Life Insurance Awareness Month rolls around every September, and during this 30-day sprint, consumers all across the nation are being reminded about the importance of life insurance.

Whether it's commercials featuring Danica Patrick or memes clouding up the Facebook newsfeed, life insurance is sure to be top of mind.

At any given time, only 3% of your market is actively buying, 56% aren't ready yet, and 40% are poised to begin.

[Read more stats: These Sales Stats and Facts Will Change the Way You Sell Insurance]

If there's someone out there who has been meaning to get life insurance, all it takes is a gentle nudge, and they're ready to become that active buyer.

If you want to help out your clients and be ready to start selling life insurance fast, you're probably wondering... how long does it take to start selling life insurance?

Life Insurance Training Timeline

You might be expecting to hear that you need quite a bit of time to become familiar with life insurance products.

And, in a sense, that's true. However, you don't need to spend weeks sifting through OLCs and brochures. In fact, you don't really need much training at all to start selling life insurance.

All you need to learn is:

- Why there's a need for life insurance in the senior market, and

- How to start up the conversation with your client.

All of the "in the weeds" details can be handled by me (Kirk Sarff).

As you become more familiar with the nuances of different life insurance products – like whole life or life with a long-term care rider – you'll be able to start navigating the details on your own. However, you don't need that knowledge to get started.

As long as you can:

- Engage your clients in a conversation,

- Gather up any information about existing life insurance, and

- Find out if they have a need for life insurance...

You're golden.

If they do have existing life insurance, send me their last statement, and I'll see if we can improve their situation.

I do the homework for you, and you get to go back to your client with good news or better news – either their current life insurance is great, or we can make it even better by saving them money on premium or by increasing their death benefit.

In fact, here's a chart showing you what we do for you versus what you're required to do:

| What We Do | What You Do |

|---|---|

| Scrub your application | Complete application with your client |

| Submit your application to the carrier | Transmit to New Horizons |

| Order all supplies | Receive case status updates |

| Keep you informed of case status | Check your bank for commission |

| Do all legwork needed to place your case |

So, really, your training timeline consists of educating yourself on the need for life insurance and how to find out that need from your client. You can learn that in a matter of an hour, but we encourage you to do some practice runs with friends or family so that you're comfortable.

