If you’re an independent insurance agent, particularly in the senior market, odds are you either sell cancer insurance or have considered it in the past.

To make things as simple as possible, this is generally how you can gauge the “worthiness” of a particular product:

- Is there a need for it?

- Do my clients like it?

- Can my clients afford it?

The Need, Like, Afford method has been a sales technique used for decades – the idea being that if you can tick all these boxes, you have the sale.

In order to really determine if cancer insurance is worth selling, we’re going back to the basics. We’ll also point out some common objections from agents and our thoughts on those throughout this article.

Need some Cancer Plan basics first? Read: Cancer Plans: Sales Techniques, Product Info, & Carrier-Specific Answers

Is cancer insurance needed?

There are a few points to consider when we look at the actual need.

- What are the odds that someone will be diagnosed with cancer?

- If someone is diagnosed with cancer, will they actually need extra money to cover the associated costs?

1. Look at the odds of developing cancer

The first one is pretty easy to determine, thanks to statistics. You can also jot these down and use them for your own sales presentations.

Half of all men, and one-third of all women will develop cancer at some point in their lifetime (American Cancer Society).

That statistic comes straight from the American Cancer Society, but in all honesty, you and probably all of your clients know at least one person in their life who has had cancer. It’s not a far-fetched idea that there’s a good chance it could happen to you.

Those are your odds of getting cancer – 1 in 2 if you’re a man, and 1 in 3 if you’re a woman.

Objection #1: The odds of using a cancer policy aren’t as great as the odds of using different insurances, like life insurance.

Sure, a permanent life insurance policy is going to be used. You will die. Your odds of cashing in on that are 100%.

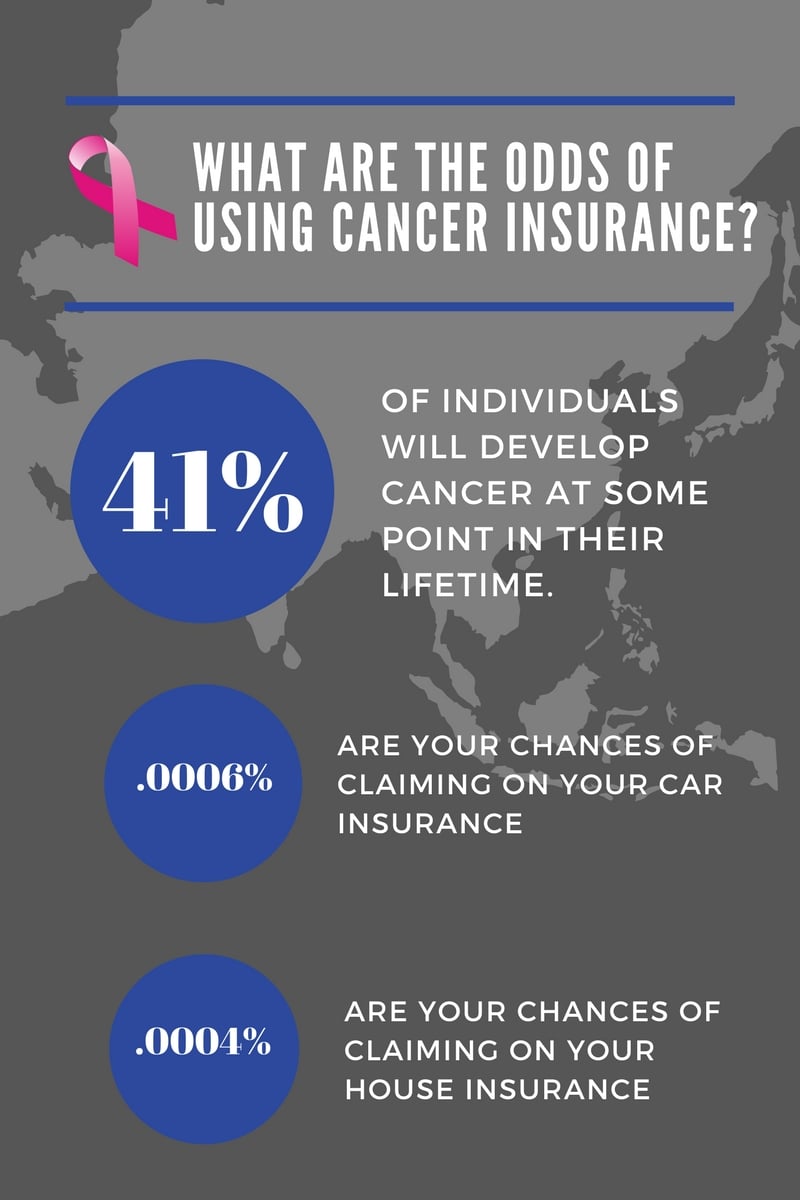

We mentioned that your odds of using a cancer policy are, collectively, 41%.

That being said, if you apply that same logic to other types of insurance that nearly everyone has – car insurance, homeowners insurance, etc. – why even buy insurance?

The odds of claiming on your house insurance is 1 in 2,766.

The odds of claiming on your car insurance is 1 in 1,685.

And remember – the odds of claiming on your cancer insurance are 1 in 2 for men, and 1 in 3 for women.

Insurance is just that – insuring against your potential risk. And with such a great risk of being diagnosed with cancer (we haven’t even mentioned the other critical illnesses often covered in these policies as well), it seems silly to discount it altogether based on the odds.

2. Look at the potential of actually needing insurance money

Two-thirds of all costs associated with cancer are non-medical.

I might be preaching to the choir here, but obviously, Medicare won’t cover any expenses that aren’t deemed to be medically necessary.

Your clients will probably look at you and say “so what?” That’s why it’s so critical to actually look at real-life examples of those non-medical costs – because you can’t ignore them.

There are dozens of examples, but here are just a few.

- When you get cancer, the treatments tend to cause loss of appetite. It’s normal to drop a significant amount of weight. That means you need all new clothing. And over time, it’s probable that you’ll put some of that weight back on – which means you need new clothes again.

- If you’re spending most of your time in a hospital – and keep in mind that cancer drains you both physically and mentally – you likely won’t be able to keep up with a full-time job. Where will income replacement come from?

- You have twice the chance of survival if you go to a research facility — so why wouldn’t you? The top cancer hospitals are in Houston, New York City, Rochester, and Boston. Who will pay for the airfare, the hotel stays, the meals, etc.?

Then, you can consider other costs, like getting a wig if your hair falls out, covering the cost of special diets, any extra deductibles or coinsurance, and suddenly, the costs left to you are racking up.

So, is there a financial need for cancer insurance? Yeah, I’d say so.

Objection #2: Your regular health insurance doesn’t pay your travel expenses, income replacement, house payment, etc. Why should you buy a plan that covers that in the case of cancer?

Because cancer is so common, and because there are so many costs associated with it that aren’t covered by regular insurance, it only makes sense to at least consider the idea of purchasing a policy.

Also, keep in mind that many cancer plans also cover other critical illnesses like heart attack and stroke, which are also extremely expensive to manage – not including the medical costs, which should be covered by Medicare and hopefully, a Medicare Supplement.

Is cancer insurance a likable product?

From an agent perspective, you have to like the product in order to want to sell it. That’s not lost on us.

For you, these are probably the most important elements of a great plan:

- The need for it is simple to explain/present to the client

- The benefits are simple to explain to the client

- The premium is affordable

- The commission is worth it

- The underwriting is reasonable

If I’m missing something, add it to the comment section at the end of this post.

So, let’s break this down a bit.

The need is extremely simple to explain to the client. Many of the agents who work for the local agency simply go through those statistics – 1 in 2 men, 1 in 3 women. Your odds of survival double when you go to a research facility. Two-thirds of cancer costs aren’t covered by Medicare.

Once you have that information rock solid, it’ll be easy as pie to present, particularly alongside a Medicare Supplement.

The benefits are also simple to explain to the client, and even moreso for lump sum cancer plans. The lump sum cancer plan simply pays the policyholder a sum of money when they’re diagnosed with cancer. It’s really that simple.

Aetna, Medico, and Mutual of Omaha have lump sum cancer plans.

The other type of plan is one where each item is paid for as it’s billed, but the benefits vary. You can see what those benefits look like in the outline of coverage provided by that company.

Standard Life and UNL have plans like this. They’re not as simple to explain to the client, but what’s nice is that you do have options if you need them.

The premium is extremely affordable, and you can always give 3 benefit options.

Most lump sum cancer plans tend to follow this pattern: $30/month for $10,000, $60/month for $20,000. And $90/month for $30,000. That’s for an individual.

You also have the option to add your spouse, your kids, or to just do your whole family. When you add others to the policy, the price only raises minimally for each benefit tier.

Objection #3: My clients don’t have any extra money to pay for this type of insurance.

If your clients are truly strapped for cash and are living off a meager fixed income, the first thing you want to take care of is their health insurance, whether that be a supplement or an advantage plan.

However, many clients are coming off of a group plan are are completely and utterly thrilled to be paying just over $100/month for a supplement. What’s another $30 or $60 for an added cancer benefit?

It’s also helpful if you have a client who already had a Plan F with someone else. You can oftentimes switch them to a G or an N with a cancer plan, and still save them money.

The commission is absolutely worth it, particularly if you’re cross-selling. If you’re only selling cancer plans, well, I don’t know anyone who only sells cancer plans. But if you’re adding a cancer plan to a supplement or to a life insurance plan, you’re doubling the amount of policies you have with that client.

So, not only are you solidifying that relationship with your client, but you’re adding to your bottom line.

Finally, the underwriting is simple, and it’s actually far easier than a Med Supp.

As long as you don’t have AIDS or HIV, you’re not looking at a very difficult application.

As far as cancer goes, the lookback period is generally 5 or 10 years, so if your client has had cancer in the past, it doesn’t make them a knockout.

Overall, I’d say that cancer insurance is a very likable product.

Objection #4: A lot of my customers wouldn’t qualify because of their health conditions.

Unless your client literally has cancer or has had cancer in the last 5-10 years, there really won’t be an issue with being accepted. While AIDS and HIV are knockouts, they’re knockouts for nearly all insurance products.

If you don’t have a lot of clients with AIDS or HIV, most of your book likely would be approved for cancer insurance.

Is cancer insurance affordable?

We already brushed on this in the last section, but in reality, cancer insurance is very affordable, especially when you compare it to other insurances seniors are eligible for.

Tacking on an extra $30-$60 for cancer coverage feels like nothing when a senior has been used to paying hundreds of dollars a month for their group insurance.

We understand that not everyone is in that situation, and certainly not everyone will be able to afford it – there are always exceptions. But if you’re in the Med Supp business, we’re betting that most of your clients would be happy to have that extra coverage for the price.

Cancer Insurance Companies – Aetna, Medico, Standard Life, United National Life, and Mutual of Omaha

New Horizons currently represents 5 carriers of cancer insurance, and while you can find all the brochures, apps, rate charts, and so on here, we thought it might be useful to give you a quick comparison chart.

Here, you can see which plans are lump sum vs. pay-as-you-need-it plans, what the waiting periods are, benefit options, issue ages, the lookback on cancer, and more.

| Aetna | Medico | Standard Life | UNL | Mutual of Omaha | |

|---|---|---|---|---|---|

| Waiting Period | 30 days | 30 days | 30 days | 30 days | 30 days |

| Benefit amount | $5,000 - $75,000 | $10,000 - $25,000 | One monthly rate for specific benefits in OLC | One monthly rate for specific benefits in OLC | $10,000 - $100,000 |

| Issue ages | 18-89 | 18-79 | 18-75 | 18-79 | 18-79, 18-54 (term) |

| Guaranteed renewable? | Yes | Yes | Yes | Yes | Yes |

| Covers internal cancer? | Yes | Yes | Yes | Yes | Yes |

| Covers malignant melanoma? | Yes | Yes | Yes | Yes | Yes |

| Covers other skin cancers? | No | No | Yes | No | Yes |

| Eligibility requirement | No cancer in past 10 years | No cancer in past 10 years | No cancer in past 5 years | No cancer in past 10 years | No cancer ever |

If you have any questions or comments about cancer insurance, please put those in the comment section below. We love helping out and reading your insights.

To get contracted, simply visit our Cancer Insurance page.

![The Simple Question That Drove $9M+ in Annuity Sales [Case Study]](https://blog.newhorizonsmktg.com/hs-fs/hubfs/NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp?width=220&height=119&name=NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp)