The licensed only agent (LOA) model is a great option for successful agents who want to expand by recruiting agents to work beneath them.

And you don't need to recruit dozens of agents, either. With less than 10 producers underneath you, you can be a very successful agency.

But before you jump in and take that next step, there's a lot to consider.

In this article, we're covering everything you need to know about starting an agency with the LOA insurance agent model. We'll cover the benefits and drawbacks, the value you offer in exchange for the LOA override, compensation agreements, and more.

Our advice is based on over 40 years of starting our own agency and continuing it to this day. We've also talked to many agency owners and are doing our best to compile all of that information in one place.

What Does LOA Stand for in Insurance?

LOA stands for licensed only agent, which is a captive agent – in our case, an agent who sells insurance products – who assigns their commissions up to another individual or company.

%20definition%20image.jpg?width=1200&name=Licensed%20Only%20Agent%20(LOA)%20definition%20image.jpg)

Note: The acronym LOA also stands for line of authority, or the types of insurance products an agent is licensed to sell. But in this article, we're referring to licensed only agent.

The individual or company receiving the commissions will keep a certain percentage, called an override. You can think of an override almost like an administrative fee. In exchange, the LOA gets a lot more support, structure, and training than an independent insurance agent doing everything on their own.

For example, an LOA might get an office space, a secretary, and a maintained website without having to pay outright for any of that. All of that extra value is paid for via the override.

Captive Insurance Agents vs LOAs

It's probably more common to see people talking about captive agents vs independent agents.

A captive insurance agent is the same exact thing as a licensed only agent (LOA). It's just different terminology.

Sub-Street Level Agent vs LOA

Another term commonly used in this space is "street level" agents or "sub-street level" agents. This is not the same thing as a licensed only agent.

Every carrier has a street level commission. If you come in at street, it means you don't need proof of production to get that commission rate. If you have proof of a high level of production, you can sometimes get commission above street level.

However, there's also a level below street, and that's sometimes referred to as "sub-street level."

A sub-street level agent still owns the business he writes, and the carrier pays the commission directly to that agent.

Some agencies prefer to have sub-street level agents instead of licensed-only agents because they don't have to handle commission payments. Being responsible for all the accounting and tracking commissions is a huge job, and this way, the carrier takes care of it.

However, usually only a very, very small agency would do that. It would also typically only be for a short time; for example, perhaps an agent is helping a new agent get on their feet.

The mentoring agent may put the new agent below street level and take a few commission points as they help that agent get started. When the new agent is ready to go on their own, the mentoring agent would cut them loose and let them get their own contract.

LOAs In the Grand Scheme of Downlines

In the world of insurance, things can get complicated as there are several levels between an LOA agent and the actual insurance company.

But here's the long story short: Insurance Company > FMO > Independent Agent > Agency > LOAs.

Insurance companies have products to sell, but they may not have the distribution – they need agents to sell their stuff! FMOs step in to help market those products, while also providing independent agents with support.

Related: Do Independent Agents Really Need a Field Marketing Organization (FMO)?

Independent agents may decide they want to grow beyond just themselves, so they may start an agency. And that agency may choose to have licensed only agents, or LOAs.

At the top of this "food chain," the overrides are very small. Each step down the chain, the override rises as the level of support increases. We'll get into commission splits and agreements a little later in this article.

Becoming an LOA for Your Own Agency

A pretty common scenario for our big writers is they set up their contracts through an LLC. They'll then become an LOA of their own LLC.

You're protected that way, but it's mostly beneficial for taxes. You pay yourself through the LLC or corporation – we see this structure all the time.

Licensed Only Agent (LOA) Model: Pros and Cons

Pros of the LOA model:

- You can do a lot of production with just 10 captive agents

- It's a natural next step for growth

- Bigger impact in your community as you can reach and help more people

- Lifelong friendships – we have agents at our local agency that have been with us for decades and are lifelong friends; I have to think we've done something right to warrant that.

Cons, or more so challenges, of the LOA model:

- Pressure and responsibility of being an agency owner

- Shifting from a sales role to management

- Figuring out how to retain agents who become successful and want to leave to become independent

- Getting the vesting agreement right

- Determining the compensation agreement and how you will structure the commissions

- Your own time, money, and effort required to get a brand new agent up and running

- Deciding on what value you have to offer agents in exchange for your override

- Figuring out if the book of business will be yours or the LOAs (i.e: will they be able to take that book of business with them if they decide to leave?)

There's so much to consider before just jumping into the idea of recruiting agents.

Pressure and Responsibility

I'd start with being honest with yourself: are you prepared for the pressure and responsibility of being an agency owner?

I remember not being able to sleep at night – I'd lay awake thinking about whether or not my agents were making a living. It's a lot of pressure, and you feel the responsibility of it.

From Sales to Management

You also need to ask yourself if you're cut out for being an agency owner. It takes the right person to be good at this. In my opinion, if you're a really good producer and you enjoy that, that gig is hard to beat.

When you start recruiting agents, you shift from sales to management. I see a lot of producers try it, and they should've just stuck with personal production because they ended up hating it.

If you're a highly successful producer, I'd first consider hiring someone to help you. Keep doing what you do best. People in support roles can help you with the things you don't like to do.

In sum, you have to be management and coaching-enclined to be good at this.

Plus, if you're a good salesman, you fight the thought that you could be selling everything yourself. You end up being a babysitter, and that may not be what you're looking for.

So, that's my word of caution for anyone thinking about starting an agency – seriously think it through first. We obviously took that step and have an agency, but it's definitely not for everyone.

How to Structure the Compensation Agreement

If you're ready to start an agency and recruit some agents, one of the first things you need to think about is how to structure the agent compensation agreement.

LOA Commission Split

We've tried to be as generous as we can at our agency because we know it's hard, especially when you're first starting. So we give our agents all that we can.

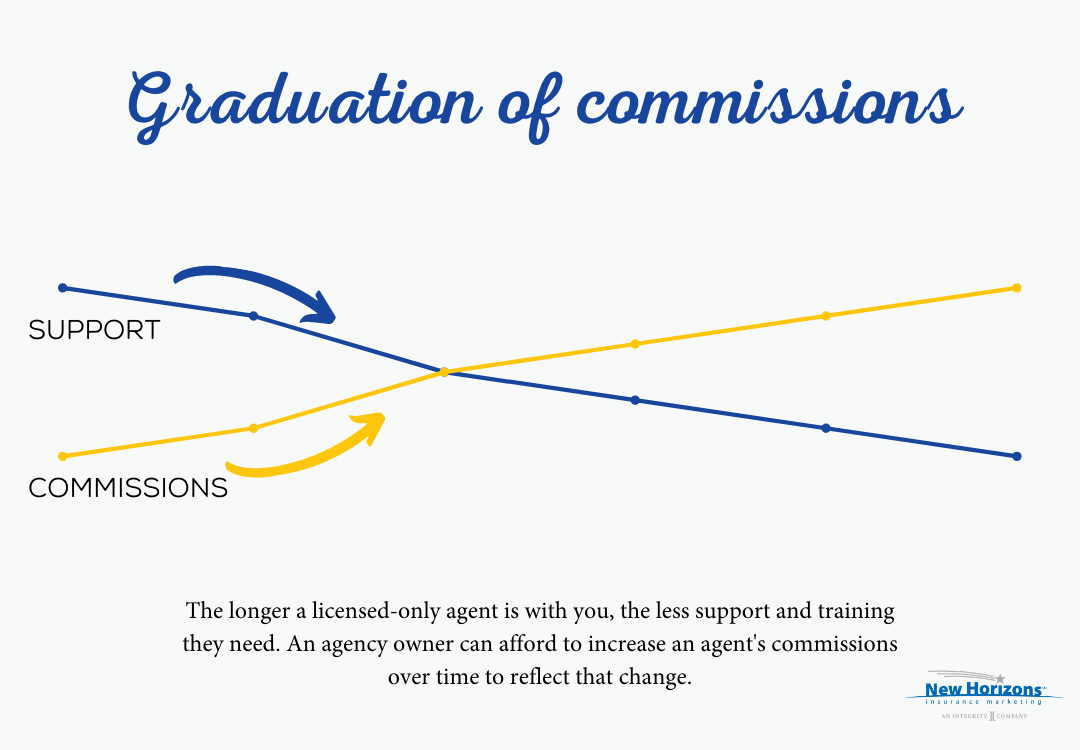

The commission split or structure can really vary, and you can also get creative with it. It could be 60/40 – meaning the LOA gets 60% and the house gets 40%, it could be 70/30, 80/20, or it could be graduated depending on how many years that agent has been with you.

A graduation of commissions can make a lot of sense because a brand new agent requires a lot more support than an established agent. As they "graduate" and need less help, the agency owner can then give them more commissions, because they're doing less for them.

I've seen agents come up with all kinds of commission splits, but the key is making sure that what you're doing for the agent is enough to justify your override. It has to be fair for both sides.

If you provide office space and secretarial administrative help, that agency owner deserves more than the person that just gives a contract and tells you to work out of your home. And yet sometimes, those spreads are the same!

There's no magic to it – it's up to the agency owner to be fair. And it needs to be crystal clear: what does the agent get, and what value is that agent bringing to the agency?

The Vesting Agreement

The vesting agreement is also an important piece to include in your agreement.

When an independent agent gets appointed, they're vested Day 1, meaning whatever commissions they earn, they continue to receive until that company's vesting requirements are satisfied.

As an example, some companies say you're vested Day 1, and those are your commissions as long as your commission amount is at least $300/year.

An LOA assigns their commissions up. If that agent leaves after a year, do they take anything with them, or are they just out?

Some agencies will do a vesting period as long as 10 years, but I'd say around 3 years is the most common.

You really need a vesting period in your agreement, because those first few years require a ton of time, money, and effort. Getting an agent started is an enormous task.

You may even be in the hole, especially in the first year, so is it fair for that agent to get all the training and support from you and then be able to leave once they're done? You need protection as an owner.

How to Structure an LOA Contract

You need a lawyer to put together the initial LOA contract. Then, you'll have a template you can use for agents moving forward. It's always best to make sure you don't leave anything out, especially in today's world.

A few items to make sure you include:

- Vesting agreement

- Commission split – whether it's a split or graduation of commissions

- Non-compete based on a radius around your business

- Who owns the block of business – the agent or the agency?

Vesting Agreement and Commission Split

The vesting agreement and commission split are pretty simple – decide on what's fair and include it.

Non-Compete

You can train a person and teach an agent a lot, but if you don't have a non-compete, they can start a business in an office next door and be your competition.

In your LOA agreement, I'd suggest you have a radius that they cannot do business within so many miles of you.

.png?width=940&name=Add%20a%20Non-Compete%20to%20Your%20LOA%20Agreement%20(1).png)

Who Owns the Book of Business?

If I'm looking from the agent's point of view, I want to know if the customers are mine or the agency's. If I bring in 100 policyholders, do I own that business or not?

That's a key difference – if I'm the agent, I want that business to be mine.

I personally think the agent should be protected in the business they bring. They should own it and have the right to do with it what they want.

Buyout Agreements

When the agent retires or if they have a change of heart and decide they don't like it, they have a block of business worth something. There ought to be a buyout agreement.

That's the way we've always done it, and I think it's fair. It allows agents to grow and not feel like they are stagnant. They are building something of value that's theirs.

Sometimes, the agent has no idea what they're signing, and they don't realize that the agency is taking advantage of them until it's too late.

Say you want to break away and work somewhere else. All of a sudden, they may say you can leave, but you don't get any of your business. We'd never do that, but a lot of people in this business do, so be aware.

Related: 5 Reasons to Sell Your Medicare Business to Your FMO

Value Agency Owners Should Provide to LOAs

If you're taking a piece of commission from an agent, you should be offering something of value to earn it.

Here are some examples of things you can provide to agents to make it fair for both sides:

- Office space

- Secretarial support

- Mentorship and professional advice from seasoned pros

- Access to computers, fax machines, copy machines, a phone system

- Postage

- Website

- Leads – a lot of times, agency owners will supply leads to new agents so they have people to call on and go see.

- Software and tools, like MedicareCENTER – if you work with an FMO like us that supplies valuable resources, such as this important tool for quoting and enrollment, that also provides value to your agents.

- Compliance help – training your agents and being a resource in this world ever-changing compliance is critical.

- Weekly meetings – we have a Monday morning meeting where we go over the production scoreboard, share insurance industry announcements, and connect with everyone to kick off the week.

.png?width=1200&name=Value%20Agency%20Owners%20Should%20Provide%20to%20LOAs%20(1).png)

A person brand new to the business will have trouble making it on their own with no support system, and that's part of why becoming an LOA is so attractive.

How to Retain LOAs

The biggest drawback of the LOA model is that the agents you nurture and train can eventually leave you. After a while, they feel that if they leave, they can make more by going out on their own.

How are you going to navigate those waters? It's important to have a game plan upfront before you start. For the agents that make it, how will you keep them and ensure they feel they can continue to grow?

For us, it's been a mix of providing a lot of value and also ensuring our agents own their book of business. It's an important topic to sit down and really think about before you invest a ton of time and money into new agents.

Conclusion

The key to starting an agency with the Licensed Only Agent (LOA) Model is having a clear understanding of expectations on both sides.

What is the owner bringing to the table, and what is the agent going to bring? What's the succession plan in the event that agent wants out?

I never wanted a person to feel like once they came on, they could never grow. If you don't consider this, I think you'll end up losing all the agents you bring on.

I hope this was helpful. While we don't have any cookie-cutter templates and we don't do consulting on this topic, we're happy to help however we can.

Good selling!

Other articles for agents looking to start an agency:

Articles in the Cover Your Bases blog series for agency owners:

![The Simple Question That Drove $9M+ in Annuity Sales [Case Study]](https://blog.newhorizonsmktg.com/hs-fs/hubfs/NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp?width=220&height=119&name=NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp)