Medicare Supplement rate increases are inevitable. There's typically at least one rate increase per year, and it's fairly common for a premium to double over the course of 7-10 years. So, how are you handling rate increases with your clients?

If you aren't, John Hockaday, Partner, says it's time to start.

If you aren't, John Hockaday, Partner, says it's time to start.

"Don't ignore it – hit it head on. Some agents put their head under the pillow, but I'd say go straight at it! They're all going to raise. It's just a matter of when," he says.

Today, we're tackling rate increases head-on. What are they, why do they happen, and most importantly, what should you do with your clients?

What's a Typical Med Supp Rate Increase?

If you've been in this business for a while, you get a feel for the ebb and flow of rate increases. They're pretty standard with a few big shockers every once in a while.

We follow rate increase information and have several years of it archived. We encourage agents to bookmark our Medicare Supplement Rate Changes page and refer back to it often. We always have a link to this page in our weekly email newsletters – make sure you sign up for those!

To give a general idea of what to expect, we did an analysis of historical rate increases in all states from three of our top carriers. The national average for a Plan F rate increase is about 8%. The national average for Plan G rate increases is 6%, and Plan N is 3.5%.

Average Rate Increases on Medigap Plans F, G, and N

| Plan F | Plan G | Plan N |

|---|---|---|

| 8% | 6% | 3.5% |

Shannan Weaver, Field Communications Director, explains the insurance company will send rate increase announcements to the FMOs 30-45 days out. Then, they send out a rate increase letter to the client.

Shannan Weaver, Field Communications Director, explains the insurance company will send rate increase announcements to the FMOs 30-45 days out. Then, they send out a rate increase letter to the client.

"They don't always send that to the agent, though," she says. "That's why we publish rate increase information as soon as we know about it."

The rate increase may be taking effect on a certain date – say July 1 – or it may be taking effect on the client's renewal date. Michael Sams, Director of Sales Training and Development, says it's more common for a rate increase to take effect on the same date for everyone.

Why Do Med Supp Rates Increase?

Medicare Supplements experience rate increases for a number of reasons, but it all starts with how the carrier prices the plan.

Community, Issue-Age, and Attained-Age Pricing Structures

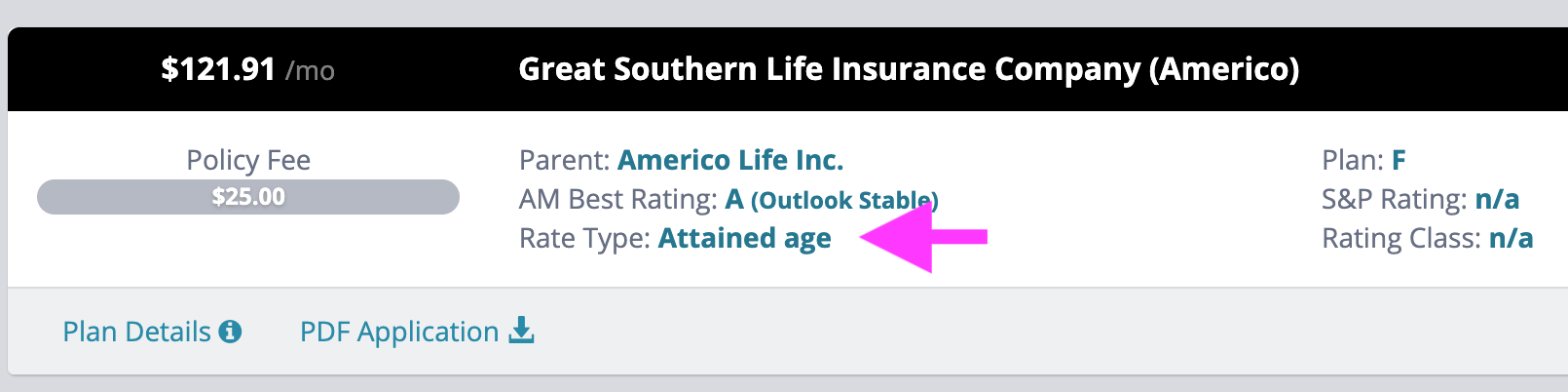

There are three pricing structures companies can use including community rated, issue-age rated, and attained-age rated. If you use our quote engine, the quote will tell you which rate type it is:

1. Community rated: Everyone pays the same, flat rate regardless of age or health status. A 65-year-old pays the same price as a 90-year-old. You can still have rate increases, but not due to age or health status.

This is the least common pricing structure. Carriers typically only do this in states where they're required to by law, which includes the following eight states:

- Arkansas

- Connecticut

- Massachusetts

- Maine

- Minnesota

- New York

- Vermont

- Washington

While carriers can offer community rated plans in other states, most don't.

2. Issue-age rated: your premium is based on your age at the time of purchase, but it won't be increasing later on because of your age. You can still have rate increases, but not due to age.

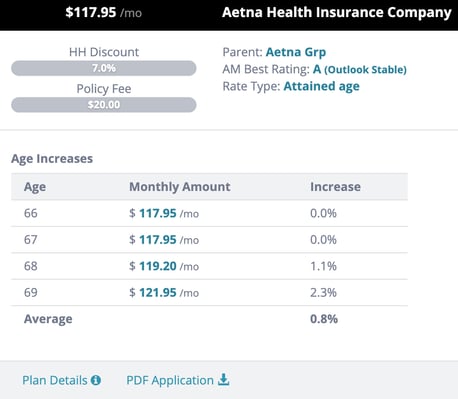

3. Attained-age rated: premiums vary based on age at the time of purchase, and your premiums can also increase later on due to your age.

Here’s an example of a typical Medicare Supplement age increase scenario:- At age 65, you pay $92.63.

- At age 66, you pay $92.63.

- At age 67, you pay $92.63.

- At age 68, you pay $96.74.

- At age 69, you pay $100.94.

You can view age-related increases in our quote engine. Run your quote like normal and make sure to check "Market Analytics." It'll look like this:

We joke this is the worst kind of birthday present.

Attained-age is the most common rating structure.

Everything Else

Age plays a big part of why clients get Med Supp rate increases. But there's also... well, everything else.

Probably the biggest one is claims experience, or the money the company has paid out for claims. If a lot of policyholders have expensive claims, it can cause the pricing to go up for everyone.

It's important to note here that the rate goes up for everyone, not individual policyholders. It's not like your rate goes up if you use the insurance a lot, and your rate won't be "protected" if you don't use it at all. When there's a rate increase due to claims experience, the rate goes up for all policyholders, whether they've used the insurance or not.

Inflation is another one. If the overall costs for health care go up, Medigap rates follow suit. Carriers also cite new technology and administration costs as factors.

All that said, most carriers will bundle all of this information into one by saying rates are increasing due to the rising cost of healthcare.

How to Communicate Rate Increases to Clients

When it comes to rate increases, be informed and reach out to your clients!

That'll not only strengthen the relationship you have, but it'll help protect you from other agents who may try to poach your business on the heels of a big rate increase.

"If there's a big increase and you're worried people will jump ship, be proactive about it," Michael says.

What to Say

Jeff Sams, Partner, advises to tell your clients there are many options:

Jeff Sams, Partner, advises to tell your clients there are many options:

"We represent a whole stable of companies, and I would like to shop the market for you in the event you want to check your current premium within the marketplace."

John agrees, saying, "Let them know you're married to them, not a company."

If the client is in their fourth, fifth, or sixth year, Jeff says it's critical to get in front of them to restart your renewal stream, but only if it's a better deal for the consumer.

There are several ways to communicate a rate increase to your client, but John's partial to in-person.

"Nose to nose is the best, so that's my first choice. Go for however you can make it the most personal," he says.

Renewal Appointments

Michael Sams admits he's not as "on top" of rate increases as he was when his client base was a little smaller.

Michael Sams admits he's not as "on top" of rate increases as he was when his client base was a little smaller.

However, here's what his rate increase system looks like:

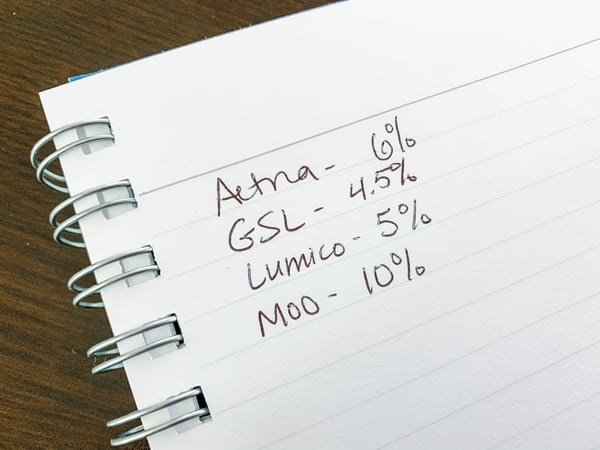

- Run a list of renewals that are 45 days out (he uses AgencyBloc for this)

- Set the renewal appointment

- Take a quick inventory of the current rate increases

- Jot the increases down an index card to reference during the appointment

"I'd reference that index card and tell my client what their new premium will be. Then, I see which carriers can beat that price and we'll see if the client can health qualify," he says.

Michael explains it's pretty typical to end that appointment by saving the client $35 per month or so without changing their coverage at all.

When you're working renewals, this system is really helpful.

When You Can't Be Face-to-Face

If you can't get in person, run on down the list of next-best options, which goes a little something like this:

- Video meeting – check out: How to Use Zoom for Client Video Conferences

- Phone call

- Postcard

We recognize that sometimes, in-person appointments, video meetings, and phone calls just aren't practical.

If you have a massive client base and a big rate increase was just announced, it's not realistic to think you can meet with hundreds of clients. In addition, many clients won't be able to health qualify to switch carriers, so there may be nothing you do for them.

We put together some resources for you to utilize in those situations, including four email templates and a customizable* postcard.

*Note: We only offer marketing customizations for contracted agents.

Conclusion

Rate increases are here to stay, unfortunately, so guide your clients through the process and help them keep premiums down.

If they can health qualify, you can likely save them money every time, and if they have some health concerns, we still have carriers that may be an option.

A great carrier to have in your arsenal for older clients is United American (UA). It is a more expensive carrier, but if your client has been taking rate increases for the better part of a decade, it very well could still save them money.

A few more quick highlights about UA:

A few more quick highlights about UA:

- Ease of underwriting and a very simple application

- Ages 80+ all the same price (no rate increases due to age)

- Pays full comp over age 80 – no comp reductions!

Let us know – how do you handle rate increases with your clients?

![The Simple Question That Drove $9M+ in Annuity Sales [Case Study]](https://blog.newhorizonsmktg.com/hs-fs/hubfs/NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp?width=220&height=119&name=NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp)