Because of the pandemic, there's been a lot hesitation about fixed index annuities (FIAs). When the stock market is volatile, it's difficult to tell clients to put their money in a product based on how the market performs.

It appears most agents thought that way during the year of COVID-19. According to Business Record¹, fixed index annuity sales were down 24% by the end of 2020. However, here at New Horizons, our agents did quite the opposite – fixed index annuity sales grew more than ever before.

When the market is low, it's an excellent opportunity to participate. You have the benefit of capturing all the gains as it comes back up.

And boy, did our agents' clients capture the gains! We've gotten our hands on a client's annual FIA statement, and their interest rate was mind-blowing.

A Primer on the Fixed Index Annuity (FIA)

A fixed index annuity is a tax-deferred annuity that protects your principal while offering the potential for growth. The key with a FIA is "zero is your hero." Your client's principal can never go below zero.

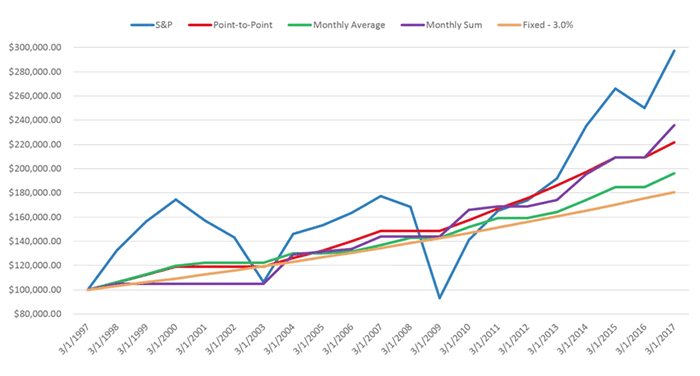

Check out this chart – the blue line is the S&P 500. As expected, it's volatile. The orange line is a fixed account – a basic, guaranteed interest rate. The red, green, and purple lines represent different index crediting strategies.

This chart shows how each indexing option performed in real life from 1997 to 2017. You can see when the market dipped in 2009 – the fixed index annuity didn't dip with it. Remember: zero is your hero.

And when the stock market soars, like it did in 2000, the fixed index annuity was capped. You still participate in the gains, but those gains are capped.

And that's the beauty of a fixed index annuity. You have the opportunity to grow your deposit, but you have the security of knowing it'll never tank.

There are several index crediting strategies, such as annual point to point or monthly averaging, but we won't get into the details of those in this particular article.

Brand new to annuity sales? Check out our comprehensive guide to Selling Annuities In the Senior Market.

Example of a Real Client's Annual FIA Statement

We can talk about how fixed index annuities perform theoretically, but we want to know how much interest real clients are earning.

One of our agents took the time to send in an example of a client's FIA statement, and we were blown away!

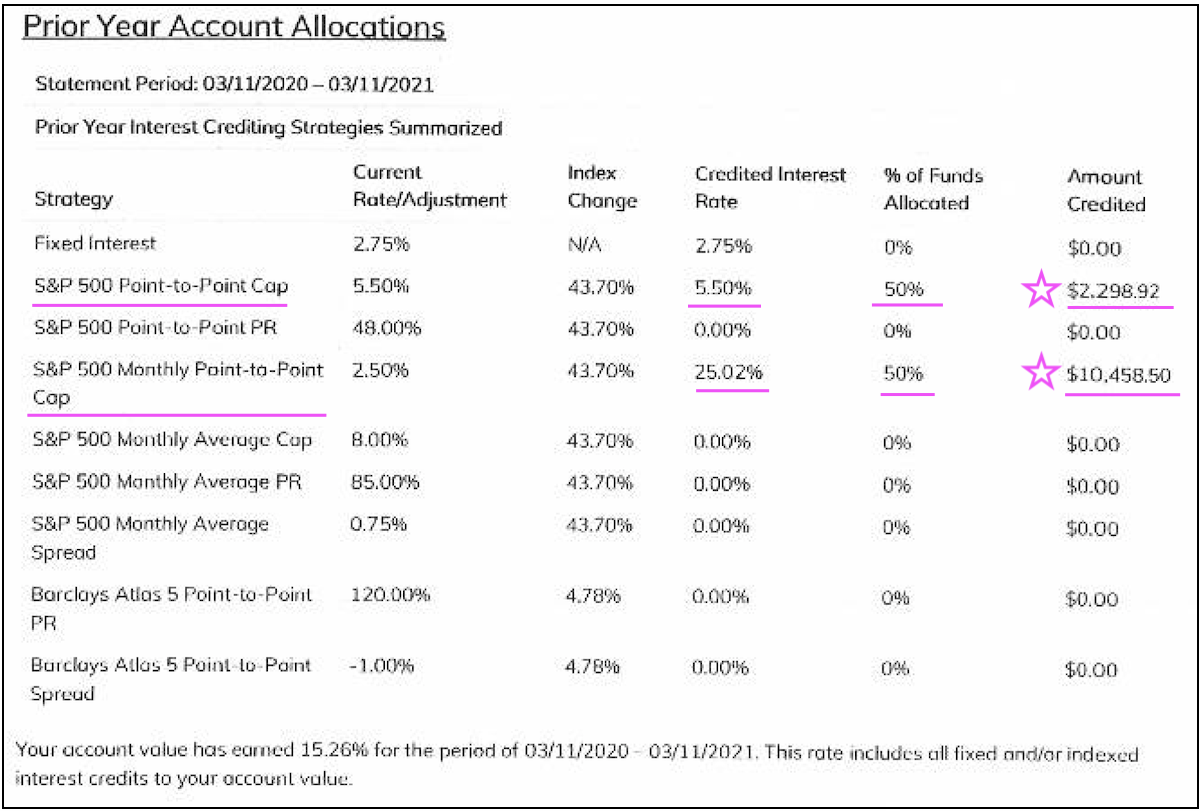

They had a SILAC fixed index annuity and put half of their money in the S&P 500 annual point-to-point cap and the other half in the S&P 500 monthly point-to-point cap.

The annual point-to-point cap credits interest to your account by comparing the index value on the policy anniversary date to the index value on the previous policy anniversary date.

This client earned 5.50% – the full amount possible – or just under $2,300. Not too shabby!

The monthly point-to-point cap credits interest based on monthly changes of the index value. For example, let’s say it’s January and the gains are 5.5%. That interest caps off at 2.50%. In February, you might see a dip to -1.5%. In essence, the interest made between January and February would be 1%.

Because of this, this option is the riskiest. However, it has the opportunity to earn the highest interest. This client could earn 0% by the end of the year, or they could earn up to 30%.

This client earned 25.02%, a gain of $10,458.50!

Combined, this client earned a total of 15.26% over the last 12 months. That sure beats a regular fixed annuity, which is right under 3% right now.

Don't Chase the Gains

It's easy to look at these returns and say, "I should tell my client to put all their money in the monthly point-to-point cap for the next year!" After all, it performed the best – by a long shot.

However, Carrie Freeburg, ASA, MAAA, and VP of Annuity Products at SILAC cautions you against that.

"Pick the strategy you like and stick with it! Agents often change strategies after the first year, and the other strategies do better. Don't follow the dance – pick your strategy and stick with it long-term.

I see people keep changing things, and they're always a year behind, and their client doesn't do as well."

Choosing a long-term approach is usually the best approach. Carrie also recommends combining strategies, like this client did.

If you're interested in how to present a fixed indexed annuity, we wrote a comprehensive article on it. Check it out!

Can You Lose Money In a Fixed Index Annuity?

Can you lose money in a fixed index annuity? The answer is no! Zero is truly your hero with SILAC's fixed index annuity products. There are no fees, so even if the market does terribly and you earn 0%, your principal stays the same.

That's a huge selling point for clients in their retirement years. They need to preserve their money now – not worry about losing it.

Do Annual Reviews With Your FIA Clients

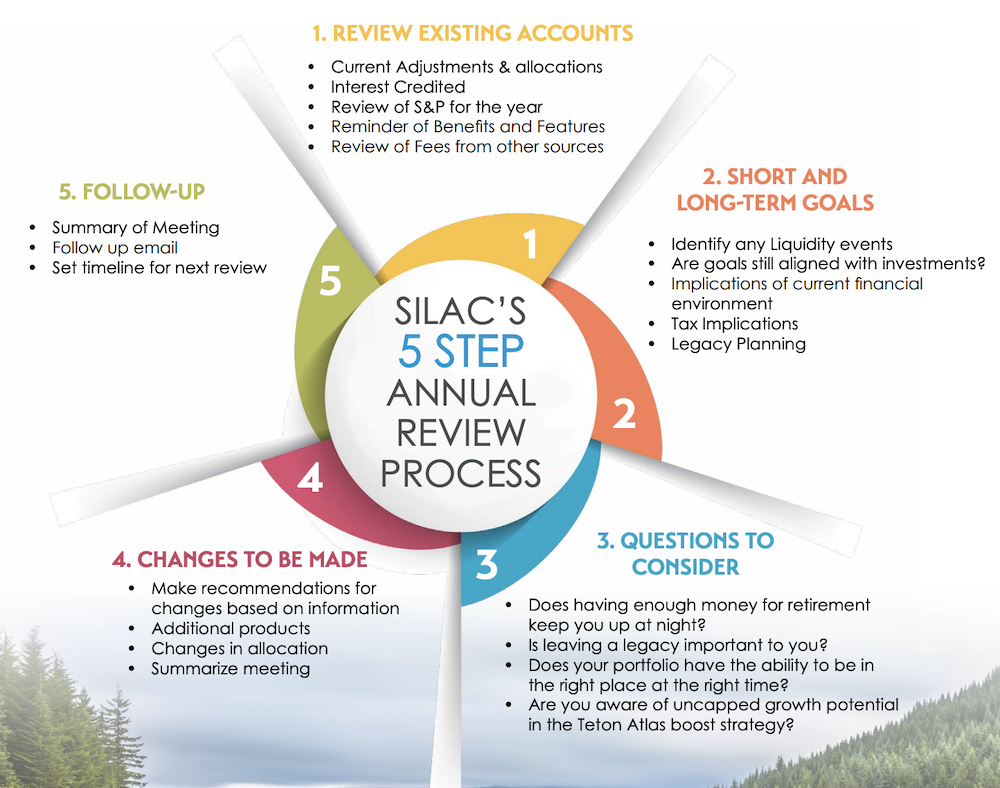

It's always a good idea to meet with your clients annually. Life happens, so you can go over any big changes, such as beneficiaries or long-term goals.

You should also meet to go over the performance of their fixed index annuity and how they want to allocate funds over the next year:

- Review current adjustments and allocations

- Review the interest they've earned (interest credited)

- Remind them of their benefits and policy features

- Review any fees their product may have

Many clients put a hefty percentage of their retirement funds into a fixed index annuity. They certainly should not be overlooked or forgotten about! Trust me – there are plenty of agents out there waiting for the first sign of blood so they can attack and steal that business.

The commissions on fixed index annuities are really great, and you should treat your clients that way! Give them the time, love, and attention they need to feel confident and know their goals are properly aligned with their investments.

SILAC has put together an agent cheat sheet to use for annual reviews that is a huge help. There's a checklist and even some scripts you can reference to help you prepare if annual FIA reviews are new to you.

You can download it using this link:

It's also available in the SILAC agent annuity portal.

Conclusion

Don't shy away from fixed index annuities! Clients love the concept, and they love the results when it's a fantastic year. Plus, the commissions speak for themselves.

Our top pick for a FIA carrier is SILAC – you just can't beat the simplicity of their product, their incredible customer service, and the returns our clients are getting. It's a knockout.

Resources: