We thought it would be really helpful to provide some tools over the next few weeks to sort out the hottest trend in our industry; life with the LTC rider, and move towards helping you position more opportunities. This week, let's take a look at some eye opening statistics:

Why is long term care such a hot topic?

- Average premiums on new LTC policies have risen 6 -17% within the past year.

- 10 of the top 20 carriers of 5 years ago of individual LTC have exited the market.

- 11% of applicants for LTC under age 50 in 2010 were denied coverage.

- 17% of applicants in their 50s were denied coverage.

- 24% of applicants in their 60s were denied coverage.

Wall Street Journal Article, Don't Grow Old Without It, April 9, 2012 - 70% of people over the age of 65 will require LTC services at some point in their lives

US Dept of Health and Human Services, National Clearinghouse for Long-Term Care Information, www.longtermcare.gov, Sept 2010

Understanding John Hancock's Claims Experience

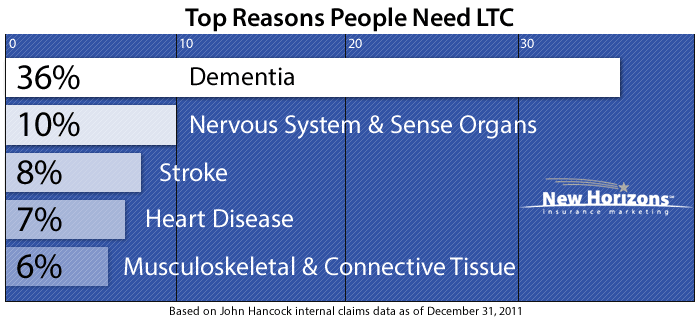

Top Reasons People Need LTC1

- Dementia = 36%

- Nervous System and Sense Organs = 10%

- Stroke = 8%

- Heart Disease = 7%

- Musculoskeletal and connective tissue = 6%

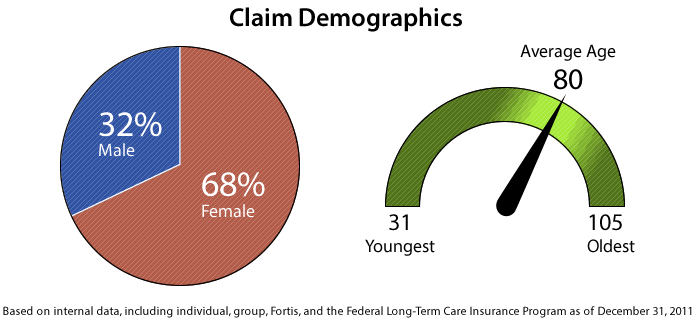

Claim Demographics2

- 68% Female; 32% male

- Average Claimant: age 80

- Youngest Claimant: age 31

- Oldest Claimant: age 105

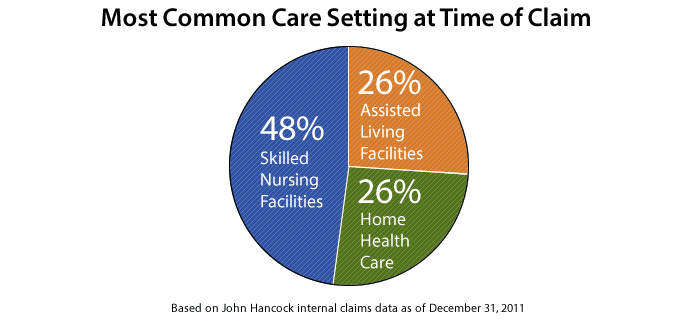

Most Common Care Setting at Time of Claim1

- 48% Home Health Care

- 26% Assisted Living Facilities

- 26% Skilled Nursing Facilities

Claims Paying History1

- We pay approximately $2 million in LTC claims per day with a total of over $4 billion in LTC claims paid

- John Hancock has more than $27.6 billion in total funds under management to ensure we will be able to meet all of our future LTC claims obligations.

- Based on John Hancock internal claims data as of December 31, 2011.

- Based on internal data, including individual, group, Fortis, and the Federal Long-Term Care Insurance Program as of December 31, 2011.

We hope this information will help you to start thinking about the opportunity and what product options you have to fill the need.

Contact us to learn how you can help families solve the LTC dilemma. We have helped agents help their clients for several years with the Life / LTC concept.

Continue on to Part 2:

The JH LTC Opportunity Series - Part 2: LTC Cost of Care

![The Simple Question That Drove $9M+ in Annuity Sales [Case Study]](https://blog.newhorizonsmktg.com/hs-fs/hubfs/NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp?width=220&height=119&name=NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp)