*For Agent Use Only*

Fixed Index Annuities (FIAs) are more popular than ever here at New Horizons. Many Medicare agents have embraced the product and are enjoying records with their personal production.

FIAs check off so many boxes for our target audience of seniors and retirees, but annuity sales can be intimidating. Talking about money can be uncomfortable, and you don't want to make a mistake when handling someone's nest egg.

From product basics to illustrations and commissions, this is your complete guide to getting started with Fixed Index Annuity sales.

Table of contents:

- What is an FIA?

- MYGA vs FIA

- Interest Crediting Strategies, Explained

- Helping Your Client Choose Crediting Strategies

- FIA Client Profile

- FIA Licencing

- FIA Presentation

- FIA Illustration Example

- Top FIA Companies

- FIA Commissions

- Conclusion

What is an FIA (Fixed Index Annuity)?

A Fixed Index Annuity (FIA) is a type of annuity that earns interest based on how the stock market performs. FIAs offer principal protection and accumulation, which are two selling points ideal for retirement planning.

With an FIA, your client can take part in market gains with no risk of losing their principal. Even if the stock market tanks, your client's interest rate will never go below zero. As we like to say, zero is your hero!

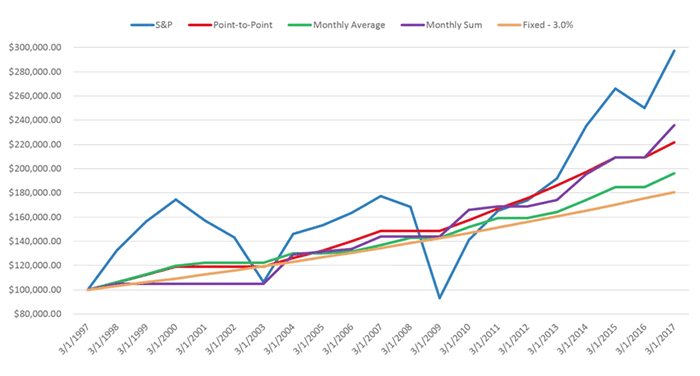

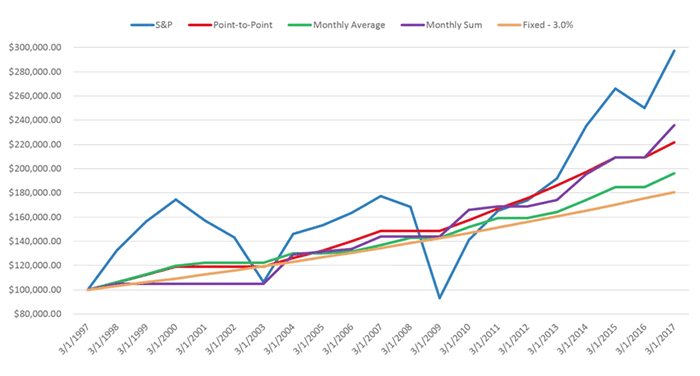

In the chart below, you'll see the S&P 500 fluctuates up and down, while all of the FIA crediting strategies either stay level or go up.

Typically, an FIA comes with a longer contract length, such as 7, 10, or 14 years; other fixed annuities can have shorter commitments, such as 1, 2, 3, or 5 years.

Let's take a look at some more ways FIAs differ from traditional fixed annuities, like MYGAs.

MYGA vs FIA

The two most popular annuity types sold in the senior market are MYGAs and FIAs. MYGA stands for Multi-Year Guaranteed Annuity, which is arguably the simplest type of annuity out there.

MYGAs and FIAs offer several important benefits, including:

- Principal protection: your client's savings are always protected from market fluctuations. Their principal is 100% protected.

- Growth potential: your deposit has the potential to grow—with MYGAs, it's guaranteed, while with FIAs, the growth potential varies with the chance of a much higher upside.

- Tax-deferred growth: clients can defer taxes until they choose to access funds in the annuity.

- Access to some funds: many MYGAs and FIAs come with withdrawal options so your client has access to a portion of their account value if they need it.

- Wealth transfer benefits: clients can avoid probate and pass along the annuity account value to a beneficiary upon death. The beneficiary could also choose to continue the policy.

| FIA | MYGA | |

|---|---|---|

| Contract Length | Longer contract length (7, 10, 14 years) | Shorter contract length (1, 2, 3, 5 years) |

| How Interest Is Earned | Can allocate funds to index crediting strategies based on the S&P 500 and other indices | Not based on the stock market's performance; no index crediting strategies; the rate is set at the beginning of the contract and is guaranteed |

| Interest Rate | Your client's interest rate will fluctuate depending on the market's performance | Rate is guaranteed and will not change for the length of the contract |

| Growth Potential | Potential to get higher interest rates | Modest interest rate, no potential to get more than the guaranteed fixed rate |

The critical difference between FIAs and MYGAs is a sure thing vs. the unknown (while still having principal protection).

| FIA | MYGA |

|---|---|

| Interest rate could be 0%+ (many clients see double-digit interest credits) | Interest rate is set in stone (typically 2 to 4%) |

| Higher growth potential, but could get zero | Interest rate is a sure thing, but no potential to get more than the fixed rate |

For clients who want to take the chance, an FIA can deliver some amazing returns!

However, there is always the chance their account value could stay the same if their interest crediting strategies don't perform well.

The Best of Both Worlds

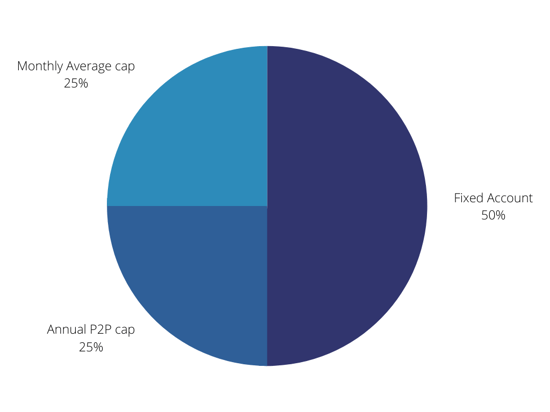

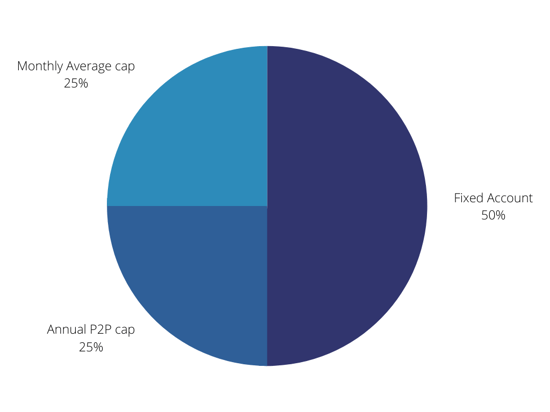

Many FIA policies have a fixed account option. If your client likes the idea of a guaranteed, fixed interest rate, they can allocate some (or all) of their funds to the fixed account, which is not based on any market performance. The fixed account rate is guaranteed, just like a MYGA.

Many agents have clients who put 25%-50% of their funds in a fixed account, while they allocate the other portion to different crediting strategies based on market performance.

That allows them to have the best of both worlds—the sure thing of a MYGA with the potential growth of an FIA.

Download the FIA vs. MYGA Fact Sheet From SILAC

Interest Crediting Strategies, Explained

When a client buys an FIA, they need to allocate their funds to crediting strategies.

Indexed crediting strategies provide interest credits that are tied to the performance of an external market index, like the S&P 500.

The annuity company credits interest at the end of the crediting strategy's term. FIA companies guarantee your client will never earn less than 0% interest for the strategy term—even during market downturns.

Note: It is possible your client could lose some of their principal if the product comes with a fee and they don't earn any interest to offset it. This is is why we recommend FIAs with no fees. We'll discuss our top annuity company recommendations later in this article.

In order to provide that floor protection of 0%, the interest your client can receive is limited. That limit comes as an adjustment, such as a cap, a participation rate (PR), or a spread.

If we come back to the following chart, you'll see that when the S&P 500 (the blue line) dips down, all the FIA crediting strategies stay level. That's the floor protection.

However, when the S&P 500 goes way up, the FIA crediting strategies are capped. They do rise, but they don't get all the gains.

There are six basic crediting strategies you'll likely see on many FIA policies. Let's go through how each one works.

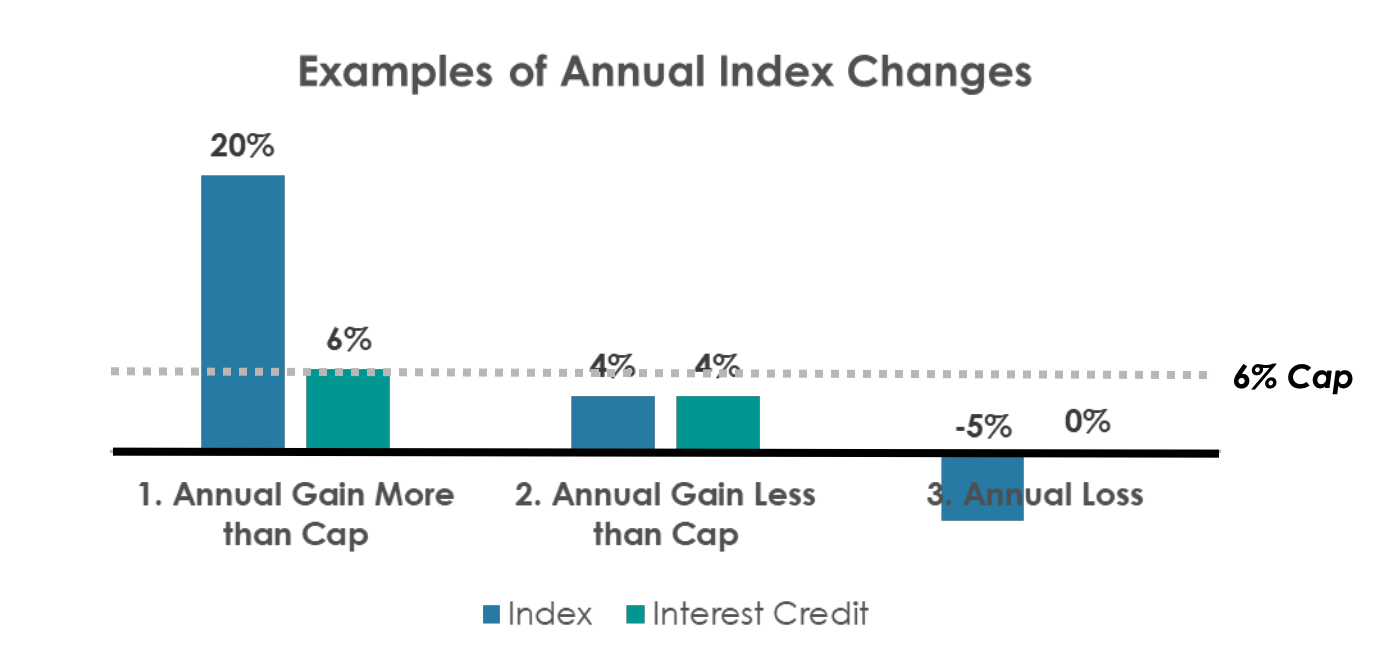

Annual P2P* Cap

Annual P2P Cap one of the simplest and most popular crediting strategies. The index price is measured at the start of the term and the end of the term. If the price increased, the interest credited to the contract will equal the percentage of the index price increase, up to a cap.

For example, let's say the S&P averages 20% over the course of a year. If your client has a cap of 6%, they'd get a 6% credit that year. Let's say the S&P averaged 4% over the year – they'd earn 4%. Finally, let's say the S&P averaged -5% over the year. They'd earn 0%.

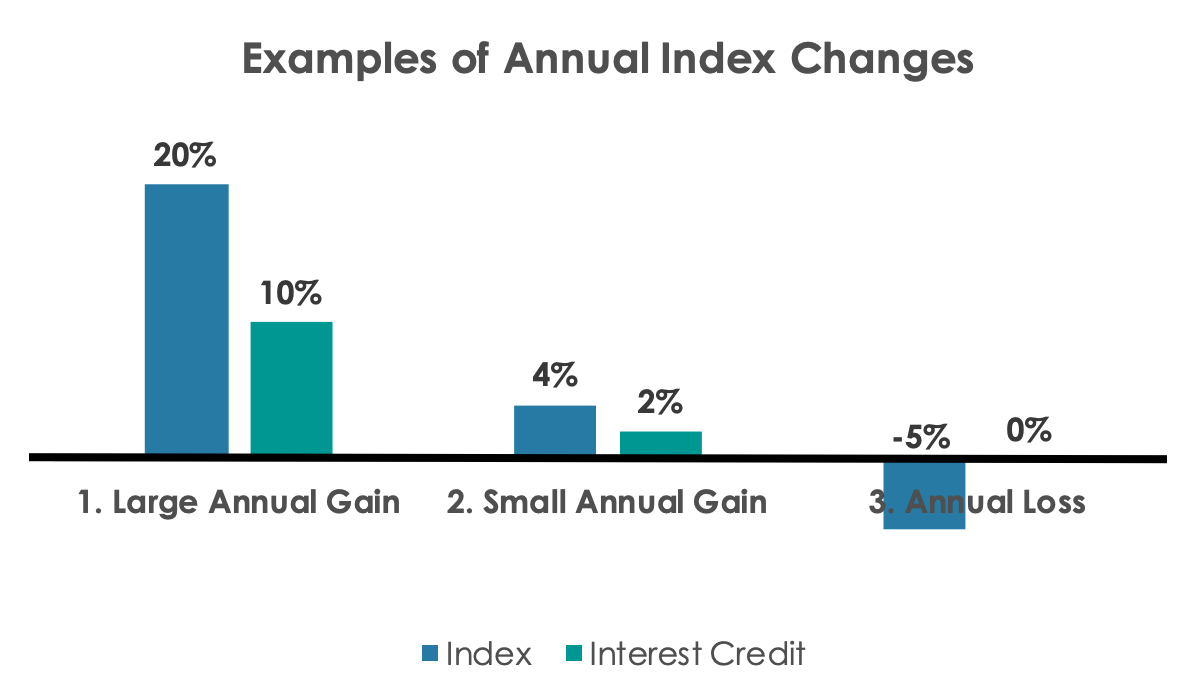

Annual P2P PR*

Annual P2P PR also measures the price of an index in two points of time, but instead of a cap, there's a participation rate.

Let's say the participation rate is 50%. This means your client would earn half of whatever the index earns that year.

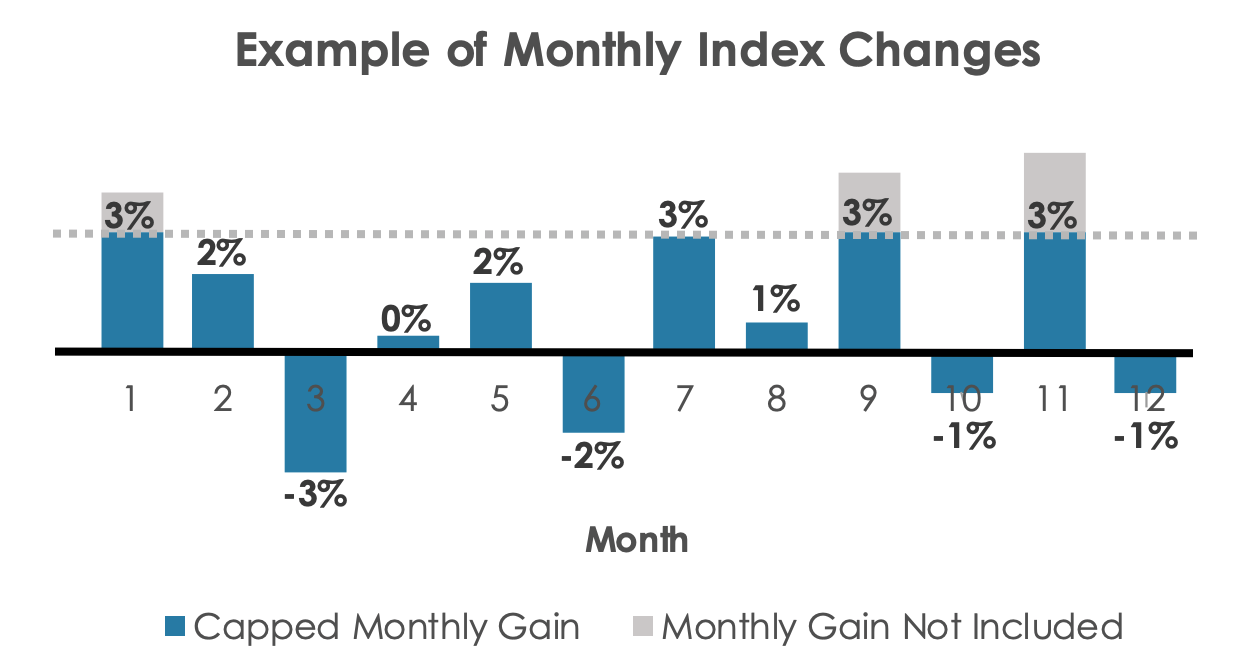

Monthly Cap (Monthly P2P Cap)

The Monthly Cap, also known as the Monthly P2P Cap, looks at the closing value of the index every month. At the end of the year, the carrier adds all the closing values up, and that's the total interest credit for the year.

In the above example, the monthly cap is 3%.

Here's a breakdown of how much interest the policyholder earned, month by month:

3% + 2% - 3% + 0% + 2% -2% +3% +1% + 3% -1% +3% -1% = 10%

In this example, the client's total interest credit for the year would be 10%.

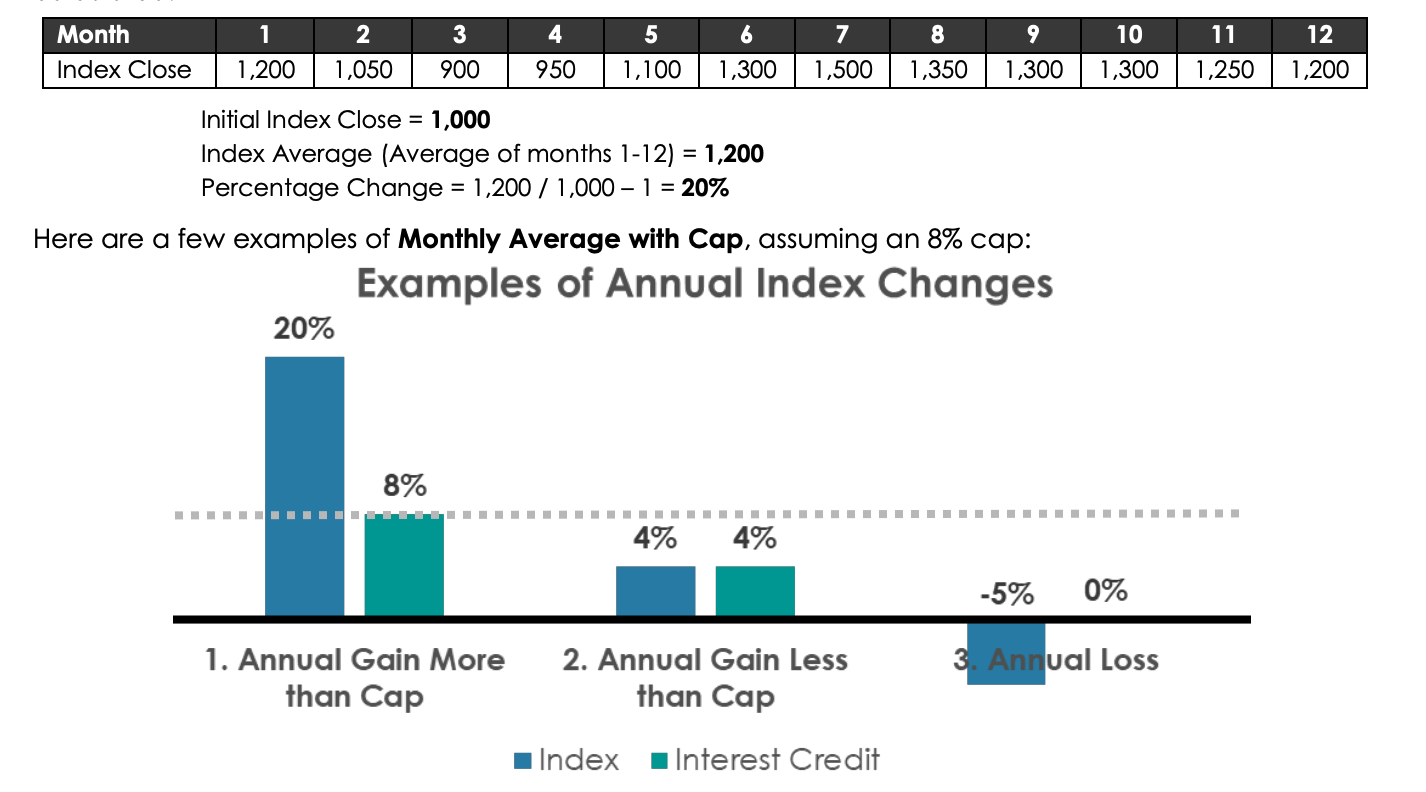

Monthly Average Cap

The Monthly Average Cap credits the policyholder the percentage change of the index average based on the closing value each month.

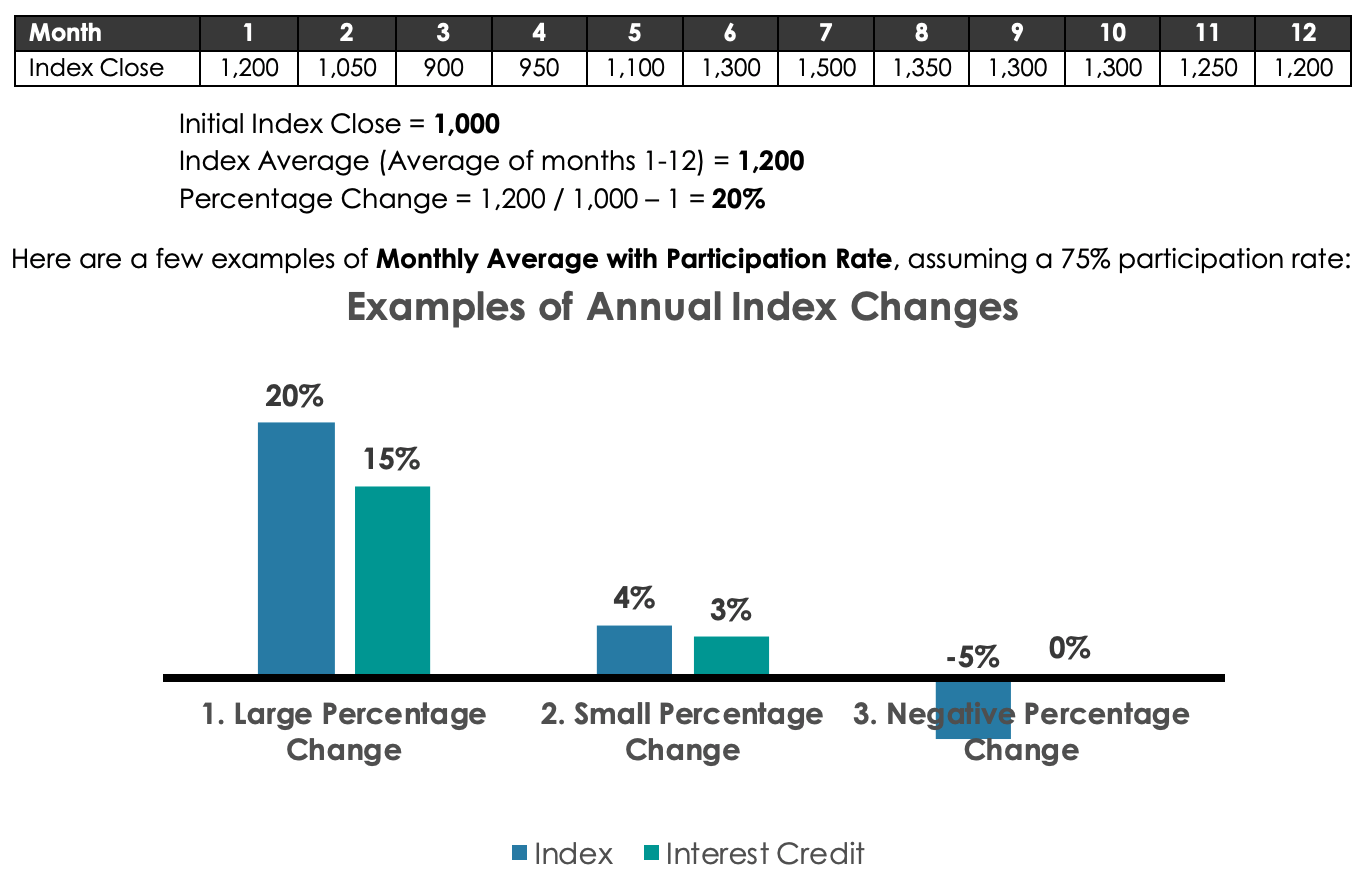

Monthly Average PR

The Monthly Average with Participation Rate (PR) credits the participation rate of the percentage change in the S&P 500.

Let's say your participation rate is 75%—here's how that would play out:

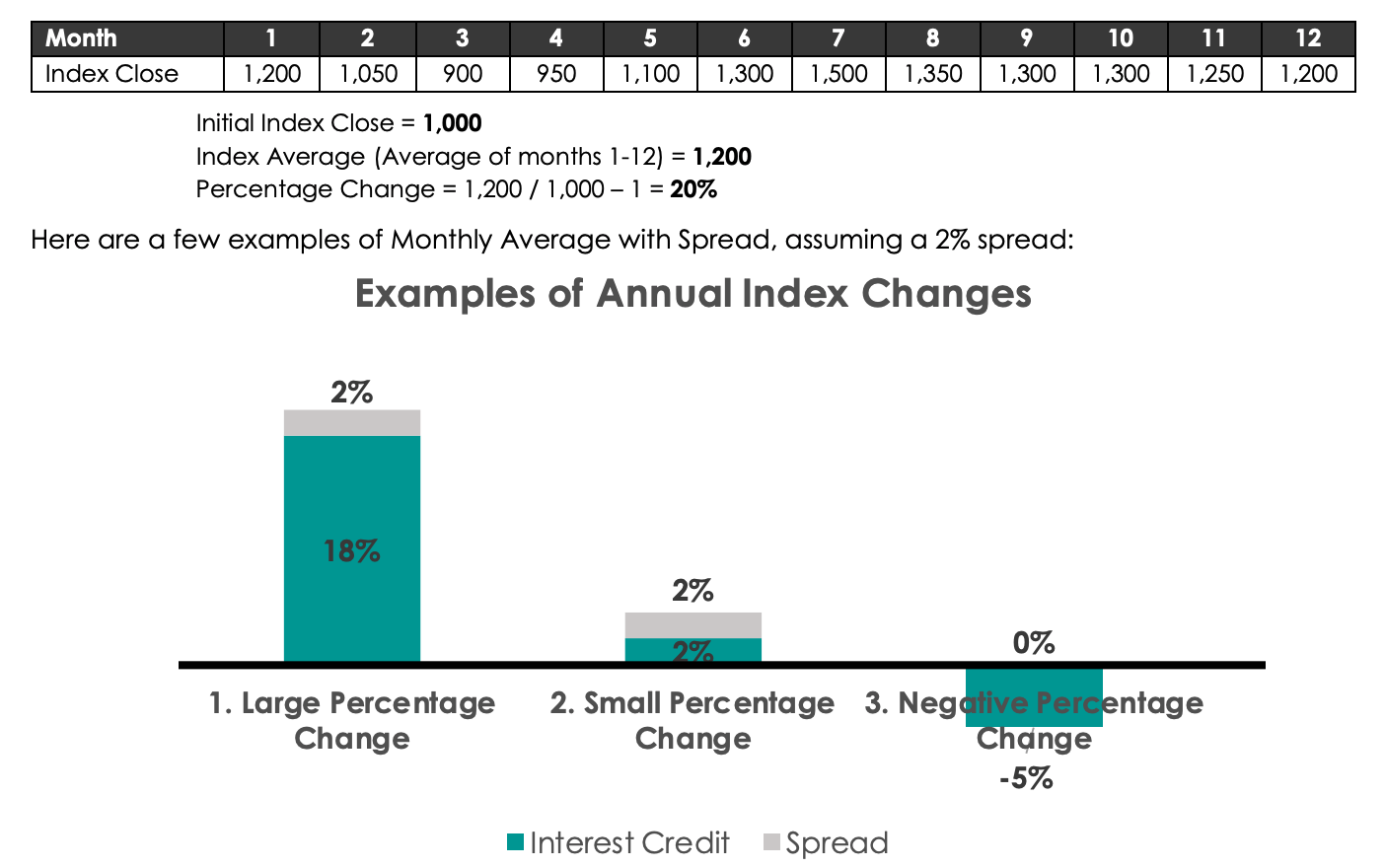

Monthly Average Spread

Finally, the Monthly Average Spread credits the closing value of the S&P 500 minus whatever the spread is.

Let's say the spread is 2%. Here's how that would play out:

Helping Your Client Choose Crediting Strategies

To provide some initial guidance, the Annual P2P Cap is the most popular crediting strategy—it's simple to explain and is straightforward, so it's easy to tell how you're doing.

Another standout is the Monthly Average Cap. This crediting strategy provides the opportunity to earn some of the highest crediting interest.

Many clients also enjoy putting a portion of their funds in a fixed account, which has a guaranteed interest rate.

No matter what strategies your client chooses, they can reallocate (or change their strategy) every 12 or 24 months, depending on the carrier and policy they choose.

Don't Chase Gains

It's easy to look at great returns and say, "I should tell my client to put all their money in the monthly point-to-point cap for the next year!"

However, Carrie Freeburg, ASA, MAAA, and VP of Annuity Products at SILAC cautions you against that.

"Pick the strategy you like and stick with it! Agents often change strategies after the first year, and the other strategies do better. Don't follow the dance – pick your strategy and stick with it long-term.

I see people keep changing things, and they're always a year behind, and their client doesn't do as well."

Choosing a long-term approach is usually the best approach. Carrie also recommends combining strategies.

FIA Client Profile

FIAs are great for:

- Seniors

- Retirees and IRA/401(k) rollovers

- Working individuals in their 40s

- Anyone coming into an inheritance

According to the United States of Aging Survey, 49% of seniors worry they'll outlive their savings.

An FIA—especially one with an income rider—is an ideal solution, as it can provide lifetime income and principal protection.

FIAs are also great for seniors who have a fairly sizable nest egg. They can preserve their money while also benefiting from greater growth potential than a MYGA.

For seniors who have their retirement savings in the stock market, an FIA is a great compromise, because they can shield their nest egg from market downturns.

Agents who also serve clients under the age of 65, an FIA can be great for working individuals in their 40s who want to build their nest egg. An FIA will help them by allocating a portion of their retirement savings to an accumulation vehicle.

Finally, anyone coming into an inheritance can grow that money with no risk of losing it.

FIA Licencing

To sell FIAs, you need:

- Life & Health license

- Anti-Money Laundering (AML) training, renewed annually

- Annuity certification course

- Individual product training for each carrier and product

We do our AML training with LIMRA. It's free and takes about 45 minutes, but it needs to be updated every year.

Learn more: How to Complete Your Free AML Training for Life and Annuity Sales

You will do the annuity certification course through your state. It's a 4-hour course that goes towards your CE credits.

Finally, every company has its own training for FIAs. There's typically required training for each FIA product you want to sell. For example, with SILAC, there's a training module for Teton and another for Denali.

It's basically a slideshow you watch, and you sign a certificate stating you've reviewed it. Most FIA carriers don't make you take tests, but some do.

Do you need a securities license to sell Fixed Index Annuities?

You do not need a securities license to sell FIAs. You only need that for variable annuities, which we don't do.

Fixed Index Annuity Presentation

The agent training slide decks, available in the SILAC Annuity Agent Portal, are a great starting place for developing a client-facing presentation.

With these slide decks are for agent use only, you can use it to help create your own client presentation.

Some key elements to think about including in an FIA presentation include:

- Product features, like lifetime withdrawals and tax deferral

- Minimum premium

- Accumulation information, like the market index options and crediting strategy information

- Liquidity, such as free withdrawals or nursing home benefits

- Contract length options and early withdrawal penalties

- Historical index period comparison for the most recent 10 years, the worst 10 years, and the highest 10 years (included in illustrations)

You may also want to base your presentation on how much information you think your clients want.

Some clients—especially analytical or logical thinkers—want to understand the product from A to Z, while others just want to get the gist and take your recommendations.

If you're in favor of a simpler presentation, download the FIA slide deck from Michael Sams, Director of Sales Training and Development. You are welcome to change it for any product you're interested in selling. Also, double-check and adjust the interest rates in the slide deck, as those change often.

For more step-by-step instructions on giving an FIA client presentation, check out How to Actually Present a Fixed Indexed Annuity (FIA) to a Client.

FIA Illustration Example

Let's look at an FIA illustration example. You'll want to use this when you're presenting and explaining a specific product to your clients. While it seems long, it's not too complicated when you break it down and know what you're looking at.

Download this sample illustration to follow along: SILAC Denali 14-Year Sample Illustration

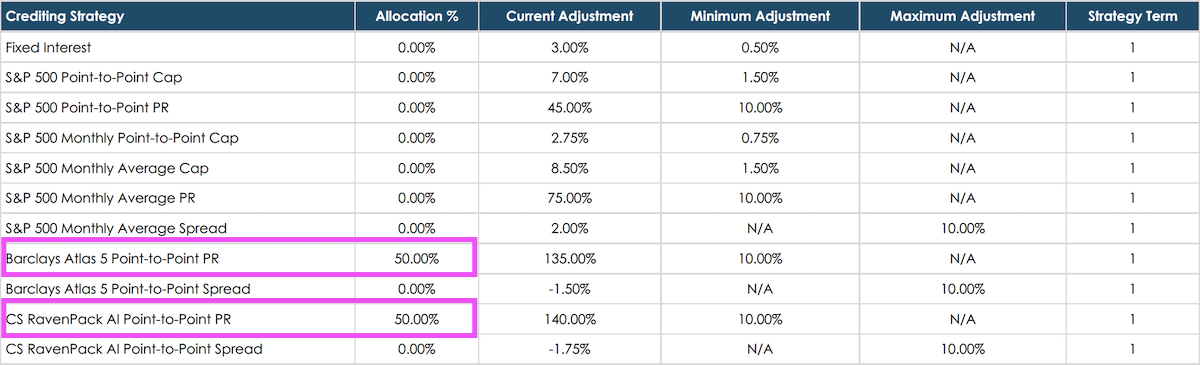

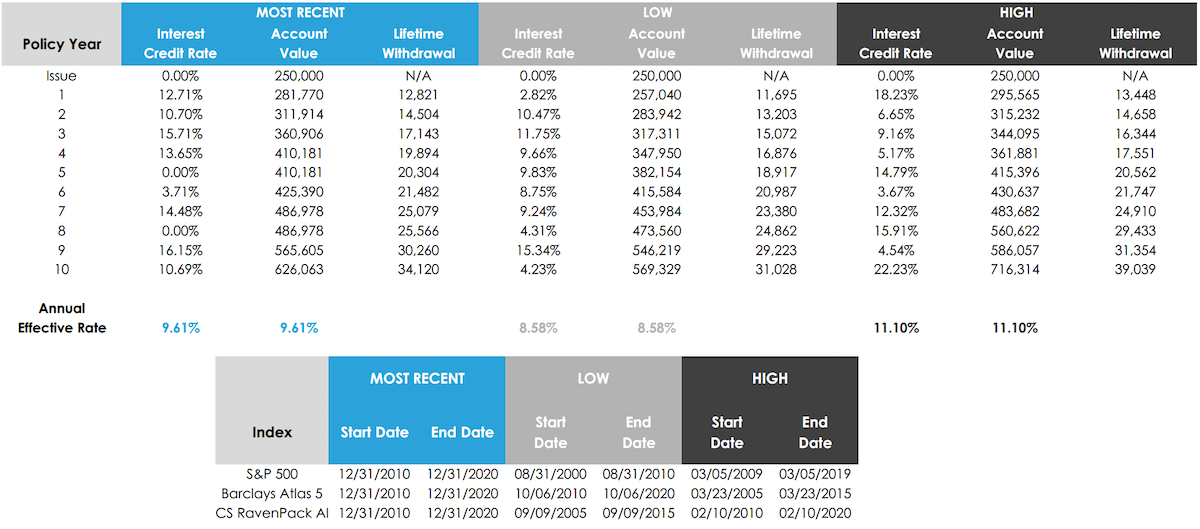

We have a 62-year-old client with $250,000 to invest. She allocates 50% of her money in the Barclays Atlas 5 Annual Point-to-Point PR and the other 50% in the CS RavenPack AI Point-to-Point PR.

Note: Barclays Atlas 5 and CS RavenPack AI are both market indexes, just like the S&P 500.

Page 5 of the illustration

Pages 6-8 go through the Guaranteed Policy Values from Year 1 through Year 48. This chart is basically the worst-case scenario—if your client got 0% interest every single year. This has never happened, but if it did, this is the policy value that's guaranteed.

Even though this is only a 14-year contract, these charts will extend out until the policyholder is age 110.

Pages 9-11 go through the Non-Guaranteed Policy Values for the same timeframe. This chart looks at the most recent 10-year period. If your client had invested $250,000 10 years ago, this is how their policy would have performed. It gives a realistic example of how their money could grow, but it's not guaranteed.

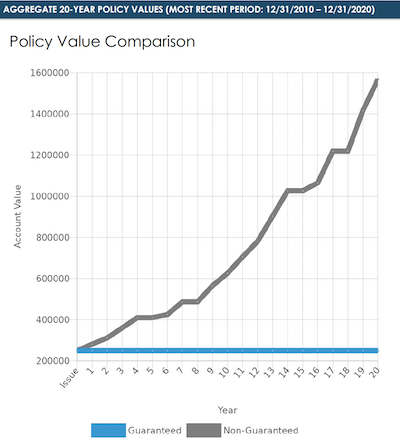

Page 12 shows a simple chart comparing the Guaranteed Policy Value to the Non-Guaranteed Policy Value.

Then, we get the historical index period comparison on page 13, which is a great tool to use during a presentation. This shows your client how their chosen allocations have done in the most recent 10 years, the lowest 10 years, and the highest 10 years.

The next few pages give more visualizations of the historical index period comparison, and the last few pages of the illustration include definitions and disclosures.

It's pretty simple when you break it down.

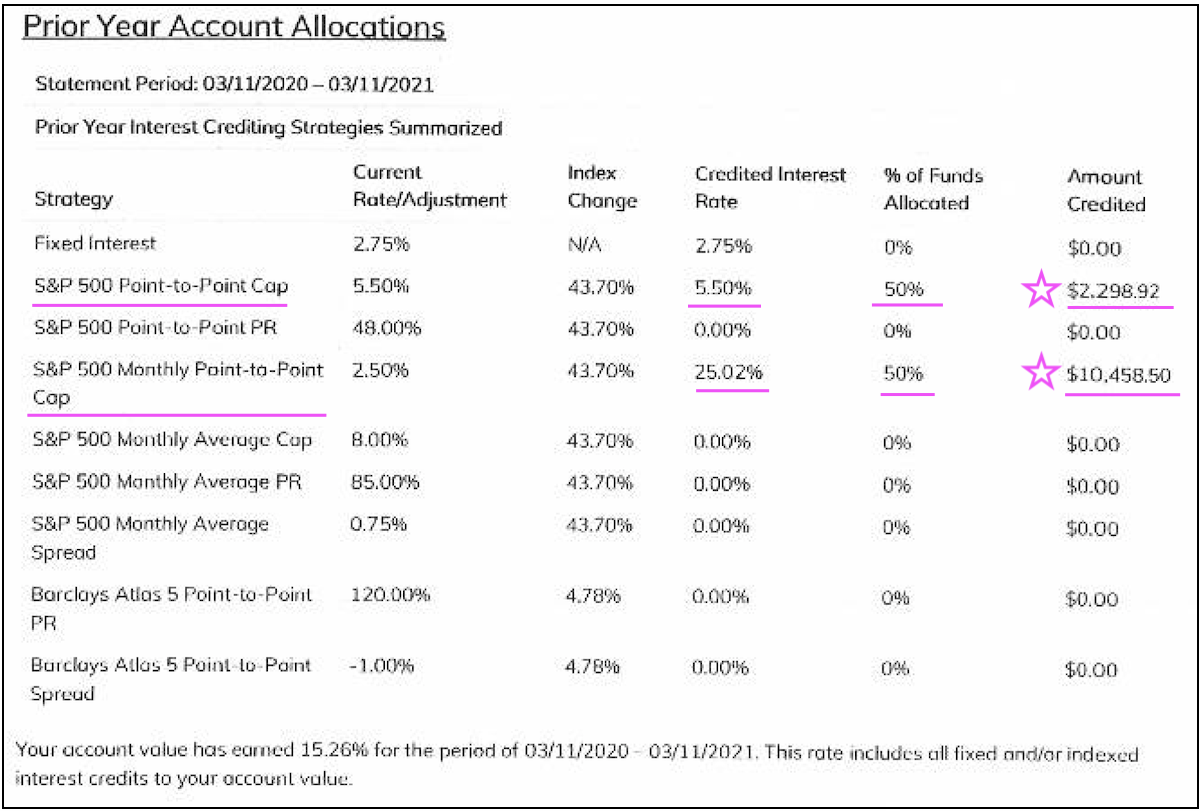

FIA Annual Statement Example

After a client has had their policy for a year, they'll get their first annual statement. The statement lets your client know how their allocations did that year.

As an example, here is a real client statement from one of our agents. They had a SILAC fixed index annuity and put half of their money in the S&P 500 annual point-to-point cap and the other half in the S&P 500 monthly point-to-point cap.

Combined, this client earned a total of 15.26% over 12 months.

Read more about this annual statement: Fixed Index Annuity Review: A Real Client's Annual Statement

Top Fixed Index Annuity Companies

The top FIA company for us is SILAC. They have incredible products that fit the needs of our senior clients. They're simple to understand, have great rates, no fees, and their customer service is unmatched.

You just cannot beat SILAC!

That said, we do have many FIA carriers, including American Equity, Equitrust, and Athene.

SILAC is just so good. The way it is right now, you really only need one FIA carrier in your portfolio. When you get too many carriers, it muddies the water a bit. However, we do have them all, so if you want a different carrier, just reach out to us.

Related:

- What is the SILAC Denali Lifetime Income Annuity?

- How to Sell Barclays Atlas 5, a New Addition to SILAC's Teton FIA

- What is the SILAC Teton FIA?

Fixed Index Annuity Commissions

FIAs give about 4 times the commission of a MYGA.

In addition, the longer the FIA contract, the higher the commission. For example, the 14-year pays a lot more than a 7-year.

To find out what your commission would be on a particular FIA product, just reach out to us.

Conclusion

If you want to expand your Medicare business in a big way, I'd highly recommend you get into FIA sales. Many of the highest producing agents at New Horizons sell them, and they are helping a lot of clients.

If you're ready to get contracted and dive into some product training, I would recommend almost everyone start with SILAC. They also hold a training webinar every Monday—you can get that information on our webinar calendar page.

If you have questions that were not answered in this article, you are welcome to set up a phone call with me (click the image below to set that up). I'd be happy to help you get started.

You can also leave a comment below or start a chat here on our website, which is available during our business hours (8 a.m.–4:30 p.m. CT, Monday through Friday).

Good selling!