We thought it would be really helpful to provide some tools over the next few weeks to sort out the hottest trend in our industry; life with the LTC rider, and move towards helping you position more opportunities. If you missed last week you can view it here:

The JH LTC Opportunity Series - Part 1: Meaningful Statistics

The Facts about LTC Cost of Care

According to the American Association for Long-Term Care Insurance LTCi Sourcebook, there are currently over 78 million baby boomers in the United States who will retire over the next 2 decades. Statistics tell us that 70% of the people over the age of 65 will require care services at some point in their lives.

Will Your Clients Be Ready for Long-Term Care Needs?

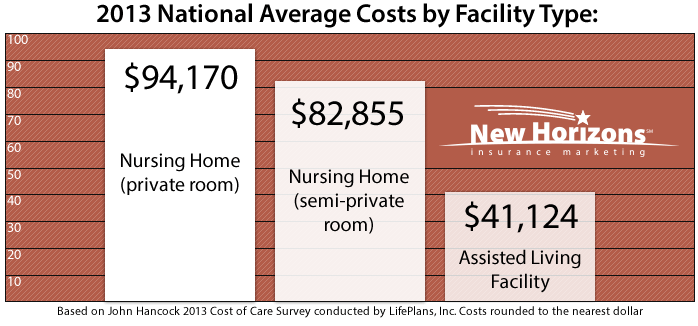

The national average for 24-hour home care or one year in a nursing home is more than $94,000

2013 National Average Costs by Facility Type:

- Nursing home - Private room = $94,170 (1 year) or a daily cost of $258.

The 5 year average annual increase is 3.6%

- Nursing home - Semi private room = $82,855 (1 year) or a daily cost of $227.

The 5 year average annual increase is 3.6%

- Assisted Living Facility = $41,124 (1 year) or a monthly cost of $3,427.

The 5 year average annual increase is 2%

*Based on John Hancock 2013 Cost of Care Survey conducted by LifePlans, Inc. Costs rounded to the nearest dollar.

LTC Cost of Care Calculator

Arm yourself and your clients with the facts by checking the current cost of care in your area using the John Hancock LTC Cost of Care Calculator. Costs vary widely based on what type of care is desired and what part of the county the care will be provided in. Use the Cost of Care map to find daily, monthly and annual costs by city and care setting. This site is also client accessible and includes inflation adjustments. We have attached an example of the output you will be provided.

Arm yourself and your clients with the facts by checking the current cost of care in your area using the John Hancock LTC Cost of Care Calculator. Costs vary widely based on what type of care is desired and what part of the county the care will be provided in. Use the Cost of Care map to find daily, monthly and annual costs by city and care setting. This site is also client accessible and includes inflation adjustments. We have attached an example of the output you will be provided.

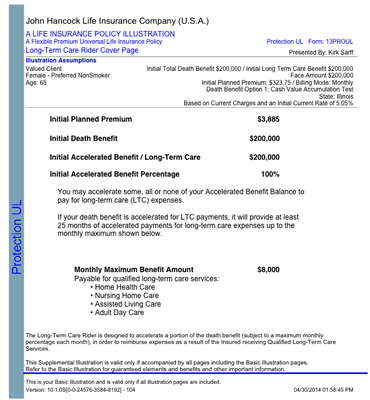

The solution has never been better

Adding John Hancock’s IMPROVED Long-Term Care rider to a life insurance policy is one simple solution to meet two important needs — death benefit protection and LTC coverage!

The first page of the illustration makes it easy for your client to understand the product:

Contact Kirk to get started!

If you missed last week you can view it here:

The JH LTC Opportunity Series - Part 1: Meaningful Statistics

Or, continue on to The JH LTC Opportunity Series - Part 3: Counting the Cost

![The Simple Question That Drove $9M+ in Annuity Sales [Case Study]](https://blog.newhorizonsmktg.com/hs-fs/hubfs/NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp?width=220&height=119&name=NH-The-Simple-Question-That-Drove-9M-in-Annuity-Sales-Case%20Study%20(1).webp)