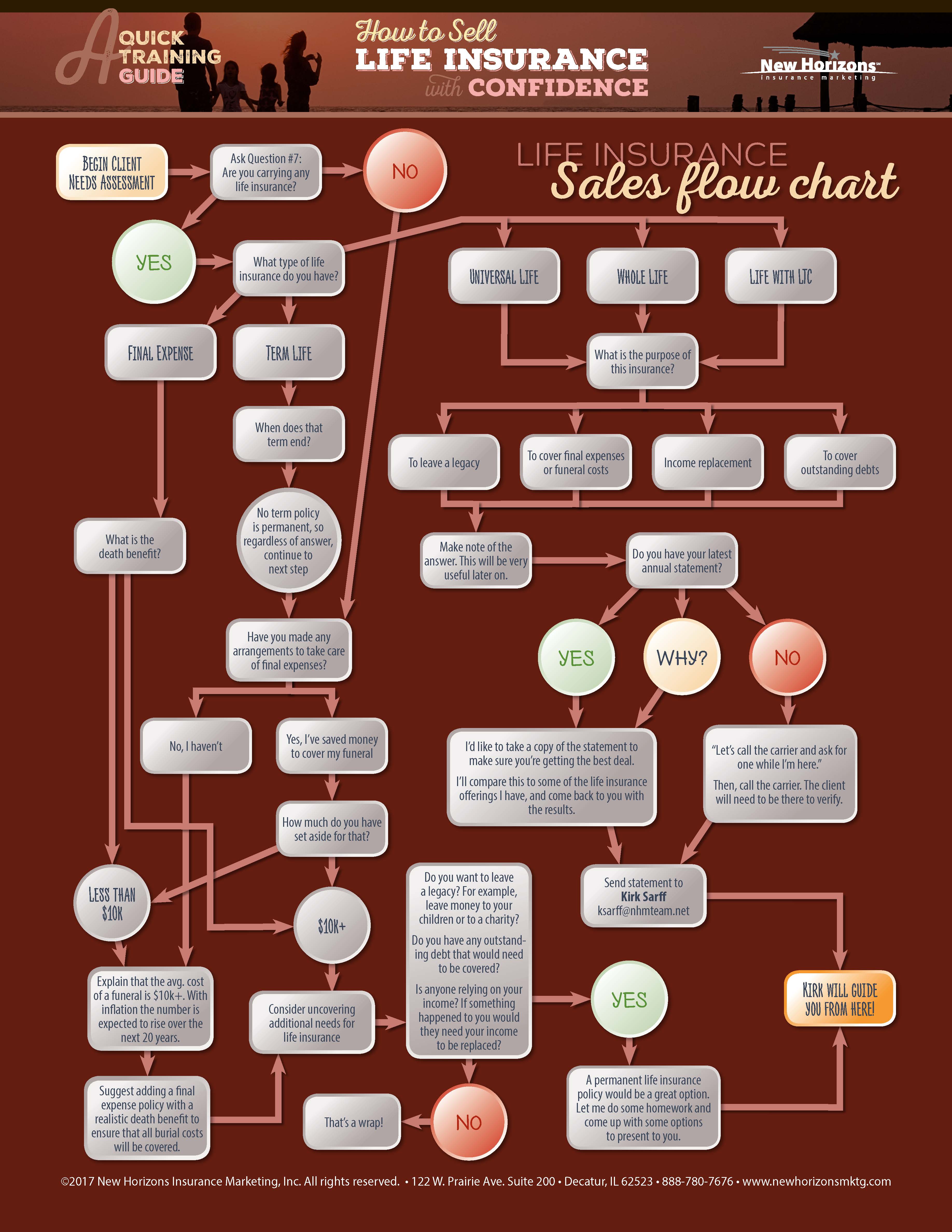

Use the Life Insurance Sales Flow Chart

We created a Life Insurance Sales Flow Chart to guide you through the conversation starter and the potential needs of your client, but what's really cool is that essentially, all paths lead to the same ending: I will guide you from there!

I can help as little or as much as you need. I have agents who send me life insurance statements from their clients and ask me to research their options. I have agents who share the budget and need of the client, and they ask me to come up with 3 or 4 options.

I also have agents who know exactly what policy they want, and they just need an official illustration from me.

With experience, you'll get to the point where you know exactly what your client needs. However, when you're just starting out, I can guide you through the process.

Find the Need for Life Insurance

As you can see in the flowchart above, the need for life insurance will dictate what path you choose.

We covered the needs in-depth in our Ultimate Guide to Selling Life Insurance in the Senior Market article, but here are the cliff notes:

Senior individuals might need life insurance for a few reasons:

- Leave a legacy

- Cover final expenses and burial costs

- Income replacement for those that are dependent on current income

- Cover outstanding debt

Another potential reason is if they are looking for a way to cover long-term care expenses. A life insurance policy with an LTC rider is generally a great option for someone who has one of the 4 main needs above, and they also don't have a plan for LTC.

Once you understand these needs, you'll feel more comfortable engaging your clients in a conversation about life insurance.

But... how do you start?

Engage Your Clients With the Client Needs Assessment (CNA)

At this point, you know that you don't need to understand what life insurance products every carrier has – you can rely on me for that.

You are also starting to get a better understanding of why a senior-aged individual would have a need for life insurance.

Now, it's time to get them talking. The best way to do that is by using a needs assessment.

Our Client Needs Assessment starts the conversation with this question: "Do you currently carry any life insurance?"

From there, you gather information about the policy if they have one. Then, you send the information to me.

If they don't have any life insurance, you'll want to pivot to the next question: "Have you made any arrangements to take care of final expenses?"

That should get some conversations going.

Michael Sams recently shared an alternative question if your client is going to retire: "Will you lose your life insurance coverage when you retire?"

That question isn't on the CNA, but as you can see, you can tailor these questions to better fit the client's situation.

When Michael asked this question, the client's eyes lit up, and he said, "Well, yes – I will lose my life coverage when I retire." Michael hit home for him, and that client felt understood.

The CNA makes it easy to get the life insurance conversation started, and we offer that as a free download.

How Long Does Life Insurance Contracting Take?

The final element in the life insurance sales process is getting contracted with the carriers you choose.

Several carriers offer Just-in-Time appointments, meaning that you can do your contracting with your first app.

These carriers include:

- American General

- Banner Life

- Cincinnati Life

- Cleaner

- Gerber

- John Hancock

- KSKJ Life

- Prudential

- Sentinel

- Transamerica

Other carriers require you to complete contracting before your first app:

- Aetna

- AIG (GI)

- Equitable

- Foresters

- Prosperity

- RNA Life

Depending on what carriers you want to start with, you may have to spend some time getting contracted before you can start selling life insurance.

If you're not sure what carriers to choose, contact me and I'll help you start with an excellent selection (888-780-7676).

Other articles that will help: