Cross-selling is a great way to increase your production, but it also helps your clients round out their health and wealth plan.

Whether you want to try some new cross-selling strategies or you're learning about cross-selling for the first time, our team has rounded up 15 ideas just for insurance agents in the senior market.

1. Use the Client Needs Assessment or other fact finder document

Cross-selling is effortless when you go into your appointment with a plan. Ultimately, cross-selling shouldn't be about trying to sell more insurance. It's really about making sure your customers are covered in all the places they need coverage.

The Client Needs Assessment – or other fact finder of your choice – will help you understand where your client has coverage gaps and where you can help solve those problems.

If they have a history of cancer in their family, it's simple to unveil that using a fact finder. Then, it's just a matter of presenting some information and guiding them to the proper cancer insurance plan.

2. Supersize the sale

Another cross-selling strategy many agents use is the "supersize" method.

We all know the McDonald's trick — sell the hamburger at a low-profit margin in the hopes that the customer will add on some fries and a drink and maybe even supersize their meal.

You can do something similar when selling Medicare Supplements. As you fill out the application, just ask: "Do you want the lump-sum cancer coverage with this?" (The product you suggest adding on will depend on what needs you've uncovered in the Client Needs Assessment.)

John Hockaday also suggests adding a question to the end of a Med Supp application to cross-sell final expense insurance. Just ask at the end, "Do you want the death benefit with this?"

When you present other insurance options as an add-on, there's an assumption that it's really common. It's almost like you're just asking as a courtesy.

3. Send a timely letter

A lot of agents have a goldmine in their existing book of business. You can send out a letter, maybe something timely, as a way to cross-sell.

As an example, fixed annuity rates are off the charts right now – it's the perfect time to send a letter or email about that to your existing customers.

They are already comfortable enough to have at least policy with you; selling another policy to them is far easier than acquiring a brand new customer. And you're helping them along the way!

4. Look at the cross-sell tags in IntegrityCONNECT

Cross-sell tags are auto-assigned in IntegrityCONNECT to clients with coverage that may not be meeting all their needs.

You can learn more about this feature in this video:

5. Use the Med Supp policy checklist

While going through the Med Supp policy checklist with your client, you’ll come to the Skilled Nursing Home Care benefits section.

It's the perfect time to explain that Medicare pays 100% during the first 20 days and all but a $200 coinsurance for days 21-100 (which their Med Supp will pay for). After that, the client will be responsible for any payments after 100 days, unless they have long-term or short-time care insurance.

It's the perfect time to ask:

- Do you have long-term care insurance?

- Have you ever looked into it?

6. Save a lot here, spend a little there

If you're switching a client to a new Med Supp that'll save them a ton on premium, you can make a suggestion about what to do with that savings.

Say you save your client $50 per month on their Medicare Supplement plan. Ask them if they have life insurance or burial insurance. A $10,000 final expense policy can be purchased with some of the savings, so your client gets more coverage and still saves money.

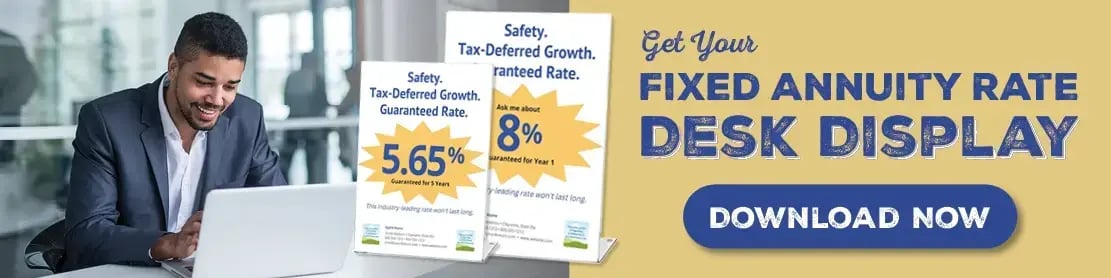

7. Use a desk display in your office

An eye-catching desk display is an easy way to inform your client of something you offer without ever actually talking about it.

We created a fixed annuity desk display that many agents use, and they tell us their clients ask THEM about the product. It's probably the easiest way to cross-sell, but you do need an office where you see your customers in-person.

Related: 8 Medicare Agents Answer: Do You Need an Office Space to Sell Insurance?

Note: you can change the rate and add your contact information on this desk display!

8. Bundle Medicare Advantage with a Hospital Indemnity plan

For agents in the MA space, Steve Spinner, Director of Medicare Advantage Sales, suggests always trying to bundle a HIP plan.

You can talk about HIP as you go through the summary of benefits with your client.

"It seems the No. 1 cost factor is the inpatient hospital stay, i.e: a copay of ~$300 per day limited to 5 days. This can be softened by a HIP plan that pays X amount per day of confinement. Medico and Aetna have excellent plans that can be quoted in CSG." -Steve

9. Don't give up if they say no the first time

If you suggest another insurance policy or annuity product and the client says no, don't stop asking.

Just because a client wasn't interested during your first appointment doesn't mean they won't change their mind over time.

Maybe something has changed. Maybe one of their buddies just went through the need for long-term care, and the urgency hits them.

Maybe they have $103,000 in their checking account, they just wrote a check for their real estate taxes, and their account dipped below $100,000. They may decide to not write a check until it bounces back up.

You never know, but no doesn't mean no forever.

10. Lay out everything you suggest at the first appointment

Cross-selling can feel sales-y. If we're being honest, clients may get the impression that you're just trying to sell them another policy to make a few bucks.

That's why Michael Sams' favorite cross-selling strategy is to lay everything out at the very first appointment. No surprises.

"I establish the fact that based on a needs assessment from the initial visit, there are multiple needs that we are going to be able to help you with. But we first tackle the one with the greatest sense of urgency. After that, we will worry about the others at a later date.

It sets the stage that there are future needs that need to be addressed without feeling like you were just trying to sell them something new every time they come in." –Michael

11. Explain you are obligated to inform

Jeff Sams' favorite cross-selling strategy is explaining to your client that you don't want to do them a disservice by not bringing these other coverage options up.

"I explain that I feel obligated to let you know we have a potential hole in your coverage, and I would like to recommend this additional coverage to avoid any surprises. Then I go right for the great coverage I am suggesting!" –Jeff

12. Get more comfortable with the cross-selling products

Sometimes, embracing cross-selling is as simple as building your confidence. Tyler Petersen suggests spending some time getting more comfortable with the products you're going to recommend.

You don't need to be an expert by any means (that's what we are for), but do some training so that you aren't afraid to have those conversations with your prospects and customers.

We have several training hubs to get you started:

13. Let your prospects know everything you offer from the beginning

We hear so often from agents that when they start trying to cross-sell, their clients would say things like, "Oh, I didn't know you did life insurance!" or something similar.

Make it clear from the beginning what product lines you offer. List them on your website and your business cards. Tell your clients on your first meeting everything you do.

Sometimes, that's all it takes to get your clients interested.

14. Inform clients of bundling discounts

Some insurance carriers offer discounts if a client bundles an ancillary product with their health insurance policy. Everyone wants a good deal, and if your client is in need of that coverage anyway, the savings may be enough motivation to go for it.

As an example, AllState offers a great dental discount. Combine an Allstate DVH policy with a Med Supp policy and save 10% on dental.

Medico has a similar program as well for Med Supp and dental bundling discounts.

Both of these carriers are very competitive on their Med Supps, too, so don't hesitate to visit their pages and request contracting!

15. Just ask

Luke Hockaday's best cross-selling strategy advice? Just ask.

If you don't ask, the answer will always be no.

Conclusion

Cross-selling is not only a great way to grow your business, but it also helps your customers have well-rounded coverage in retirement.

What's your favorite cross-selling strategy? Share in the comments below!

More cross-selling resources: