N: Is Plan N Worth the Risk?]

Differences Between Medicare Supplements

I just mentioned Medicare Supplement benefits are standardized, which means a Plan G is a Plan G, no matter which company you buy it from.

So... if the benefits are the same, what makes a supplement different from carrier to carrier?

The two main differences are going to be:

- Cost

- Underwriting

What is the company charging the consumer for the insurance, and what health questions are they asking?

If you have a client and you apply for coverage with one company, and they can't pass those health questions, you have a lineup of other companies with a different set of health questions.

How Rates Are Set

This isn't something you'll share with a client, but it's helpful for you to understand.

There are ways in which Medicare Supplement rates are set:

- Community Rated – priced the same for everyone (not common)

- Issue Age – priced on your age when you are issued the policy

- Attained Age – based on current age

Open Enrollment vs. Guaranteed Issue

Medicare Supplement open enrollment and guaranteed issue (GI) situations are going to be the most complex thing we cover today. Stay with me, though.

[Read more: An In-Depth Explanation of Guaranteed Issue (GI) and Open Enrollment]

Medicare Supplement Open Enrollment

Your Medicare Supplement open enrollment period is a 6-month window starting on your Part B effective date.

You have 6 months where you can apply for a Medicare Supplement policy without going through underwriting. In other words, you don't have to health qualify.

Your clients only get this opportunity once in their life. They don't have to worry about pre-existing conditions or underwriting.

Once that person gets outside of their open enrollment period, they have to be able to pass health questions in order to qualify to change from one insurance company to the next.

If I have a client with Cigna, and Cigna has had some rate increases over the course of a few years, and I see that Mutual of Omaha can save my client some money for identical coverage, the kicker is they have to be able to pass health questions. If they can health qualify, I can give my client a much better price for identical coverage.

Outside of the 6-month window, a person will always have to pass underwriting to switch Medicare Supplements.

Guaranteed Issue

Guaranteed issue (GI) happens when you lose coverage. For example, if you're on group insurance and you lose it because you're retiring. That's really common.

Another common example is perhaps you're losing your Medicare Advantage plan. They announce to you that they're terminating their plan in your zip code. That's a guaranteed issue situation where you can buy a particular plan without having to pass health questions.

For folks who were first eligible for Medicare prior to January 1, 2020, they have a window where they can buy plans A, B, C*, D*, F*, G*, K, or L without having to pass any health questions. That window is 60-63 days depending on which state you're in. We stick with 60 days to be on the safe side.

*Plans C and F are no longer available to people who are new to Medicare on or after January 1, 2020. However, if you were eligible for Medicare before January 1, 2020 but not yet enrolled, you may be able to buy Plan C or Plan F. People eligible for Medicare on or after January 1, 2020 have the right to buy Plans D and G instead of Plans C and F.

The Ideal Medicare Supplement Client Profile

When we're thinking about an individual who would really like and benefit from a Medicare Supplement, here's what our list of bullets looks like:

- Requires more medical attention

- Likes a simple plan with preferably no co-pays

- Does not appreciate or like physician and hospital networks

- Likes to travel – is a snowbird

- Fears change

A Medicare Supplement is usually a no-brainer for snowbirds since the alternative option – a Medicare Advantage plan – is going to have networks.

Folks who don't like change or plans that get tweaked every year are going to like a supplement. Medicare Supplements stay the same year-in and year-out – no surprises.

Medicare Supplement Sales Tips

Selling is all about education.

You're going to focus on educating the client about how Medicare works and how a supplement fits in perfectly.

Tip 1) Use the Medicare & You Handbook

CMS puts out a publication each year called the Medicare & You Handbook. This handbook should be in your Medicare Supplement kit as it can help you explain how Medicare Supplements work.

The feedback I get is the more clients read, the more confused they become. You're there to put all of this into English for them.

The Client Guide we put together can also help you explain the costs of Medicare to your client.

Tip 2) Use the Client Needs Assessment

The Client Needs Assessment structures your appointment and will help you talk about Medicare coverage options naturally.

Watch this webinar recording to learn more about how to use it:

Tip 3) Know your presentation

Here are the main points you want to cover when giving your presentation:

- There are two main roads you can go down – Medicare with a supplement and a drug plan or Medicare Advantage.

- Medicare Supplements are standardized.

- No networks.

- Medicare covers about 80%, and the supplement covers about 20%.

- Here are the two plans I'd recommend for you, and here's how they work.

I'd recommend narrowing it down to only two plans to keep the confusion to a minimum. Introducing 3 or more plans becomes information overload – especially when you've likely just finished explaining how Medicare works.

Keep in mind that less is more. The more simple and succinct you can make your presentation, the better.

Plan G Presentation Script

When you have a Plan G, all Medicare-approved expenses are covered except the Medicare Part B deductible. There are no other costs – it’s 100% coverage from there.

Plan N Presentation Script

Plan N is very similar to a Plan G. It’s a little less premium, and you still have the same deductible.

But every time you go to the doctor, you pay up to a $20 copay. When you go to the emergency room, you’ll pay up to a $50 copay unless you’re admitted.

The final thing is that if there are any excess charges from the doctor, Plan N won’t cover them, while Plan G will.

Honestly, this has never been a problem for us, but I do want to let you know that.

Plan F Presentation Script

Finally, Plan F is considered the “Cadillac.” It pays everything after Medicare – it’s that simple. No copays, no deductibles.

The reason why this isn’t the most popular plan today is that as of January 1, 2020, Plan F is no longer available to those coming onto Medicare.

For everyone that was on Medicare before that date, they can always have a Plan F. However, the concern is that the plan will see some hefty rate increases once no new seniors are entering the plan.

How to Quote a Medicare Supplement

Once your prospect decides which plan fits their needs and budget the best, it's time to provide a quote.

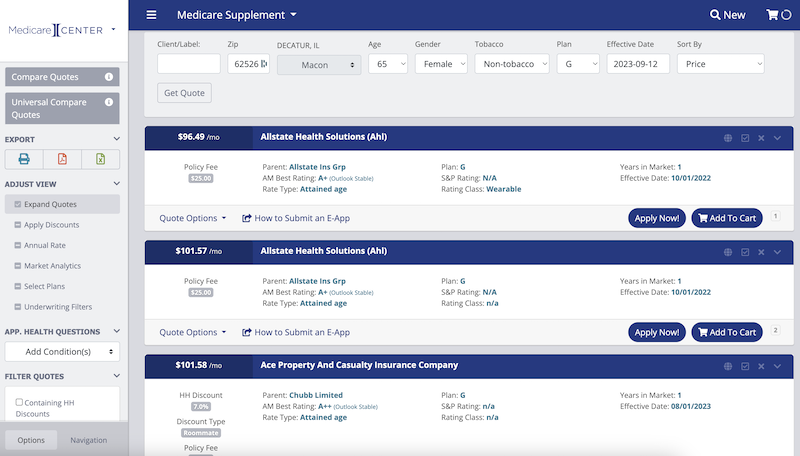

You can use MedicareCENTER to run quotes (click on CSGApp in your account menu), or you can use our legacy quoting system (the same software as what's in MedicareCENTER).

From there, you will put in your client's basic information – zip code, age, gender, tobacco or non-tobacco, and which plan they want – and you will see a list of carriers and their prices from least expensive to most expensive.

Tip: For clients that need to health qualify, there is an option called "substandard," or a supplement that is more lenient on underwriting in exchange for a higher premium.

Tip: For clients that need to health qualify, there is an option called "substandard," or a supplement that is more lenient on underwriting in exchange for a higher premium.

In most situations, packaging a cancer plan or a short-term care plan with the Medicare Supplement is going to be beneficial to the client.

How to Get Medicare Supplement Leads

Finally, if you want to sell Medicare Supplements, you obviously need some prospects to sell them to.

Here are the most popular ways to get Medicare Supplement leads:

- Network with people you know

- Sell to your existing book of business (looking at insurance agents in different fields or financial planners/advisors)

- Cold-calling

- Working from T65 lists (seniors getting ready to turn 65)

- Buy leads in LeadCENTER

Beyond these traditional methods of prospecting, you could delve into other techniques such as:

- Creating a website

- Being active on social media

- Newsjacking

- Email marketing

- Leaving business cards

You can read about 10 free ways to market to your Medicare prospects here.

After the first few years, you won't have to actively prospect anymore unless you want to.

Once you're established, you'll be working solely off of referrals, as long as you're asking for them.

No matter how difficult or awkward it feels, ask every single client if they have any family members or friends who would benefit from your services. That's how you can grow organically and quickly without spending a ton of time and money on lead generation.

Getting Contracted to Sell Medicare Supplements

Now, you have to get contracted with Medicare Supplement carriers in order to sell their products.

We recommend starting with 2-3 carriers. You can see a list of the carriers we represent here.

The best place to begin is by pulling some quotes in your zip code. You'll see which carriers are the most competitive, and our team can also help you fill in any gaps with carriers who have different perks or niches.

You can also schedule an onboarding call with us to get advice on which carriers you need in your portfolio. We're very friendly and would love to answer any questions you have!

Medicare Supplement Marketing Materials

To support Medicare Supplement agents, we've created a library of free marketing materials.

One of our most popular downloads is our client guide to Medicare Parts A & B.

You can explain Parts A and B, and you can even show your clients how Plans F, G, and N compare. We update this every year.

Medicare Supplement Sales FAQs

Can you have two Medicare Supplement plans?

You cannot have two Medicare Supplements at the same time.

What license do you need to sell Medicare Supplement?

To sell Medicare Supplements, you need your health license, but some states require an additional Medicare line (or equivalent).

You can read more about licensing here.

How to get certified to sell Medicare Supplements?

To sell Medicare Supplements, you don't necessarily need to certify like you would for Medicare Advantage sales. however, you do need your health license, and you'll have to complete contracting paperwork for the carriers you want to sell.

What states are the best to sell Medicare Supplements?

The best states to sell Medicare Supplements are Indiana, Illinois, Iowa, South Dakota, Kansas, New Mexico, Michigan, Arizona, and Texas.

You can learn more about why here: Want to Expand Your Med Supp Business? Consider These States

What percent commission do agents get who sell Medicare Supplements?

Medicare Supplement commissions vary by state, carrier, and production volume. There are different commission schedules, which you can request to check what your commission percentage would be.

How much do you get paid to sell Medicare Supplements?

Medicare Supplement sales can be very lucrative! You can see income examples in our newly revised agent e-book:

Conclusion

If you've made it this far, hats off to you.

There's a lot of information you need to take in when you're learning about Medicare, but once you've got it down pat, you're off to the races.

Be sure to browse our available Med Supp carriers and fill out a contracting form to start the process!